Are ground-floor condo units less profitable in Singapore?

In the Singapore property market, most people would gravitate towards a higher floor unit. This is even clearly reflected in developer pricing, where we expect that the higher floor units will come at a premium.

But we've also discovered that some contrarian buyers prefer ground floor units — and besides benefits like a lower quantum, many have cited experiences where their ground floor units have performed better than the top floor neighbours.

While this may be true for certain developments (there are projects where the ground floor units have special features like high ceilings, etc), this may not be representative across the board. Let's take a closer look to see what the numbers tell us:

We started by picking out all the transactions for level 1 units, between 2014 to 2024. We should clarify there may be some inaccuracies in this approach, as level 1 is not always the ground floor for every condo; but it's true enough for the vast majority.

We found that over the past 10 years, ground floor units make up a small number of transactions; just around five per cent of the total:

| Row Labels | Average of quantum | Average of per cent | Count of project_name |

| Not Ground | $280,620 | 24.49per cent | 27,806 |

| Ground | $282,745 | 24.72per cent | 1,477 |

| Average | $280,727 | 24.50per cent | 29,283 |

Although such a large general comparison doesn't help much, do note that the average quantum of ground floor units is actually a little bit higher.

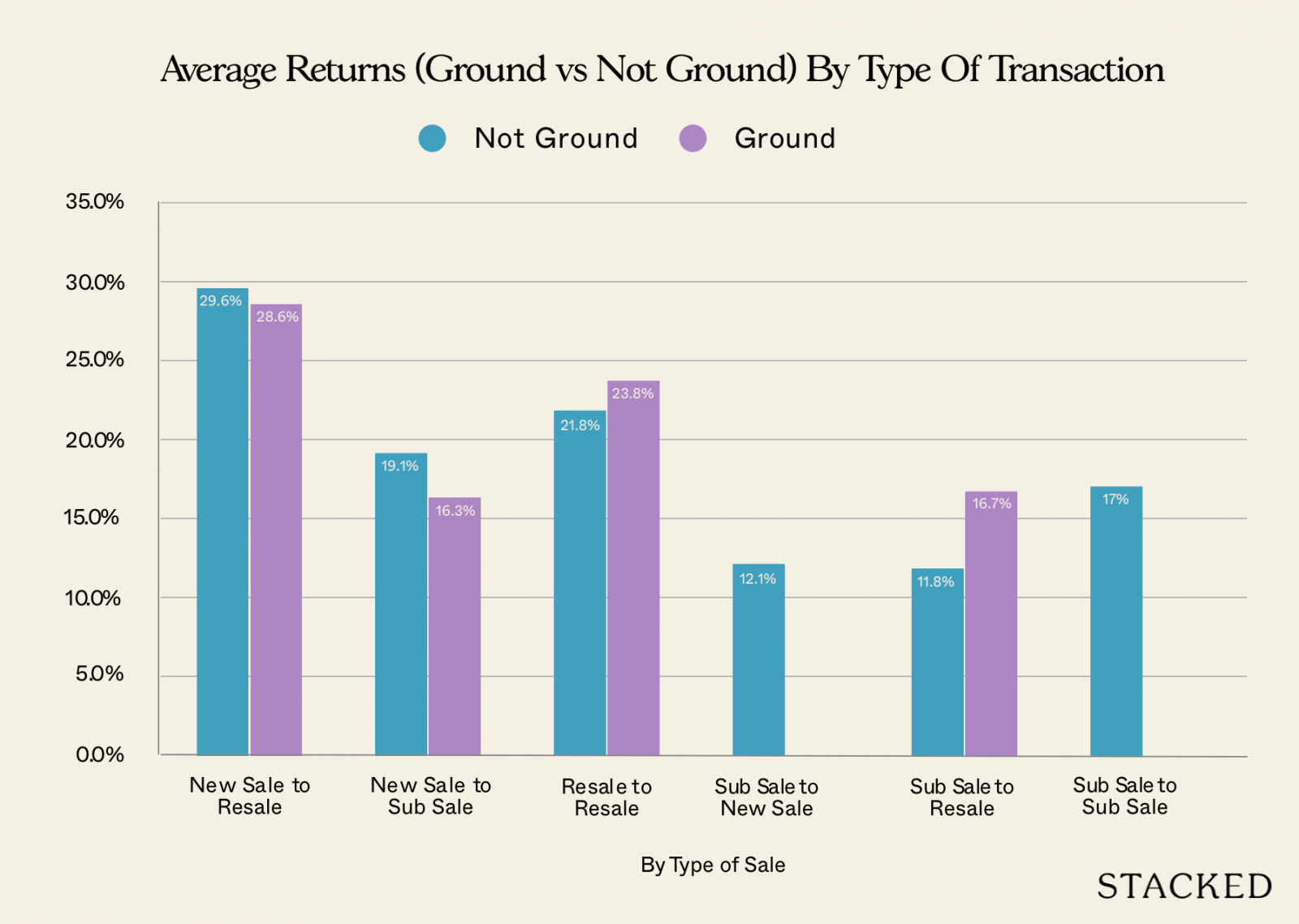

There may, for instance, be a difference between ground floor units that are bought during developer sales and then resold (new-to-resale), versus those bought from other owners and sold again (resale-to-resale).

