All the new launch condo updates for 2021

It’s still early days in 2021, but it doesn’t look as if the property train will be slowing down much (we’ve detailed it more here ).

2020 has ended with private residential prices rising by 2.2per cent for the whole of 2020 , which while it is lower than 2019, is still very encouraging given the major Covid-19 pandemic that has gripped the world.

Even if you are not exactly in a hurry to buy a home, it is still worth keeping your ears to the ground for what is about to come up in the property market in 2021. So before you put down any cheques or rush to a show flat, here’s a sense of what’s coming up this year:

| Development | Location | Selling Price |

| Artra | Alexandra View | $1,669 psf |

| Le Quest | Bukit Batok West Ave. 6 | $1,304 psf |

| 120 Grange | 120 Grange Road | $3,178 psf |

| The Linq @ Beauty World | Upper Bukit Timah Road | $2,186 |

| Development | Location | Percentage sold | Selling price |

| The Tre Ver | Potong Pasir Ave 1 | 99.9per cent | $1,548 psf |

| The Tapestry | Tampines Avenue 10 | 99.8per cent | $1,390 psf |

| Parc Botannia | Fernvale Road | 99.7per cent | $1,293 psf |

| Magaret Ville | Magaret Drive | 99.7per cent | $1,895 psf |

| Queens Peak | Dundee Road | 99.5per cent | $1,631 psf |

| Grandeur Park Residences | Bedok South Ave 3 | 99.4per cent | $1,331 psf |

| Parc Esta | Changi Road | 98.6per cent | $1,714 psf |

| Seaside Residences | Siglap Road | 98.5per cent | $1,592 psf |

| Amber 45 | Amber Road | 97.1per cent | $2,360 psf |

| Kallang Riverside | Kampong Bugis | 94.3per cent | $2,081 psf |

| Twin VEW | West Coast Vale | 94.2per cent | $1,442 psf |

| Stirling Residences | Stirling Road | 93.7per cent | $1,754 psf |

| Parc Colonial | Woodleigh Lane | 93.4per cent | $1,747 |

| Daintree Residence | Toh Tuck Road | 92.7per cent | $1,743 psf |

| Riverfront Residences | Upper Serangoon View | 91.6per cent | $1,314 psf |

| Jui Residences | Serangoon Road | 90.6per cent | $1,684 psf |

| Development | Location | Percentage Sold | Selling Price |

| The Lilium | How Sun Road | 1.30per cent | $2,126 |

| Cuscaden Reserve | Cuscaden Road | 3.60per cent | $3,435 |

| Dairy Farm Residences | Dairy Farm Road | 9.60per cent | $1,550 |

| The Gazania | How Sun Drive | 10.40per cent | $2,072 |

| Petit Jervois | Jervois Road | 10.90per cent | $2,892 |

| Juniper Hill | Ewe Boon Road | 11.30per cent | $2,810 |

| Midwood | Hillview Rise | 11.50per cent | $1,648 |

| The Avenir | River Valley Close | 12.20per cent | $3,235 |

| Leedon Green | Farrer Road | 13.80per cent | $2,723 |

| Pullman Residences | Dunearn Road | 14.70per cent | $2,750 |

| Wilshire Residences | Farrer Road | 15.30per cent | $2,657 |

| Sloane Residences | Balmoral Road | 15.40per cent | $2,930 |

| Meyerhouse | Meyer Road | 17.90per cent | $2,561 |

| Riviere | Jiak Kim Street | 18.00per cent | $2,924 |

| Haus on Handy | Handy Road | 18.10per cent | $2,866 |

| The Hyde | Balmoral Road | 19.70per cent | $2,900 |

| Urban Treasures | Jalan Eunos | 19.80per cent | $1,960 |

While we can’t cover every single development yet (many are still too new), there are some highlights already emerging. Here are the ones to take note of early this year:

Address: Normanton Park (District 5)

Developer: Kingsford Huray Development Pte. Ltd.

Lease: 99-years from 2019

Expected TOP: 31 Dec 2023

Number of units: 1,862 (1,840 apartments, 22 villas)

Why is this interesting?

