8 best personal loans in Singapore with lowest interest rates (February 2024)

If you're in urgent need of money, but are too paiseh to borrow from your family and friends, your best bet is probably a personal loan.

With a personal loan, you borrow cash from a bank or financial institution and pay them back in fixed instalments over an agreed period. But you'd typically need to meet a minimum income requirement and the bank will check your credit history.

Still, it's generally much cheaper and safer to get a personal loan from a bank rather than engage a moneylender. Here's a look at the personal loans with the lowest interest rates in Singapore in February 2024.

Here are the current starting interest rates on offer from the most popular personal loan providers in Singapore. We'll use the example of a Singapore citizen earning $2,500 a month, who wants to borrow $10,000 and repay it over three years.

| Personal loan | Interest rate and Effective Interest Rate (EIR) | Processing fee | Monthly repayment | Eligibility |

| UOB Personal Loan | 2.88per cent (EIR 5.43per cent) | 0per cent | $302 | – Singapore Citizen/PR: $30,000 – UOB Credit Card/CashPlus customer |

| Standard Chartered CashOne | 2.88per cent (EIR: 5.84per cent) | 0per cent | $307 | – Singapore Citizen/PR: $20,000 – Foreigner: $60,000 |

| Trust Instant Loan | 2.87per cent (EIR: 5.41per cent) | 0per cent | $302 | – Singapore Citizen/PR: $30,000 – Foreigner: $60,000 |

| GXS FlexiLoan | 2.99per cent (EIR 5.65per cent) | 0per cent | $303 | – Singapore Citizen/PR: $20,000 |

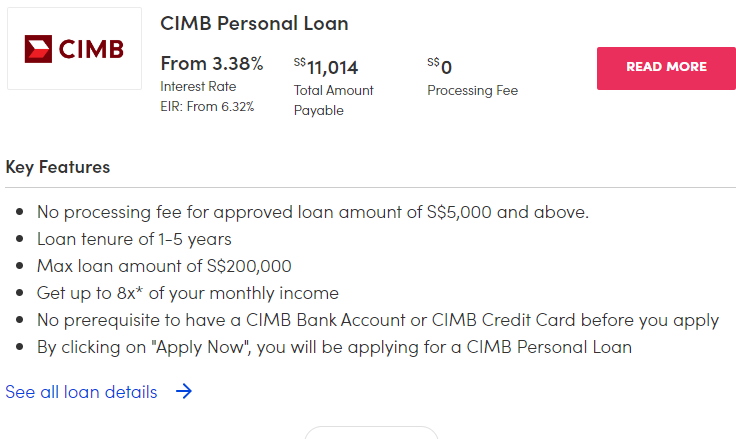

| CIMB Personal Loan | 3.38per cent (EIR 6.32per cent) | 0per cent | $306 | – Singapore Citizen/PR: $20,000 |

| Citibank Quick Cash (New Customers) | 3.45per cent (EIR: 6.5per cent) | 0per cent | $307 |

– Singaporean/PR: $30,000 – Foreigner: $42,000 – Rates apply to new Citi customers only |

| DBS/ POSB Personal Loan | 3.88per cent (EIR 7.9per cent) | 1per cent | $310 | – Singapore Citizen/PR: $20,000 – Foreigners with existing Cashline and/or Credit Card account: $20,000 – Existing DBS/POSB customers |

| HSBC Personal Loan | 3.6per cent (EIR: 6.5per cent) | 1per cent | $308 |

– Singaporean/PR: $30,000 for salaried workers, $40,000 for self-employed or commission-based workers – Foreigner: $40,000 |

Not mentioned in this table is OCBC's ExtraCash personal loan which brings you up to 5.43 per cent interest rate (EIR 11.47 per cent) amounting to $323 monthly repayment with a $100 processing fee.

There's quite a bit of jargon here, so let's go through some points of confusion that may be swimming around in your head.

Interest rates: Notice that interest rates are quoted as "from Xper cent" instead of being stated simply as "Xper cent"? That's because personal loans are pretty dynamic as they all depend on factors such as

Banks often personalise your interest rate when you submit an application, so, typically, you'll see the final interest rate only after your application is approved.

