Disney's future, a hot topic among Hollywood elite

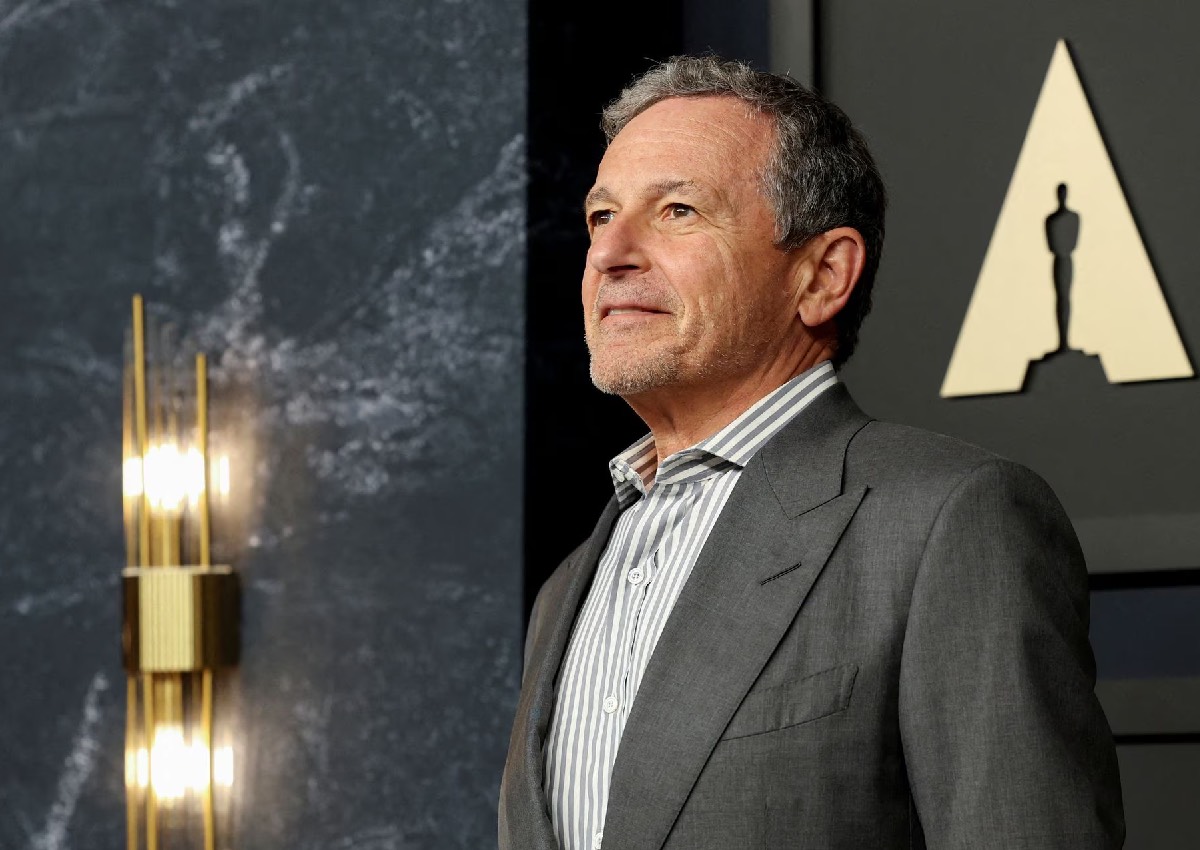

Hollywood's favourite parlor game of the week: What will Bob Iger do next?

From Culver City to New York City, the US media and entertainment industry's powerbrokers are spinning scenarios about the future and the possible breakup of the industry's most powerful conglomerate.

Walt Disney chief executive Iger, who returned to the company in November for a second stint, triggered the vigorous industry chatter in mid-July when he suggested during a CNBC interview that the company's television businesses, including its stations and cable channels, "may not be core to Disney."

His remarks spurred a frenzy of activity among bankers and private equity players, who began evaluating whether they should "make a move," one banker, speaking on condition of anonymity, told Reuters.

"He's signalling to investors," said the banker. "It starts people thinking."

Iger fuelled the conjecture last week during Disney's third-quarter earnings call with investors, when he said the company is mulling strategic partnerships for its marquee sports brand, ESPN, and has received "notable interest," though Disney planned to retain control.

The three businesses that will drive the greatest growth over the next five years, he said, are the company's film studios, theme parks and streaming video.

One top media executive envisioned Iger spinning off the ABC broadcast network, local TV stations and Disney's cable networks such as Disney Channel or FX as a separate company, loading it with an appropriate level of debt.

Another veteran media executive predicted Disney would spin off the television asset to its shareholders as a separate, publicly traded company by 2024, with private equity potentially playing a role.

A fourth media executive who has run traditional and digital media companies said Disney may need to attract outside investors in ESPN so that it can competitively bid for increasingly expensive sports media rights, such as for NBA games, which expire after the 2024-25 season.

That would potentially free up cash for Disney to acquire NBCUniversal's stake in Hulu, assuming full ownership of the streaming service next year. Under an agreement reached in 2019, NBCU parent Comcast can require Disney to buy the Hulu stake, or Disney can require NBCUniversal to sell it, as early as January 2024, at a market value of at least US$5.8 billion (S$7.9 billion).

Disney declined to comment.

The fourth executive, along with other senior media figures who spoke with Reuters, said Iger is likely crafting options, retaining ownership of ESPN, with the opportunity to shed it in the future to position Disney as a more attractive acquisition target.

The executive likened the strategy to one executed by former Time Warner CEO Jeff Bewkes, who sold off parts of the media conglomerate's business before selling its core film and television unit to AT&T in an $85.4 billion deal that closed in 2018, said the veteran executive.

"You sell the parts, then sell what's left," said the veteran. "That's the full-Bewkes."

That may well be Iger's end-game, these executives speculated. To make it attractive for the only likely buyers big enough to digest a Disney - Apple or Alphabet's Google - Iger would need to prune Disney down to just the parts that preserve its global intellectual property portfolio, while separating out its cash-generating legacy businesses like TV.

[[nid:642392]]

"There's no way a FAANG company is going to buy his company when he has all these cable channels, a broadcast network and a cable sports network," said the executive, using an acronym for the five major US technology companies, Facebook (now Meta), Apple, Amazon, Netflix and Google. "It's not the business they're in, and it's unlikely the government would ever allow it."

Amazon, fresh off its $8.5 billion acquisition of MGM last year, would not likely be interested in such a deal, said one source familiar with the matter. And Facebook is not viewed as interested in traditional media assets.

Needham and Co analyst Laura Martin floated the investor appeal of Apple acquiring Disney, writing in March that the combination of great content and strong distribution would create value. This idea continues to circulate in Hollywood.

"Obviously, anyone who wants to speculate about these things would have to immediately consider the global regulatory environment," Iger said, when asked about the possibility during the investor call. "I'll say no more than that. It's just - it's not something that we obsess about."

In that, he may be alone.

ALSO READ: Disney extends CEO Bob Iger's contract through 2026