10 things first-time homebuyers should know before buying in 2021

It’s always a huge challenge when first-time homebuyers ask “what do I need to know?” The Singapore private property market is so unique, and so dynamic, that what you know today may not apply tomorrow; and there’s just so much ground to cover.

After much deliberation, here are what we think is the most important things you need to know… at least as of 2021:

For HDB flats, this isn’t a mistake you can make. HDB will cap your monthly loan repayments to 30 per cent of your monthly income, as part of the Mortgage Servicing Ratio (MSR).

For private property owners though, the Total Debt Servicing Ratio (TDSR) applies instead. This caps your maximum loan repayment to 60 per cent of your monthly income, inclusive of other loans like education loans, or car loans.

Yes, it’s a bit strange that people buying even more expensive homes are allowed to borrow twice as much; that seems counterintuitive, considering the main point is financial prudence. Nonetheless, that’s the reality of the situation.

So as a first-time homebuyer, it’s up to you not to game the system, and really stretch your loan to the full 60 per cent. If more than half your salary is being swallowed by debt, then even a slight drop in income can result in serious consequences. This is especially true if you’re already a dual-income family, and there isn’t a “back-up” like your spouse joining the workforce.

Also, do realise that foreclosure is a serious stain on one’s credit score. There are cases of people who have lost their homes to foreclosures, and been unable to get home loans for years after their financial recovery.

To be frank, HDB has the right idea with the 30 per cent cap. Even if you can go beyond this limit, we’d suggest that you err on the side of caution.

Many people forget to factor in the monthly maintenance fees, but this can be quite a drain monthly on cash flow depending on the development.

The maintenance fees for a condo are based on share value. The bigger your home, the higher the share value; and the more you pay for maintenance.

For example, a typical maintenance cost might be $75 per share value. So a unit that is 50 sq. m. or less (around 540 sq. ft.) might have a share value of five, coming to $375 per month.

As maintenance fees are almost always collected quarterly, you can expect a bill of around $1,125 every three months. If you don’t pay this on time, the interest rate can be as high as 15 per cent per annum.

Sometimes, when you’re comparing between two equally-matched developments, the maintenance fees may be the tiebreaker you’re looking for.

As a general rule of thumb, maintenance fees will go up as the number of units goes down. If there are only 50 units to share the upkeep, for example, each owner will probably have to contribute more. But in a mega-development like Normanton Park , Treasure at Tampines , etc., where there are well over 1,000 units, maintenance fees can be way cheaper. Privacy and exclusivity affect more than just the asking price.

Lastly, don’t forget that maintenance prices may not stay the same throughout. Depending on if the maintenance costs go up higher than expected, your monthly maintenance could increase as well.