EIR: EIR stands for Effective Interest Rate. Taking into consideration other fees (like processing fee; see next point) and the loan repayment schedule, it is a more accurate reflection of the cost of borrowing than the advertised interest rates.

Processing fee: This is the main hidden cost of personal loans and is worth highlighting. The processing fee is deducted from the principal-meaning, for a $10,000 loan with a $100 (or 1per cent) processing fee, you get only $9,900 in cash. As a borrower, you might not "feel" it, but it does eat into your funds and increase the cost of borrowing.

Now, let's walk through the seven personal loan packages highlighted.

UOB's personal loan is only open to existing UOB credit cardholders or CashPlus customers who are Singaporeans, PRs aged 21 to 65. You'll also need to be a salaried worker earning at least $30,000 a year. Not an existing UOB customer? You'll have to get a UOB credit card or CashPlus to apply for a UOB Personal Loan.

The interest rate is from 2.88 per cent p.a. for a loan periods of 12, 24, 36, 48 or 60 months, with a 5.43 per cent p.a. EIR.

While UOB used to only waive processing fees for loan periods 24 months and up, processing fees are now waived for all loan periods.

If you're an existing UOB customer, you can get instant approval when you apply for your personal loan online.

Thinking of applying for a UOB Personal Loan? Apply now to get up to S$1,200 cash via PayNow or an Apple Mac Mini, 512GB (worth S$1,156.85) when you apply for a minimum loan of $8,000 through MoneySmart.

Plus, take a loan of $50,000 or more and enjoy UOB cash rebates of up to two per cent for loan tenures of three, four and five years. Enjoy 0.5 per cent cash rebates for loans $15,000 to below $50,000.

Valid until Feb 21, 2024. T&Cs apply.

Standard Chartered CashOne personal loan is open to Singapore Citizens, PRs and foreigners with a Singapore Employment Pass aged 21 to 65.

The barriers to entry for the Standard Chartered CashOne personal loan are slightly lower than for other banks. The minimum annual income requirements are $20,000 for Singaporeans and PRs (that's lower than for other banks!) and $60,000 for foreigners.

You also don't necessarily need to be a salaried worker to apply — Standard Chartered is cool with salaried employees, variable/commission-based employees, and even self-employed individuals.

You can apply for this personal loan online by signing in through SingPass and receive your loan disbursement within 15 minutes. There's no need to be an existing Standard Chartered customer to get this personal loan.

So, it's fast-but is it also affordable? Standard Chartered charges an initial annual fee of $199 (deducted from your approved loan) for any loan tenure between one to five years. From the second year onwards, you won't have to pay any more annual fees — unless you miss any instalments, in which case you will pay $50 in annual fees for that year. Plus the late payment fee of $100. Lesson learnt: Don't miss your payments!

Because of the $199 fee, CashOne is more worthwhile if you're taking out a big loan. A $10,000 loan would mean you'd be paying a fee worth 1.99 per cent of your principal amount.

Interest rates are advertised as starting from 2.88 per cent, working out to an EIR of 5.84 per cent and above. In reality, interest rates are personalised, so yours might differ from this example.

From now until Feb 21, 2024, apply via MoneySmart to get attractive gifts of up to S$6,337 (an Apple Watch Ultra 2 + S$5,100 cashback). Existing customers can get up to S$5,608 in cash rewards when applying for a minimum loan of $8,000 with a tenure of three to five years.

GXS is a digital bank that's 60 per cent owned by Grab and 40 per cent owned by Singtel. Now, don't be dissuaded by the idea of a digital bank. Like any regular bank, GXS offers customers a personal loan — and a pretty good one at that.

With a loan tenure between two and 60 months, GXS FlexiLoan interest rates start from 2.99 per centp.a., with an EIR of 5.65 per cent p.a.. This is one of the best EIRs around currently, second only to UOB's personal loan with an EIR of 5.43 per cent p.a..

On top of that, GXS FlexiLoan doesn't charge any annual, processing, early repayment or late fees — something almost unheard when it comes to loans from your traditional banks. You heard that right, repay your loan early with no extra charges! However, GXS will charge you late interest if your repayments are late, so you won't get off scot-free.

One downside to the GXS FlexiLoan is that foreigners aren't eligible. It's only for Singapore Citizens and Singapore Permanent Residents between 21 and 65 years old. The minimum annual income is S$20,000.

