3 pieces of financial advice for private-hire drivers and other new economy contractors

With the rise of tech startups like Grab and Airbnb, a lot of people have been taking up new jobs in the recent years either as a full-gig or as a way to earn supplementary income.

Though these jobs can be attractive especially in face of rising unemployment rate and slow income growth, they are not without their own financial pitfalls. If you are considering becoming a "new economy" contractor like driving for Grab or hosting Airbnbs out of your HDB flat.

A rising tide lifts up all boats. When companies like Grab and Airbnb are growing like weeds, people who are participating in that growth can be rewarded immensely. Now, Grab drivers in Singapore can expect to make $26 per hour in Singapore.

If you work 50 hours a week, that's easily more than $5,000 per month of income, which compares favorably against the national average of $4,056, though there are other costs involved like paying for petrol. However, when you are first starting off as a contractor, it's not easy to forecast exactly how much money you will earn or even how reliable your source of income might be. There will be some days or weeks when you just don't get enough business.

Therefore, when you are first starting out as a new economy contractor, it might be a good idea to apply for a personal line of credit. Since the best personal line of credit offerings in the market offer annual fee waivers, you can secure an access to readily available funding in case you are short of cash for a few days or weeks at a time.

While credit cards are usually the best way to pay for things when you don't have enough cash in your bank account, you can't always rely on it especially if you can't pay off the balance within your current billing cycle (i.e. maximum of 30 days).

A line of credit lends you a sum at an interest rate that's lower than that of a credit card, so you can still afford to pay for things you need. When you've established a steady stream of cash flow from your gig after a year or two, you can cancel your line of credit and avoid paying the annual fee after the fee waiver expires.

Another downside of having a contractor job is that you don't get any CPF contribution or health insurance from your employer. Just because you don't get these benefits, however, it doesn't mean that you shouldn't have them. Therefore, you should really consider cutting out a portion of your weekly income and setting it aside for investment so that you can build either a rainy day or a retirement fund.

Given that most new economy contractors are relatively young in their 20's and 30's, investing in funds is an especially great idea that can compound their net worth over a long period of time. To start investing today, check out our guide on the best online brokerages in Singapore.

