Buying the dip: Should you invest in the stock market now?

The geopolitical war between Russia and Ukraine rages on.

And things aren’t looking too great for the stock market with the Federal Open Market Committee increasing interest rates to combat inflation in the US.

For those of us invested, you’re probably seeing a sea of red and might be panicking to sell whereas some of us see it as a great opportunity to "buy the dip".

Whether you’re the former or the latter, one question lingers in our minds in times of stock market volatility: “Should we invest now?”

With even more uncertainty looming overhead due to expected interest rate hikes, the Russian-Ukrainian war and other factors, investors must be ever-more cautious when making investment decisions.

Investors should:

Right now, the stock market has already fallen 13 per cent from previous highs in January 2022.

While no one can predict what will happen during the ongoing conflict, we can look to the past to understand the future.

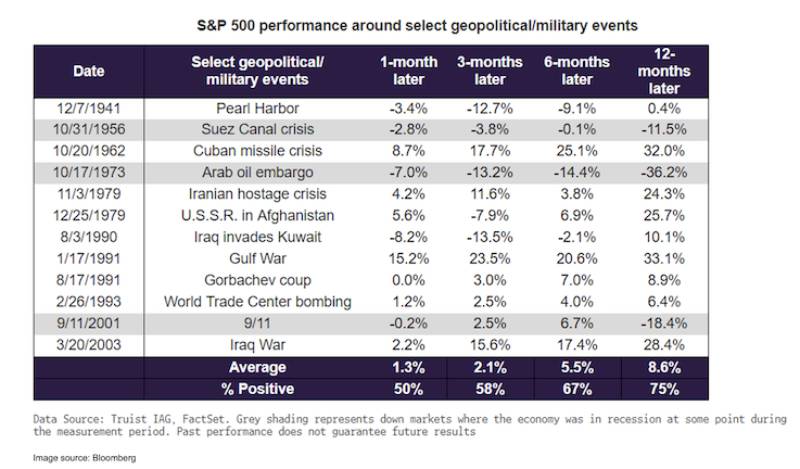

The table below tracks the Standard & Poor’s 500 (S&P500) index after major geopolitical and historical events:

As evident above, the stock market tends to bounce back with two-thirds of these events having a positive return after 12-months.

However, things are looking very different this time as there are plenty of other factors to consider, with one of the major ones being the Federal interest rate hike expected this week.

Generally, when interest rates rise, the stock market will tend to see a dip in prices as borrowing costs for both consumers and businesses will increase.

The reasons for this are two-fold:

Aside from the impacts of war and the expected interest rate hike, there are other concerns that investors are worried about such as supply chain disruption, a potential energy crisis if Russia decides to cut supplies as well as oil prices skyrocketing and signalling a recession.

Some of us might have heard of the terms "buying the dip" or "buy low sell high".

However, is it really that easy? I mean, if everyone could do it, why aren’t we all super-rich right now?

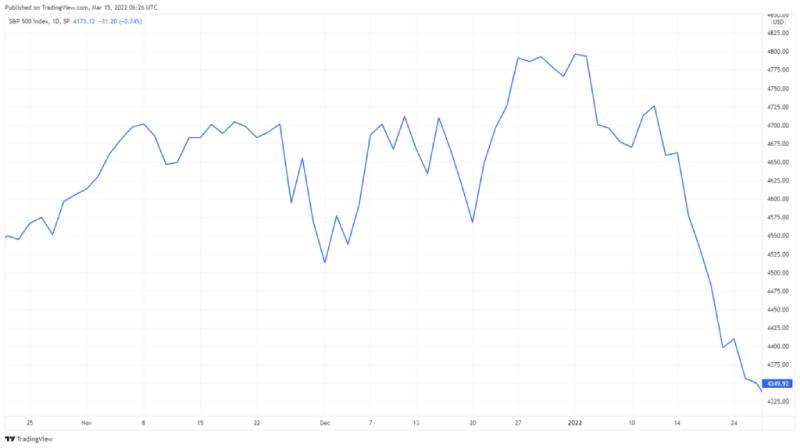

To illustrate that timing the market in order to buy a "dip" take a look at the following chart of the S&P 500:

As an investor looking to buy the "dip", Jan 24 to 26, 2022 would look like a great time to enter. However…

The market has since seen a spike before dropping even further than before to where it is today on March 14, 2022.

As you can see, timing the market is something easier said than done, and more often than not, you will not know if this is really the dip that you should invest in.

In investor terms, this is commonly referred to as the bear market trap or "catching a falling knife".

You can’t be sure if the stock you bought will continue to fall in price, causing you to suffer more losses.

So what then, should investors do when the stock market seems bearish (bleak) and volatile?

READ ALSO: Why rich, young Chinese are more likely to invest at home than their parents

With oil prices spiking, raising alarm bells for a possible recession in the US, we need to be prepared for the ripple effects we will feel at home.

With inflation reaching four per cent in Singapore and rising costs of living, there is a need to exercise prudence during these uncertain times.

Here are some quick tips on how to do so:

With lots of uncertainty looming overhead, it is a good time to reassess our investment portfolios and re-evaluate our investment strategies.

If you’re invested in the stock market but are worried and about to panic sell, don't!

So long as the companies you are invested in have strong fundamentals and you have a long-term investing horizon, such market downturns are only temporary setbacks.

Don’t believe it? Take a look at this chart:

In the long run, the stock markets have almost always recovered after major crises.

However, this chart is only valid for the overall stock market indices and does not apply to single stocks or individual sectors.

For those of us who have done our due diligence, have a strong conviction in our investments and own a portfolio of stocks with solid fundamentals; congratulations, you can sit back and take a little breather as the market will eventually recover.

On the other hand, those of us who want to invest and buy the dip, stick to high-quality stocks or other investment vehicles.

Are you a long-term investor that practices DCA? If you are, stay the course and continue buying in.

In other words, the current market downturn is a great opportunity to buy high-quality stocks at a discount.

Disclaimer: All content is displayed for general information purposes only and does not constitute professional financial advice.

READ ALSO: How I earned Bitcoin from MapleStory in 2011: The rise of crypto and the metaverse

This article was first published in Seedly.