Here's why these condos lost money despite being bought at a property market low

This week, we looked at some properties that saw losing transactions, despite being bought at an "ideal" time — during 2003 to 2005, or 2015 to 2016 (all low points in the property market).

And while many of the reasons could be related to seller circumstances (see here for the previous piece), there's naturally some curiosity over the condos involved. Here, we examine the projects that saw quite a number of losing transactions, despite being bought at a low.

| Project | Average of per cent | Volume |

| REGENT GROVE | -20.6per cent | 5 |

| YISHUN SAPPHIRE | -11.3per cent | 7 |

| COMPASS HEIGHTS | -10.6per cent | 5 |

| THE SAIL @ MARINA BAY | -9.3per cent | 6 |

| STARVILLE | -8.1per cent | 13 |

| THE MADEIRA | -7.6per cent | 6 |

| MELVILLE PARK | -7.2per cent | 8 |

| THE TREVOSE | -6.8per cent | 6 |

| HILLVIEW REGENCY | -6.7per cent | 5 |

| THE LINEAR | -6.1per cent | 5 |

| HILLINGTON GREEN | -5.7per cent | 5 |

| LAKEHOLMZ | -5.2per cent | 7 |

| AMARYLLIS VILLE | -5.0per cent | 7 |

| THE GARDENS AT BISHAN | -4.6per cent | 11 |

| THE GLACIER | -4.0per cent | 5 |

| SAVANNAH CONDOPARK | -3.8per cent | 8 |

| RIVERVALE CREST | -3.4per cent | 9 |

| GRANDEUR 8 | -2.3per cent | 14 |

Source: URA

| Project | Average of per cent | Volume |

| OUE TWIN PEAKS | -11.5per cent | 17 |

| HEDGES PARK CONDOMINIUM | -8.1per cent | 7 |

| NINE RESIDENCES | -6.7per cent | 5 |

| PARC ROSEWOOD | -6.4per cent | 5 |

| TRILIVE | -6.2per cent | 7 |

| # 1 SUITES | -5.0per cent | 5 |

| KINGSFORD HILLVIEW PEAK | -3.5per cent | 18 |

| THE GLADES | -3.4per cent | 12 |

| ICON | -2.1per cent | 5 |

Source: URA

An important note:

As we've pointed out in the previous article, the losing transactions are not always due to problems with the project.

The losses may be due to government policy measures, urgent sales, or simple market fluctuations. The following projects may perform better in other circumstances.

Location: Hillview Rise (District 23)

