Here's how much you need to earn to afford a condo

Looking to buy private property but not sure how much you can afford?

When it comes to buying property, it pays to be mindful when working out how much you can borrow, so you don't end up with a very expensive mistake.

Eligibility is not to be confused with affordability. In the property-buying context, it is important to note that one's eligibility to take up a home loan is not the same as one's ability to afford a property.

How do you afford a condo in Singapore?

Some financial experts say that your monthly mortgage repayment, including principal and interest, should not exceed 30 per cent of your gross monthly income.

This is the same as the Mortgage Servicing Ratio (MSR) for HDB flats and new ECs. Others say that such requirements are too stringent.

While opinions on what constitutes a golden mortgage-to-income ratio may differ, what's important to note is that financial sustainability should always be a key focus when making big-ticket purchases like property.

This is so you don't end up starved of cash for your other goals (or having to eat instant noodle and bread every day).

To make life easier for property seekers in Singapore, we've crunched the numbers to provide the approximate income that you need to be earning to afford a condo.

This will depend on the type of condo you're buying (new condos are generally more expensive) and its location (homes in the Core Central Region (CCR) are more costly).

These estimates are made based on the ability to service mortgage repayments with the following assumptions in mind:

For this article, we're looking at two-bedroom condo units. Average prices are derived from 99.co's Researcher, based on sales transactions that occurred in Q4 of 2022.

