6 policy changes implemented in Singapore by Jan 2020 that will affect you financially

The year 2020 heralds many exciting milestones, many of which were announced some time ago and have far-reaching implications for the lives of Singaporeans and their personal finances.

#1 INCREASE IN MONTHLY CPF RETIREMENT SUM SCHEME PAYOUTS

In Nov 2019, Minister for Manpower Josephine Teo announced in Parliament that changes will be made to the Retirement Sum Scheme to reduce the payout duration to last till the member is aged 90, down from the current age of 95.

According to Minister for Manpower Josephine Teo, this would affect 60,000 members on the Retirement Sum Scheme who are currently receiving their payouts, who will see their monthly CPF payout increase.

This new payout duration (and higher monthly amounts) will take effect on 1 Jan 2020, and will apply to future CPF members on the Retirement Sum Scheme who turn 65 from 1 July 2020.

#2 INCREASE OF BASIC HEALTHCARE SUM FROM $57,200 TO $60,000

The CPF Basic Healthcare Sum is a benchmark for how much each cohort of Singaporeans would require to pay for basic subsidised healthcare costs in their old age. To account for changing healthcare costs and life expectancies, the Basic Healthcare Sum is adjusted every year for members below the age of 65.

From 1 Jan 2020, the Basic Healthcare Sum will be set at $60,000, up from $57,200.

Note that once you turn 65, your Basic Healthcare Sum will be fixed to the prevailing Basic Healthcare Sum and will not change for the rest of your life.

#3 INCREASE IN PRE-SCHOOL SUBSIDY QUANTUM AND INCOME CEILING

Prime Minister Lee's announced in his National Day Rally 2019 that means-tested subsidies for infant care, pre-school, and kindergarten programmes will be enhanced from 1 Jan 2020 for both the subsidy amounts as well as the qualifying income ceilings.

This is expected to benefit 30,000 more households who enrol their children into full-day and half-day pre-school programmes under the Early Childhood Development Agency (ECDA) as well as kindergarten programmes run by Anchor Operators and the Ministry of Education.

