5 new retirement realities for the millennial Singaporean

In an era of low interest rates, the traditional strategy of saving and stashing away your monies in higher-interest rate accounts is dead in the water.

With various banks slashing their interest rates multiple times in 2020 – there is a growing realisation what was a low risk way to make some returns…. is actually now “more risky”.

[embed]https://www.facebook.com/TheStraitsTimes/posts/10157568450527115[/embed]

Why?

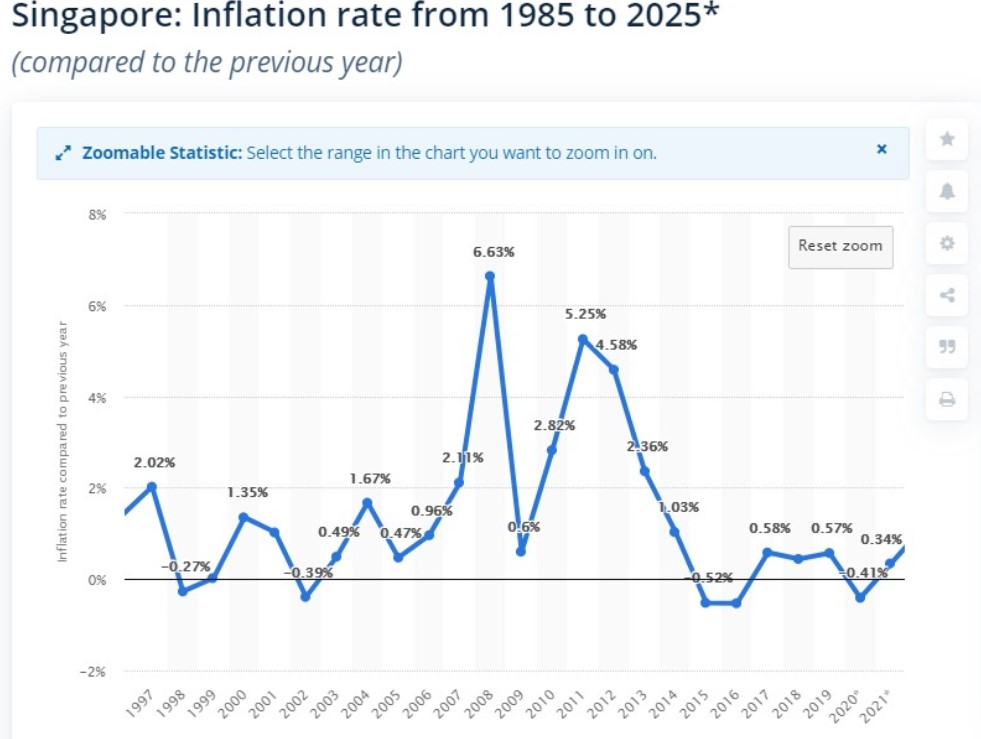

What was considered low risk can also be reframed as high risk as those monies sitting in the bank accounts slowly get devalued by the impact of inflation.

From a possible maximum of 1.85 per cent, the interest rates in these accounts are averaging just under 0.5 per cent, which means savers are locking in funds below the rate of inflation and getting nearly nothing in return.

This is a reality that all of us must learn to grapple with.

That popular image of retirement as a carefree twilight spent with family and friends on the balcony no longer exists.

For the average millennial Singaporean – here are 5 realities that you will need to understand and reframe in order to secure your own financial future.

Inflation will continue to chip away at your accumulated savings relentlessly. That is why it is so important to learn how to deploy your liquid assets to work hard for you.

And of course, since you are reading this at Stacked – so we will say it. One of the best hedges against inflation will be property.

Owning a property can serve as a hedge against stock market volatility and inflation, as home values and rent prices tend to appreciate with inflation.

There is a strong belief that Singapore property remains a safe haven for investors.

[embed]https://www.facebook.com/SRXProperty/posts/3741666022563110[/embed]

And that is why Singapore property prices across most segments have increased

[embed]https://www.facebook.com/ChannelNewsAsia/posts/10157996894657934[/embed].

The supply of money sloshing around will inflate over time, which means it becomes slightly less valuable every year – around 2 per cent, on average .

