- Consumer confidence in Mainland China has returned to the pre-pandemic level, and consumer confidence in Hong Kong has basically recovered.

- The concept of luxury consumption has changed due to COVID-19, and a considerable number of respondents tend to buy higher-quality luxury items.

- The concept of sustainable development is widely recognized, and most respondents show a willingness to pay more for sustainable practices.

SHANGHAI, June 8, 2021 /PRNewswire/ -- The 2021 CHINA LUXURY FORECAST was jointly released today by Ruder Finn, a global, leading integrated communications consultancy, and Consumer Search Group (CSG), one of Asia's most prominent leading market research groups. The forecast explores key indicators of the luxury market in Mainland China and in Hong Kong, and reveals market trends based on consumer behaviors and preferences.

The basis for the 2021 CHINA LUXURY FORECAST is a survey of 2,000 consumers in Mainland China and Hong Kong. Altogether, the survey encompassed 1,500 respondents living in Mainland China and 500 respondents in Hong Kong. Among those surveyed, the average annual household income was RMB 1,435,000 in Mainland China and HKD 1,009,000 in Hong Kong. The survey was conducted in January 2021.

"The past year of 2020 was very special. In the face of the sudden impact from COVID-19, the Chinese luxury market recovered at an unexpected rate after a trough in the first quarter. By the end of the year, it had achieved rapid growth. In this context, the 2021 CHINA LUXURY FORECAST also reveals the impact of COVID-19 on consumer psychology, concepts of consumption, and behaviors, with a view to helping the Chinese luxury industry meet new challenges and opportunities," said Simon Tye, Executive Director of CSG Hong Kong.

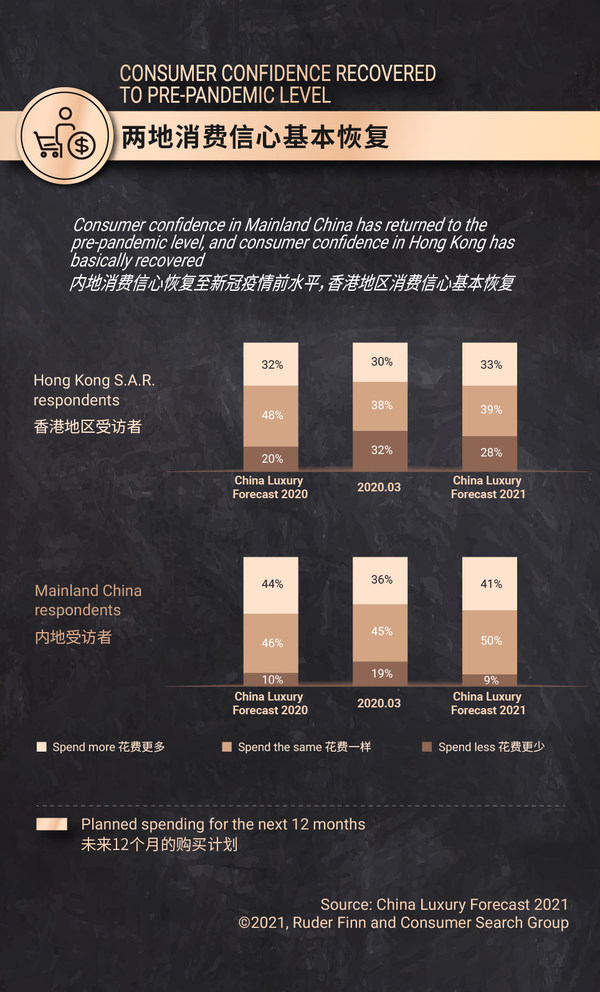

Consumer confidence has basically been restored in both Mainland China and Hong Kong. Mainland China consumers are more optimistic.

Compared with the survey results released during the outbreak of the pandemic in March last year, consumer confidence in both Mainland China and Hong Kong have shown a full recovery. Regarding their purchase plans for the next 12 months, 41% of the respondents in Mainland China and 33% of the respondents in Hong Kong indicated that they would spend more on luxury goods, basically returning to pre-pandemic levels. Some 9% of respondents from Mainland China said they would spend less, which is basically the same level as in the survey results (10%) before the outbreak at the end of 2019. And 28% of Hong Kong respondents said they would reduce spending, which is still an increase compared to 20% before the pandemic.

