Vietnam eyes greener power but banks on coal to avert blackouts

HANOI/HOA BINH, Vietnam — Lights are off and air conditioning is down at the headquarters of Vietnam's state-run electricity provider EVN as the country's top power utility tries to "lead by example" to avoid a repeat of last year's crippling blackouts, an official tells visitors.

But many businesses around Vietnam's capital Hanoi appear to be ignoring the call to conserve power, keeping decorative but otherwise purposeless neon lights on the outside of high-rise buildings on all night.

The difficulties in curtailing consumption illustrate the challenges facing Vietnam a year after sudden outages caused losses of hundreds of millions of dollars to multinational manufacturers with investments in the Southeast Asian country.

Vietnam is pursuing a patchwork agenda of energy-saving measures, grid upgrades, regulatory reforms and a massive increase of coal power as it seeks to avert electricity shortfalls, according to government data and interviews with officials and experts.

But Trinh Mai Phuong, EVN's communications director, explains during a media visit that even the biggest infrastructure upgrade underway, a new US$1 billion (S$1.35 billion) transmission line connecting the centre of the country to the highly industrialised north that was hard hit by blackouts last year, may not be enough.

"I would not say it is a game changer," he said of the line that could be completed as early as this month, noting power consumption is expected to hit record highs in the coming weeks as the country braces for more heatwaves.

The soaring power demand is making it increasingly difficult for Vietnam to meet climate change commitments while providing enough power to satisfy large investors such as Samsung Electronics, Foxconn and Canon.

Broader sector-wide reforms are needed over the longer term, foreign investors and analysts said.

In the short term, Vietnam is banking mostly on coal to provide enough reliable electricity. It may be just enough — or not — but either way it may signal a blow to the country's commitments to reduce reliance on fossil fuels.