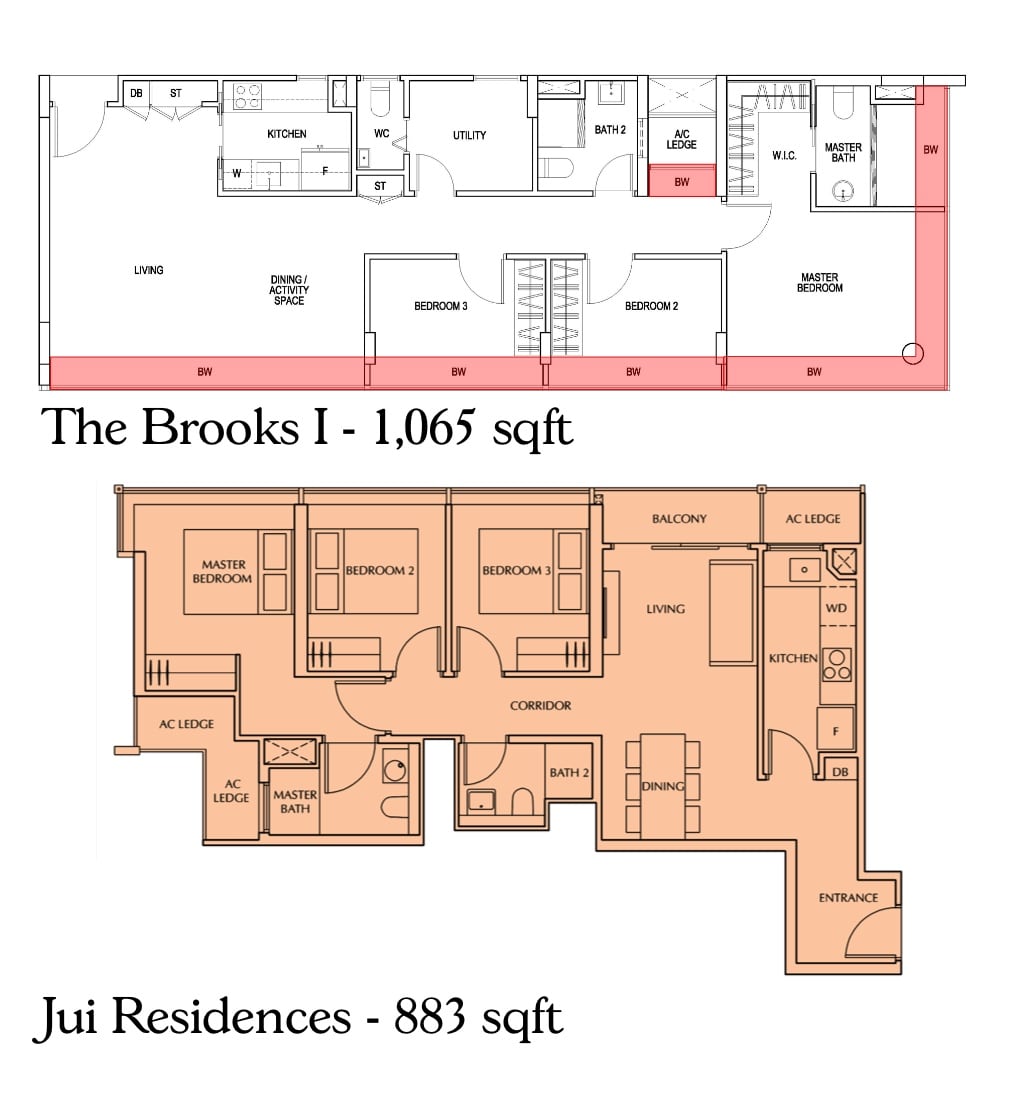

It’s possible for a 1,100 sq. ft. unit to have less liveable space than an 800 sq. ft. unit, on account of the floor plan.

For example, many old condos have huge unit sizes, such as 1,000+ sq. ft. two-bedders. However, a check may show that 200 sq. ft. is wasted on planter boxes, another 150 sq. ft. is wasted on a big air-con ledge, 50 sq. ft. is useless long corridors, etc.

For those buying in 2021, the big debate right now is on dumbbell layouts. Some people love it, because it eliminates corridors, by having bedrooms on either side of the living room. Others hate it, because the main door opens up right into the living room.

When it comes to dual-key units, be aware that the liveable space is often less than a unit of comparable size. This is because dual-key units often trade liveable space for more functional space; such as having an additional bathroom and kitchen for the other sub-unit.

In every case, it’s important to look at more than just the total square footage. What matters is not the technical size, but whether you have room for your lifestyle needs.

Your “dream theme” may not be possible in every floor plan. For example, you cannot hack away load-bearing walls in a unit. This can mean certain elements you dislike, such as an enclosed kitchen, are unchangeable.

Before you buy, you might want to run the floor plan past a contractor or interior designer. They’ll be able to tell you whether design features – such as kitchen islands and walk-in wardrobes – are feasible on the plan.

For loft units, or high-ceiling units, never assume you can build a mezzanine floor. This requires permission from URA; it may not be allowed, no matter how spacious it looks to you.

Some buyers fail to check first, and end up wasting money on high-ceiling units, where they pay for “strata void space” for no reason (yes, you might have to pay for the “air” between the ground and ceiling, if it’s high enough).

Before putting in a kitchen island, feature wall, study, etc., do consider the amount of storage space you need. This is especially important for those of you with bulky hobbies – like camera equipment, golf clubs, drums, etc.

First-time homebuyers often overlook this aspect, and assume there will be space somewhere to keep it. The “space” often ends up being a mountain of cardboard boxes in a corner, until you end up paying $3,000 to $5,000 for custom carpentry work to deal with it. Try to pick units where there’s already sufficient storage, such as units where the mandatory bomb shelters have already been converted to storerooms. You don’t want a scenario of a cramped-looking home because of a lack of space to put all the stuff – it’s not a good look.

