6 actionable steps to compare between a new launch and resale condominium

We’ve covered the basics of new versus resale condos before, but now let’s get further into specifics.

In practice, you’ll end up choosing between a mix of new and resale condos in a given neighbourhood; or you may have to consider a new launch versus specific surrounding resale condos. Here’s what you need to know, about making a fair comparison:

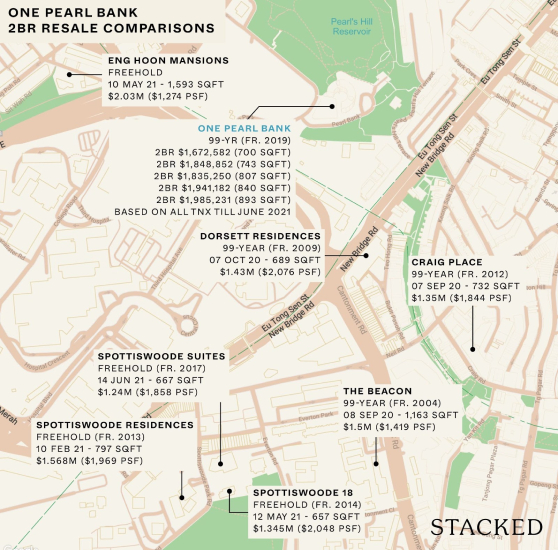

A typical approach is to compare developments within a one-kilometre radius of the new launch.

This isn’t really a hard and fast rule though; you could also compare between a shorter distance (e.g., 500 metres) – you might do so if it means staying within walking distance of a school, MRT station, mall, etc.

Many people like to compare by per square foot (psf) only, but that usually doesn’t tell the full story especially if there is a mix of resale comparables with different ages.

So you should also record down the overall price to compare properly – it doesn’t always mean a high psf means it should be ruled out automatically.

Let’s say we’re considering two-bedroom units. We should do a price comparison, with similar-sized units in nearby resale condos.

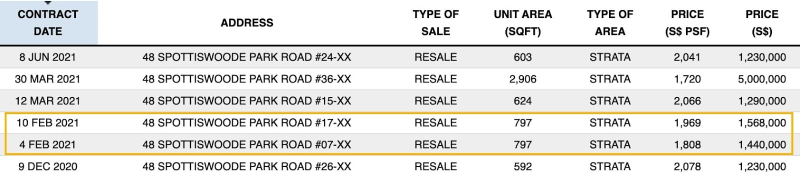

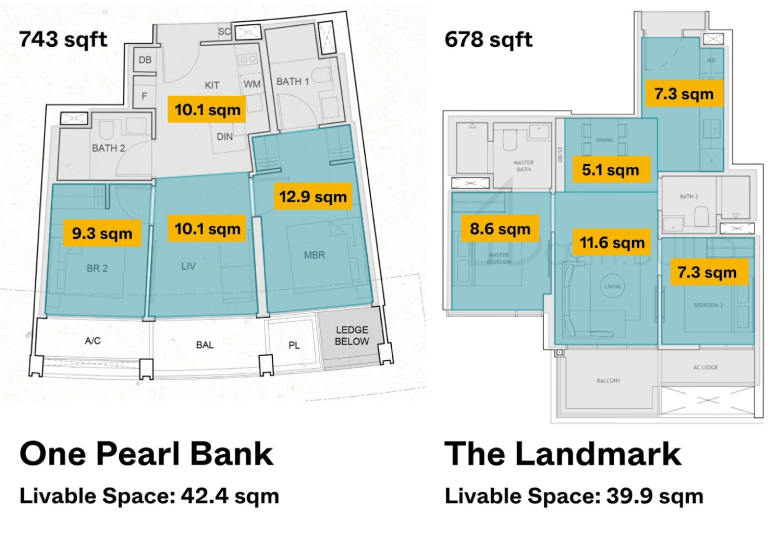

For example, here’s how we would compare a two-bedder at One Pearl Bank, to the most similar-sized unit in Spottiswoode Residences.

The two-bed, two-bath unit here comes in at 797 sq.ft, which is 54 sq. ft. larger; but it’s the closest point of comparison.

(You’ll also notice that definitions such as “one-bedroom” or “two-bedroom” are quite vague. Older resale condos can have one-bedders that are the size of three-bedders, by today’s standards; that’s why it’s best to look at the actual square footage).

In Spottiswoode, a 797 sq. ft., two-bedroom unit on the 17th floor went for $1,568,000.

In One Pearl Bank, a 743 sq. ft. unit transacted at $1,780,000.

We can see the larger freehold Spottiswoode Residences are around 12 per cent cheaper.

[[nid:534567]]

In itself, this isn’t surprising – a new launch condo will always be priced higher than their resale counterparts.

What we need to ask is whether this 12 per cent premium is worth paying (at the end of the whole comparison process).

You’ll also notice that, when making these comparisons, we stick to the most recent transactions possible.