Even at these modest levels, inflation is the silent thief in your wallet, making you a tiny bit poorer every day.

If it appreciates, buy it.

If it depreciates, lease it.

Rising life expectancy means the level of savings required to provide a reasonable income for retirement at age 65 is becoming increasingly infeasible for most people.

According to the book “The 100-Year Life: Living and Working in an Age of Longevity” by Lynda Gratton and Andrew J Scott – they predicted that given the average level of savings in advanced economies, many people currently in their mid-40s are likely to need to work into their early to mid-70s.

And many currently in their 20s (many of whom could live to be over 100) – will be working into their late 70s, and even into their 80s.

It is scary – but this is what we need to prepare for especially with increasing life expectancy.

[embed]https://www.facebook.com/TheStraitsTimes/posts/10156153171182115[/embed]

If we plan for this right – longevity will be a real gift.

But if we were to ignore and fail to prepare – it will be a curse.

When managing our money, we should worry less about dying young and more about living an astonishingly long life.

During the era of our parents and grandparents, the longer employees worked and gained experience, the more they earned.

That was the model I heard when growing up – when the advice everyone gave me was to study hard, pick a career, then go long and deep.

Unfortunately that advice didn’t prepare me for the world I am seeing today.

In the past, the older generations had the benefit of the pension system.

(Watch the point at 7:07 as the retiree shared about his government pension scheme)

[embed]https://www.facebook.com/watch/?ref=external&v=847487732703521[/embed]

In the past, those approaching retirement could count on company pensions that were guaranteed to last a lifetime. Now those plans no longer exist.

Currently, there is some semblance of certainty on CPF Life payouts if you are aged 55 today.

But do take note, that what is certain can always become uncertain.

So it is wise to consider your CPF Life payouts as providing the most basic level of retirement income.

It does not remove the need to have a more comprehensive retirement plan.

[embed]https://www.facebook.com/ChannelNewsAsia/posts/10156420576562934[/embed]

With rising costs of living and inflation – we cannot be sure that $1k – $2k per month is enough by the time we reach 65 years old.

This is especially so when the majority of us are using our CPF monies to pay for our home.

And if we millennials decide not to save enough, or invest unwisely, then our savings will fall short, thereby jeopardizing our own retirement.

In today’s tech-driven employment landscape, we cannot apply the rules our parents and grandparents lived by to secure a steady job.

And this is a new reality that became more apparent thanks to the pandemic.

The workforce was suddenly split into 2 – those who can work from home and those who can’t.

The future of work is also no longer so clear-cut – there will be stages where it overlaps one another.

With the half-life of a learned skill just five years – this means much of what we learned 10 years ago is obsolete.

At the same time, half of what we learned five years ago also becomes irrelevant.

New sectors will rise and fall and new firms take over as dominant forces.

It becomes even more important to take personal responsibility on your own finances.

And perhaps this is why articles about saving your first $100K before 30 are so popular .

For millennials, there has been a lot of discussions about achieving your first $100K.

Financial advisers will tell you it’s not people on the highest salaries who have the best investment portfolios; it’s those who are disciplined and make sure they regularly put money aside.

Beginning this $100k endeavor will be hard but it gets easier once you gather momentum.

You as human capital faces risks to be disrupted. That $100K can serve as a form of psychological security to propel you to take more risks with your career.

(Don’t confuse this $100K with emergency funds – it should be separate.)

Remember to not put your financial capital into the same basket as your human capital.

Separate them out but remember to manage both well.

A show of hands of who pays for their monthly mortgage via CPF?

And who pays for their mortgage via cold hard cash?

The truth is a large majority of Singaporeans pay for their home via their CPF monies.

This system allows for us to have more cash on hand while allowing us to use our CPF contributions to pay down our housing mortgage.

But this also means we are borrowing from our future retirement monies at a cost of 2.5 per cent.

When we choose to give up the 2.5 per cent returns guaranteed by the CPF Board by channeling those monies to our property, there are a few consequences that we must be aware of.

Instead of having the 2.5 per cent returns working for you, it now becomes a cost that works against you.

Let’s explore the scenarios:

Do take note, I have not even considered the cost from the interest rate of the mortgage loan!