As to preferred categories over the next 12 months, the respondents in Mainland China are most willing to increase or maintain spending on beauty and cosmetics, followed by clothing and shoes. Meanwhile, the luxury automobile and travel areas would face expectations of fewer orders. Among the respondents in Hong Kong, more people are willing to increase or maintain spending on fine wines, followed by beauty and cosmetics.

During the past year, the outbreak of COVID-19 has had a significant impact on the national economy, but it is interesting to note that 36% of respondents in Mainland China and 31% in Hong Kong actually spent more on luxury goods in 2020 than they previously had planned. More interestingly, the figure of spending more in third-tier cities ranked the highest with 41%, which shows strong momentum for luxury goods purchasing power among the vast number of shoppers living in third-tier cities in China. Meanwhile, 19% of respondents in Mainland China and 37% in Hong Kong said they spent less last year than they had planned. Overall, Mainland China consumers have more optimistic expectations towards the future.

The survey also shows that a noticeable proportion (mostly more than 30%) of respondents in both Mainland China and Hong Kong are willing to buy niche luxury brands in all luxury categories except luxury watches. For niche luxury brands, the potential of China's luxury market will be exciting.

With the development of the market and the rise of the "Guochao" (China-Chic), the confidence and pride of mainland consumers in Chinese brands are also increasing. Nearly 50% of respondents in Mainland China believe that Chinese brands, when compared with Western brands, are showing better performance and have a bigger advantage in price. Whether it is style and design, or functions and craftsmanship, more than 70% of Mainland China respondents believe that Chinese brands are comparable to Western brands, or even better.

COVID-19 affects the concept of luxury consumption.

Respondents' descriptions of their own behavioral changes since the pandemic reflected the impact of COVID-19 on consumption mindsets, purchasing patterns, and lifestyles among luxury consumers. Some 65% of respondents in Mainland China and 48% of respondents in Hong Kong tended to buy higher-quality items after the COVID-19 pandemic; 59% of respondents in Mainland China and 49% in Hong Kong will be buying more luxury items because they want to treat themselves better. Consumers attach more importance to life quality. It is worth noting that 17% of respondents in Mainland China and 32% in Hong Kong shifted purchases towards cheaper versions of regularly purchased luxury products during COVID-19. And 12% of respondents in Mainland China and 21% in Hong Kong intend to buy more secondhand luxury items after COVID-19.

At the same time, COVID-19 has further accelerated the use of digital channels among consumers, with 55% of respondents in Mainland China and 63% in Hong Kong saying that they started to use online channels more often for purchasing luxury goods after COVID-19 started.

Official brand websites have become the first choice for online shopping among mainland consumers, and offline duty-free shops have sprung up in Mainland China.

Among online destinations for luxury shopping, official brand websites still top the list in Hong Kong and also have become the most popular online purchasing channel for respondents in Mainland China year-on-year, accounting for 54% of purchases. Luxury brands' self-operated e-commerce businesses are attracting more and more consumer attention. Tmall/Taobao and JD.com account for 43% and 40%, respectively, in Mainland China, closely following the popularity of official brand websites.