When they say "instant", they mean it. Trust's personal loan, called Trust Instant Loan, disburses cash to you in just 60 seconds with the Trust credit card. This is how it works: You have a Trust credit card with a certain available credit balance at any one point in time. The Trust Instant Loan converts a portion of that balance into cash for you to spend on anything you want.

The Trust Instant Loan is open to all Trust customers. Given how it works, as I just explained above, you do need to have a Trust credit card to be eligible. But this isn't a bad thing-for one thing, it makes repaying the loan seamless. Each month, you'll see your loan instalment charged to your credit card bill. To pay the instalment, simply pay through your credit card statement via your Trust App.

Aside from being fast, the Trust Instant Loan is also affordable with an interest rate starting from just 2.87 per cent p.a. (EIR from 5.41 per cent p.a.). They also charge no processing fees, annual fees, or the like. However, there is a three per cent early repayment fee on your remaining loan amount if you repay the rest of your loan early.

While only Singapore Citizens and PRs are eligible for the GXS FlexiLoan, the Trust Instant Loan is open to Singapore Citizens, PRs, and Foreigners aged 21 to 65 years old. You could be a salaried worker, commission-based, or self-employed as long as your annual income is $30,000 for Singaporeans or $60,000 for Foreigners.

The CIMB Personal Loan is another personal loan that comes with no processing fees — if you take a loan amount of at least $5,000. Smaller loan amounts (the minimum is $2,000) will be subject to a processing fee of 1per cent and a super high interest rate of nine per cent-that's an EIR between 16.17 per cent to 18.15 per cent!

For higher loan amounts, CIMB offers rates from 3.38 per cent (EIR 6.32 per cent) for loan tenures between one to five years. Here's a breakdown:

As far as eligibility goes, the CIMB Personal Loan is fairly standard. It's open to Singapore Citizens and Singapore PRs with a minimum annual income of $20,000, but not open to foreigners.

You'll also need to be 21 to 70 years old-that maximum age sits between the Citibank and DBS personal loan age limit. There's no prerequisite to have a CIMB Bank Account or CIMB credit card before you apply, so go ahead as long as you meet the criteria above.

Like any personal loan, you'll incur a penalty fee if you try to repay it early. For the CIMB Personal Loan, this fee is three per cent of the outstanding loan amount or $250, whichever is higher.

That means the minimum in extra charges that you'll fork over is $250. That's higher than that for the UOB and Standard Chartered personal loans we talked about above. For both of those, the early repayment fee is the higher of three per cent or $150.

The 3.45 per cent (EIR: 6.5 per cent) Citibank Quick Cash is only available to customers who are completely new to Citibank loans. If you already have a Citibank loan, you'll be given a higher interest rate.

Just log into the Citi Mobile App, key in the amount of cash you need and you can get the funds instantly.

Citi Quick Cash is open to Singapore Citizens and PRs (salaried or self-employed) with a minimum annual income of $30,000, and foreigners with an annual income of at least $42,000. The eligible age range is 21 to 65 years.

With Citibank's Quick Cash personal loan, you can choose a tenure of 12, 24, 36, 48, or 60 months — all with zero processing fees. You can get 3.56 per cent interest rate on Citibank's personal loan with a shorter 1-year tenure, or 3.45 per cent if you intend to drag your loan repayment to three years. While the interest rates differ according to tenure period, you'll get an EIR of 6.5 per cent for all.

That said, don't take our word for it. Rates are customised, so what you get might not be exactly the same as the above examples.

Do note that these rates are only for new Citi Credit Card or Citibank Ready Credit account holders. Existing customers have their own rates, and can apply for a personal loan via the Citi Mobile App without the need to provide any additional documents.

The DBS/POSB personal loan is only open to existing DBS/POSB customers. If you already have (1) a DBS/POSB Cashline account or have a DBS/POSB credit card and (2) credit your salary into a DBS or POSB deposit account, you can get the cash disbursed instantly.

The loan is open to Singaporeans and PRs, as well as foreigners with DBS/POSB Cashline or credit card accounts. You must be aged 21 to 70 years with a minimum annual income of $20,000 — this opens up DBS/POSB personal loans to include slightly older groups of people and lower income earners compared to other banks.