You’ll want to keep to transactions within the past 12 months, as transactions from too long ago don’t account for factors like inflation).

We can repeat this process for any other resale condos within range.

Next, we’ll compare the specific floor plans between the new launch, and one of the nearby resale units.

For simplicity, let’s stick to comparing between the same units we discussed in step two:

The positives to the Spottiswoode unit is that it does not have a wasted entranceway. It also has a squarish layout, with a decent area for a dining table (unlike One Pearl Bank’s layout).

The unit also comes with a household shelter to store things, something that is always an overlooked area in new developments.

The downsides are the large planter and bay window space, which buyers pay for but often under-utilise. Both bathrooms do come with natural ventilation, and but weirdly enough the AC is located on the balcony itself.

So you’ll want to look for the usual odd suspects in older developments – planters, bay windows, or awkward shaped layouts.

Do make a list of pros and cons for each comparison. This can provide clarity when deciding whether the price premium for a new launch is worth paying.

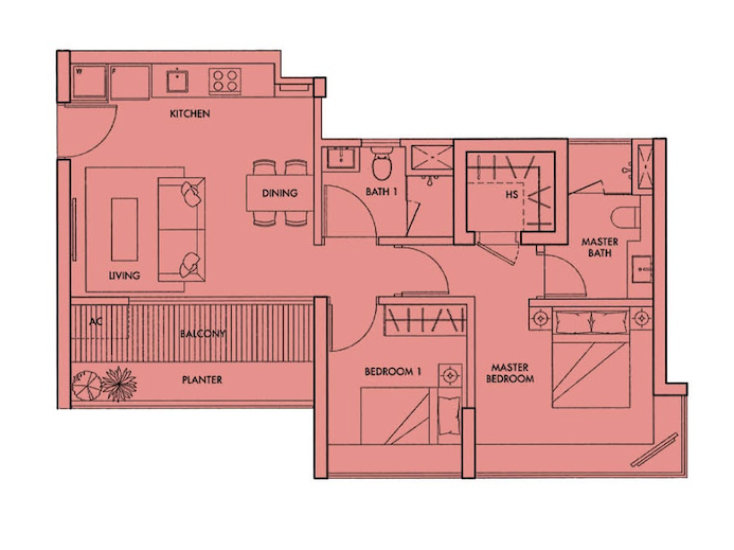

Liveable space – also referred to as habitable space – refers to space that’s not purely functional.

For example, an air-con ledge does count toward the total square footage you pay for – but it’s not liveable space, as you don’t eat, sleep, entertain guests, etc. on that ledge.

Note that areas such as toilets, kitchens, the household shelter, etc. are not considered liveable spaces (they’re referred to as functional spaces).

As you can see above, the difference in total square footage – between One Pearl Bank and a comparison unit at The Landmark – is 65 square feet. However, the difference in liveable space is only about 38.5 sq. ft.

[[nid:529780]]

As a loose rule of thumb, most people will only feel a significant difference if the liveable space is 50 sq. ft. or larger (but note this differs between people).

Also note that comparisons can get tricky for certain layouts, such as dual-key units.

A dual-key unit almost always has less liveable space than an equal-sized counterpart, due to having extra functional spaces (e.g., a second kitchen, another toilet, and so forth for the second sub-unit).

For more help on this, use a tool like Attribuild that can help you compare between projects more easily.

They don’t have a full library of resale condos though, so don’t expect to find any for the more obscure developments.

Do consider if the resale units will save you money on any renovations. For example, if you want a kitchen island or walk-in wardrobe, the previous owners of a resale unit may already have it done.

This would save you however much a contractor would charge (although you need to ensure the condition is good)

On the other hand, the renovation work may also detract from the resale value. If you absolutely hate what the current sellers have done, then maybe it’s cheaper to go with the new launch – you will spare yourself the cost (and time) of having to hack up the old renovations.

New launches are usually in a “ready to move in” state, which makes renovations quicker and cheaper.

At this point, for instance, we’re inclined to say the 12 per cent gap from a Spottiswoode unit looks more attractive. This is due to its attractive location just minutes away from two MRT stations, and extensive condo facilities. It’s also situated in a quiet enclave right next to a park.

Of course, Spottiswoode would be older by about 10 years once One Pearl Bank is completed; but with its lower quantum and convenient location, this freehold development would likely be more favoured in the long run as One Pearl Bank gets older.

Its lower quantum now also means more upside potential relative to One Pearl Bank, assuming One Pearl Bank’s prices stay put.

Sometimes, you may find a unit that’s just “right” for you, despite the numbers making no sense. When this happens, you need to ask yourself if you’re a pure homeowner, or if you have investment goals.

If it’s the former, you might want to buy anyway, while tempering your expectations of gains. But if you’re focused on investment, you may have to set some of your preferences aside.

ALSO READ: Analysing unprofitable condominiums: 6 reasons why The Tennery has performed badly

This article was first published in Stackedhomes.