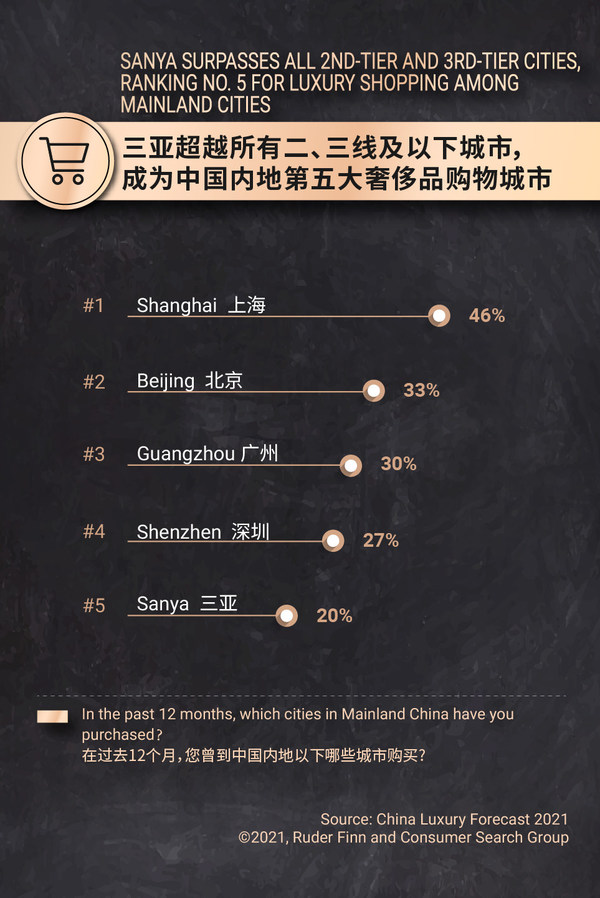

Because of restrictions on overseas travel due to COVID-19, mainland consumers shifted their overseas shopping plans by returning their focus to Mainland China. Hence, Shanghai, Beijing, Guangzhou, Shenzhen, and Sanya have become the top five mainland cities for luxury product purchases. Driven by the development of Hainan's open economy, duty-free stores in Hainan are rising rapidly as a key shopping destination for consumers. Sanya has surpassed all second-tier and third-tier cities to become the fifth-largest luxury shopping city in Mainland China.

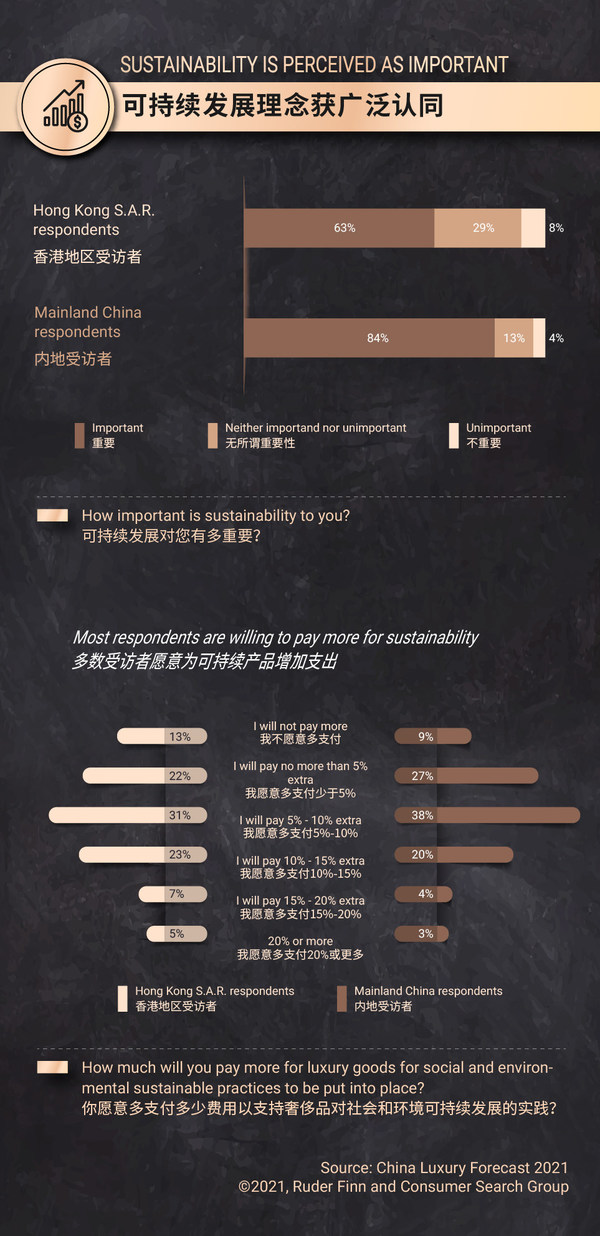

The concept of sustainable development is widely recognized, and most respondents are willing to increase spending on sustainable products.

