Money diaries: How a couple in their 30s making $16,500 a month spends their money

Are you saving as much as a late-30s couple earning $12,000/mth? How much are people really spending on their mortgages or parents’ allowances?

Money diaries provides a micro, non-filtered view into local households and their expenditures.

For this season, respondents included a couple in their 30s working in the cryptocurrency and F&B marketing industries and a 60-something couple where the husband is serving as a consultant and the wife is retired.

Read on to find out how much it really costs to run a household in Singapore.

First up, we thought we share how one of our profiles – the couple in their 30s – shares their financial responsibilities month-to-month with you.

The couple has one child and lives in a four-room HDB flat. While they did not provide a breakdown of how much each of them earns, the gross monthly household income is $16,500.

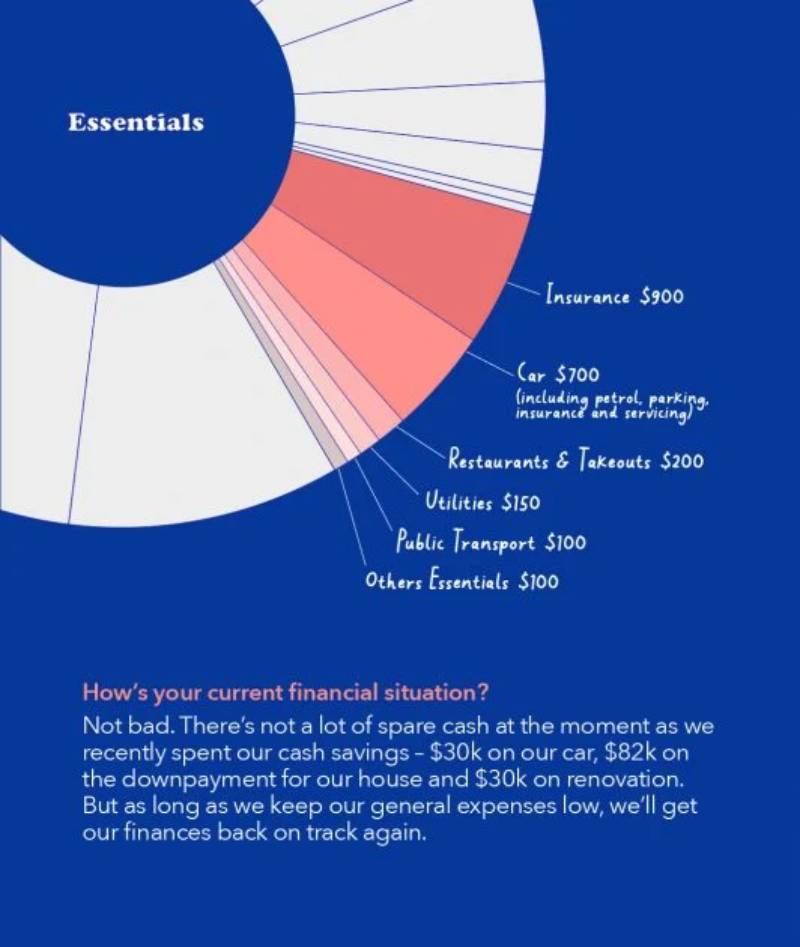

Here’s a breakdown of their monthly income/savings, loan repayments and general expenses – separated by essential expenditures and family/entertainment expenditures:

With monthly payments for their home loan at $1,000, car loan at $1,000 and insurance at $1,800, they managed to save $1,000 and invest $1,800 monthly.

According to the couple, they intend to save up to $100,000 in cash individually for the short-term and upgrade to a landed home in the future.

Expenditure-wise, with their disciplined (forced) monthly loan repayments and savings plan, they admitted they don’t have a lot of spare cash to spend.

“We’ve also recently used our cash savings on our car ($30k), down payment for our 4-room house ($82k) and renovations ($30k), so for now, we’re keeping our general expenses low until we can get our finances back on track again.”

Among their monthly expenses on essentials, their big-ticket expenditures are mainly groceries ($900) and the car (petrol, parking, insurance, servicing) – which is about $700 a month.

Of course, they also give their parents a monthly allowance ($4k) and spend $1,150 a month on their child’s school fees. Other family expenditures include shopping ($800), family outings ($800), gifts ($450) and so on.

With monthly savings taking up only about six per cent of their monthly household income, it falls short of the recommended 20 per cent based on the 50/30/20 rule.

[[nid:577939]]

The rule basically states that you should reserve 50 per cent of your monthly income for essentials like transportation and food, 30 per cent for discretionary expenditures and at least 20 per cent for savings.

For the couple, if we assume their monthly investments as low-risk, fixed-rate savings with 100 per cent guaranteed return on principal, then that would put them closer to 17 per cent.

The home, if it appreciates by the time they sell it, would also guarantee a return on investment in the future.

This article was first published in 99.co.