When is the best time to sell your HDB resale flat during a BTO month?

Sometimes, some readers would ask us if HDB resale demand will slow during a BTO month (Feb, May, August or November).

The presumption is that as BTO flat prices are subsidised, hopeful homebuyers would rather buy a BTO flat than pay higher prices for a resale in the same estate. Furthermore, with less competition, resale buyers could perhaps negotiate better resale prices (eg. lower Cash Over Valuation or COV, etc.).

A different school of thought would say that BTO flat applicants are different from HDB resale buyers. BTO flat buyers are prepared to wait 3.5 to four years for their new home, while HDB resale buyers need their homes like now. So these are two mutually exclusive groups.

Rather than debating about it, we've compiled some data from 99.co Researcher and HDB's past BTO exercises to see which is true. Perhaps then, if you are ever thinking of buying (or selling) your HDB resale flat, you'd know if there really is a right time after all.

For this article, we've analysed past BTO exercises for four-room and five-room HDB flats from February 2020 to February 2023.

Understandably, there were only three BTO exercises in 2020 due to Covid — the combined May/August 2020 BTO (held in August) was one of the largest of its kind.

We'll then analyse the HDB resale volume (three months before and three months after) at five different estates (three mature and two non-mature) where a BTO exercise was held.

If a BTO exercise ends in the 1st or 2nd week of a month, we'll take that as the application month. If it ends in the 3rd or 4th week, we'll take the following month as the application month. This is because it takes roughly three-six weeks after application closes for BTO application results to be known.

Since the February 2020 BTO exercise, the non-mature estate of Yishun has had three exercises where four-room and five-room flats were offered. Here are some details from those exercises.

| Yishun | No of units | No of Applicants | Application rates – 1st timers | Application rates – 2nd timers | Application rate – Overall | BTO Price at Launch (excl. Grants) | Resale Prices in Estate in the same month* |

| 4-room flats | |||||||

| February 2022 | 686 | 2187 | 2.5 | 16.2 | 3.2 | From S$270k | S$288k – S$545k |

| May 2022 | 207 | 2525 | 9.4 | 28.4 | 12.2 | From S$328k | S$350k – S$568k |

| November 2022 | 917 | 1422 | 1.1 | 10.5 | 1.6 | From S$248k | S$320k – S$655k |

| 5-room flats | |||||||

| February 2022 | 613 | 2018 | 2.3 | 22.3 | 3.3 | From S$385k | S$450k – S$659k |

| May 2022 | 166 | 2491 | 9.4 | 48.1 | 15 | From S$485k | S$525k – S$875k |

| November 2022 | 795 | 1410 | 1 | 16.6 | 1.8 | From S$366k | S$500k – S$746k |

*based on 99.co Researcher data

Among these three exercises, the highest demand for BTO flats seems to be in May 2022, with 2,525 applicants for four-rooms and 2491 applicants for five-rooms. It should also be pointed out that the starting BTO prices in that exercise were higher than the other two.

A review of resale transactions for four-room flats in Yishun three months before and after shows a slight dip in May before a 61 per cent surge in the 2nd month.

Similarly, there was a 36 per cent jump in volume one month after the November 2022 exercise. Notably, the starting BTO prices in the November 2022 exercise were the lowest among the three.

If we review five-room flats, there was a 69 per cent surge in transactions one month after the November exercise as well. Based off these charts, does this mean there really is a correlation between a BTO month and the resale volumes thereafter?

Or perhaps this pattern is only prevalent in non-mature estates?

Heading west to our second non-mature estate, here's a summary of past BTO exercises in Jurong West:

| Jurong West | No of units | No of Applicants | Application rates – 1st timers | Application rates – 2nd timers | Application rate – Overall | BTO Price at Launch (excl. Grants) | Resale Prices in Estate in the same month* |

| 4-room flats | |||||||

| November 2021 | 130 | 229 | 1.4 | 3.7 | 1.8 | From S$264k | S$380k – S$670k |

| May 2022 | 246 | 1827 | 5.3 | 19.6 | 7.4 | From S$320k | S$330k – S$677k |

| February 2023 | 186 | 567 | 2 | 24.1 | 55 | From S$288k | S$408k – S$650k |

| 5-room flats | |||||||

| May 2022 | 214 | 3294 | 9.1 | 51.2 | 15.4 | From S$412k | S$440k – S$730k |

*based on 99.co Researcher data

Among its recent exercises, the highest demand was also in May 2022 when 1,827 applicants vied for 246 four-room units and 3,294 applicants applied for 214 five-room flats.