There’s a lot of buzz around Normanton Park, mainly revolving around its former no-sale license.

As this is something of a long topic, we’ll present a detailed explanation of this later in the week (and our review); do follow us on Facebook for an update. The other really hinges on the fact that it will be the largest new launch project of 2021.

That said, Normanton Park had something of a late start, due to the aforementioned incident. This has led to speculation that the developer will price it to move, due to the five-year Additional Buyers Stamp Duty (ABSD) deadline (even with the Covid-19 extension).

This is especially given the size of Normanton Park (1,840 units and 22 villas), which is a lot of units to sell in a tighter than usual time frame.

We’ll let you know if these expectations pan out, once we get hold of the real pricing. In the meantime, bargain hunters might want to keep an eye on this project.

Normanton Park has the same name, and same locational advantages, as its predecessor. We do expect it to generate investor interest, due to its close proximity to the One-North tech and media hub.

Even with the arrival of One-North Eden (see below), the area is still packed with prospective tenants; from students at institutes like INSEAD, to the foreign workers in the nearby tech start-ups.

One major drawback, however, is that it’s quite far from any MRT station.

Address: Slim Barracks Rise (District 5, Queenstown)

Developer: TID Residential Pte. Ltd.

Lease: 99-years from 2019

Expected TOP: 2024

Number of units: 165 units

Why is this interesting?

As we mentioned regarding Normanton Park above, there has been little supply of homes in the One-North area up till now (an even One-North Eden is quite small, at 165 units). This is despite the area being a tech and media hub, with a good supply of prospective tenants.

One-North Eden also has the advantage of being about 400 metres (five minutes’ walk) from the One-North MRT station; and the nearby Fusionopolis, Biopolis, etc. are packed with amenities (there is, for instance, a Cold Storage and Watsons already in Fusionopolis).

Failing that, it’s just one train ride to Buona Vista, where you’ll find The Star Vista mall.

This isn’t a family condo, but it will definitely draw attention from singles or couples working in the area; as well as from pure investors.

Address: Tan Quee Lan Street (District 7)

Developer: GuocoLand Pte. Ltd.

Lease: 99-years

Expected TOP: 29 Jun 2022

Number of units: 556 units

Why is it interesting?

Back when Midtown Bay was launched, GuocoLand pointed out they had also secured a land plot along Tan Quee Lan Street. This is where Midtown Modern is sited.

This development will be one of the closest ever to Bugis Junction, and the attached Bugis MRT station.

This location is more or less guaranteed to make it one of the hottest launches this year; we believe those who didn’t secure a unit at Midtown Bay (which had only 219 units) will look at either The M , or Midtown Modern as the next alternative.

Landlords are bound to have their eye on these three developments, as a way to capitalise on the Ophir-Rochor corridor (we have a more detailed explanation of these factors in an earlier article ).

Midtown Modern is also adjacent to the Bras Basah area, which is Singapore’s designated cultural district (it’s within a one-kilometre radius of art schools like La Salle, NAFA, and SOTA).

That said, we have to wonder if there’s getting to be too many condos clustered in the same area; especially with the former Shaw Tower being redeveloped into even more residential housing.

ALSO READ: HDB BTO launch in February: Bidadari, Bartley, Boon Keng, Bukit Batok, where should you apply?

