2020 year-end checklist for your property investment

So you’ve owned a home, or perhaps even a second property, for quite some time. In the eyes of many, this leaves you set for life; but you probably know the truth by now: it’s not as simple as sitting back and letting the money roll in.

Every year, Singapore’s dynamic property market changes. Back in the 1990’s, your rent could have more than paid your mortgage.

In the early 2000’s, practically every HDB flat was a golden ticket to condo ownership in five years. In 2020 however, things have gotten more complicated – from Coronavirus to new housing policies, it’s tougher to tell where you stand.

To get a clearer picture, run through this checklist for your property investment. This will help to ensure you’re holding on to assets, not liabilities:

This is the first place to start, because it’s the most detailed and time consuming. You need to know the expenses to determine your net rental yield and ROI (further below).

Start with your initial expenses, which are:

If you have lost the records for these, you can contact IRAS (or the CPF board with regard to your CPF usage) to check the details. Remember that stamp duties such as BSD and ABSD are often paid with your CPF, so you may have no record of it on your bank transactions.

If you obtained a bank loan in the early 2000’s or before, it was common practice for many banks to subsidise legal fees; you may not have paid them yourself.

Next, work out your recurring expenses. These are:

The monthly loan repayment, in particular the interest portion

For example, say you have a loan of $1 million for 25 years, at 1.3 per cent per annum. The monthly repayment is $3,906 per month. Of this amount, the interest portion is $1,083 per month (the rest is just repaying your principal).

[[nid:509410]]

You need to know this because, if your property is rented out, the interest portion of your monthly loan repayment can be claimed as a tax deduction.

Besides, when evaluating the likely return on your property, it’s the interest-portion of the loan repayment that’s considered the “true” cost. For readers using HDB loans, the repayment amounts would not have changed in almost two decades; HDB’s interest rate has remained at 2.6 per cent for a long time.

But if you use a bank loan, the interest rate will fluctuate, often changing every one or three months for many loan packages.

This can make the interest paid to date a bit hard to determine. You can either contact your bank and ask for help, or drop us a note.

As long as you have your repayment details, we can put you in touch with an expert who can determine what you’re paying (and whether it’s time to switch to a cheaper loan; see below).

Maintenance fees for condos, or conservancy charges or HDB flats. For condos, check the amount paid per share value, and compare it to previous years.

For example, if the current rate is $75 per share value, and your unit has a share value of five, this would come to $375 per month. We explain more about share values in this earlier article .

You’ll want to check if this amount has been increasing over the past few years, and the rate of the increase. This is to help you to adjust your subsequent rental rates, and maintain or raise your net rental yield (see below). You also need to know this amount, to determine your ultimate gains based on your selling price.

For HDB properties that are not Executive Condominiums (ECs), the conservancy charges are set by your town council.

Your property tax rate, which is determined by IRAS. The tax rate is pegged to your property’s Annual Value (AV), which is an estimate of the rental income your property could earn.

The AV applies regardless of whether or not your property is rented out. We have a more in-depth explanation of the AV and property taxes in this guide .

Do visit the IRAS website and check the AV of your property, against your actual rental income. If there’s a large disparity (e.g. your property is assigned an AV of $50,000 but you make under $40,000 a year in rental), you can file an objection to the IRAS assessment.

You can also appeal to IRAS if your rental property is vacant, or has been for some time.

Knowing the property tax paid also helps you to adjust your rental rate, asking price if selling, etc.

Property agent service fees, if you use one for rental. This is typically one month of gross rental income, for a two year lease (or half a month for twelve months’ lease). Note that this amount is subject to Goods and Services Tax.

This is ((gross rental income – recurring expenses) / total cost of property) x 100

For example: Say your gross rental income is $42,000 per year, and your recurring expenses are $25,000 per year. Your property cost $1.3 million:

(($42,000 – $25,000) / $1.3 million) x 100

This would come to a net rental yield of 1.3 per cent.

A net rental yield is not useful when read in isolation; just knowing the yield for this year doesn’t mean much. However, you can compare it to your net rental yield in previous years, and keep a running tally.

This will give you a sense of how well the property performs as a rental asset.

In addition, you should check the net rental yields in your given area or development, as a point of comparison. If yours is a lot lower than, say, several units in your block, then it may be time to raise your asking rent.

