6 upcoming luxury new launch condominiums in 2021

March 2021 saw a surge in new condo sales; 1,293 units as opposed to 645 in February. Now that alone isn’t surprising – the Chinese New Year period is usually slow, so the month after always sees a big surge in sales. What’s interesting is the rise in new, high-end condo purchases.

Here’s what’s happening:

March 2021 saw the Core Central Region (CCR) leading in new sale transactions, with 546 units. This accounts for around 42 per cent of total transactions for the month.

This is an oddity, as the high quantum of CCR condos means sales volumes in this region (districts 1, 2, 6, 9, 10, and 11) almost never beat the other regions.

In fact, the last time the CCR led in new sale volumes was way back in November 2013.

In terms of price, at least 100 transactions reached $2 million, and at least 16 transactions reached $5 million. Two penthouse units (detailed below) reached $14.8 million and $13.9 million respectively.

But before we get too excited, it’s important to know that…

The first is Midtown Modern ; this is a 99-year leasehold property situated along Tan Quee Lan Street, next to Bugis Junction. It’s from the same developer behind the neighbouring Midtown Bay (hence the name).

Midtown Modern sold 368 of its 558 units during launch, which accounts for over 67 per cent of CCR sale volume in March. In addition, one of the units sold was a penthouse – this transacted at around $14.8 million, or about $4,213 psf. This was the highest transaction for the month*.

These are the five latest transactions in Midtown Modern, according to Square Foot Research:

| Date | Unit Size | Price PSF | Quantum |

| April 3, 2021 | 1,066 sq. ft. | $2,464 | $2,625,480 |

| March 31, 2021 | 635 sq. ft. | $3,093 | $1,964,000 |

| March 31, 2021 | 1,066 sq. ft. | $2,465 | $2,626,470 |

| March 31, 2021 | 1,442 sq. ft. | $2,651 | $3,823,380 |

| March 30, 2021 | 474 sq. ft. | $3,288 | $1,557,270 |

The median developer price is $2,726 psf, with the cheapest transaction at $2,299 psf, and the highest at $4,213 psf.

*The second-highest, interestingly, was not located in the CCR. It was a penthouse unit sold at $13.9 million, or about $2,450 psf, in Meyerhouse in District 15.

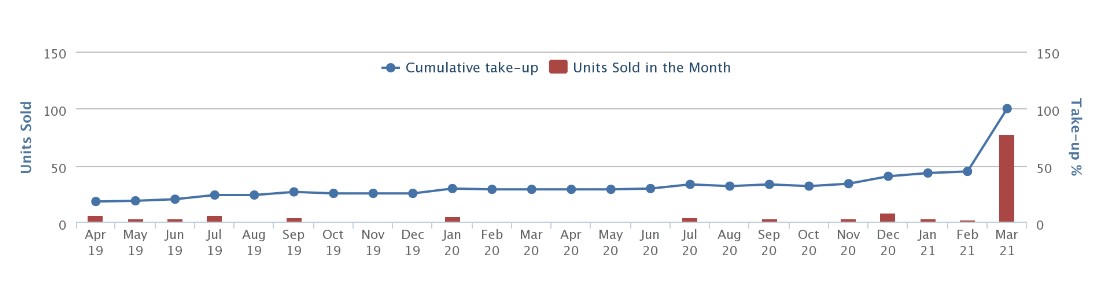

RV Altitude is a small, 140-unit freehold development in River Valley Road. Sales had been slow since 2019, and then this happened in March:

This was due in part to developer discounts:

The median developer price in March was $2,641 psf, down from $2,982 psf from the 2019 launch. The highest price was at $2,966 psf, while the lowest was at $2,446 psf. Not great news for the early buyers.

Eden is a 20-unit freehold development in the Newton area, which was bought for about $292.6 million (transaction records show this was split into three transactions, of $13 million, $261.4 million, and $18.2 million respectively). The buyers were a Taiwanese family.

The momentum in the CCR is likely to be sustained, at least in the near term. One of the factors is the number of new launches that we’re seeing: there were 12 launches within the CCR last year, and another 10 in 2021.

The interest isn’t fading – even as we write this, Irwell Hill Residences near Great World City has sold out 50 per cent of its units.

That said, it isn’t all a bed of roses either. The Atelier , near Newton MRT station, has moved just its first four units – one of them transacting at $4.48 million. A slew of existing new launches in District 10 such as Wilshire Residences, and Hyll on Holland aren’t faring too well at the moment.

Nevertheless, signs are showing that high-end buyers are coming up again, and there are a number of luxury new launches in the coming months to take note of.

Upcoming launches include:

Some of the headline developments are:

Key highlights:

For those of you that remember, Park Nova is the new development that will replace Park House, which holds the record collective sale price of $2,910 sq ft per plot ratio. At a land cost of $375.5 million, this means the estimated break even price for this new development is around $3,842 psf ppr.