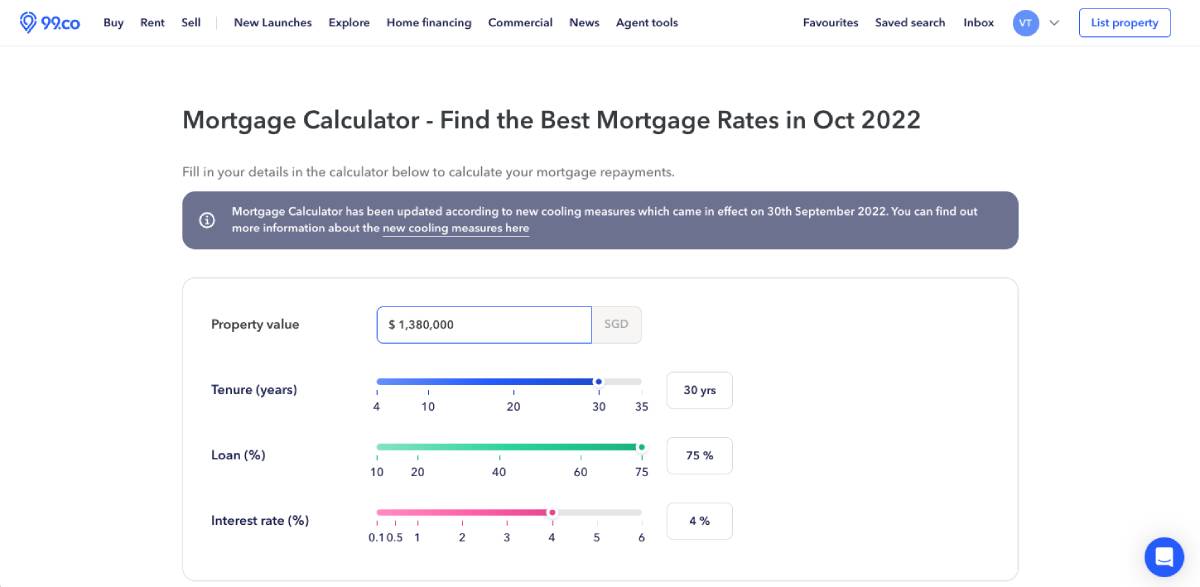

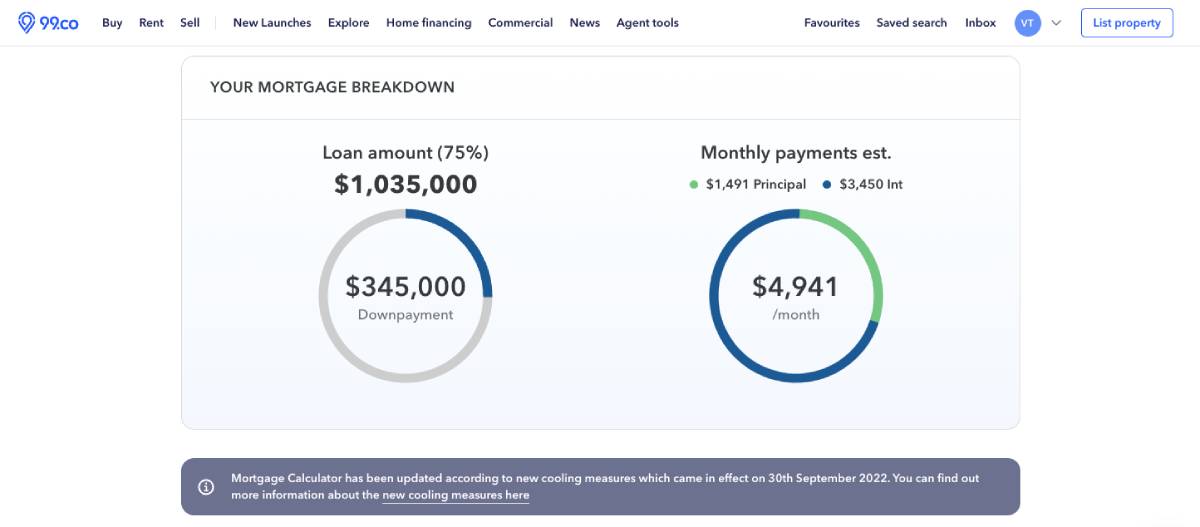

We also used 99.co's mortgage calculator to calculate estimated monthly mortgage repayments.

| Market segment | Average price | Loan amount (75%) | Downpayment (25%) | Estimated monthly instalment (with 4% interest rate) | Estimated monthly household income |

|---|---|---|---|---|---|

| CCR | $2.22m | $1.67m | $555,000 | $7,948 | $14,451 |

| RCR | $1.75m | $1.31m | $438,000 | $6,266 | $11,393 |

| OCR | $1.38m | $1.04m | $345,000 | $4,941 | $8,984 |

*Do note that these estimates are based on the average price, which may be higher or lower than the actual price. We recommend you to calculate with 99.co's mortgage calculator based on the actual price to determine if it's within your means.

If you meet the minimum income requirements, here are some new launch condos with two-bedder units that hover quite comfortably within the average price ranges in the respective market segments:

Core Central Region (CCR):

Pullman Residences Newton

Leedon Green

Rest of Central Region (RCR):

The Landmark

Myra

Outside Central Region (OCR):

Urban Treasures

Bartley Vue

Despite two rounds of cooling measures in December 2021 and September 2022, prices of condos have increased by 8.1 per cent in 2022.

When broken down by market segments, RCR condos saw the highest price increase at 9.7 per cent, followed by OCR condos at 9.3 per cent and CCR condos at 4.8 per cent.

If you're looking for affordable condos, you may want to consider resale condos.

| Market segment | Average price | Loan amount (75%) | Downpayment (25%) | Estimated monthly instalment (with 4% interest rate) | Estimated monthly household income |

|---|---|---|---|---|---|

| CCR | $2.24m | $1.68m | $560,000 | $8,020 | $14,582 |

| RCR | $1.5m | $1.13m | $375,000 | $5,370 | $9,764 |

| OCR | $1.12m | $840,000 | $280,000 | $4,010 | $7,291 |

*Do note that these estimates are based on the average price, which may be higher or lower than the actual price. We recommend you to calculate with 99.co's mortgage calculator based on the actual price to determine if it's within your means.

If you're looking to buy resale private property, here are some projects with two-bedder units that nestle comfortable within the average price ranges in the respective market segments:

CCR:

D’leedon

26 Newton

RCR:

Queen’s Peak

Sky Green

OCR:

The Estuary

Skies Miltonia

Now that you're caught up with how much both new and resale condos cost in Singapore, you might be asking the million-dollar question (literally): Can I really afford to buy a condo?

[[nid:617026]]

We'll look at the income numbers published by the Ministry of Manpower's Research and Statistics Department.

According to them, the median gross monthly income from work (this includes employer CPF contributions) of full-time employed residents in 2022 is $5,070 an 8.33 per cent increase from the previous year.

For the uninitiated, the median takes the income in the middle, so half of the workers earn less than the numbers below, and half earn more.

If you're a dual-income couple looking at buying a condo, you'll have twice the earning power to finance it. With your combined income, condos in the OCR and RCR will fall within your monthly affordability range.

After being in the workforce and saving up for a few years, you and your partner will probably be able to afford the hefty downpayment and sign that cheque to buy your dream condo.

ALSO READ: Should you be upgrading to a condo in 2023?