If we review the resale volume chart for Jurong West, there were discernible dips in volume in the months before the BTO application month.

Note however, that the 3rd month for the February 2023 exercise is June, so the number of transactions for that month is incomplete at the time of publishing.

While there was only one exercise with five-room flats, there was also a dip during the BTO month and the month after. In theory, it seems that there are discernible dips one month before or during a BTO application month — at least in the two non-mature estates we've looked at so far.

The assumption is that BTO applicants (especially 2nd timers) would wait for their BTO results during the application month. Once the results are out (and they realise they've not gotten a queue number), they may reconsider resale flats instead (or wait for the next BTO exercise).

Moving on to mature estates, Tampines has had four exercises with four-room and five-room flats since August 2020. Here's a summary:

| Tampines | No of units | No of Applicants | Application rates – 1st timers | Application rates – 2nd timers | Application rate – Overall | BTO Price at Launch (before Grants) | Resale Prices in Estate same month* |

| 4-room flats | |||||||

| May/August 2020 | 871 | 1781 | 1.7 | 9.6 | 2 | From S$311k | S$345k – S$634k |

| November 2020 | 360 | 1441 | 3.1 | 20.7 | 4 | From S$334k | S$325k – S$675k |

| August 2021 | 989 | 3443 | 2.7 | 19.3 | 3.5 | From S$342k | S$405k – S$700k |

| August 2022 | 150 | 3347 | 17.2 | 127.4 | 22.3 | From S$381k | S$409k – S$780k |

| 5-room flats | |||||||

| May/August 2020 | 717 | 1308 | 1.3 | 12.7 | 1.8 | From S$423k | S$440k – S$813k |

| November 2020 | 244 | 1126 | 3 | 36.3 | 4.6 | From S$460k | S$465k – S$809k |

| August 2021 | 881 | 4255 | 3 | 40.1 | 4.8 | From S$475k | S$480k – S$889k |

| August 2022 | 117 | 3082 | 18.5 | 201.2 | 26.3 | From S$520k | S$565k – S$882k |

*based on 99.co Researcher data

Among the four past exercises, the hottest demand was last August 2022, where 3,347 applicants were vying for just 150 four-room units and 3,082 applicants wanted 117 five-room units.

If we correlate that demand with our resale volume charts below, we can see that transactions were mostly flat throughout the August 2022 BTO season for four-room and five-room flats. In fact, over the past four exercises, volumes were consistent throughout (at least for four-room flats).

For five-room flats, there were some fluctuations in resale volume before the BTO month, such as the 37 per cent dip the month before the November 2020 exercise. There was a smaller dip for four-room flats in that same exercise as well.

The largest spike however was the August 2021 exercise, when HDB released 881 five-room flats.

Resale demand for five-rooms peaked one month before that exercise. One reasoning could be that longer wait times (four-five years) for larger BTO developments may have driven more on-the-fence buyers to resale.

More importantly, at least for Tampines, there is no common pattern to correlate BTO application months with resale volumes. In other words, it's possible that in mature estates, resale volumes are less impacted during BTO exercises in the same estate.

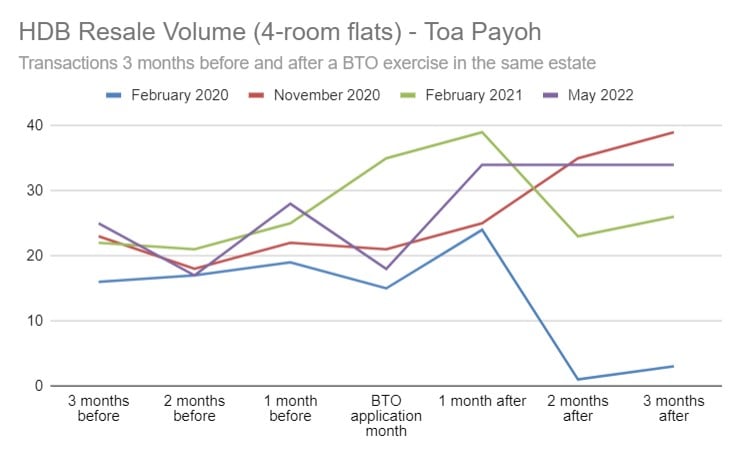

Moving closer towards central, we decided to take a look at another mature estate — Toa Payoh. Here's a summary of its past BTO exercises:

| Toa Payoh | No of units | No of Applicants | Application rates – 1st timers | Application rates – 2nd timers | Application rate – Overall | BTO Price at Launch (excl. Grants) | Resale Prices in Estate in same month* |

