How to invest in property: 5 contrarian ideas to get you started

“When everyone else is buying you should be selling, and when everyone is selling you should be buying.”

That seems to be the most common perception of what “contrarian” investing means.

Over the years, this term seems to gain in popularity as we see it been bandied around by entrepreneurs like Elon Musk or Peter Thiel.

There is value to having a certain mindset that is geared towards being diametrically opposite of the typical thoughts that our biasness falls into.

But as we go through the standardized Singapore education system, the brain is used to conforming than being contrarian.

Like a muscle, it needs to be stretched and strengthened first.

Here I share 5 different ways to get started on having a contrarian investment mindset.

Aidah shared about how humility can be the most understated investment strategy. She is very right on this.

My best clients who are successful professionals in their own industry – tend to defer to my expertise regularly in their property investment choices.

They know themselves and their subject matter very well. Doctors and surgeons are very good at saving the lives of their patients.

But they are also able to recognise their own limited knowledge in property investment.

“I don’t know” is not a sign that you lack confidence.

Instead, it is an indication that you are open to better solutions or suggestions.

In fact, consistently admitting the phrase, “I don’t know” gives you a sense of security and yes, power.

It means you will be wrong less often – allowing you to live an honest life.

In the book The Intelligence Trap – David Robson presents the argument that intelligent and educated people are less likely to learn from their mistakes, for instance, or take advice from others.

And when they do err, they are better able to build elaborate arguments to justify their reasoning, meaning that they become more and more dogmatic in their views.

Worse still, they appear to have a bigger “bias blind spot,” meaning they are less able to recognise the holes in their logic.

This is where you need to avoid the trap of confirmation bias by finding competing opinions.

If you hear a particular development is a great investment, find another viewpoint that says that otherwise.

At Stacked Homes – our fiercely independent editorial team means they present their opinions without the coloured lens of commission rates.

They know how important the right property choice is so they take the time to highlight the various pros and cons in great detail to help you in your decision-making process.

Nassim Taleb is a well-known contrarian investor.

In 2020, a fund that he advised has a YTD returns of 4,144 per cent as it capitalized on pandemic fears.

He is well-known for introducing the concept of antifragility.

If you drop a glass cup on the floor, it will smash, representing fragility.

If you drop a stone, despite the fall, it continues entire, firm, representing resilience.

And if you cut off a Hydra head, two are born in place, representing antifragility. With more adversity, the response is to become stronger.

The Antifragile concept explains that some form of randomness and variance make things less fragile.

Some stress is productive; some physical work is good for the bones; some fasting is good for the immune system etc.

On the information and knowledge level, we can apply the concept of antifragility by constantly exposing our ideas, beliefs, investment thesis to a certain level of contradictory information – in order to make them less fragile.

