Is buying a car in Singapore worth it? This easy formula breaks it down for you

PUBLISHED ONJuly 15, 2020 9:01 AMByCandice Cai

PUBLISHED ONJuly 15, 2020 9:01 AMByCandice CaiIn Singapore where car prices are sky-high, getting your own set of wheels is a decision that's not to be taken lightly.

If you've been mulling over whether to take the plunge, here's one quick way to figure it out.

Personal finance site The Woke Salaryman invited followers to send him finance-related questions in an Ask Me Anything (AMA) session on Instagram.

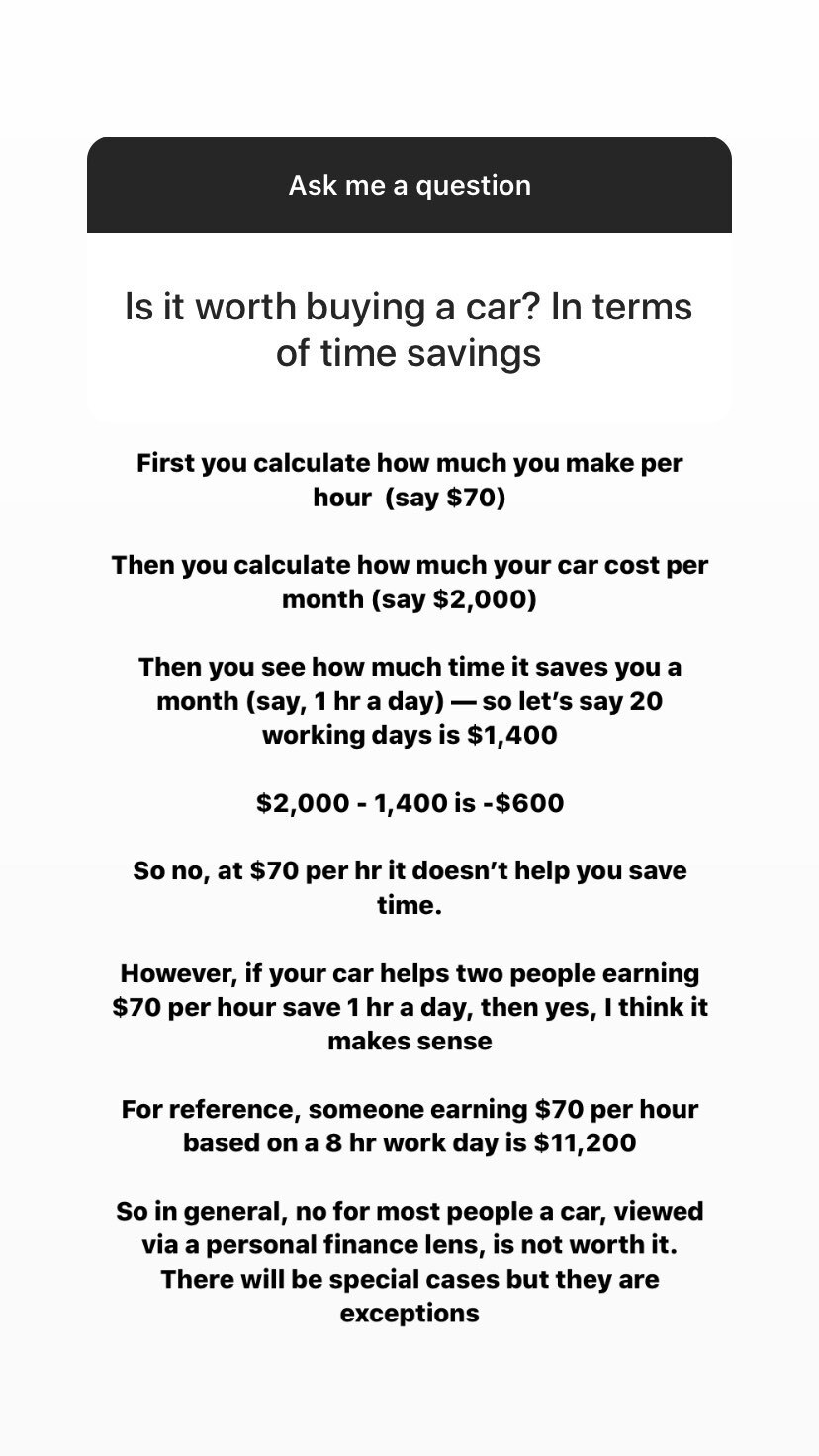

In a Story shared on Tuesday (July 14), he shared an easy-to-remember formula to work out whether it makes financial sense for you to fork out upwards of $50,000 on a car.

Here are the steps:

First, calculate how much you make per hour. So if you work a five-day week, then it'll be your salary divided by the average number of days worked in a month and divided by the number of hours worked in a day.

For example's sake, a salary of $3,000 works out to be about $17 per hour.

[[nid:492363]]

Then, you'll have to figure out how much it costs to maintain the car every month (don't forget to include road tax, maintenance and other hidden costs). Let's just assume it is $1,000.

The next step is to see how much time it saves and translate that into potential earnings.

Say if having a car saves you one hour a day, that would translate to about 22 hours in time savings a month, which works out to be $374.

So one can easily see that by weighing the cost ($1,000 a month), versus savings ($374), buying a car is definitely a loss-making purchase and hence, "not worth it".

However, the writer noted that if the car can be shared by others who would benefit from the time saved as well, then it may make sense. But that is if the arrangement even works out, logistically.

He ended the post with how for most people, "a car, viewed via a personal finance lens, is not worth it". "There will be special cases but they are exceptions."

candicecai@asiaone.com