There are 183,737 millionaires in Singapore, and 1,000 who are 'crazy rich': Credit Suisse

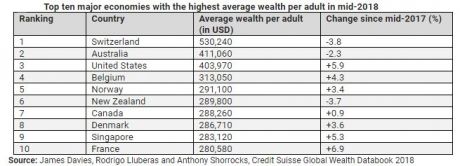

SINGAPORE - The number of millionaires in Singapore grew 11.2 per cent in the 12 months to mid-2018 to 183,737 as wealth per adult rose 5.3 per cent to over US$283,000, the ninth highest in the world.

This is according to Credit Suisse Research Institute's 2018 Global Wealth Report released on Thursday (Oct 18), which found that household wealth in Singapore grew strongly at 7.4 per cent to around US$1.3 trillion.

Those who may be considered "crazy rich" - ultra high net worth individuals who hold more than US$50 million (S$68.9 million) in wealth - number about 1,000 in Singapore, a 1.1 per cent increase, said Credit Suisse.

Credit Suisse said Singapore's wealth per adult has increased more than 146 per cent since 2000, mainly from high savings, asset price increases and a rising exchange rate from 2005 to 2012.

Financial assets make up 55 per cent of gross household wealth in Singapore, a ratio similar to that of Switzerland, the richest per capita economy.

Credit Suisse forecast that the number of millionaires here will grow by 5.5 per cent per annum in the next five years to reach 239,640.

Singapore's average debt of US$53,000, equal to 16 per cent of total assets, is moderate for a high-wealth country, Credit Suisse added.

The report also said that aggregate global wealth rose 4.6 per cent to US$317 trillion in the same 12-month period, outpacing population growth.

Wealth per adult grew by 3.2 per cent, raising global mean wealth to a record US$63,100 per adult.

The US was the biggest contributor to global wealth as it added US$6.3 trillion, continuing its winning streak of yearly growth in total wealth and wealth per adult since 2008. Its total wealth now stands at US$98 trillion.

China had the second-largest household wealth after adding US$2.3 trillion to reach US$52 trillion. The country's wealth is projected to grow another US$23 trillion in the next five years to comprise 19 per cent of global wealth by 2023.

Non-financial assets were the main growth drivers in all regions except North America, and accounted for 75 per cent of wealth growth in China and Europe and 100 per cent in India.

"The United States and China are the obvious outperformers and drivers of wealth growth, despite rising trade tensions," noted John Woods, Credit Suisse's chief investment officer for Asia-Pacific.

He added that asset price and exchange rate fluctuations had the heaviest impact in Latin America and parts of the Asia-Pacific, contributing to much of the year-on-year variation in wealth levels. Currency depreciation against the US dollar also affected wealth trends in some of the major regional economies such as Australia and India.

"Asia-Pacific countries continue to make significant contribution to global high net worth wealth pool, with China, Japan, Australia, Korea and Taiwan making up more than 8.8 million millionaires, representing over 20 per cent of the global total," Mr Woods said. The Asia-Pacific (including China and India) emerged on top as the largest wealth region, as household wealth grew 3 per cent to more than US$114 trillion.

This year's report includes themes such as the global wealth outlook for women, and the narrowing wealth gap between the top two tiers of the global wealth pyramid and the bottom two tiers.

In its overall wealth outlook, Credit Suisse projects global wealth to rise by nearly 4.7 per cent per annum over the next five years to US$399 trillion by 2023.

This article was first published in The Straits Times. Permission required for reproduction.