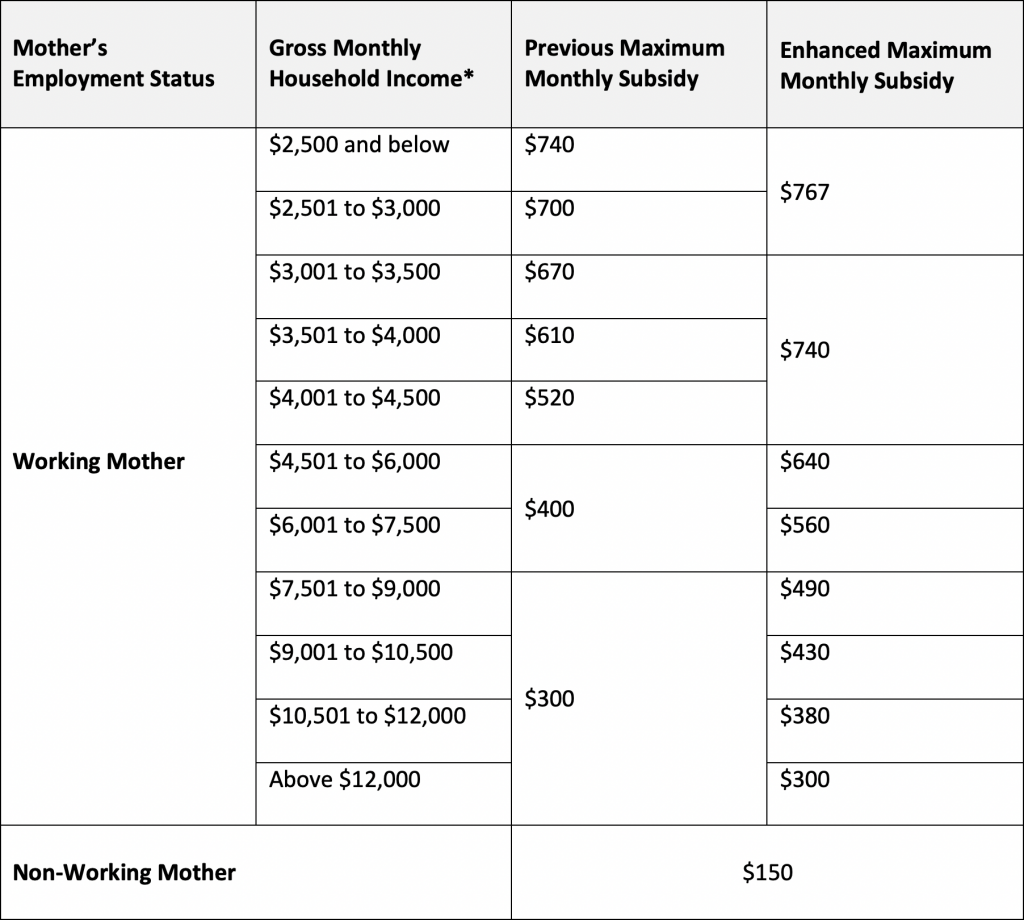

Here are the previous and enhanced maximum subsidies for full-day childcare programmes and the respective income tiers:

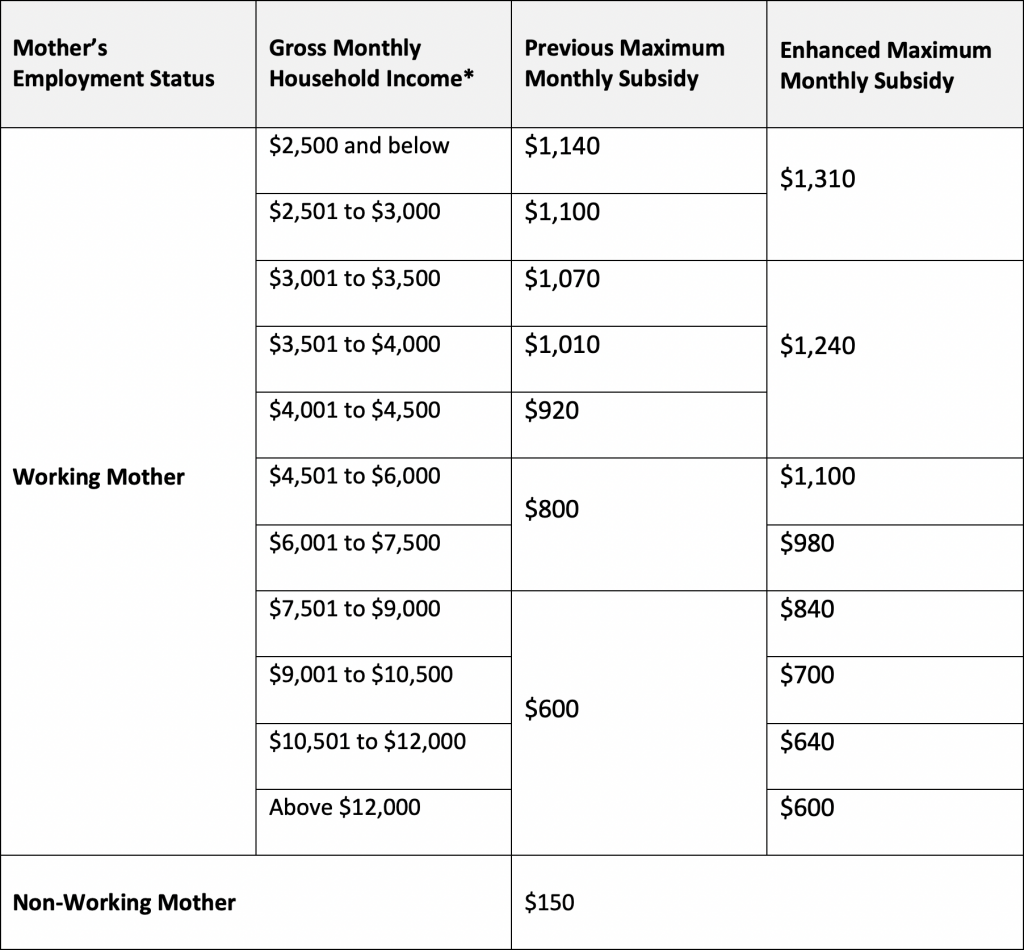

Here are the previous and enhanced maximum subsidies for full-day infant care programmes and the respective income tiers:

Here are the previous and enhanced maximum subsidies for the Kindergarten Fee Assistance Scheme (KiFAS) and the respective income tiers:

* Households with 5 or more family members (including 3 or more dependants) can choose to have their subsidy tiers assessed on a Per Capita Income basis, and potentially qualify for higher subsidies.