One of the factors here is that, quite often, developers charge less for ground floor than higher floor units, which could lead to greater room for appreciation.

| Avg Gains ($) | Avg Gains (per cent) | Volume | ||||

| Type of Sale | NOT GROUND | GROUND | NOT GROUND | GROUND | NOT GROUND | GROUND |

| New Sale to Resale | $290,135 | $265,242 | 29.6per cent | 28.6per cent | 11,964 | 531 |

| New Sale to Sub Sale | $234,402 | $190,318 | 19.1per cent | 16.3per cent | 4,054 | 113 |

| Resale to Resale | $297,629 | $314,219 | 21.8per cent | 23.8per cent | 11,028 | 786 |

| Sub Sale to New Sale | $331,560 | 12.1per cent | 1 | |||

| Sub Sale to Resale | $129,841 | $176,355 | 11.8per cent | 16.7per cent | 749 | 47 |

| Sub Sale to Sub Sale | $164,931 | 17.0per cent | 10 | |||

| Average | $280,001 | $281,787 | 24.4per cent | 24.6per cent | 27,806 | 1,477 |

Indeed, there's a slight improvement to gains for ground floor units, in new-to-resale (28.6 per cent), versus resale-to-resale (23.8 per cent).

What we didn't expect, however, was for the difference to be so marginal. This suggests that, regardless of whether you buy new or resale, there's very little difference in gains between the ground floor and higher units.

Next, it could be that the region makes a difference. Would a ground floor unit in a prime central region, such as District 9 or 10, perform differently from ground floor units in more mass-market and fringe regions?

We took a look, and again, we maintained the comparison between new-to-resale and resale-to-resale for each region:

| Avg Gains ($) | Avg Gains (per cent) | Volume | ||||

| Region | NOT GROUND | GROUND | NOT GROUND | GROUND | NOT GROUND | GROUND |

| Central Region | $281,910 | $301,147 | 18.0per cent | 18.2per cent | 10,623 | 423 |

| East Region | $238,851 | $238,165 | 21.8per cent | 21.4per cent | 4,404 | 342 |

| North East Region | $279,608 | $278,513 | 28.5per cent | 27.3per cent | 6,357 | 323 |

| North Region | $320,495 | $288,143 | 37.5per cent | 34.3per cent | 2,395 | 210 |

| West Region | $300,777 | $325,736 | 30.4per cent | 30.7per cent | 4,027 | 179 |

| Average | $280,620 | $282,745 | 24.5per cent | 24.7per cent | 27,806 | 1,477 |

Again, there's very minimal difference in most regions. The only notable gap was in North region properties, where higher floor units outperformed the ground floor by 3.2 percentage points. The North East region also saw higher floor units outperform by 1.2 percentage points.

Everywhere else, the difference was less than a single percentage point; so perhaps you'll want to be more picky about higher floors, the further north or north east you go.

