Where can you afford to purchase an HDB flat in Singapore?

The cost of housing varies among different areas of Singapore, making some neighborhoods much more affordable than others. We set out to estimate roughly how much someone would have to make annually to afford a home in each neighborhood.

Housing prices vary dramatically between neighborhoods in Singapore. For this reason, affordability varies for individuals and families across the island. Have you ever wondered how much you would have to earn to live comfortably in various neighborhoods in the country? In this article we analyse how much you would have to earn in order to afford a typical 4-room HDB flat in each of Singapore's neighborhoods.

WHAT KIND OF SALARY DO YOU NEED TO PURCHASE A HOME IN EACH NEIGHBOURHOOD?

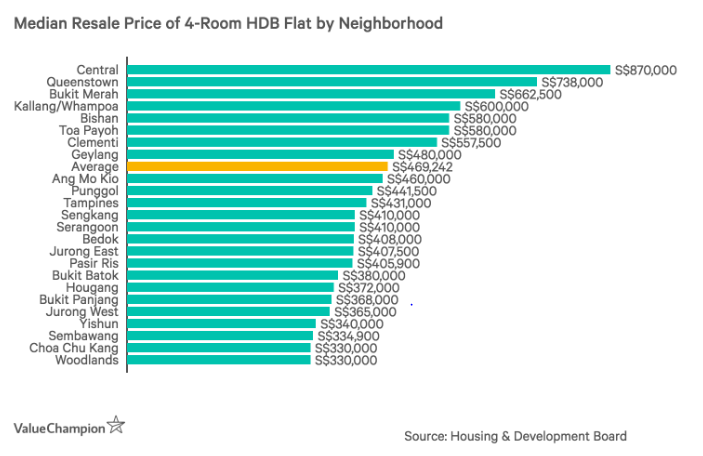

In order to answer the question of how much one would need to afford a home in each neighborhood Singapore, we first estimated the home loan size and monthly payment based on median HDB resale prices. To make these calculations, we assumed that borrowers would require mortgages of 75 per cent of the median resale price. Additionally, we calculated monthly payments using an interest rate of 2.5 per cent and housing loan with a 25 year tenure.

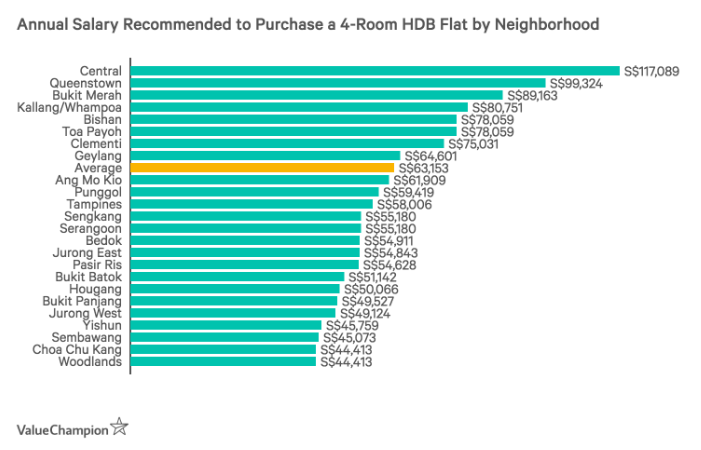

Next, we estimated that individuals would spend 30 per cent of their income on their monthly mortgage payments. Technically, individuals could afford to make larger monthly payments than 30 per cent of their monthly income, but this leaves little income for other necessary expenses like food, utilities and insurance, not to mention savings. The chart below illustrates the results of our estimations by neighborhood; however, it is important to note that this chart is simply a rough guideline and does not preclude anyone from finding an affordable home in any of the neighborhoods listed.

WHAT JOBS EARN THESE LEVELS OF INCOME?

In order to comfortably afford a 4-room HDB flat in some of Singapore's most expensive neighborhoods, it is necessary to earn about S$100,000 per year. According to the Ministry of Manpower some of the highest paying positions in Singapore, which would easily be able to afford these homes, include specialist medical practitioner (median annual gross wage: S$260,748), university lecturer (S$145,704) and financial/Insurance services manager (S$112,255).

Some careers that appear to pay well enough to allow for individuals to afford more moderately priced neighborhoods include sales and marketing manager (S$84,764), recreation centre manager (S$75,012) and civil engineer (S$71,772).

Finally, careers that would allow for individuals to afford homes in more affordable neighborhoods include bus driver (S$46,332), chef (S$39,593) motor vehicle mechanic (S$38,135).

This is not to say that certain careers would prevent or guarantee your ability to purchase a home in a certain neighborhood, but rather an illustration to show which careers might best assist you in purchasing your dream home. Additionally, these estimates are specific to 4-room HDBs and does not consider smaller apartments, which would be more affordable.

WHAT ELSE SHOULD PROSPECTIVE HOMEOWNERS CONSIDER?

If seeing that your annual salary would allow you to purchase a home in any of the neighborhoods listed above excites you, it is important to remember that there is more to being able to afford a home than being able to meet monthly mortgage payments.

Most notably, under the current Loan-to-Value (LTV) ratio rules, individuals purchasing a home must make down payments of at least 25 per cent of the home price, with at least 20 per cent of the down payment (or 5 per cent of the home's price) paid in cash and the remaining amount can be paid for using CPF Ordinary Account savings.

This could require a significant amount of savings. For example, a home that costs S$500,000 requires a down payment of at least S$125,000; not a small sum for most residents.

In addition to the down payment, it is also necessary to consider a number of home ownership costs that you may plan pay for with your personal savings. Because you may cover these costs with personal savings, they may decrease your ability to make a large down payment.

For example, you may want to consider upgrading appliances in your new home or making renovations to the interior of your new home. If you do not consider these costs then it will be difficult to properly assess how much of a down payment you can afford. Also, while it is possible to finance the cost of your renovations with a loan, taking a renovation loan will decrease the maximum monthly mortgage payment that you can afford.

WHAT DOES THIS MEAN FOR PROSPECTIVE HOME BUYERS?

Ultimately, these estimates are useful for giving you the picture of housing affordability across various neighborhoods in Singapore, but they should not be taken as strict rules as you plan to purchase a house.

For instance, because these figures are based on the median price in each neighborhood, there will undoubtedly be cheaper and more expensive homes in each neighborhood. This highlights the importance of thoroughly combing real estate listings in order to get a better idea of what types of homes you could afford.

Additionally, to make the analysis more simple, we chose reasonable inputs for down payments, interest rates and loan tenures. Based on your circumstances, these inputs could change significantly, which could impact your ability to purchase a home in various neighborhoods. Therefore, it is important to conduct your own due diligence especially when it comes to comparing your loan options with different principal amounts, tenures and interest rates.

This article was first published in ValueChampion.