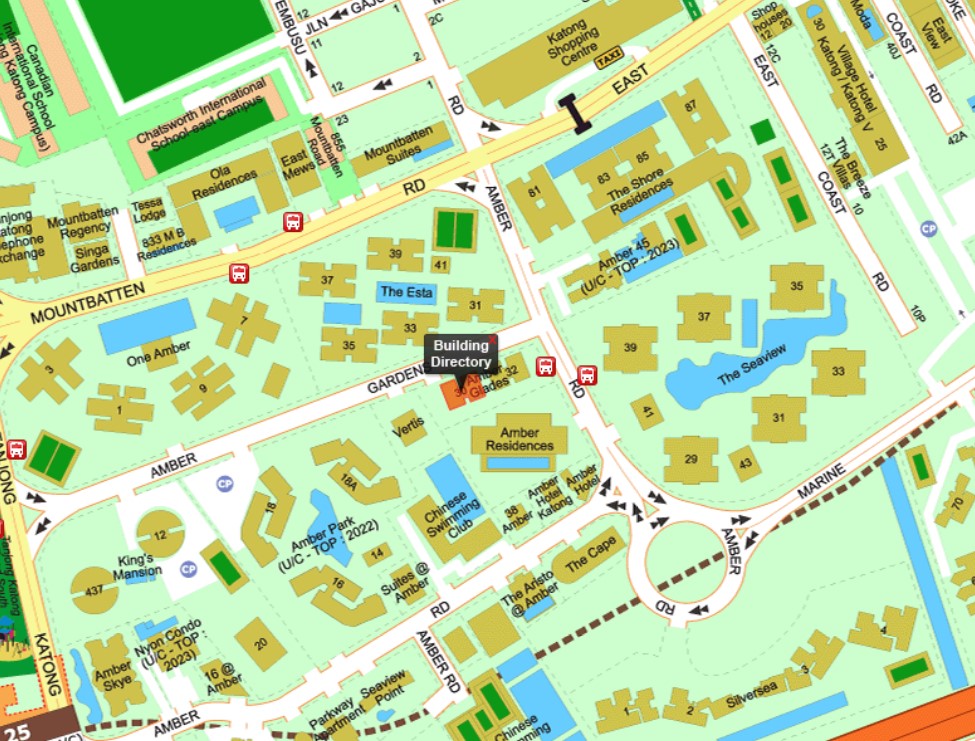

Address: Amber Gardens (District 15)

Developer: Far East Organisation

Lease: Freehold

Expected TOP: TBD

Number of units: 110

Why is it interesting?

This is built on the site of the former Amber Gardens, which was regarded as one of the best East Coast locations in its day. It’s located close (about four minutes’ walk) to the stretch of eateries and family-friendly pubs along East Coast Road, starting from Katong Shopping Centre all the way down to Joo Chiat.

It’s also about 1.2 kilometres (a three-minute drive, or a long 15-minute walk if you can manage it) to Parkway Parade, where you’ll find Giant and Cold Storage.

Right now, it’s a bit far from any MRT station; but Tanjong Katong station (slated for completion in 2023) will just be a few minutes’ walk away. This is likely to be up before Amber Sea is completed.

Address: Makeway Avenue (District 9)

Developer: Bukit Sembawang Estates Pte. Ltd.

Lease: Freehold

Expected TOP: 2024

Number of units: 120

Why is it interesting?

This condo is roughly 600 metres (eight minutes’ walk) to Newton MRT station. This is likely to be viewed as an alternative to the larger Kopar at Newtown , which is also close to the Newton train station.

The highlight is definitely the location – beside being near Newton Circus, it’s also within striking range of Novena, with malls like United Square.

And, of course, landlords are quick to zero in on such centrally located properties (tenants are seldom in short supply in the Newton area, which is minutes from the city centre, but not so expensive as living along Robinson Road or Raffles Place).

What a lot of buyers will point out, of course, is that Kopar at Newton is marketed on more or less the same advantages. We feel the Atelier will appeal to buyers who prefer smaller, more boutique-like developments compared to the larger Kopar.

(Kopar, on the other hand, is likely to have much lower maintenance fees given the larger number of units. We’ll keep you updated as the numbers are revealed).

The most interesting of these sites, at the moment, is Yishun Avenue 9. This is simply because there hasn’t been a Yishun EC since 2015, and market watchers will be eager to see how well it performs.

While the site is quite far from any MRT station – a common challenge for ECs – it’s just around 700 metres to Junction 9 shopping mall. We have a little more on this upcoming site in an earlier article .

The new launches this year also seem to be well spread out, giving a wide range of options – and there are no less than four ECs to look forward to.

With regard to discounts however, sellers don’t seem to be flinching or lowering prices much; so we wouldn’t count too much on it being a strong buyers’ market, despite earlier Covid-19 predictions.

This article was first published in Stackedhomes.