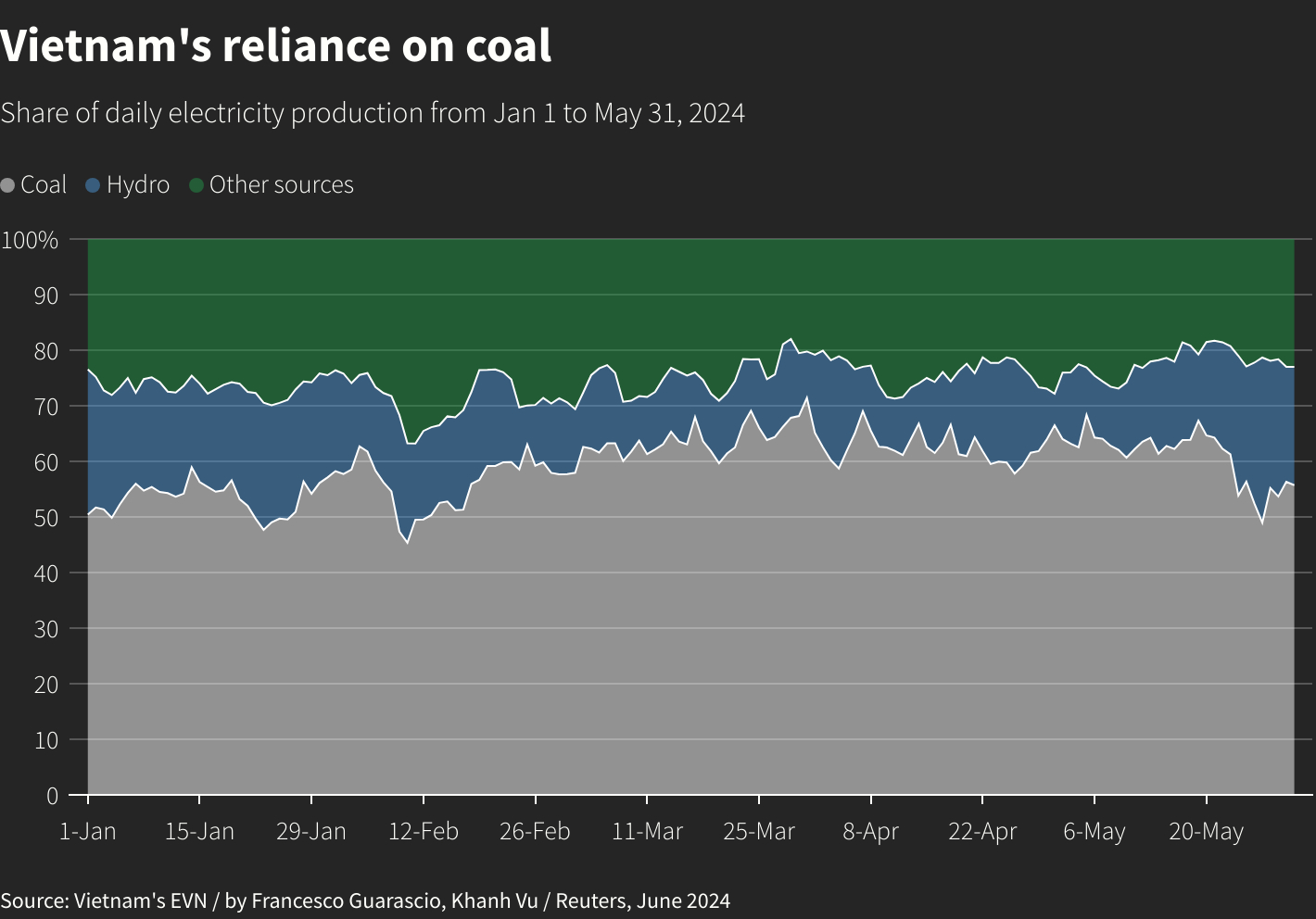

Coal use rose massively in the first five months of 2024, with coal-fired power plants accounting on average for 59 per cent of electricity output, exceeding 70 per cent some days, according to EVN data.

That was up from nearly 45 per cent in the same period last year and 41 per cent in 2021, when Vietnam began drafting plans to cut coal that persuaded international donors to commit US$15.5 billion to help phase out the fuel.