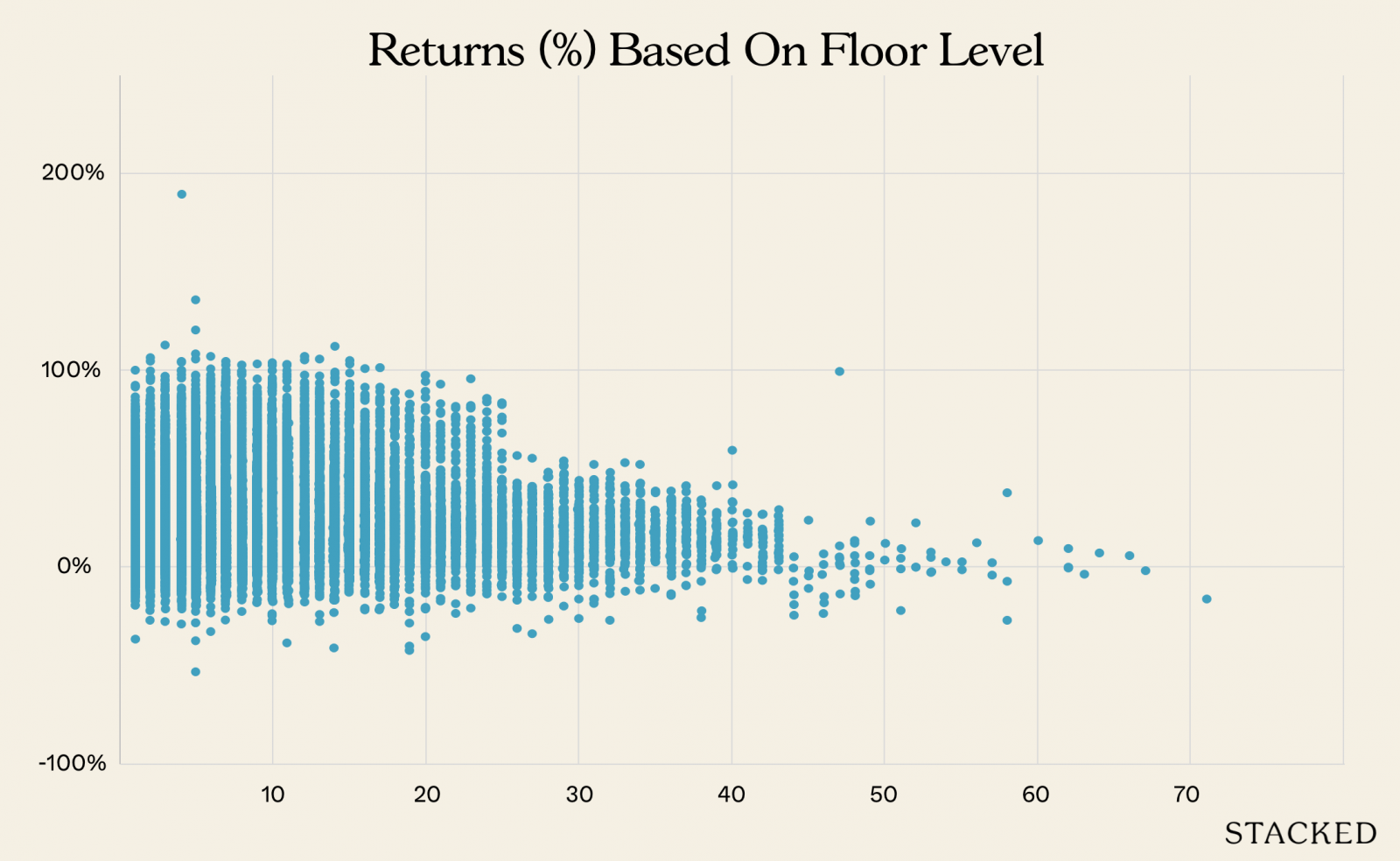

The horizontal axis shows the height (i.e., the further left on the graph, the higher the floor). The vertical axis shows the range of returns, as a percentage.

Note that transaction volumes are very low on the highest floors. Very few condos reach up to 50 storeys or more; and when you get to these topmost floors, you tend to end up with penthouse or premium units. These tend to be rare, one-off transactions, hence the lack of any range in the pricing.

Among the lower floors, the price ranges are wider. But these gains are more uniformly distributed, and not clustered around a tiny handful of transactions. In general though, from the 25th floor and up, gains tend to be much more narrow.

| Row Labels | New Sale to Resale | New Sale to Sub Sale | Resale to Resale | Sub Sale to New Sale | Sub Sale to Resale | Sub Sale to Sub Sale | Grand Total |

| 25 And Above | 16.6per cent | 17.3per cent | 13.9per cent | 12.1per cent | 9.1per cent | 24.1per cent | 15.7per cent |

| Below 25 | 30.4per cent | 19.1per cent | 22.2per cent | 12.2per cent | 15.2per cent | 25.0per cent | |

| Average | 29.5per cent | 19.0per cent | 21.9per cent | 12.1per cent | 12.1per cent | 17.0per cent | 24.5per cent |

With the exception of rare transaction types (e.g., sub-sale-to-sub-sale), those who bought below the 25th floor tended to see higher returns! An average gain of 25 per cent, compared to those who purchased on higher floors (15.7 per cent).

Why would this happen?

When we showed this to realtors, a common reason was that the topmost units in many condos are often penthouses, or other such premium units. These units are intended as indulgences for wealthy buyers, rather than investable assets. Coupled with the low transaction volume, it results in diminished gains.

We suppose that's plausible. But to stick with the numbers we've found, we can draw the following conclusion:

Ground floor units do not see a substantially worse return than higher floor units. Any difference in gains is likely to be marginal and of little real impact. However, you may be interested in units below the 25th floor. Based on what we've found, units in this range tended to bring in higher returns.

Speculatively, we'd reference our same theory from earlier: higher floor units tend to cost more from the start, and may just have less room for appreciation.

[[nid:712858]]

This article was first published in Stackedhomes.