Developer: Kingsford Development Pte Ltd

Lease: 99-years

Completion: 2017

Number of units: 512

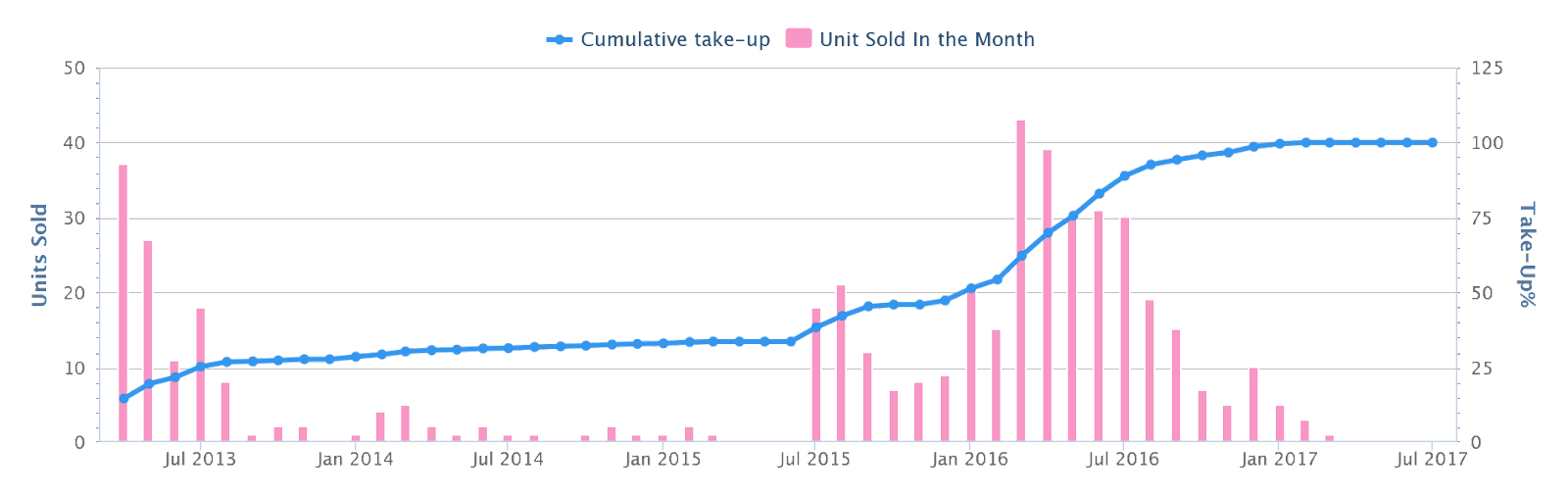

The earliest buyers are probably unhappy about what happened here. After a relatively good launch, sales at Hillview Peak stalled out. The developer then offered significant discounts, which caused sales to finally pick up:

This is the volume of developer sales from Square Foot Research. Notice the long period of muted sales, before discounts kicked in and volumes rose again. This can be explained by the developer pricing:

Median prices were around $1,312 psf at launch, but the poor sales meant that Kingsford Development had to push out discounts, with a new selling price of around $1,200 psf.

Now all of this explains why the 2015 to 2016 buyers were able to snag units at a lower price. However, the very same reason for those low prices may also have worked against them. Hillview Peak's transaction history doesn't look too great, with 35 profitable to 30 losing transactions.

One realtor raised the issue that nearby condos, such as Hillview Park, Glendale Park, and Hillview Heights, are all freehold compared to Hillview Peak being leasehold.

And as some of you may well know, this was one of the infamous developments for which the developer had received stop-work orders and fines from the government.

Besides, the poor construction quality in general continued to be reported even after it was completed.

As to the project itself, the location is actually quite good. The condo has good greenery all around, with Bukit Gombak Park to the west, and Bukit Timah Nature Reserve to the east. HillV2 is also just across the road from this condo; it's not the biggest mall, but it does provide day-to-day amenities like a Cold Storage and a Guardian.

There's also MRT access (Hillview MRT on the DTL), which is about a 10-minute walk out to Upper Bukit Timah Road.

Location: Leonie Hill Road (District 9)

