5 reasons why Singapore should build more HDB maisonettes

HDB stopped building maisonettes way back in 1995, but Singaporeans never got over their love for it.

As we've pointed out before, a significant portion of million-dollar flats are maisonettes; and if Singaporeans are buying them despite the advanced lease decay, then perhaps it's worth revisiting the scheme.

Here's why we think the double-storey maisonette may be worth building again today:

Since 2013, we've had Three-Generation (3G flats). Designed for extended families living together, these are 1,237 sq. ft. units. These are bigger than five-room flats by a slim margin (the average five-room flat is around 1,185 sq. ft.).

The appeal is more in the layout than in the small space increase; 3G flats have four bedrooms and three bathrooms (two attached, one common), with a service yard.

There have been similar options like the $1.418 million loft Dawson HDB unit (where our conclusion was that there weren't any better alternatives), or the loft unit in Punggol that was sold for $1.198 million — but given the record prices, you can just see how much demand there is for units such as these.

We do think flats for extended families will come in handy, as our population ages. It can allow for grandparents to be looked after, for example. But 3G flats have a layout with limited potential — all you're really getting is one additional bedroom.

[[nid:596341]]

A maisonette allows for a dual-floor living — such as grandparents on the ground floor, immediate family on the top floor, etc. This fulfils some of the privacy needs that a 3G flat may lack, and it also allows for some different options (see point 3).

A maisonette can also provide for even larger families, for whom even a 3Gen flat might be a squeeze. From experience on the ground, we've met many extended families who feel a need for an Executive Apartment (EA) or jumbo flat, rather than just a 3G flat.

If necessary, we can impose the same conditions for buying a maisonette that currently exists for 3Gen flats (e.g., it can only be sold to other multi-generational families). This ensures the maisonettes will be for home ownership rather than investment.

Many of the existing maisonettes are old, and will soon be halfway through the lease. Many banks won't give out loans (or give out loans with a much lower quantum) for properties with 60 or fewer years on the lease. As such, offloading the property later may not be possible.

We're aware that most buyers are older and consider the maisonette a "forever home" — but it's always nice to have a backup, in the form of being able to trade down to a five-room, four-room, etc. in case a financial emergency happens in our old age. This is something that a 40 or 50-year-old flat may not provide.

There's also the simple reality that Singaporeans are living longer. Over the next decade, as the leases on these maisonettes tick down, it could become increasingly risky for even 50+ year-olds to buy these units, and possibly outlive the lease.

A small number of newer maisonettes might satisfy their needs, and draw them off the older properties.

