How to start managing and investing your money

When I was 18, I made my first investment in the stock market. My uncle had opened a brokerage account for me and smirked, “Go ahead and play the market, this will be the best present anyone can give you.” “Ha,” I thought to myself, “We are the future - we know what companies to buy. I can be quick, nimble and disciplined. It can’t be that hard.”

Get your feet wet in the stock market. The earlier the better.

It was September of 2007. I was in my first year at the University of Pennsylvania at the time. There were free newspapers all over campus, as the Financial Times and Wall Street Journal tried to attract the eyeballs of the next generation of Wall Street worker-bees.

I was religiously reading the newspaper and watching Yahoo Finance’s top movers every day.

Finally, the day to make my move arrived. Amazon was in the worst-performing stocks, dropping by over 5 per cent in a single day. With sweaty palms, I quickly got online to buy my first stock.

After 3 days, Amazon went up by 7 per cent and I sold. I sat back in my chair a bit light-headed. It felt good to be right. I thought to myself, “If I can keep this up for a year, it would equate to an 800x return!”

Emboldened, I began speculating with the same strategy. I started off with a few quick wins, bringing my one-month return to over 30 per cent. I was trading in everything from big tech, to Chinese insurance, to up and coming renewable energy.

It is early October 2007. The markets hit an all-time high but cracks were starting to appear. The subprime mortgage crisis was bubbling and the stock market started swinging up and down violently. I am still placing my bets. Moving my portfolio in and out of stocks that looked primed for a rebound.

I kept returning to a very volatile and high-profile solar company called Suntech Power. I first bought it when it at $45 and sold at $55. Then at $65 and sold at $80. Then bought again at $80.

I went home for the Christmas holiday and told my parents about my stock market successes. My mom, volunteering at a climate change NGO at the time, was so impressed that she too went to buy Suntech Power.

The pain is real, but experiencing it early will be the best thing that can happen to you.

Within the first week of January, the stock had moved from $80 to $60. I figured I would just ride this out for a bit. Markets were getting really choppy at this point. When Bear Sterns was bailed out and sold to JP Morgan in March 2008, the stock had moved further down to $30.

Markets were in freefall and my small-minded strategy was over. I ended up holding on to Suntech Power for a few more years. The company ended up filing for bankruptcy and I sold the stock for around $0.80 in 2012.

My loss was not only in my investment value but also in missing a great recovery. In just over a year from its bottom of March 2009, the global stock market doubled.

If you are invested right now, during the fastest correction on record catalyzed by Covid-19, do not be disheartened and turn away from investing forever. This is a good correction for all of us, while your human capital (earning potential) is still strong and with a long way to go.

Take the opportunity to reflect on your investment strategy and understand the difference between investing to grow wealth and gambling.

"Investing is not nearly as difficult as it looks. Successful investing involves doing a few things right and avoiding serious mistakes," said John Bogle , founder of The Vanguard Group, which leads the proliferation of low-cost index funds for individual investors and manages over US$5 trillion (S$7 trillion) in assets today

The markets are powerful. All of financial science has clearly shown us that whether you are a professional investor or retail investor, they are hard to beat persistently.

But there is an evidence-based way to harness the power of markets to grow your wealth: It involves diversification, cost management, and patience. It is about taking compensated risks and avoiding the greed of leverage and downfalls from hubris.

Understanding how markets work through Nobel Laureate Eugene Fama’s efficient market hypothesis is a good place to start!

Humility developed from tip 2 is required to take this seriously.

In order to achieve higher expected returns, you have to accept higher volatility.

Stocks are more volatile than corporate bonds, which are more volatile than high-quality government bonds, which are more volatile than cash. If you can stomach volatility, you can patiently achieve expected returns by being diversified and taking compensated risks.

This is easier said than done. Can you stomach your stock investment portfolio going down by over 40 per cent in a crisis and stay the course? If not, you probably should not be invested in 100 per cent stocks, and need a balanced portfolio of diversified stocks and bonds.

Your core portfolio is for your wealth building and consuming. Not gambling.

Understand what big-ticket items you have upcoming, and bucket your money into tranches. The closer the need for your money, the less volatility it can afford to take. The further out the need for the money (like retirement), the more you can target higher expected returns.

Once your buckets and goals are set, you will have a core portfolio suitable for your needs and be on your wealth-building journey.

It is unwise to have a core portfolio that is beyond what you can stomach in terms of volatility from tip 4.

“Cash drag” can almost defeat the purpose of investing.

If you are sitting in 90 per cent cash and make a 10 per cent return on your invested money, that will only equate to a 1 per cent return on your total wealth. You should only have in cash what you need in the next 2-3 years so that you can be efficiently invested and let the power of compounding take over.

Let’s say you manage to get an average 7 per cent per year return on your investment portfolio (below the long-term average of the global stock markets). In 10 years it will 2x, in 30 years it will be 7.6x, and in 60 years it will be 58x.

Up to 37 per cent of your gross salary goes into your CPF. Being efficient with your CPF and getting efficiently invested can make a huge difference to your future.

