5 common mistakes of first-time HDB home-buyers in Singapore

There are a lot of important decisions to make before you can move into your first home.

While it may be overwhelming to keep track of all of these issues, neglecting to do so can end up costing you thousands of dollars.

We strongly recommend keeping an eye out for the following missteps in order to comfortably enjoy your new home.

NOT CREATING A FEASIBLE BUDGET

Before you even start visiting homes, it's important to have a good idea of how much you can afford to pay for your new place.

With that in mind, there are two cost categories to consider as a prospective homeowner.

First, it is important to understand the upfront cost of a down payment.

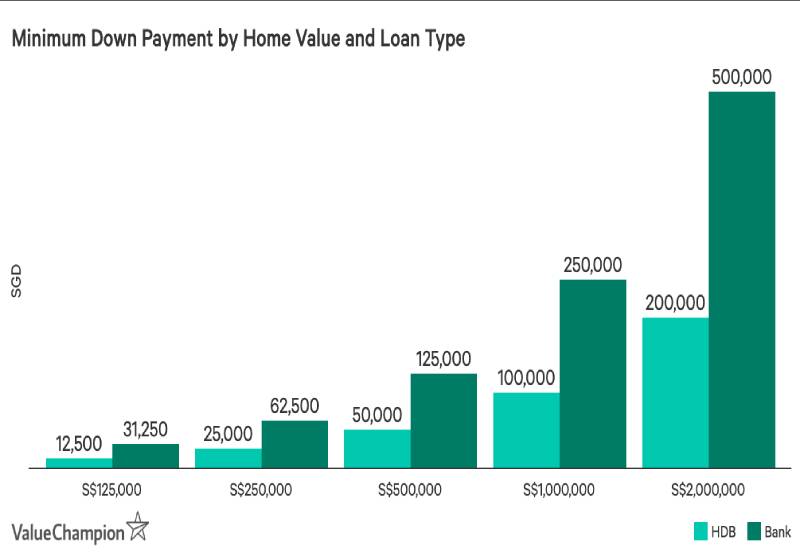

Those choosing to use a home loan from a bank will have to make a downpayment of at least 25 per cent of their home's value, including a cash payment of at least 5 per cent of the home's value.

These loans tend to be the cheapest option due to their competitive interest rates; however, those financing their purchase with an HDB loan only have to make a down payment of 10 per cent.

On top of the down payment, prospective homeowners must consider the ongoing costs of homeownership.

As a general guideline, experts recommend that prospective homeowners spend 30-40 per cent of their gross monthly income on housing.

For homeowners, this includes mortgage payments, utilities (e.g. gas and electricity bills), homeowners insurance and maintenance costs.

To calculate your monthly mortgage payments, you can use ValueChampion's free home loan calculator.

CONFUSING HDB & BANK LOAN OPTIONS

Choosing a home financing option is one of the more complicated aspects of becoming a homeowner.

Before even comparing the different rates available, individuals must consider HDB loans and bank loans.

Recently, bank loans have been a more affordable choice as they tend to charge lower interest rates than the Housing & Development Board.

Additionally, banks have fewer eligibility requirements and allow borrowers to purchase private residences.

[[nid:458932]]

A common, though incorrect, assumption is that first-time home buyers must utilise a HDB loan when purchasing their first flat.

With the current concessionary interest rate for HDB home loans at 2.6 per cent, borrowers can actually save a significant amount of money by applying for a more competitive home loan offered by a bank in Singapore.

With this in mind, it is important to compare the best rates available before applying for any home loan.

FAILING TO NEGOTIATE ON SALE PRICE

New home buyers can also fall victim to real estate agents that are incentivised to close deals quickly.

These agents may try to rush home buyers into making a quick decision, which ends up in a higher sales price than is optimal for the buyer.

Our advice on this topic is to thoroughly research similar properties before viewing a flat and engaging in negotiations.

Once you have a feel for the average cost of a similar home, you'll have a good idea of whether you are receiving a fair offer.

FORGETTING RENOVATION EXPENSES

Unless you're purchasing a brand new home, you may end up deciding to renovate.

Depending on the scale of your plans, renovation projects can be expensive.

[[nid:456857]]

Our research suggests that the average home renovation for a 4-room HDB flat is around $55,000. Due to this high cost, households often opt for renovation loans to make their projects feasible.

If you're interested in a home renovation and may need a loan, it is worth researching the best loans and promotions available, in order to cut down on the total cost of project.

NOT SHOPPING AROUND FOR HOME INSURANCE

Finally, for those that choose to protect their homes with homeowners insurance, it is important to understand all of your options before signing up for a policy.

While the cost of home insurance may seem like a drop in the bucket compared to other expenses in this article, it is possible to save as much as 35-50 per cent on a home insurance policy, without sacrificing protection, if you do your research.

For this reason, we recommend comparing the best deals in order to save several hundred dollars over the course of your home ownership.

AVOID COSTLY MISTAKES WITH CAREFUL PLANNING

Your new home will not only be your residence, it will be an investment in your future.

As with any investment, it is easy to make costly mistakes that eat into your finances.

Keeping clear of these common mistakes will help ensure the highest return possible on your purchase.

This article was first published in ValueChampion.