Developer: Cove Development Pte Ltd

Lease: 99-years

Completion: 2015

Number of units: 462

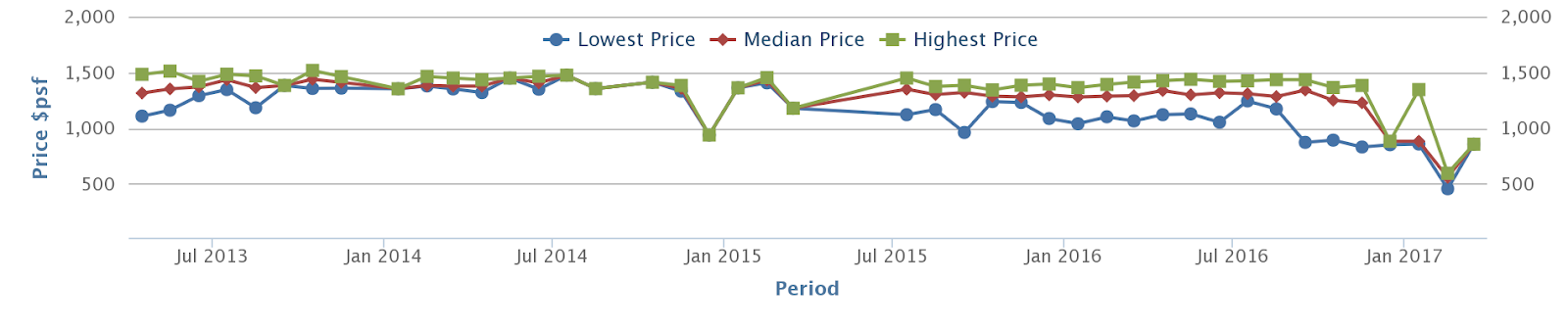

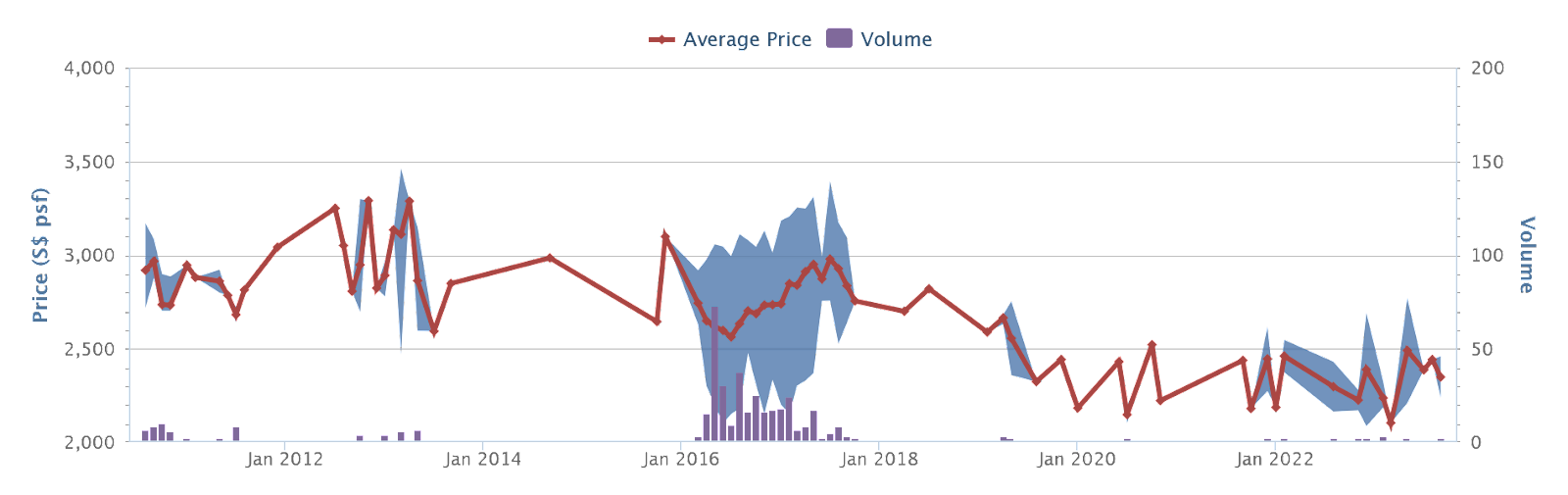

OUE Twin Peaks saw price drops after initial sales. Units began to move only after a 15 per cent discount in later phases, which explains how the 2015 - 2016 buyers managed to buy at the bottom. You can see this in its price movement on Square Foot Research:

That said, most transactions at OUE Twin Peaks have been losing transactions, even today. There are only two profitable instances and 46 recorded losses.

We've written about it here, but a combination of being one of the few leasehold condos in a freehold area, the high prices during its launch, and well, its current age right now does work against it.

As newer and more luxurious properties sprout up in the area (Boulevard 88 and Park Nova are nearby), it makes it harder to stand out to the higher-end clientele.

That said, the location is fantastic, as you'd expect from a condo along Grange Road. Somerset MRT (NSL) is even within walking distance, along with the slew of malls like Orchard Central, 313, and so forth. The issue is simply that many other options exist nearby, which are freehold and equally luxurious (if not more so).