As the market continues to mature and leaders from government and industry continue to promote sustainable development, people are becoming more and more aware of its importance. For this report, Ruder Finn and CSG cooperated with the consulting agency yehyehyeh, led by Ms. Shaway Yeh, to conduct in-depth research on consumer perceptions of sustainability.

The survey shows that a large portion of respondents (84% in Mainland China and 63% in Hong Kong) consider sustainability important. Meanwhile, 85% respondents in Mainland China and 62% in Hong Kong share a common view that the luxury market is an important means for encouraging sustainability. In both Mainland China and Hong Kong. reducing or eliminating pollution in the production process and sourcing ethical raw materials are the top two concerns among consumers, while the fur-free issue is of least importance to respondents.

About 90% of the respondents in both Mainland China and Hong Kong are willing to pay more for a luxury brand that supports practices of sustainable development for society and the environment. Among them, the largest group of respondents include those willing to spend 5% to 10% more; they make up more than 30%. On the other hand, consumer purchase intentions will fall for a luxury brand that is not making an effort to support sustainability. Some 92% respondents in Mainland China and 81% in Hong Kong will more or less cut their purchases of products sold under a brand that is irresponsible towards sustainability.

Generation Z shoppers have unique perceptions and behaviors.

Generation Z consumers (those 21 to 25 years old) have become an important force in luxury consumption, and their consumption perceptions and behaviors are quite different from those among older consumers. Compared with older respondents, Generation Z consumers put more value on purchasing luxury goods that "reflect my achievement" (38%) and pay less attention to goods that "reflect my taste" (33%). These reasons are below the top-ranked "improve life quality" (52%). Generation Z consumers are also the least likely to get luxury information from television (6%). In terms of fine dining and luxury travel, they are significantly more dependent on KOLs' recommendations than older respondents. In addition to Mainland China celebrities, their preferences for celebrities from Hong Kong or Taiwan are significantly lower than those of older respondents, while their preferences for celebrities from Japan, Korea, Europe or the Americas are significantly higher than those of older respondents. As for the proportion of "intend to buy more second-hand luxury items after COVID-19", the number of Generation Z respondents is significantly higher than that of older respondents.