Save for Les Maisons Nassim (also by Shun Tak Holdings), Park Nova is probably the one that is most talked about in the luxury circles for now. This is Shun Tak Holding’s first residential development in Singapore – and it is an ultra luxurious one at that.

With just 54 exclusive units of sizes ranging from 1,432 to 5,899 square feet, it is undoubtedly a project aimed at the well heeled.

The smallest 2 bedroom + study unit at 1,432 square feet has an indicative price tag of $5.xx million, which could get you a landed home in other parts of Singapore – so you can just imagine what the rest of the prices here will be commanding.

It is designed by London-based architectural firm, PLP Architects, of which they have designed a butterfly inspired residential tower that has balconies that are overflowing with greenery.

Key highlights:

Canning Hill Piers will steal most of the limelight: this was the former Liang Court mall. Once complete, it will be one of the closest residential developments to Clarke Quay MRT (about 420 metres, or a six-minute walk).

The existing site was purchased by City Developments (CDL), CapitaLand, and joined by Ascott Residence Trust at a price of $400 million.

This area is a major lifestyle destination, as well as an expatriate enclave. We’re not just referring to nightlife: this development also adjoins River Valley, which is a high-end enclave for families. As such, Canning Hill Piers is one of the rare developments that will draw both home buyers and investors.

The unit count is also a likely crowd pleaser. At 696 units this is a mid-sized development: not so big as to create competition among sellers and landlords, but still big enough to keep maintenance fees in check.

ALSO READ: 5 new launch RCR condos with units below $1.5m (2021)

Key highlights:

One Bernam was actually a Government Land Sales (GLS) site that attracted 4 bids – with the top bid of $440.9 million coming from Chinese Developer HY Realty. At this land cost, the estimated breakeven will be about $2,264 psf ppr.

One Bernam is the second largest upcoming CCR development, with 351 units. About 87 units are one-bedders (441 to 463 sq. ft.), with the majority (232 units) being two-bedders that range from 700 to 872 sq. ft.

If this strikes you as being favourite sizes for landlords, you’re right. One Bernam is in the heart of the business district, just 370 metres – or about a five-minute walk – to Tanjong Pagar MRT station. It’s not exactly a family condo, given that much traffic and urban density; but the location is excellent for expat singles / couples working in the CBD.

This condo also has one of the most unusual layouts we’ve seen, with the facilities clustered in a separate area from most of the residential blocks.

Key highlights:

Existingly called Cairnhill Mansions, this was sold to developer Low Keng Huat in February 2018 for $362 million. At this land price, the estimated breakeven for this new project is about $3,315 psf ppr.

Klimt Cairnhill is a small freehold development (only 240 units), located halfway between Orchard and Newton. It’s next to Goodwood Park hotel, which leads down Scotts Road toward Far East Plaza and Wheelock Place.

However, Newton MRT station is actually a bit closer (about 450 metres, whereas Orchard MRT is 650 metres away).

Klimt Cairnhill will provide an alternative, for those considering The Atelier and Kopar at Newton . While it isn’t as close as these two developments, it does have the advantage of being closer to Orchard.

ALSO READ: 4 reasons why resale condos may be more popular in 2021

Key highlights:

This was the former City Towers in Bukit Timah, which had a rough time for its residents as they had to go through four collective sale attempts plus a squabble after a pair of sibling owners attempted to block the deal.

It was a competitive bid with 7 bidders, but that finally went to the top bid by Japura Development, at a land price of $401.9 million. This means the estimated break even would be around $2,568 psf ppr.

Not too much is known about this new launch at this point, but it can house a 24-storey residential block with approximately 190 units.

It is located on the Bukit Timah belt so it will enjoy close proximity to good schools, and that freehold status will definitely be an attractive point for homeowners. Kudos to the developers though, for trying out a more refreshing condominium name – but it’s not for everyone.

This was the old Cairnhill Heights, which had gone en bloc in April 2018 for $72.6 million, so the estimated breakeven for Cairnhill 16 is about $2,381 psf ppr.

Cairnhill 16 is one of the best-located condos in the CCR, being around 600 metres from Far East Plaza and The Paragon (these are along the main Orchard shopping belt). Newton MRT station is also around the same distance. As far as new launches in 2021 go, this may be one of the closest to the heart of Orchard Road.

Unlike Grange 1866, the development seems angled more toward owner-occupancy. There are zero shoebox units, with the majority of units being three-bedders that range between 1,055 to 1,292 sq. ft.

There are only 39 units, and it’s located far off enough from the main road that the noise isn’t an issue. This is nice for privacy – but being within the heart of Orchard inevitably means a lot of looming buildings, and less green space. This is one for pure urbanites, not nature lovers.

This article was first published in Stackedhomes.