On an island-wide basis in 2020, most three-bedder condo units have a net rental yield of between one to two per cent, while compact units tend to have a higher rental yield due to their lower quantum (around three per cent).

However, contact us to find out the specifics of your development and area.

These days, there are many free online tools to check your current property value; and we’re always on hand to give you a more precise valuation if you need it.

As with your net rental yield, however, this is a number that’s only meaningful when read in context.

[[nid:513835]]

Measure the rate of appreciation compared to previous years; you’ll usually need to track the price movement for at least five years, to see any meaningful pattern. In addition, we should add the caveat that transaction volumes matter.

If you live in a boutique condo with just 30 units, for example, there may only be one or two transactions every few years.

This limited history makes it hard to get a good read of how much the market values the development; prices can be more unpredictable when you sell.

Nonetheless, do at least check the latest transactions in your area. If nothing else, it’s to affirm that you’re not holding on to a depreciating unit.

Consecutive years of falling prices (e.g. five straight years) could indicate it’s time to sell and move on.

Knowing your ROI, should you sell at this point, is helpful to your overall financial plans; such as your retirement portfolio. We have a detailed explanation on how to do this.

However, we’ll post a shortcut for you here: just use this or any other online ROI calculator (if you have internet banking, they usually have similar tools). Simply input your total gains and total costs, as worked out above, and the length of time you’ve held the property.

Take note of the annualised ROI as well as the percentage return. If this doesn’t match what’s required in your long-term investing, then it may be time for a switch, to increase rent, refinance, etc.

At the time of writing, it’s possible to get home loan rates as low as 1.2 to 1.3 per cent per annum. If this is lower than what your bank is charging, it may be time to reprice (switch to a different package from the same bank), or refinance (switch to a different bank).

At any given time, only two or three banks tend to be the cheapest. We can help you find the current cheapest options for free, so do get in touch with us.

That said, there’s typically a price to switch; around $500 to $800 for repricing, and $2,500 to $3,000 for refinancing. As such, it may take some time to cover the cost of doing so, before you see real savings. It’s not always worth doing if, say, you’re intending to sell the house in a year.

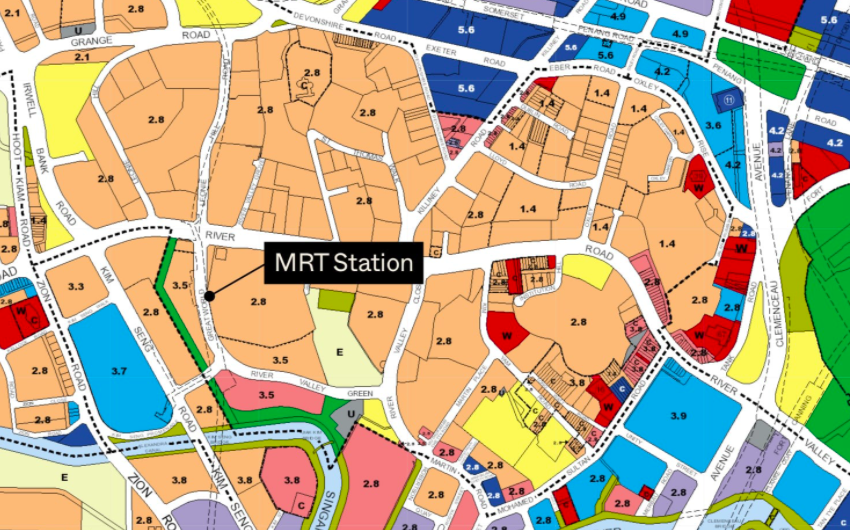

Zoning changes are always important to note, as they could mean future residential developments creeping up next to yours. The URA Master Plan acts as the general guide on property investing: you’ll want to take note of things like:

Your future rental rates, asking prices, or even decision to hold on to the property can be guided by understanding URA’s plans for the area.

The pay-off is significant, as you’re no longer lost in guesswork when setting rental rates, deciding whether it’s time to sell, etc.

The last thing you want is to discover, 10 years too late, that your property hasn’t appreciated sufficiently; and that any gains won’t fulfil your retirement / upgrading plans.

Property investment is not a one-time planning process. Pure homeowners can get away with ignoring these issues for many years; but investors, aspiring upgraders, landlords, etc., have to check at least once a year.

This article was first published in Stackedhomes.