How much do you need to earn to buy a new or resale executive condo?

Thinking of upgrading from an HDB flat, but find that buying a condo is too expensive? Your best bet is to get an Executive Condo.

A hybrid of public and private housing, Executive Condominiums (EC) come with condo facilities, but are cheaper than condos as they're subsidised. Just like HDB flats, you can take CPF Housing Grants to buy a new EC.

And the best part about getting a new Executive Condo? You don't have to pay the Additional Buyer's Stamp Duty (ABSD) upfront when you're upgrading. The caveat is that you have to sell your flat within six months. After 10 years, the EC becomes fully privatised like condos, allowing you to sell it to foreigners.

On the other hand, since they're considered public housing, new ECs have a few restrictions similar to HDB flats. This includes the five-year Minimum Occupation Period (MOP), income ceiling of $16,000, and Mortgage Servicing Ratio (MSR).

MSR restricts the monthly loan amount you can take for an HDB flat or a new EC. So you can only use up to 30 per cent of your monthly income for your home loan.

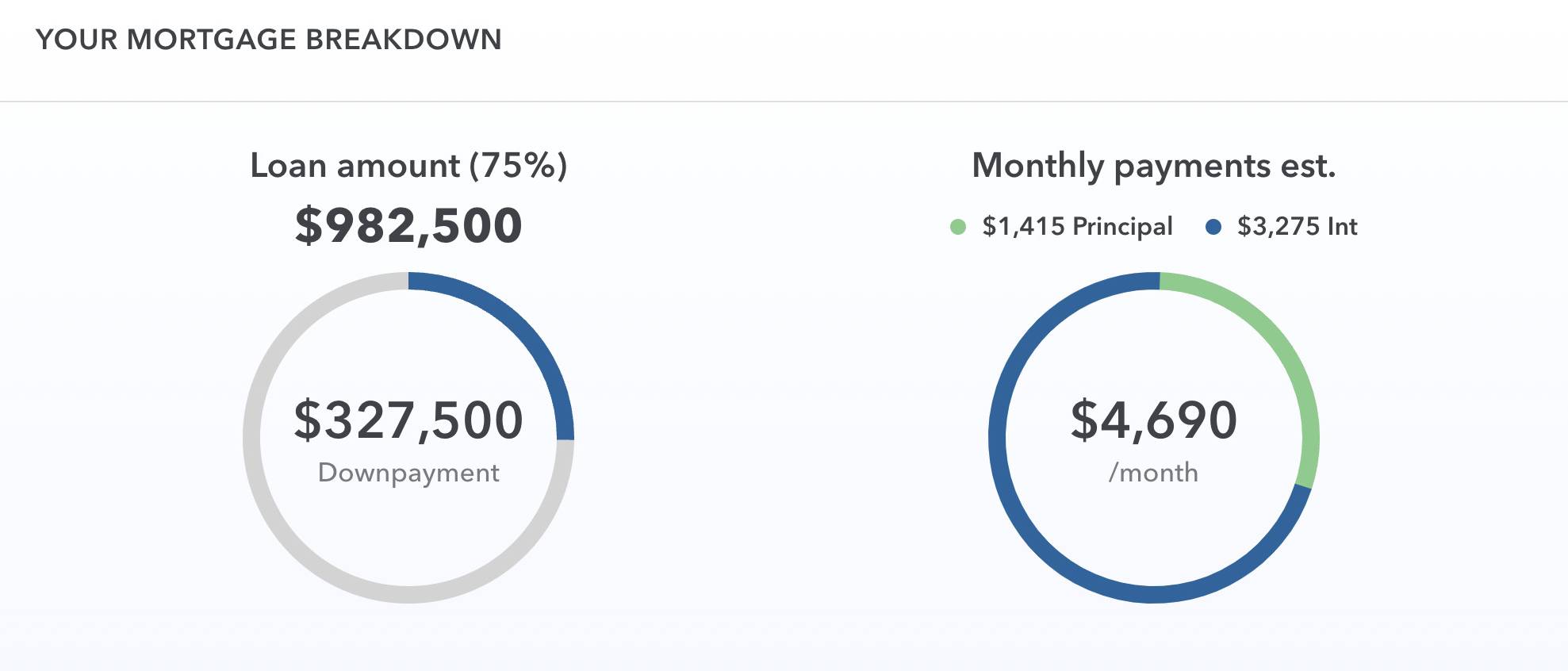

At the same time, you can only take up a bank loan to pay for an EC, meaning you can only get 75 per cent financing. So what's the minimum income to afford an EC?

You can calculate this by working backwards. Based on the price of the EC, you can find the maximum loan amount you can get. After that, calculate the monthly instalments using 99.co's mortgage calculator to derive the minimum income you need to buy an EC.

