2 blue-chip companies that slashed their dividends

Blue-chip companies are generally recognised as being large, stable and consistent.

These are companies that have enjoyed many years of growth and amassed an impressive track record.

However, blue-chip companies are not immune to economic slowdowns.

The Covid-19 pandemic has caused major disruptions to supply chains and suppressed demand for products and services.

These two blue-chip companies are seeing tougher times ahead, and have cut their dividends to conserve cash.

SIA Engineering Company Ltd, or SIAEC, specialises in aircraft line maintenance and maintenance, repair and overhaul (MRO) services for airlines. SIAEC is a subsidiary of Singapore Airlines Limited (SGX: C6L), or SIA.

For the fiscal year ended March 31, 2020 (FY 2020), SIAEC reported a 2.6 per cent year on year decline in revenue.

Operating profit, however, increased by 19.2 per cent year on year to $67.7 million.

Though net profit increased by 20 per cent year on year to $193.8 million, the group reduced its final dividend by 37.5 per cent to $0.05 from $0.08 a year ago.

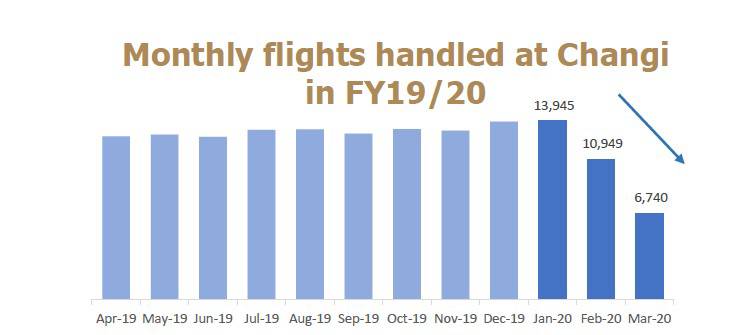

SIAEC started seeing a significant slowdown in March, when the number of flights handled at its Singapore base fell to only about 50 per cent of its usual workload

These flight reductions had a direct and adverse impact on the group's line maintenance revenues.

Fleet management revenue was also impacted as this is based on flying hours.

Base maintenance unit, along with engine and component segment, are expected to be badly affected moving forward even though the effect was insignificant for the fiscal year 2020.

Changi Airport had reported that the number of scheduled flights for April was 6 per cent fewer than originally scheduled.

The plunge in flights for April and most of May will have an adverse impact on SIAEC's financial performance.

The pace of recovery for the MRO business remains unclear, but is expected to be slow and is directly dependent on the recovery of the aviation industry.

Singapore Post is a leading post and parcel service player that provides innovative mail and logistics solutions in Singapore and the region. The group has operations in 19 markets.

For FY 2020, Singapore Post announced a slight year on year dip of 0.7 per cent for its total revenue, while operating profit declined by 21.3 per cent year on year.

Underlying net profit remained flat at $100.2 million.

[[nid:486555]]

The group declared a lower final dividend of $0.012, down 40 per cent from last year's $0.02.

For FY 2020, total dividends came up to $0.027, a drop of 23 per cent from the $0.035 declared in the fiscal year 2019.

Singapore Post's post and parcel division, which made up 56 per cent of group revenue, continues to see declines in mail volumes.

Revenue for this division fell just 1 per cent year on year from $745.7 million to $737.2 million.

Operating profit for the division, however, plunged by 23 per cent to $127.5 million.

Letter volumes continue to decline at a double-digit percentage, while border closures and the grounding of airlines will add to freight costs and terminal dues.

In short, Singapore Post does not expect to see a material improvement in the business environment anytime soon.

These two blue-chip companies are not the only ones facing tough challenges ahead.

The current quarter will turn out to be even harsher than the previous, as the full impact of the pandemic will be felt.

More pain will be felt by a wide range of businesses, whether they are directly or indirectly affected.

As the situation is dynamic and continues to evolve, it is uncertain at this point when a tentative recovery can be seen.

This article was first published in The Smart Investor.