Like the Standard Chartered CashOne loan, you don't need to earn a regular salary to be eligible for this loan. Self-employed individuals and commission earners can also apply.

DBS's personal loan promises interest rates as low as 3.88 per cent. There is a processing fee of one per cent, bringing the lowest possible EIR to 7.56 per cent. Loan tenures of six months to five years are available.

As usual, these are the lowest possible rates and the actual interest rate depends on what DBS is prepared to extend to you. The maximum possible EIR is 20.01 per cent.

HSBC's personal loan is open to Singaporeans and PRs aged 21 to 65 years old with an annual income of $30,000 and above for salaried workers, and $40,000 for self-employed or commission-based workers. Foreigners must earn at least $40,000 a year and have an employment pass with at least six months' validity.

The best part about HSBC's personal loan is its long loan tenure of up to seven years — currently the longest loan tenure in Singapore. So if you need to borrow a large sum but can't afford high monthly repayments, HSBC's personal loan is definitely one you should consider.

On the downside, HSBC's interest rates aren't the lowest. With advertised interest rates starting from 3.6 per cent p.a., the EIR starts from 6.5 per cent p.a.. The calculation of the EIR includes the one per cent processing fee, which is subject to a minimum of $88. Remember, however, that actual interest rates will vary from person to person.

Another factor to consider is that HSBC's personal loan comes with an annual fee of $120, and only the first year's fee is waived. Don't miss your payments, or you'll be subject to a $120 late payment fee. These fees used to be $60 and $75 respectively, but have been bumped up to $120 since Jan 8, 2024.

If you’re just looking for the cheapest personal loan, the UOB Personal Loan and Standard Chartered CashOne personal loan are your best bets. Citibank’s Quick Cash is also a good option to consider if you’re a new Citi customer.

That said, remember that the actual interest rate a bank offers you will depend on factors like your credit history, how much you want to borrow and for how long. So if you don’t get offered the lowest advertised interest rates with one bank, you might want to compare that with what the other banks are willing to offer you.

There are certain groups of individuals that may have a harder time taking out a personal loan.

If you need the cash ASAP, the fastest options are the DBS Personal Loan (for existing DBS customers), UOB Personal Loan (for existing UOB customers), and Standard Chartered CashOne.

On the other hand, if you don’t need the cash fast but do need a long tenure period to repay a large loan amount, HSBC’s personal loan currently offers the longest tenure in Singapore of seven years.

Whatever personal loan package you choose, opt for the smallest loan amount and shortest term you can comfortably manage. This will keep your interest payments to a minimum.

While researching personal loans, you might have come across many different loan types, some of which do not seem to fit what we described above.

MoneySmart lists only term personal loans, which is when you borrow a fixed sum with a fixed repayment plan that you agree on before you see the cash.

We usually recommend these loans because they have much lower interest rates. You can pay back slowly and steadily at a pace comfortable to your financial situation.

Many banks also offer a personal line of credit — sometimes called a credit line, revolving loan, or even "flexible repayment loan".

This is a pre-approved amount of money you can cash out in part or whole, but you need to repay it ASAP or else face sky-high interest rates. Don't fall for it unless you're absolutely confident you can pay the money back immediately.

These days, most banks base their personal loans on either your personal line of credit or credit card limit. So you will need either a credit card or credit line to get the loan. However, it is still considered a term loan if it comes with a structured repayment plan.

But before you sign up, understand that your credit cards with this bank will be as good as dead because you'll have effectively "spent" your credit on a cash loan.

But it can be prevented. If you must take out a loan, channel all your energies into paying it off on time to avoid late charges. In the meantime, re-examine your income and budget, making a note of everything you spend on, so you won't have to resort to loans again.

Ideally, you should draw up a budget that gives you enough leeway to set aside some cash for the future without starving to death.

You should also build up an emergency fund worth a few months' expenses. If you're hit with unforeseen circumstances, you can dip into this fund instead of having to take a loan.

It's also a good idea to know what types of insurance you need. We recommend hospitalisation insurance at a bare minimum, and life insurance if you have dependents. Being sufficiently insured ensures that you don't get hit with huge bills if the unexpected happens.

ALSO READ: 6 best personal loans in Singapore with lowest interest rates (November 2023)

This article was first published in MoneySmart.