For illustration purposes, we'll use the average price of a three-bedroom EC unit, derived from three-bedroom unit transactions for new launch ECs in the first five months (up to May 21) of 2023. These ECs include:

Estimates are based on the following assumptions:

| Average price of a 3-bedroom new launch EC | Loan amount (75%) | Downpayment (25%) | Estimated monthly instalment (with 4% interest rate) | Estimated monthly household income to meet 30% MSR |

| S$1.31 million* | S$982,500 | S$327,500 | S$4,690 | S$15,633 |

*based on 99.co's Researcher.

Disclaimer: Do note that these estimations are based on the average price, which may be higher or lower than the actual price of the EC. We recommend that you calculate based on the actual price to determine if it's within your means.

We consider resale Executive Condos as those that have passed the five-year MOP and entered the resale market, but they haven't passed the 10th year mark yet. As mentioned earlier, these units can only be sold to Singaporeans and PRs, like resale HDB flats.

But unlike new ECs, resale ECs don't have as many restrictions, such as the MOP and having to dispose of your existing flat. Find out more about the differences between new and resale ECs here.

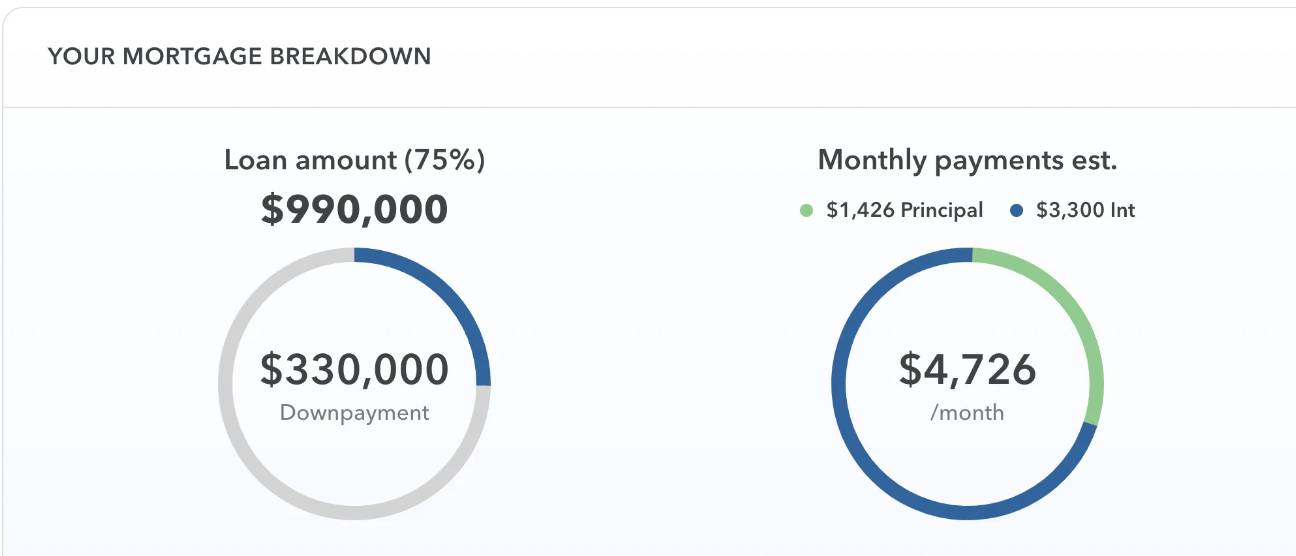

More importantly, you're not subjected to the 30 per cent MSR requirement. Instead, you'll have to meet the total debt servicing ratio (TDSR), which limits the total amount of loans you can service in a month. As of Dec 16, 2021, the TDSR is capped at 55 per cent. So compared to the MSR, it gives you more affordability to buy a resale EC.

The estimated minimum monthly income you need to buy a resale Executive Condo

We calculate it the same way as the new launch EC, but based on the transactions of three-bedroom resale ECs in the first five months (up to May 21) of 2023. So this would include ECs that have TOPed from 2014 to 2018, such as:

Estimates are based on similar assumptions:

| Average price of a 3-bedroom resale EC | Loan amount (75%) | Downpayment (25%) | Estimated monthly instalment (with 4% interest rate) | Estimated monthly household income to meet 55% TDSR |

| S$1.32 million* | S$990,000 | S$330,000 | S$4,726 | S$8,593 |

*based on 99.co's Researcher.

Disclaimer: Do note that these estimations are based on the average price, which may be higher or lower than the actual price of the EC. We recommend that you calculate based on the actual price to determine if it's within your means.

ALSO READ: 10 condo units with at least 200% gain in April 2023