For more information, visit the ECDA website's Subsidies and Financial Assistance page.

#4 ENHANCED WORKFARE INCOME SUPPLEMENT

Introduced in 2007, the Workfare Income Supplement (WIS) provides eligible Singaporean workers with cash to supplement their monthly income and additional CPF top-ups to help boost their retirement adequacy.

From Jan 2020, the qualifying income cap will be increased from $2,000 to $2,300 a month, which increases the number of workers who will be eligible to receive WIS.

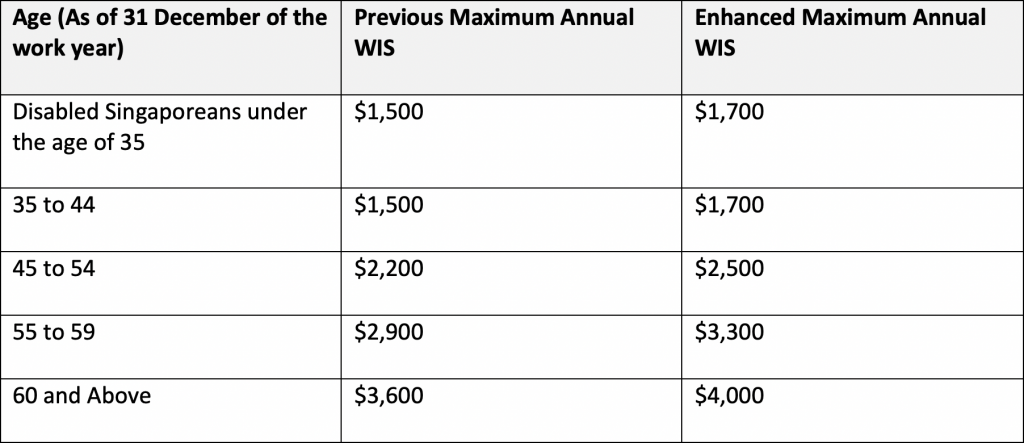

WIS is also given to self-employed individuals, and their maximum annual WIS will also be increased come Jan 2020:

WIS is paid out every month. Of the eligible WIS amount, 40 per cent is disbursed as cash (via bank transfer or cheque) while 60 per cent is disbursed as CPF contributions.

#5 GOODS AND SERVICES TAX (GST) PAYABLE ON DIGITAL SERVICES FROM OVERSEAS PROVIDERS

[[nid:469594]]

From 1 Jan 2020, Goods and Services Tax (GST) will be payable on digital services, including those provided by overseas companies. This includes digital subscriptions like Netflix, Spotify, Apple iCloud, Adobe Creative Cloud, and Microsoft Office 365.

It is at the companies' discretion on what to do with the GST they now have to pay on sales generated from Singapore customers - such as increasing prices by 7 per cent or absorbing the additional cost. You can check if a business is GST-registered.

Companies based in Singapore, must register for and pay GST if their annual taxable turnover exceeds $1 million, while overseas digital providers must register for and pay GST if their annual global turnover exceeds $1 million and their revenue generated from customers in Singapore exceed $100,000.

The Inland Revenue Authority of Singapore (IRAS) has said that taxing GST on overseas digital services will level the playing field in GST treatment, whether they are procured locally or overseas.

GST-registered businesses can claim input tax credit on these overseas digital services, which ensures only the value added is taxed at each stage of the supply chain, and the total GST is only charged and collected at the end (as an output tax).

#6 EXPIRY OF ADVISORY PERIOD FOR E-SCOOTER BAN ON FOOTPATHS

The government has enacted laws that prohibit the use of electric scooters on footpaths on 5 Nov 2019, but have put off issuing fines to errant e-Scooter riders to allow them to adjust to the new rules.

Within a month, the Land Transport Authority has issued 3,444 warnings and impounded 111 personal mobility devices.

From 1 Jan 2020, the Advisory Period expires, and those who breach the law would be liable to fines of up to $2,000 and/or jailed for up to 3 months.

This article was first published in Dollars and Sense.