A government-guaranteed CPF OA interest rate of 2.5 per cent for 30 years will give you a total return of 110 per cent. Taking market volatility and investing to earn 7 per cent for 30 years will give you a total return of 660 per cent.

Spend your effort on things you can control and shape for yourself and humanity.

After my first job in investment banking at UBS, I wanted to get closer to a real operating business. I was fortunate to find a home at GrabTaxi (now known as Grab), and help start their payment business (now known as GrabPay).

I realised that being productive is really about contributing your time, effort, and unique creativity to make lives better. This could be done through daily interactions with other, relationships or the products and services you build.

I wanted to do something that would make a lasting impact on people’s lives. My partners and I saw how difficult it was to invest well, so we started Endowus to help people invest better, conveniently and intelligently across all their money - CPF, SRS, and cash.

Time spent trying to beat the market and investment success are not correlated, with professionals not able to show any persistence in returns. The hope is that Endowus lets people spend more time living life, knowing that they have set themselves up for success.

Don’t be afraid to spend money on things that enrich your life.

If you love food, spend money on food experiences that inspire you. If you love travelling, spend money on those life-changing trips. There is no need to feel guilty about it. Money is a means to an end - not the end. Just spend within your means so “future you” will not suffer at the hands of the current you.

You have worked hard for it. Start taking it seriously so it can bear more fruit for you and your family.

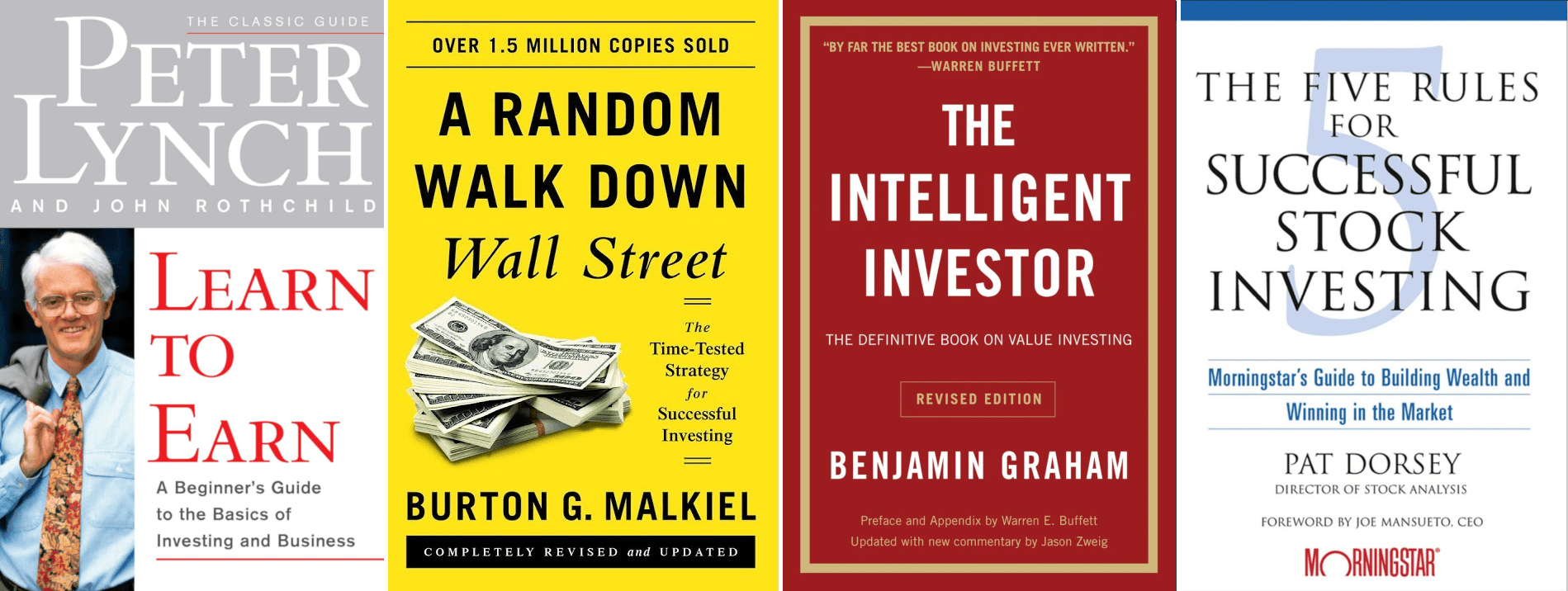

Most people I talk to would rather spend 30 minutes looking for where to have supper tonight than research for 30 minutes on how to grow their wealth over the next 30 years. Put in the effort to understand why and how you should take risks with your hard-earned money for higher expected returns.

As Warren Buffett famously said, “Someone's sitting in the shade today because someone planted a tree a long time ago.”

It is hard for any investment to beat the interest rates you might be paying on high-cost debt, so before you do anything save up and clear your debt so you can start your wealth-building journey.

This article was first published in Endowus.