Best travel insurance for extreme sports and outdoor adventure coverage (2023)

We all know friends who are adrenaline junkies. Those who get kicks out of taking crazy risks and going on wild adventures all around the world. Heck, maybe you're thinking: That's me.

We all know how important travel insurance is, but if you're planning a ski trip, scuba diving trip or something even crazier than that, then you need to know which travel insurance cover extreme sports and outdoor adventure.

Here are six things you need to pay attention to when buying any sort of adventure sports travel insurance.

Planning your long-awaited trip overseas with your pals for scuba diving, rock climbing, skiing or snowboarding?

Remember to get travel insurance that covers your winter sports, water sports, or mountaineering and rock climbing (usually considered more dangerous).

When browsing travel insurance plans, you'll realise that sports and adventure are usually split into three broad categories:

This table is a general comparison. Click in to each travel insurance review to see the specific outdoor activities they cover:

| Travel Insurance | Leisure Outdoor Activities | Bungee, Rock Climbing |

| FWD Travel Insurance | Yes | Yes |

| NTUC Travel Insurance | Scuba diving (up t0 30m), ski, winter sports, hiking, trekking (below 4,000m) only | Yes, but climbing only on man-made walls. |

| MSIG Travel Insurance | Yes | Yes, but rock climbing must be done harnessed and on man-made walls |

| Singlife with Aviva Travel Insurance | Buy rider | No |

| DBS Chubb Travel Insurance | Yes | Yes, but rock climbing must be done harnessed and on man-made walls |

| Great Eastern Travel Insurance | Yes | Bungee jumping only |

| Sompo Travel Insurance | Scuba diving (max 30m, with certification), trekking (below 3,500m) only | Rock climbing only if done on man-made walls. |

| Etiqa Travel Insurance | Yes | Bungee jumping only |

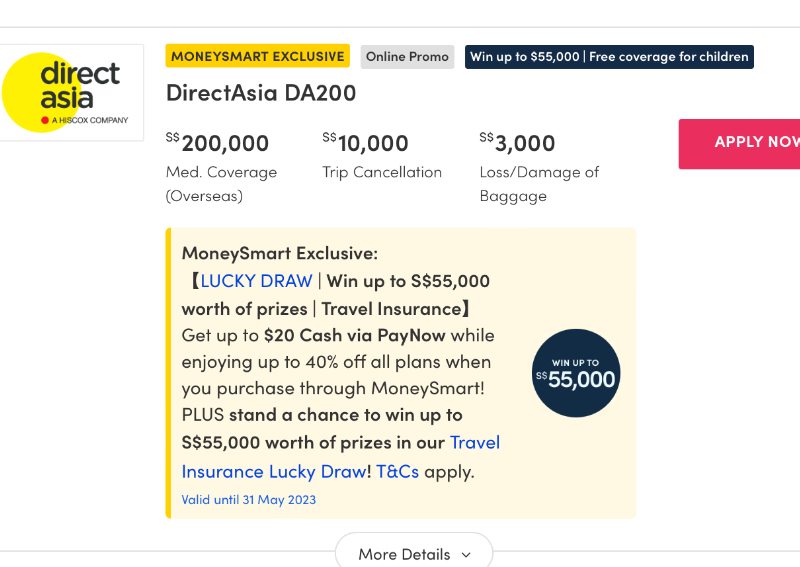

| Direct Asia Travel Insurance | Buy rider | Buy rider |

| Citibank Travel Insurance (by AIG) | Scuba diving (max 30m), trekking (below 3,000m), harnessed abseiling | Organised, harnessed rock climbing |

| Tokio Marine Travel Insurance | Yes | Yes |

| UOB Travel Insurance | Scuba diving only | No |

| OCBC Travel Insurance | Yes | Bungee jumping only |

Even if your travel insurance plan claims that it covers outdoor adventure and extreme sports, there will still be exclusions — aka activities that your insurance company is not willing to cover. Here are a few major examples:

You'll be surprised that most marathons are not covered by travel insurance since there's a grand prize you technically can win.

Now, you might say that you're probably not going to do any of these sports. But between insurance companies, there are different standards as to what's allowed, so always check your terms and conditions before you buy your travel insurance.

Lazy? Scroll up and you can read through our travel insurance reviews instead. We've scoured through policy wordings and terms and conditions for their outdoor adventure and extreme sports coverage.

While some travel insurance seems to have a comprehensive coverage, you have to make sure that the activity that you are doing is covered under Personal Accident or Personal Liability.

For instance, if you got the Singlife with Aviva travel insurance and decided to buy the Adventurous Water Sports rider as well, you will be covered for all the usual scuba diving (up to 40m), white water rafting, kayaking, yachting, wakeboarding etc.

You'll have to scroll to the end of your policy wording to check out the terms and conditions. Singlife with Aviva travel insurance states that it covers you for:

In other words, if you get seriously injured during any of these activities, your Singlife with Aviva travel insurance will cover emergency medical costs, your death, and any damage you caused to the properties in that accident.

However, if you were to look at Etiqa travel insurance, you'll see that the plan covers you for personal accidental death. When it comes to personal liability, some outdoor activities are excluded, such as:

These are exactly the kind of activities where you're more likely to suffer an accident. So don't forget to check the fine print!

Some activities will be covered by your travel insurance, but only if it's within a specific circumstance. Again, this is not being unrealistic. But it does mean you have to be careful that your activities don't exceed the boundaries set by your travel insurance. These are examples of some activities which aren't covered by your insurance:

So while some of these activities are covered by certain travel insurance policies, they do have limits to their coverage. Be careful to stay within the stipulated boundaries.

Some travel insurance companies require that you upgrade your travel insurance plan to include winter sports rider or outdoor adventurous activities riders. Although it might seem unfair to incur a steep increase in the premium price, do note that most of the time, this increases your coverage for other categories within the same plan as well.

How much do these winter sports and sports riders cost?

Currently, there are two travel insurance plans that require you to buy sports riders: Direct Asia travel insurance and Singlife with Aviva travel insurance. The latter costs $8.89 per week for Adventurous Water Sports rider or $8.63 per week for Winter Sports rider.

If you're a hardcore skier or diver, then this section should not be news for you. If you have your own sporting equipment that you intend to bring on the trip, you have to be aware how much your travel insurance is covering you. When your gear can cost a few hundred dollars, you'll definitely want to invest in a plan that will insure you don't lose out if your gear is stolen or damaged.

This is especially important if you're planning to go scuba diving, hiking or skydiving. Since you're most likely not going to be near any decent medical facilities should anything happen, you may need to get emergency medical evacuation.

Check to make sure your travel insurance policy covers you sufficiently for such an occasion. Where possible, choose policies that can give you at least $500,000 cover for medical evacuation, even if you end up paying a little more. Here are some that offer $500,000 or more:

ALSO READ: Travel insurance Singapore guide (2023): Must-knows for choosing the best travel insurance

This article was first published in MoneySmart.