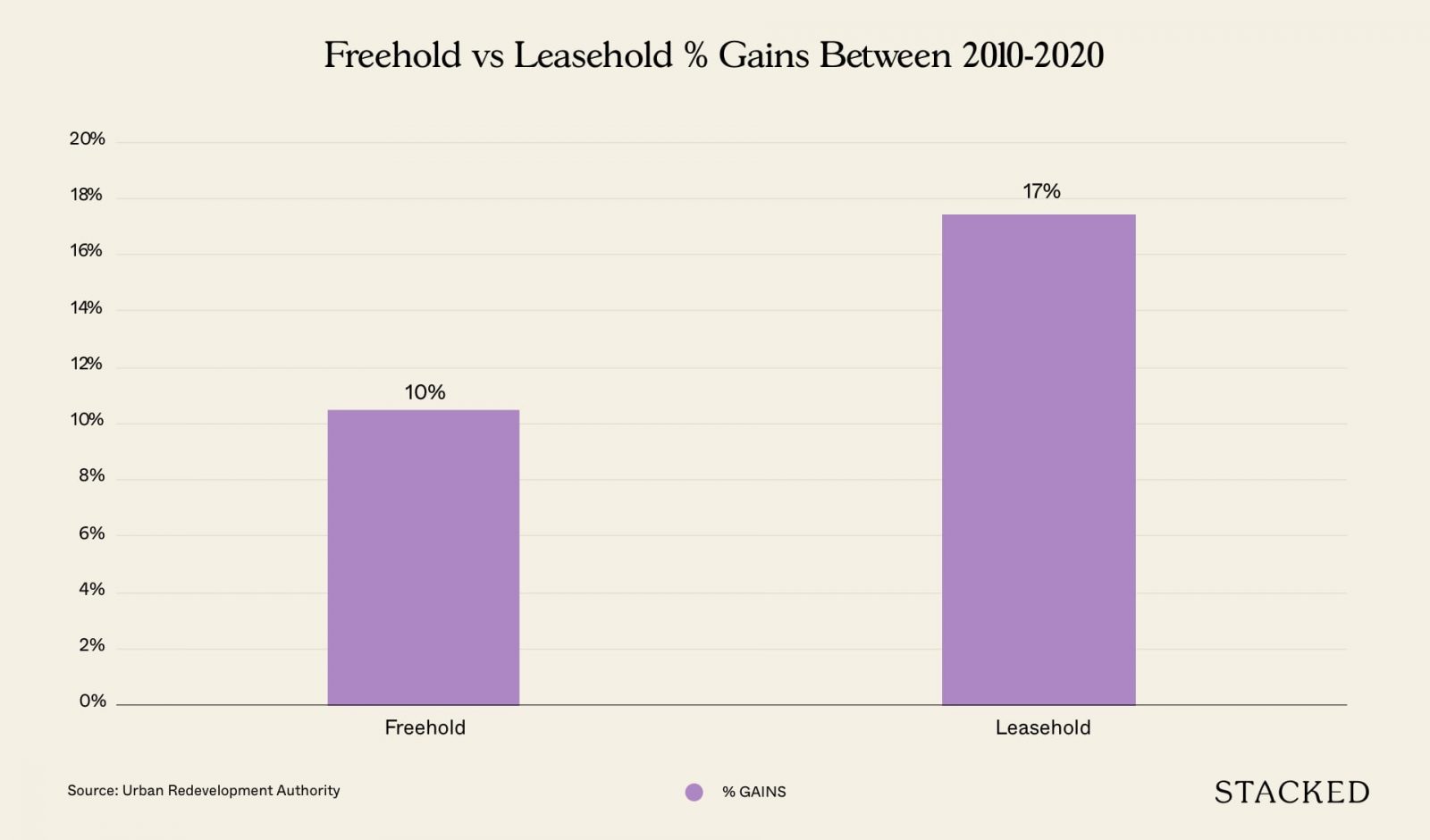

For example – there is a strong persistent investment belief that freehold properties make the best investment choices.

But what if I were to show you data that over the same period that 99-year LH properties actually outperformed freehold properties?

Okay the argument frankly isn’t as straightforward (for more on that subject read here).

But being aware of such information will definitely make you think twice about your beliefs on the infallibility of freehold properties – guiding you better in your decision-making process.

In an uncertain world, understanding the concept of Antifragility will help you create a portfolio that is resistant to vulnerabilities like sustained volatility and sharp setbacks.

In Singapore, we introduced the concept of borrowing from our retirement monies to pay for our monthly mortgage. There is a cost to this borrowing and this is where the term CPF accrued interest is born.

In most parts of the world – bigger places than Singapore – retirement monies are considered untouchable and majority do not allow withdrawals for housing payments.

In Malaysia, 22 per cent of their salary is contributed to their EPF. And only 30 per cent of the 22 per cent is allowed to be used for housing. This means a maximum of 6.6 per cent of their income can be used for the monthly mortgage. (0.3 * 22 per cent = 6.6 per cent)

In Singapore, 37 per cent of our salaries is contributed to our CPF accounts. And 21 per cent is channelled to CPF OA, 7 per cent to SA and 9 per cent to Medisave.

This means we are allowed to use up to 21 per cent of our income on our home mortgage – as long as we are below 45 years old.

So what does it mean when we turn 46 years old?

Too late to participate as a property investor?

The strong culture of home ownership in Singapore is perhaps one of the reason why we are allowed to use this much of our income on our home.

It also explains why there is strong love affair for the Singapore property market. This is where a significant portion of our retirement monies are parked in.

In other countries – a house is a home. In Singapore, your house is likely to be an investment vehicle as well.

Hence, it is so important that you pay attention closely to the details and how unusual it is – so you can make this interesting exceptionalism of the Singapore housing system work for you.

It’s uncanny how often people feel most strongly that stocks are going to go up or the economy is going to improve – and then just the opposite occurs instead.

The problem isn’t that investors and their advisors are chronically stupid or unperceptive. It’s that by the time the signal is received, the message may already have changed.

When enough positive general financial news filters down so that the majority of investors feel truly confident in the short-term prospects, that is when the economy will probably start to get hammered.

It is similar to how people behave during property launches when the market was soft.

Back in March 2019 – the Florence Residences could only sell 54 units during its opening launch.

No one was really keen to buy back then when it was first launched at relatively attractive prices.

[[nid:509912]]

Why?

I remember the reluctance of buyers to commit when they see a near-empty showflat that is devoid of crowds. They ask themselves – are we in the right room?

But once a showflat is packed to the brim, irrationality and emotions takes over as the fear of missing out outweighs any intial reluctance about the property purchase.

Developers love the environment a crowded packed room will create during a sales launch and they will play it to their advantage.

(Perhaps less applicable today due to social distancing measures)

Protect yourself by going to the least crowded room.

The most successful people will be those who are able to think differently. They are the contrarians.

This 3-minute video has a strong lesson on being outstanding and contrarian (watch with sound that commentary is key).

It is very hard to be the first in anything.

It requires

To succeed as a contrarian – you must recognise what the crowd believes, have concrete justification for why the majority is wrong, and have the patience and conviction to stick with what is, by definition – an unpopular bet.

Do not confuse security with certainty.

The man who knows he will be hanged tomorrow has certainty, but not security.

His fate is not much more comfortable than that of the saver who today plans to use low-risk bonds as a vehicle for retirement saving — the certainty such a saver will achieve is the certainty of a low standard of living in old age.

You can’t think your way to success. Nor can you think your way through every problem.

You have to live with uncertainty, but you also have to experience and do the things you want to get good at.

Get yourself started and stop procrastinating.

[[nid:514298]]

What is the worst-case scenario and are you okay with it?

And if you think you are okay with it…

Is there any way to mildly experience it and deal with it so you can see what your reaction is and then improve it?

I guess it is a little bit like going for a vaccination. You will be uncomfortable at the beginning but that discomfort protects you later on.

If you are keen to explore the concept of contrarian investing through Singapore property – let me know. Wisdom is not always in the crowds.

This article was first published in Stackedhomes.