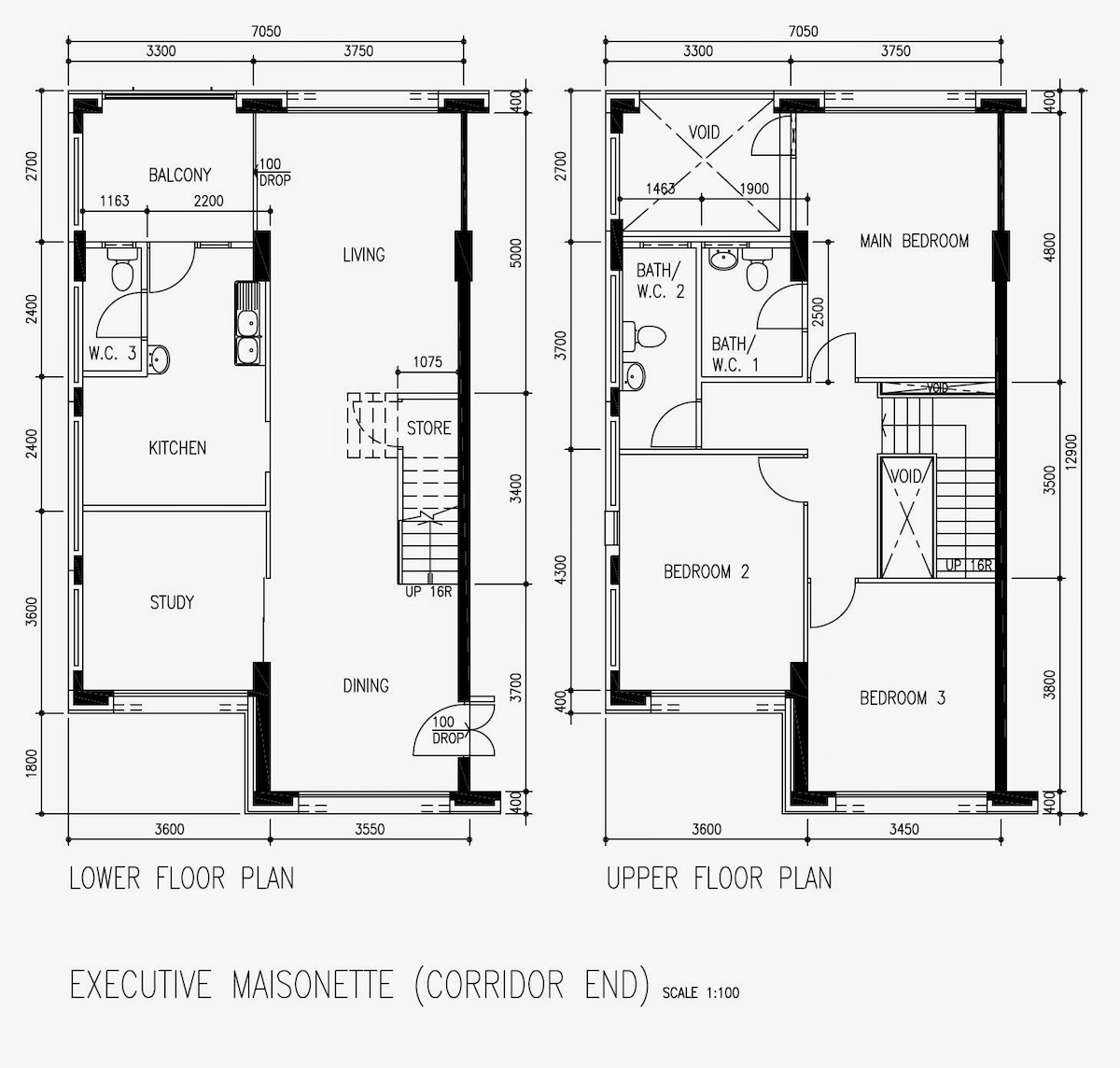

A common concern over maisonettes is the stairs, which can be tough for the elderly. This is currently true as most maisonettes have bedrooms upstairs. But we have learned a lot over the years, and can probably improve on it today.

We could relocate a bedroom for the grandparents downstairs, for instance, leaving the upper floors to the younger members. Safety features for the elderly have also been improved, so now we can incorporate emergency ringers, or smart home features, to ensure anyone can quickly call for help; even with the double-storey layout.

Finally, for extended families that live together but want a bit more privacy, we could improve the separation between upper and lower floors, as some dual-key units do.

This may not be as extreme as completely segregating both floors, but just ensuring it's possible to move about without always being directly observed.

In our experience, most extended families can afford an EC as well as a resale maisonette. The reason they may pick the latter is the recurring costs of ECs.

HDB conservancy fees tend to stay below three digits, whereas ECs are still condos with pricey common facilities; and a three or four-bedder EC unit will still probably incur maintenance fees of $300 to $400 a month.

Besides this, a new maisonette might allow for HDB loans, whereas an EC absolutely requires a bank loan (although this would depend on HDB's decision). Given rising interest rates and the lower cash outlay, some buyers may want to stick to HDB loans.

All this could allow a new maisonette to be a prudent choice for some families, as opposed to the expense of an EC.

A common gripe about BTO flats is that they're all in "ulu" areas. A simple solution could be to have a handful of special flats in these less developed areas — some maisonettes, for instance, which won't be found in more central BTO launches.

This could encourage some families to consider less mature areas, in exchange for more living space (or just a unique layout).

In some sense, this could also encourage more creativity in home design, due to the unique nature of the layout. This can create a better sense of pride in their home, and while we don't have absolute numbers to prove this — a great number of well-designed homes that we've featured in our Living In series have been HDB maisonettes.

Is it just by chance that they so happened to be maisonettes?

On a larger scale, one problem could be that maisonettes are not as space efficient.

It may be more optimal to build two smaller units in its place, for instance, to raise the available supply of housing. This is especially true if the members of the extended family, say the children, start moving out (then we need a separate unit for the children, while the family is still in an oversized unit).

[[nid:611639]]

Given the demand for housing today, it may seem like the more prudent thing to do would be to build as much housing in as short a time as possible, than to optimise for the best living environment. After all, the shorter the BTO process, the more it may improve our falling birth rate numbers.

For individual owners, we're also assuming that extended family means there's someone younger and fitter to clean the flat. A maisonette takes a lot more work to upkeep than a normal flat. As an aside to that, the renovation costs also tend to be much higher.

Nonetheless, we do think a few maisonettes for larger families could be a welcome idea. What do you think?

ALSO READ: Updated list of HDB maisonettes in 2022: How much have prices increased and where to find them

This article was first published in Stackedhomes.