3 listed pawnbrokers on SGX: What do we know about them?

Given the current bleak economic outlook, many people are having it hard to deal with either job retrenchments or a pay reduction. On the same note, small time business owners are also facing cash flow issues with a sharp dive in business volume.

One alternative way to resolve temporary cash flow issues will be to make use of their personal valuable items by pawning them to pawnbrokers.

For those uninitiated, here's a quick rundown of the pawnbroking process:

When you pawn your valuable items, you get cash immediately from the pawnbrokers while your items will stay as collateral with the pawnbrokers for a period of 6 months. You will be charged a monthly interest rate (usually lower than 1.5 per cent per month). Furthermore, you will be able to redeem back your items within 6 months by paying up the interest and principal sum borrowed.

In this article, we will be looking at 3 pawnbrokers listed on SGX, mainly, MoneyMax, ValueMax and Maxi-Cash.

As mentioned, pawnbrokers' main source of income hails from the interest charged from loaning out the principal sums to the consumers. If they could not redeem their items in 6 months' time, the pawnbrokers will have the right to take ownership of the items and sell it out in the market to recover the principal sums.

However, consumers could also choose to extend the redemption deadline at the expense of higher interest rate. This will allow the Pawnbrokers to earn additional interest income from them while consumers will still be able to redeem their items at a later date.

With that, we do a quick financial analysis on 3 companies in the pawnbroking industry.

MoneyMax's revenue increased by 24.4 per cent from $146.5 million in FY2018 to $182.2 million in FY2019 due to a broad-based increase in revenue in all business segments namely retail and trading of luxury items, pawnbroking and auto financing segments.

With the reclassification of rental expenses to depreciation of rights-of-use assets and interest adjustment from its leases, MoneyMax has seen its profit after tax risen by 74.2 per cent from $5.5 million in FY2018 to $9.5 million in FY2019.

MoneyMax's dividend per share has been largely stable at 0.5 Singapore cent for the past 3 years (FY2016 - FY2018).

For FY2019, MoneyMax has risen the dividend per share by 100 per cent to 1 Singapore cent per share on the back of a sharp profit increase. Based on the share price of S$0.16, the indicative yield stands at 6.25 per cent.

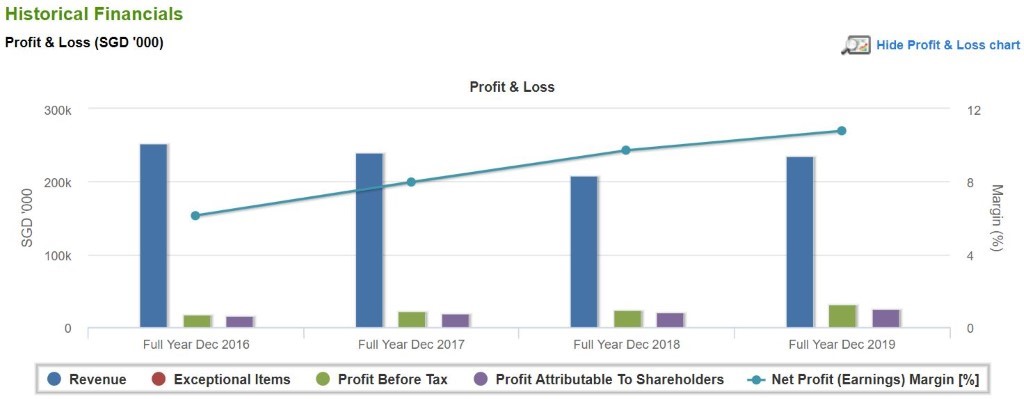

ValueMax's revenue increased by 13.0 per cent from $208.7 million in FY2018 to $235.9 million in FY2019. Revenue from retail and trading of jewellery and gold business increased by $24.1 million due to increase in gold price while revenue from pawnbroking and moneylending business increased by $1.2 million and $1.9 million respectively in FY2019.

With the increase in share of profit of associates and the decrease in allowance for expected credit losses, ValueMax's profit after tax risen by 25.2 per cent from S$20.8 million in FY2018 to S$26.0 million in FY2019.

ValueMax's dividend per share has been on a rising trend since FY2016 with dividend coming in at 1.61 Singapore cents per share. The rising trend is in tandem with the continuous growth in ValueMax's profit after tax.

Compared against FY2016, dividend has risen by 49 per cent to a record high of 1.61 Singapore cents per share in FY2019. Based on the share price of S$0.285, the indicative yield for ValueMax stands at 5.6 per cent.

Maxi-Cash's revenue increased by 7.3 per cent from $203.7 million in FY2018 to $218.4 million in FY2019. The increase in revenue was primarily attributed to the higher revenue obtained from the pawnbroking business and the retail and trading of LuxeSTYLE branded merchandise, pre-owned and new jewellery.

With the decrease in operating expenses such as foreign exchange loss, Maxi-Cash's profit after tax risen by 42.4 per cent from S$10.5 million in FY2018 to S$14.9 million in FY2019.

Maxi-Cash's dividend per share has been on a downtrend since FY2016 to FY2018. Dividend for FY2016 came in at 1.5 Singapore cents per share and has dropped to a low of 0.95 Singapore cents per share.

However, on back of strong growth in profit after tax, Maxi-Cash's dividend per share has grown by 40 per cent in FY2019 to 1.35 Singapore cents per share. Based on the share price of S$0.126, the indicative yield for Maxi-Cash stands at 10.7 per cent.

To provide support to the public coping with the current challenging conditions, the Singapore Pawnbrokers' Association ("SPA"), together with Ministry of Law's Registry of Pawnbrokers has come out with an interest cushioning plan for the industry.

SPA has obtained consensus from its members to offer interest waiver with the following guidelines:

While the interest waiver conditions may lend a helping hand to the small-medium businesses and cash-strapped consumers, it means that there may be a potential drag to the profits of pawnbrokers.

That said, the pawnbroking industry seems to be a cash-cow business with the 3 companies mentioned above being able to pay out handsome dividend yields of above 5 per cent. Last but not least, it may stand to benefit if the economic downturn is prolonged for a long time.

This article was first published in Investor-One.