Location: Ang Mo Kio Central 3 (District 20)

Developer: AMK Properties Pte Ltd

Lease: 99-years

Completion: 2005

Number of units: 579

Grandeur 8 is a condo with a good track record. It's only had 24 unprofitable transactions in its history, and 550 profitable ones.

If there is a drawback, it's that Grandeur 8 requires a bus connection to get to Ang Mo Kio MRT (NSL, CRL). This is about a 650-metre walk to Block 504, where services like 265 can get you to the train.

Nearby amenities are good, though not fantastic. The small Djitsun mall is nearby, just one avenue away (Ang Mo Kio Avenue 2).

There's a cinema here and some eateries, though not much else. Broadway Plaza, also near Djitsun Mall, adds some retail options. Alternatively, the local market and food centre are also within this cluster.

This is a condo for those who want a quiet enclave, away from the traffic and crowds. It is within an HDB area though, so those who insist on low-density housing may dislike it.

| SOLD ON |

ADDRESS | UNIT AREA (SQFT) |

SALE PRICE (S$ PSF) |

BOUGHT ON |

PURCHASE PRICE (S$ PSF) |

PROFIT (S$) |

HOLDING PERIOD (DAYS) |

ANNUALISED (per cent) |

| 14 Feb 2007 | 14 ANG MO KIO CENTRAL 3 #19-XX | 1,722 | 381 | 2 Sep 2003 | 400 | -33,000 | 1,261 | -1.4 |

| 28 Nov 2006 | 6 ANG MO KIO CENTRAL 3 #11-XX | 1,421 | 492 | 28 Jul 2003 | 514 | -31,611 | 1,219 | -1.3 |

| 9 Oct 2006 | 16 ANG MO KIO CENTRAL 3 #18-XX | 1,227 | 501 | 15 Dec 2004 | 526 | -30,000 | 663 | -2.6 |

| 4 Mar 2006 | 6 ANG MO KIO CENTRAL 3 #02-XX | 1,195 | 444 | 26 Sep 2003 | 448 | -5,000 | 890 | -0.4 |

| 1 Feb 2006 | 8 ANG MO KIO CENTRAL 3 #14-XX | 1,421 | 512 | 1 Aug 2003 | 529 | -23,520 | 915 | -1.3 |

| 5 Dec 2005 | 12 ANG MO KIO CENTRAL 3 #03-XX | 1,281 | 454 | 30 Jul 2003 | 455 | -1,000 | 859 | -0.1 |

| 14 Nov 2005 | 2 ANG MO KIO CENTRAL 3 #10-XX | 1,195 | 485 | 5 Aug 2003 | 486 | -800 | 832 | -0.1 |

| 7 Oct 2005 | 12 ANG MO KIO CENTRAL 3 #02-XX | 1,227 | 440 | 4 Aug 2003 | 458 | -22,000 | 795 | -1.8 |

| 12 Sep 2005 | 14 ANG MO KIO CENTRAL 3 #15-XX | 1,227 | 509 | 25 Jul 2003 | 513 | -4,000 | 780 | -0.3 |

| 22 Aug 2005 | 2 ANG MO KIO CENTRAL 3 #13-XX | 1,195 | 481 | 8 Jul 2003 | 493 | -14,600 | 776 | -1.2 |

| 19 Aug 2005 | 14 ANG MO KIO CENTRAL 3 #06-XX | 1,227 | 487 | 29 Jul 2003 | 491 | -4,000 | 752 | -0.3 |

| 1 Jul 2005 | 12 ANG MO KIO CENTRAL 3 #09-XX | 1,227 | 468 | 28 Jul 2003 | 475 | -9,000 | 704 | -0.8 |

| 22 Apr 2005 | 10 ANG MO KIO CENTRAL 3 #16-XX | 1,119 | 505 | 28 Aug 2003 | 517 | -13,730 | 603 | -1.4 |

| 7 Jul 2004 | 12 ANG MO KIO CENTRAL 3 #09-XX | 1,227 | 473 | 28 Jul 2003 | 484 | -14,000 | 345 | -2.5 |

Source: Squarefoot Research

The losses from here are likely due to market timing, as most transactions have been profitable since.