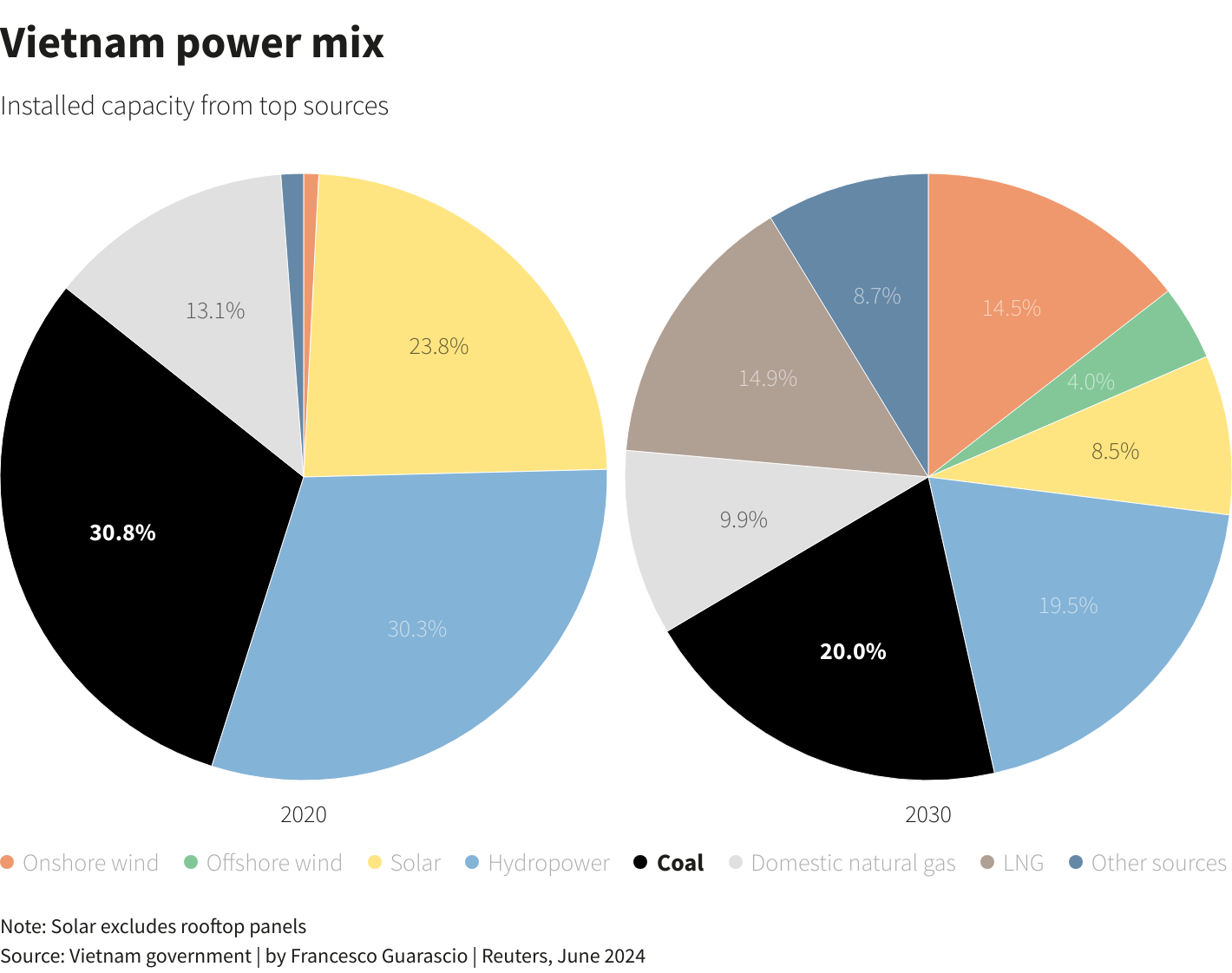

Thanks to a new coal-fired power plant that came online in 2023, coal accounted for 33 per cent of total installed capacity last year, up from 30.8 per cent in 2020, taking Vietnam further away from the goal of lowering that to 20 per cent by 2030.

Energy conservation is another key pillar of the plan. EVN and its local units have encouraged energy-hungry clients, including foreign manufacturers, to save power with tailored measures, especially in peak hours.

But that risks Vietnam's reputation as a reliable place for investment and could affect future manufacturing expansion plans, according to foreign investors who declined to be named because they were not authorised to talk to media.

The matter should be addressed by solving generation and distribution issues, and not from the consumption side, two foreign investors said.

Vietnam's industry ministry did not reply to a request for comment.

Vietnam is using only a fraction of its installed solar and onshore wind capacity due largely to administrative hurdles.

It has not approved regulations to kick-start offshore wind projects and delays dog projects to build power plants fuelled by imported liquefied natural gas, which is cleaner than coal.

The four energy sources together should account for more than 40 per cent of installed capacity by 2030, according to the government's plans, though analysts are sceptical.

Hydropower is projected to fall to less than 20 per cent of installed power generation by the end of decade from more than 30 per cent in 2020.

But some capacity is being added in the north where needs are higher.

One of Vietnam's largest hydropower plants at Hoa Binh is adding two General Electric turbines to its existing eight, which will boost its total capacity to 2.4 gigawatts from less than 2 GW now by the second half of 2025, said Dao Trong Sang, EVN's manager of the expansion project, during a visit to the dam.

The Hoa Binh plant, combined with the new transmission line that brings electricity to the north from separate plants, may add eight per cent capacity to the power-hungry north.

The power crisis cannot be solved without long-awaited reforms, experts say, though progress to date has been slow.

In April, the industry ministry issued an updated methodology for determining electricity prices, a step towards possibly reviving projects stuck for years because of a lack of clarity about tariffs.

However, the methodology could force developers to shoulder excessive risk, complicating their access to finance, said a Vietnam-based official who declined to be named because they were not authorised to talk to media.

A separate draft decree enabling manufacturers to buy electricity directly from producers is seen as close to approval after years of internal debate, according to several analysts.

The use of direct power purchase agreements (DPPAs) could make it easier for multinational companies to avoid higher tariffs on exports and boost the use of renewables to help them meet environmental, social and governance requirements.

But the DPPA rules need to be combined with other reforms, such as clearer provisions to directly connect factories to power-generation projects, the official said.

ALSO READ: World's biggest solar farm comes online in China's Xinjiang