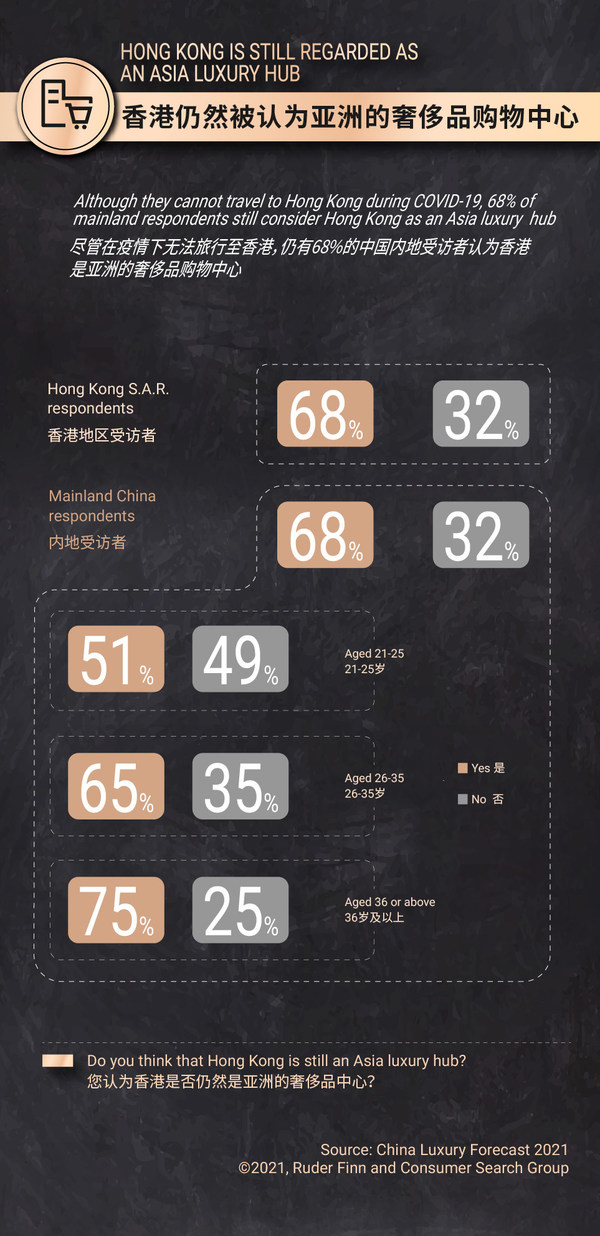

Hong Kong is still perceived as an Asian luxury hub by a considerable proportion of respondents from both Mainland China and Hong Kong.

The survey shows that 68% of respondents from both Hong Kong and Mainland China still regard Hong Kong as an Asian luxury hub, even though since last year Mainland China consumers have not been able to travel to Hong Kong as easily as they could because of COVID-19. But the percentage is lower among younger generations. (In the older group of consumers ages 36 and over, 75% of respondents agreed on this. In the middle group ages 26 to 35, 65% believed this. But among Generation Z consumers, the percentage fell to 51%.) When asked about possible travel destinations during the next 12 months, 23% of Mainland China respondents chose Hong Kong, which ranked second only to Mainland China (43%). Japan ranked third (21%) on the list of future travel destinations for mainland consumers.

"Although Mainland China's luxury market has been on a course of rapid growth, with the stabilization of COVID-19 and normalization of international travel in the coming years the part of the domestic luxury consumption growth that is due to border controls is expected to subside. To cope with the challenge, it is important to minimize the gap between domestic and overseas markets. Apart from narrowing differences in terms of service and price, the domestic market could also create more diversified product choices for Chinese consumers and further strengthen the connection with them by using different strategies such as building China exclusive versions, cross-brand collaborations and combinations of Chinese elements," suggests Gao Ming, Senior Vice President and Managing Director, Luxury Practice Greater China, Ruder Finn Group.

About Ruder Finn Group

Ruder Finn is a global, integrated communications consultancy, producing award-winning work at the intersection of strategy, creativity and content. We help our clients engage with those vital to their success by delivering meaningful, measurable, business results through inspirational, data-driven, communications counsel and solutions. Ruder Finn Group consists of Ruder Finn, RF Thunder and RFI Studios. Our strong network includes offices across the global major markets in New York, San Francisco, Washington, D.C., London, Beijing, Shanghai, Guangzhou, Shenzhen, Hong Kong, Singapore, Kuala Lumpur, New Delhi, Mumbai and Bangalore. This seamless regional network coordination ensures that we have the talent and capacity to deliver exceptional outcomes for our clients. For more than 70 years, Ruder Finn has always been the symbol of "outstanding communication". We represent multinationals in sectors including luxury, healthcare and life sciences, automotive, travel and tourism, lifestyle, culture and art, technology and financial services. Our expertise encompasses integrated marketing communications, digital and social marketing strategy, reputation management, media relationships, crisis management, CSR, employee engagement, and executive skills training. Our research and analysis team provide insights and counsel in market trends, producing annual research reports including the China Luxury Forecast, Physicians Digital Outlook Survey and other publications. Ruder Finn Group's key clients include Hermès, L'Oréal, Michelin, Emirates, Jumeirah, Four Seasons, Omron, Sanofi, Roche, Volkswagen Group and leading brands from the Kering, LVMH and Richemont Groups.

About Consumer Search Group

Established in 1982, Consumer Search Group (CSG) is one of the most competent marketing research consultancies, offering comprehensive marketing research services for a diverse range of clients. At present, CSG has offices in Beijing, Shanghai, Guangzhou and Hong Kong in order to provide timely and accurate market information designed to explore and benefit from the flourishing Chinese market. With more than three decades of solid experience, we are a confident and competent provider of first-class services. Our mission - namely Creativity, Solutions and Growth - best illustrates our work culture. We exhibit creativity and the spirit of innovation. We are adaptable to the ever-changing market, providing clients with comprehensive solutions and value-added services. We grow together with our clients.