For some people, they accept this as a cost. They don’t view their home as an investment – it is a home where we nurture and grow our families.

And rightly so.

But our home is also the most expensive item that we will ever purchase as we will sink huge amounts of monies into it.

In the long run, wouldn’t it be nice to have a home that also acts as an investment property?

This is because if we plan this right, the leveraged nature of property investment can secure your financial future and eventually – your retirement nest egg.

Imagine this scenario:

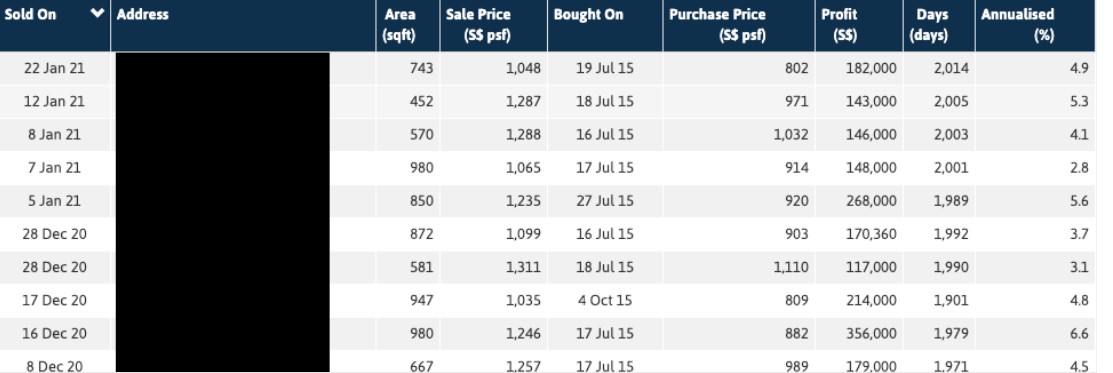

You selected the right property to stay in with the best entry price and you exit at the height of the market.

Imagine staying in a property for 5 years and then exiting with nett profits of $100K.

This meant you did not pay to stay in your property.

Your property paid you about $20K per year to stay there.

The key to success in this is understanding and reframing your thoughts that your home is an investment vehicle.

But not just any investment vehicle – a vehicle that can perform better than the 2.5 per cent guaranteed returns from the CPF Board.

Figuring out how much money you’re likely to need on an annual basis in the somewhat distant future is no easy matter.

We answer we want a “comfortable” retirement but do ever thought about what that really means?

[embed]https://www.facebook.com/watch/?v=406520997347597[/embed]

If you’re being real with yourself, you might have a sinking feeling that you really haven’t been putting your best foot forward with regards to your own finances.

That’s because it’s in our nature to seek comfort and to start taking life, work, and family for granted.

That is why it is so important to embrace these realities as early as possible so as to inoculate ourselves against future shocks.

Reality as we know it is just our perception of it – a kind of map of reality, not the true territory of reality.

As an agent with experience on the ground – perhaps my reality will be slightly different than yours. My experience of 15 years provides a context that you might not have even considered.

Whatever you think your reality is – it is important to identify the strongly held assumptions (beliefs) that influence what we perceive.

Those who grew up seeing their parents or close relatives being successful in property investment will have the belief that property investment is the way to go.

But those who grew up seeing their loved ones incurring losses or racking up unprofitable property investments will think otherwise and start pursuing other investment vehicles instead.

Again, there is only perception that stems from our own belief systems.

As millennials, we have the advantage of time on our side. Even the older millennials here – do not worry as I expect all of us to have many years ahead of us.

The best way to acknowledge and prepare for these realities is by opening ourselves up to new feedback information to create a loop of faster knowledge improvement.

Keeping these new realities in mind will take conscious effort, because the way much of our life experience has been dealing with the outside world is as cause-and-effect thinking.

While it might be adequate, it is pertinent to think 3-4 steps ahead as well.

Learn to take more risk by preparing ourselves to do a whole lot more exploration than we’re used to.

Explore and exploit. Rinse, and repeat.

This cycle ensures you’re always attuned to new opportunities, and able to adjust course based on the new information you’ve gathered.

This article was first published in Stackedhomes.