Money Muse: The 2008 financial crisis wiped out 50% of his portfolio value

Money Muse is AsiaOne's maiden series of profile interviews with financial and investment bloggers where we learn more about what they do, how they started writing, their motivations as well as lessons gleaned through their writing journey.

We recently caught up with Stanley Lim from Value Invest Asia, which focuses on stock and market analysis of the Singaporean and Malaysian markets.

Stanley used to be an analyst and writer for The Motley Fool Singapore and has since started out on his own with Value Invest Asia.

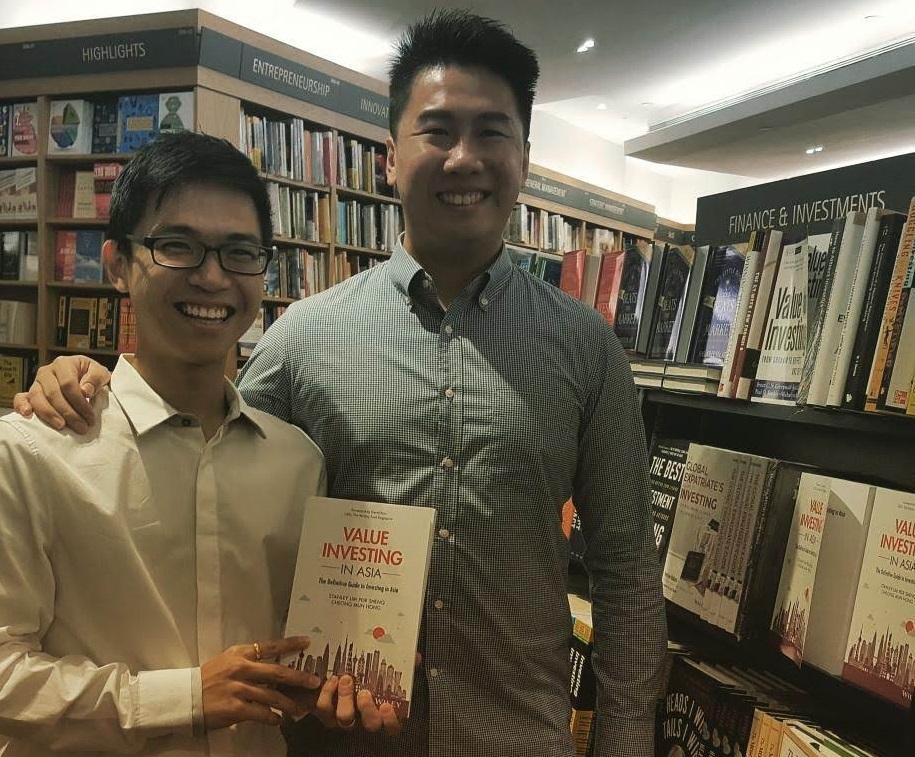

Stanley also wrote a book entitled Value Investing in Asia back in 2017 where he focuses on a practical, step-by-step guide to investing in Asian stocks.

Aside from writing articles about investments, Stanley and his team have also recently branched out into producing content through podcasts and YouTube videos.

We caught up with Stanley to get an understanding of how he kicked off his journey into the world of investment analysis and writing.

HOW DID YOU START OUT IN THE FINANCIAL INVESTMENTS SPACE? WHEN DID YOU DEVELOP YOUR PENCHANT FOR ANALYSIS AND WRITING?

Stanley (S): I started out as an engineer in Malaysia. My first salary was RM1,600 (S$524) a month — and that was after spending 15 years in school. I thought, as most people probably do, that having a degree is the most important thing we need to have in order to command a good salary.

I realised that most people like myself are completely ignorant about financial education. So I began learning more about it, even joining the rigorous CFA (Chartered Financial Analyst) programme before eventually joining the financial industry. I ended up joining The Motley Fool Singapore, where I started actively writing on investment matters.

YOU WRITE A GREAT DEAL ABOUT SINGAPORE AND MALAYSIA MARKETS. ARE YOUR READERS FROM THESE TWO COUNTRIES?

S: Right now, our audience includes investors in Singapore and Malaysia. This is because we share mostly on stocks and market analysis of the Singapore and Malaysia market.

Some of our readers also got to know us through our book, Value Investing In Asia.

HOW DO YOU MAINTAIN YOUR MOTIVATION TO CONTINUE WRITING AND, MORE RECENTLY, TO PRODUCE PODCASTS AND VIDEOS?

S: Writing does take up a lot of time. A good piece might require weeks of research and planning of the structure to ensure it is relevant and engaging for our audience.

However, writing can also be very therapeutic and I tend to learn a lot as I am trying to put my point across in an article or in our book.

More time is needed now as we have started producing content in audio and video form as well. The planning, shooting and editing can double or triple the time needed to produce a piece of content. However, seeing how our work helps people in their financial decision-making process and even improving their lives really motivate us to continue our work.

COULD YOU SHARE A PARTICULAR INSTANCE THAT GREATLY INCREASED YOUR MOTIVATION TO CONTINUE WRITING?

S: The constant comments and feedback we get from our audience are very important and really motivate us.

We get comments even from readers in the US and Europe telling us how our work and research help them better understand Asia and the stock markets here. I think knowing that our work is impacting people's perception of Asia, especially Singapore and Malaysia, is really rewarding to us.

WHAT WAS AN INVESTMENT HURDLE YOU'VE FACED? HOW DID YOU OVERCOME IT?

S: This would be during the global financial crisis. I started investing back in 2006. As the market was constantly going up, I became overconfident in my investment decisions, even though I was just starting out.

During the financial crisis, my portfolio declined more than 50 per cent and all my savings were stored in my portfolio. So within a few months, the money I saved up over the past four years was cut in half.

Luckily, I never took on any debt to invest in the stock market so I was able to hold on to it and was able to recover all of my losses within the next year or so.

WHAT WAS THE BIGGEST LESSON YOU LEARNT FROM THAT EXPERIENCE?

S: It really taught me not to invest in the stock market with debt as we can never predict when the market is going to turn. However, if we are investing with just our own money, we possess the staying power for a subsequent recovery of the market.

COULD YOU NAME A PERSON IN THE INVESTMENT SPACE WHOM YOU ADMIRE THE MOST?

S: It has to be my ex-boss at The Motley Fool Singapore, Dr David Kuo.

David is not just a great investor but I really admire that he is a great communicator. He is one of a few investors I have come across that really know how to articulate complex investment concepts and information in very interesting and easy-to-understand formats. I learnt a lot from him during my time with the company.

IF THERE WERE ONE THING YOU COULD TELL YOUR AUDIENCE, WHAT WOULD IT BE?

S: Don't be afraid to start investing in the stock market. Cash is not as safe as we think it is. If we invest in the right companies, we can still see our wealth grow over time, but if we just keep our money in cash, it is almost certainly going to depreciate over time due to inflation.

Value Invest Asia will be part of a growing stable of bloggers whose writings we will feature in our money column. Look out for their stories!

simeonang@asiaone.com