Here's how to maximise your child's Child Development Account (CDA)

Having children’s never easy, especially with Singapore’s high cost of living.

To mitigate the cost, the government rolled out the Baby Bonus scheme, where cash rewards are given to encourage Singaporeans to have more children.

With the Baby Bonus, parents will need a Child Development Account (CDA) to receive grants and cash rewards from the government.

So how does the CDA work? Is there a way to make the most of it?

Here’s a quick guide on how to maximise your child’s CDA account and to get the most out of your Baby Bonus rewards!

Want to discuss parenthood hacks to save money? You can do so at the Seedly community!

The CDA is a special savings account for children that can be opened with POSB/DBS, OCBC or UOB banks , to help build up the savings that can be spent on approved uses.

The CDA account comes under the Baby Bonus scheme, which is part of the Marriage and Parenthood Package.

Under this scheme, there’s a Baby Bonus Cash Gift component and a Baby Bonus CDA component.

When you open a CDA account for your child, you will receive the following benefits:

You will be getting $3,000 that will be deposited into your child’s CDA under the government’s CDA First Step Grant.

For those who didn’t know, the government also matches every dollar you save into your child’s CDA account.

Meaning if you deposit $3,000 into your child’s CDA account, the government will deposit $3,000 into the same account as well!

There is, however a cap of $3,000 (1st child), $6,000 (2nd child) $9,000 (3rd, 4th child), and $15,000 (5th child onwards) on the dollar-for-dollar matching scheme.

As announced end-February 2021, the dollar-for-dollar matching for the second child has been increased to $6,000 from $3,000 previously.

So, as long as your child is

1) a Singaporean and

2) whose date of birth or estimated date of delivery (EDD), is on or after Jan 1, 2021, he/she will be eligible for the higher matching of $6,000.

As an overview, here’s a quick look at how much money you can get from the government under the Baby Bonus scheme:

| Baby Bonus | Payout (1st Child) | Payout (2nd Child) | Payout (3rd, 4th Child) | Payout (5th Child Onwards) |

|---|---|---|---|---|

| Cash Gift | $8,000 | $8,000 | $10,000 | $10,000 |

| First Step Grant (CDA) | $3,000 | $3,000 | $3,000 | $3,000 |

| Dollar-for-Dollar Matching (CDA) | $3,000 | $6,000 (enhanced from 2021) |

$9,000 | $15,000 |

| Total | $14,000 | $17,000 | $22,000 | $28,000 |

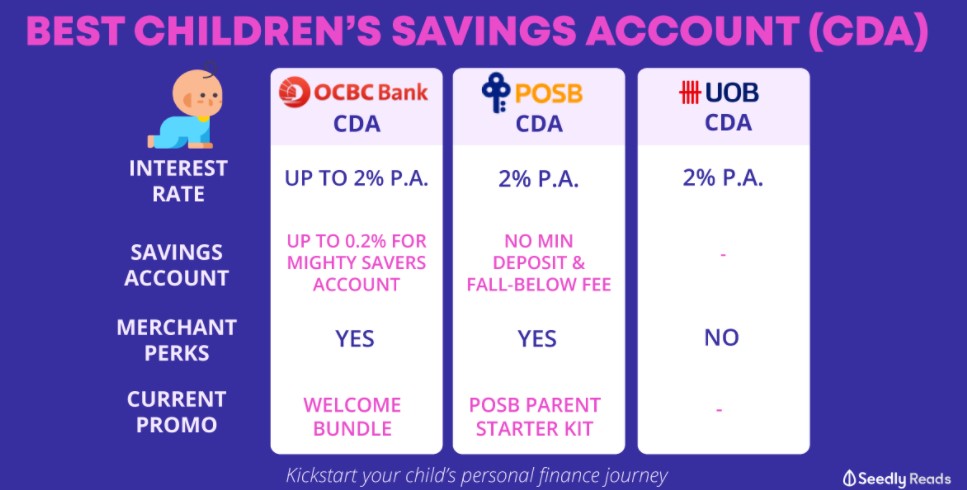

There are a few banks that you can choose to open a CDA account for your child.

It is wise to compare these different bank accounts so that you will choose one that reaps the highest interest rates for your child.

Here we did a quick comparison of POSB, OCBC and UOB’s CDA accounts :

As mentioned above, the government does dollar-for-dollar matching when you top up your child’s CDA account. Here’s the maximum you can top up to maximise this benefit:

| Maximum amount you can deposit to receive dollar-for-dollar matching | Dollar-for-follar matching by government | Total (Excluding cash gift and CDA first step) | |

|---|---|---|---|

| 1st Child | $3,000 | $3,000 | $6,000 |

| 2nd Child | $6,000 | $6,000 | $12,000 |

| 3rd, 4th Child | $9,000 | $9,000 | $18,000 |

| 5th Child Onwards | $15,000 | $15,000 | $30,000 |

An integrated shield plan is an add on to your MediShield Life insurance plan. It offers additional benefits from private insurers that can help cover large hospital bills and selected costly outpatient treatment.

Having your child covered at a young age is beneficial, as he/she will not be excluded from any pre-existing conditions. With the dollar-for-dollar matching, you are essentially only paying for half the premiums!

Of course, your child will also receive his/her MediSave account with $4,000 given by the government.

While you can use your child’s MediSave pay for the integrated shield plan, it is much better to use his/her CDA account, as keeping your money in your MediSave account reaps you a higher interest rate (5 per cent) as compared to the CDA account (2 per cent) .

If you decide to max out the dollar-to-dollar matching scheme, you will be having $9,000 in your child’s CDA (assuming this is your 1st child).

Your child’s CDA can only be used in a list of approved expenses , some of which include:

When your child turns 13, whatever money that was not used from his/her CDA account will be automatically transferred to their Post-Secondary Education Account !

This account can be used for their post-secondary related school activities.

This article was first published in Seedly.