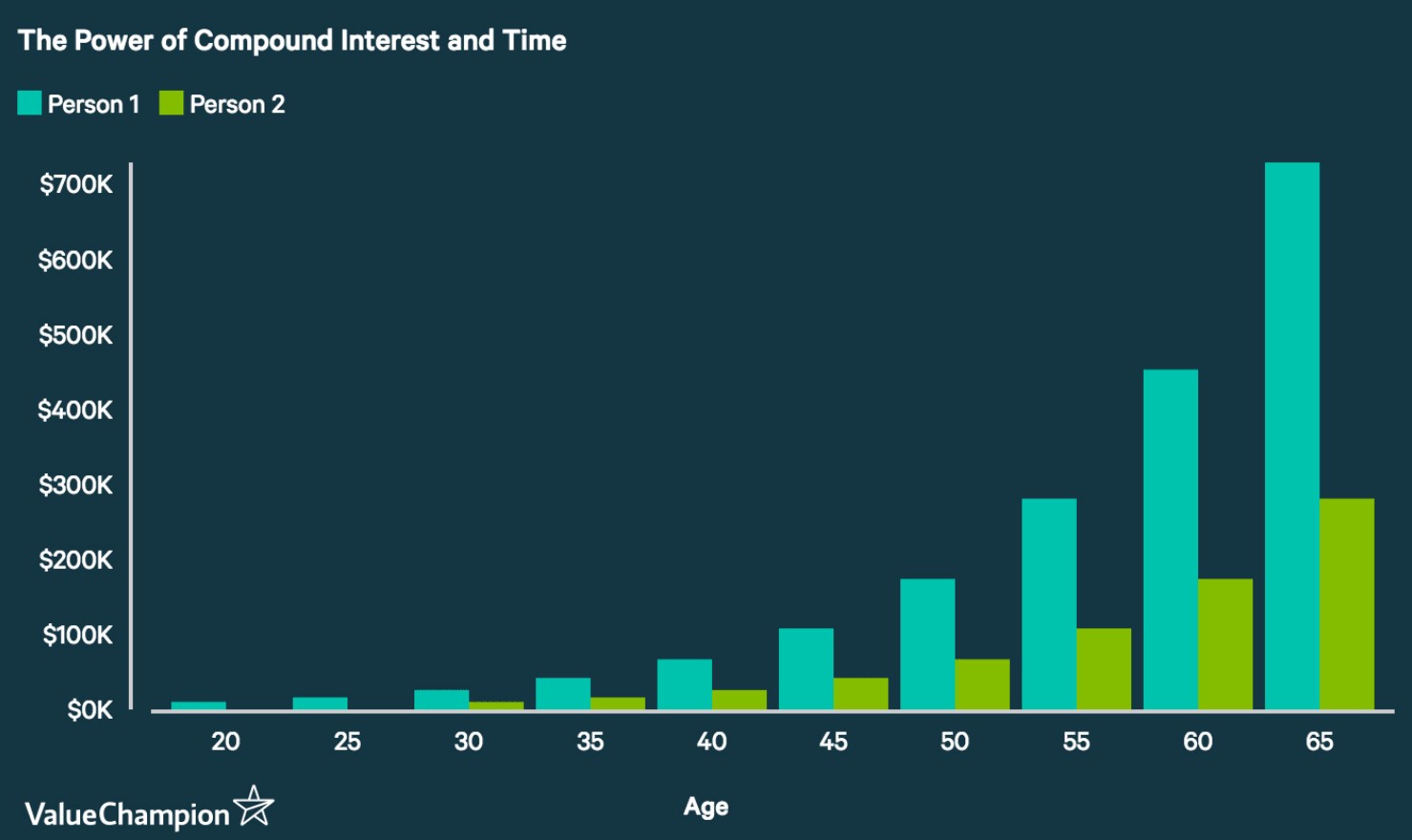

Take a look at the chart above. here, we feature two people who invested $10,000 that returns 10 per cent per year. This means that after one year they would have $11,000 ($10,000 x 10per cent = $1,000 and $1,000 + $10,000 = $11,000).

The only diffrence between Person 1 and Person 2, however, is that Person 1 began investing at age 20 while Person 2 began at age 30. Because of this difference of 10 years, Person 1 has more than double what Person 2 by the time they reach the age of 65. It’s like what Warren Buffett said: the best thing you can do for your retirement savings is to start investing early.

While you are developing your own "business" as a Grab driver or an Airbnb host, you should try to minimise your reliance on debt. Borrowing to finance your consumption that isn't necessary will only increase your financial burden as monthly interest payments start to build up over time.

However, if you encounter an emergency that you absolutely cannot avoid (i.e. large medical bills, etc.), you may want to consider getting a personal loan to help you cope with the immediate necessities.

Although personal loans aren't the cheapest source of money, they still offer a decent interest rate especially for things that cannot be backed by an asset; only loans like home loans tend to be cheap because the loan can be guaranteed by the borrower's home.

When you need to borrow to pay for your hospital bill, there's nothing that a lender can receive in case you default on your loan. Therefore, personal loans tend to cost more; however, they are still much cheaper than their alternatives like credit card debt, pawnshop loans or payday loans.

To be a successful as a contractor, you must be able to protect yourself from the unpredictable emergencies that life can throw at you at any given point. Contractors have to deal with unsteady flow of income and lack of job security that a full-time job can provide, so it's all the more important to be conservative about one's finances.

While a line of credit, a personal loan or investing can help you prepare financially when you might suddenly need a large sum of money, it's always recommended that you control your spending down to a minimal level in the first place.

This article was first published in ValueChampion.