| 4-room flats | |||||||

| February 2020 | 1211 | 11684 | 7.6 | 48.7 | 9.6 | From S$395k | S$280k – S$788k |

| November 2020 | 910 | 3598 | 3.2 | 18.1 | 4 | From S$466k | S$292k – S$790k |

| February 2021 | 797 | 4667 | 5.1 | 21.4 | 5.9 | From S$464k | S$293k – S$853k |

| May 2022 | 165 | 1797 | 7.4 | 78.5 | 10.9 | From S$420k | S$370k – S$975k |

| 5-room flats | |||||||

| November 2020 | 144 | 2170 | 7.1 | 171.4 | 15.1 | From S$627k | S$520k – S$1.09m |

| February 2021 | 323 | 3193 | 6 | 84.1 | 9.9 | From S$611k | S$620k – S$1.06m |

*based on 99.co Researcher data

For four-room flats, the hottest demand were the February 2020 and May 2022 exercises, when overall application rates were 9.6 and 10.9 respectively. In the two exercises where five-room flats were offered, demand was equally high, especially among 2nd timers.

A look at the resale volume before and after the BTO exercises show two different stories. For the February 2020 BTO, there was a dramatic fall in four-room resale transactions two months after (it picked up again in June 2020 with 28 transactions).

Two years later, in May 2022, resale volume dipped 36 per cent during the BTO application month, before surging 89 per cent a month after.

In other words, while both exercises experienced high application rates, their equivalent resale patterns during those periods were different.

We should point out that in the November 2020 exercise, the starting BTO price for a four-room was S$466,000. This was almost 96 per cent of the average resale price for four-rooms sold in the same estate in the same month. That would possibly explain the continuous surge in resale volume after that BTO month, as BTO buyers-in-waiting decided to buy resale instead.

For five-room flats, demand dropped 54 per cent a month after the February 2021 exercise. This was mirrored by a 41 per cent drop two months after for four-room flats. Both chart patterns look almost similar although they're one month apart.

Finally, we've decided to move a little closer to town. So far, only four-room flats have been offered at Queenstown for recent BTO exercises. Here they are:

| Queenstown | No of units | No of Applicants | Application rates – 1st timers | Application rates – 2nd timers | Application rate – Overall | BTO Price at Launch (excl. Grants) | Resale Prices in Estate in the same month* |

| 4-room flats | |||||||

| August 2021 | 534 | 4099 | 5.2 | 56.7 | 7.7 | From S$540k | S$375k – S$986k |

| May 2022 | 671 | 2919 | 3 | 31.3 | 4.4 | From S$511k | S$490k – S$980k |

| November 2022 | 2443 | 5652 | 1.4 | 18.8 | 2.3 | From S$516k | S$592k – S$996k |

| February 2023 | 572 | 2531 | 2.3 | 45.7 | 4.4 | From S$541k | S$500k – S$1.19m |

*based on 99.co Researcher data

What's unique about Queenstown, being a mature estate and all, is that its past three exercises have included Prime Location Public Housing (PLH) flats.

Despite misconceptions surrounding the 10-year Minimum Occupation Period, there was still quite a significant number of applicants during these exercises. For example, in the February 2023 exercise, there were 2,531 applicants vying for just 572 units.

Based on the resale volume for four-room flats in Queenstown, there are two observations.

First, there was more resale volume during the non-PLH August 2021 period than the past three recent PLH-based BTO exercises. You'd also notice the 29 per cent spike one month after August 2021, which could be indicative of unsuccessful applicants entering the resale market.

Second, despite the lower application rates in recent PLH-based BTO exercises, resale volumes were also lower. It's likely that BTO applicants were more keen on non-PLH exercises in other estates at lower price points.

Indeed, in the February 2023 exercise, there was a respectable 55 per cent increase in resale volume during the BTO month.

As with the Jurong West charts, note that February 2023's 3rd month is June, which has incomplete transactions at the time of publication.

Based on our analysis of the BTO exercises for four-room and five-room flats in these five estates, here are some observations:

In conclusion, we don't think resale volume would be heavily affected when there's an ongoing BTO exercise in the estate. However, resale volume in the same estate might pick up one to two months after the BTO application ends.

In other words, there really isn't a specific or strategic time to buy or sell a HDB resale flat even if there's a BTO exercise happening for the estate.

But, if you're a HDB flat owner with intention to sell your flat, and there happens to be a BTO exercise for your estate (where the application rate is high), you might just see greater demand for viewings after the ballot results are released. Just saying…

ALSO READ: Comedian Mayiduo self-designed his Punggol BTO flat interior, spent $40k on reno