With regard to the kitchen, an often-overlooked consideration is whether it’s a “one-wall” kitchen. This means that only one side of the kitchen has counters and cabinetry; this can be a big source of frustration, if you’re a serious cook.

ALSO READ: A first-time homebuyer's journey: List of 27 ECs with big units and a review of Citylife @ Tampines

Views are not the only reason condos have “premium stacks”. Singapore is a very hot and sweaty country – the last thing you want is to have the sun blasting through your window, and turning your living room into a microwave.

(Besides, your air-con is likely to consume more power than way, and break down more often; and some fabrics will fade under constant sun glare).

As this is a pretty important consideration, we have a longer article to explain it in detail. But in summary, suffice it to say that North-South facings are ideal, whereas East-West facings are the worst.

Do note, however, that other factors may change this. For example, if there are other blocks to screen you from the sun, then even an East-West facing might be okay.

Bad facings can also, ironically, work to the advantage of some buyers. If you actually like the sun blasting in, for example, or you’re seldom home during the hotter hours and don’t care, you could save money by picking a worse facing. That can diminish your resale prospects, though.

If you’re viewing a home at a time like 2 to 3pm on a weekday, you’re not getting a true sense of the noise levels. Most people are at work during those hours.

It’s best to also drop by around 7pm when the evening rush starts, and neighbours turn on the TV, start practicing the piano, talk in the corridors, etc. This will also give you a sense of how bad the traffic congestion can get, if you’re driving home. The Land Transport Authority does do traffic assessments for newer condos – but these were not done for older resale units, where high density can seriously snarl up the roads.

For those of you buying landed homes, it’s a common mistake to assume low-density enclaves are all bastions of peace. It depends entirely on your neighbour – living next to a loud family in a demi-detached unit is still a nightmare, even if the rest of the estate is peaceful.

If you can, drop by a condo on the weekend. This is when residents invite friends and relatives over; you can get a sense of how packed the facilities get, and how the noise level changes on different floors. In well-spaced-out developments, you may not need a very high floor for peace and quiet.

If you’re moving with young children – especially if you have a baby to look after – moving into a new condo poses a challenge: there’s a chance that loads of residents are all doing renovations at the same time, which can make it extremely disruptive for several months.

Even for resale units, you may want to try and time your purchase, so you move in when the neighbour’s renovations are just about done.

Besides renovations, take note of construction work facing your unit. New MRT stations and malls are all great in the long run – but it might mean several years of drilling, noise, and dust before you see the benefits. If you’ve never lived in an environment of construction noise, you may just be surprised at how loud it can be, and how that constant noise can play a part in stress levels.

Construction can also mean that some existing amenities will shift away. For example, the nearby supermarket and eateries may be inaccessible or even move elsewhere, if there’s construction work for several years.

For older resale units, it’s worth getting a contractor to take a look. You can sometimes get a discount or freebie, if you use the same contractor who will be doing the renovation work for you.

Older homes can have problems that go beyond cracks and minor leaks. For example, you may need to overhaul the entire air-con system, including the condenser; or you may find that leaks are not fixable on your end (e.g., the leak is coming from a neighbouring unit).

Remember that you can ask for these to be fixed, as a condition of sale. One advantage of having a realtor is that they can negotiate such terms for you.

Besides this, it’s a common mistake not to check, after the Option To Purchase (OTP) has been signed or exercised. Remember the condition of the property can change, just before it’s handed to you. There have been cases where leaks, electrical problems, and even fires have happened, in the days before the buyer takes possession.

If you have any maintenance issues as a condition of sale, you should check that these have been fulfilled, before you sign the last few forms.

The Minimum Occupancy Period (MOP) is five years, but there are two things to remember here.

First, the MOP begins from the time of key collection, not from the time of purchase. This means you need to add the construction time to the MOP, to determine how long it is before you can sell or upgrade. Most HDB flats take around four years to be built, so a BTO flat typically means a nine-year wait before you can sell.

Second, if you have children, don’t forget their schooling might keep you in the area for longer than five years. Primary school is six years; and the final year is the dreaded PSLE year. You probably don’t want to move too far from their school, in that time.

ALSO READ: A first-time homebuyer's journey: My personal review of Windermere EC

This article was first published in Stackedhomes.