A deeper look into the loss-making transactions shows that the losses incurred were all bought at a market low but sold just not long after in 2005/06 before the market really started to peak in 2007/08. In any case, these losses sustained were also minimal, with the bigger losses just above $30,000.

Location: Lengkong Tiga (District 14)

Developer: Pencroft Investments Pte Ltd

Lease: Freehold

Completion: 2006

Number of units: 250

This is a very unique condo: it's the only one in Singapore with a sizeable observatory.

There's even a working telescope in there for stargazing activities (we're told it's a Meade LX200, which is apparently a really big deal, but we don't know enough about stargazing!).

The entire condo is also themed around the concept of stars and constellations, in its surrounding sculptures and design.

Due to the theme, it was necessary that Starville be in a low-density location (tall buildings that are all lit up tend to interfere with stargazing). Most of the surrounding homes here are landed properties, which is a big plus to those who like privacy.

The downside is typical of being in a landed area: public transport access isn't very good, and you'll need to travel out for most amenities.

This isn't a drawback to most buyers though, as the entire point of these smaller, exclusive projects is to be away from the crowd. Starville also has a good track record. With just 250 units, this project has seen 220 profitable transactions, and only 15 losses.

As with Grandeur 8, the losses we found were likely due to them being sold just 2/3 years later in 2005/06.

Just look at the difference the holding period makes:

| SOLD ON |

ADDRESS | UNIT AREA (SQFT) |

SALE PRICE (S$ PSF) |

BOUGHT ON |

PURCHASE PRICE (S$ PSF) |

PROFIT (S$) |

HOLDING PERIOD (DAYS) |

ANNUALISED (per cent) |

| 26 Apr 2007 | 60 LENGKONG TIGA #09-XX | 1,270 | 598 | 18 Jul 2003 | 606 | -10,000 | 1,378 | -0.3 |

Source: Squarefoot Research

Here’s a 1,270 sq ft unit bought on July 18, 2003 and sold four years later at a slight $10,000 loss.

| SOLD ON |

ADDRESS | UNIT AREA (SQFT) |

SALE PRICE (S$ PSF) |

BOUGHT ON |

PURCHASE PRICE (S$ PSF) |

PROFIT (S$) |

HOLDING PERIOD (DAYS) |

ANNUALISED (per cent) |

| 18 Oct 2021 | 60 LENGKONG TIGA #03-04 | 1,755 | 916 | 10 Jul 2003 | 388 | 926,668 | 6,675 | 4.8 |

Source: Squarefoot Research

And here’s one that was bought just eight days earlier on July 10, 2003, but sold 18 years later at a profit of close to a million.

Location: Bedok Rise (District 16)

Developer: Sherwood Development Pte Ltd

Lease: 99-years

Completion: 2016

Number of units: 726

The recent Sceneca Residence may have stolen the spotlight from The Glades, which was previously also known for being next to Tanah Merah MRT station (EWL).

This is a very significant stop, as it's the interchange where the train goes to Changi Airport. As such, The Glades often appeals to aviation industry workers, be it as a home or rental unit.

That said, Seneca Residence could also end up being a boon to The Glades. Seneca is mixed-use and will introduce commercial elements, including a supermarket.

This will resolve a longstanding problem in the area: a lack of nearby amenities. You may expect the new launch to have a knock-on effect, at least slightly pushing up the prices of resale neighbours like The Glades.

The low initial prices of The Glades weren't due to issues with the condo, but timing. For starters, The Glades launched just after the seventh month and saw weak sales (we have no idea why the developers chose that timing).

Coupled with being launched in a late-bull market, the developer eventually discounted prices by $8,000 to $38,000, thus allowing some buyers to get a good deal.

The Glades is doing reasonably well now, with 128 profitable transactions and 34 losing transactions to date.

ALSO READ: 5 spacious HDB flats above 1,300 sq ft but under $590k

This article was first published in Stackedhomes.