Outlook of 3 medical related companies that are well positioned for growth

With the ongoing Covid-19 pandemic, many medical-related stocks are in the spotlight recently. Investors are hopeful that these companies will be able to strongly benefit from this crisis.

Some of the companies that are operating clinics, producing test kits and medical equipment such as masks and medical gloves have seen their trading volume and share price surging in the last 3 months.

In this article, we will be looking into 3 medical-related companies that are well-positioned to gain from this pandemic. The 3 stocks are: Q&M Dental Group, UG Healthcare and Healthway Medical.

Q&M Dental Group ("Q&M") was first established in November 1996 in Singapore. It is now the largest private dental healthcare group in Singapore with over 70 dental clinics located in various locations islandwide.

Among the 200 qualified and experienced dentists in the group, about 40 are specialists or dentists who have undergone extensive post-graduate training either locally or from various established training institutions overseas.

Based on its Year to Date price chart, we can see that the share price for Q&M has been stagnant for the first 2 months of 2020, trading within the range of 45 to 48 cents.

In the month of March, Q&M share price has fallen significantly due to the broader market sell down as the global economy is being impacted by the Covid-19 pandemic.

However, towards the end of April, Q&M share price has soared and reached a high of 73.5 cents with trading volume of nearly 52 million shares as the group has decided to venture into producing Covid-19 test kits.

In the announcement dated April 23, 2020, Q&M has entered into a joint venture agreement with Acumen Holdings, for a 51 per cent equity stake in the joint venture company, Acumen Diagnostics Pte. Ltd. ("Acumen Diagnostics") for a consideration of $3.0 million.

The joint venture's principal business will be in the manufacture, sale and distribution of diagnostic test kits, including for Covid-19, as well as analysis of test results and conducting of clinical trials for vaccines, including those for Covid-19.

In another announcement dated May 14, 2020, Q&M has provided an update on the group's operations during the Covid-19 pandemic period.

For its Singapore's operation, the group's dental outlets are classified as essential services under primary care service, and the group have been carrying on with non-elective, urgent and emergency dental services.

For its Malaysia's operation, the group's dental clinics continues with the treatment of nonelective, urgent and emergency dental services despite the nationwide Movement Control Order (MCO).

UG Healthcare Corporation Limited ("UG Healthcare") is a disposable gloves manufacturer with its own established global downstream distribution that markets and sells disposable glove products under its proprietary "Unigloves" brand.

The Group owns and operates an extensive downstream network of distribution companies with a presence in Europe, United Kingdom, USA, China, Africa, South America, Japan, Korea and Canada. The Group also distributes ancillary products including surgical gloves, vinyl and cleanroom disposable gloves, face masks and other medical disposables.

Based on its Year to Date price chart, we can see that UG Healthcare's share price has seen a spike in January and its trading volume has soared to a high of 57 million shares as investors started to take notice of glove manufacturers due to the Covid-19 pandemic.

Moving forward to the month of May till now, UG healthcare's share price has soared from 25 cents to 75 cents. That is a return of 200 per cent and their trading volume has spiked up across the trading days as investors rush in to buy and benefit from this rising demand for medical gloves.

This similar rising trend can also be seen in UG Healthcare's regional listed peer such as Top Glove Corporation Berhad, Hartalega Holdings Berhad and SuperMax Corporation Berhad.

[[nid:491502]]

In the announcement dated May 19, 2020, UG Healthcare has provided investors with an update on their business operations.

The group mentioned that the surge in demand for gloves and healthcare/medical disposables has led to higher Average Selling Prices (ASP) for these products.

The Group is currently operating at its optimum production efficiency with the existing production capacity of 2.9 billion gloves per annum. The planned additional annual capacity of 300 million gloves will be added in FY2021.

Healthway Medical Corporation Limited ("Healthway Medical") is one of Singapore's private outpatient medical service providers.

It offers quality healthcare services across the medical value chain in family medicine, dentistry, paediatrics, orthopaedics, sports medicine, aesthetic medicine, TCM and healthcare benefits management.

Currently, the group operates 11 medical practice groups, comprising more than 80 clinics. Each medical practice group has an established brand presence and has its own medical specialisation, market positioning and service proposition.

Based on its Year to Date price chart, there are 2 periods where its share price and trading volume has spiked up.

In the month of January, Healthway Medical's share price has jumped to a high of 5 cents with trading volume increased to about 120 million shares as investors are speculating that the Covid-19 will have a positive impact on Healthway Medical.

In the month of April, we can see that its share price has gone up again on the back of heavy volume as investors are predicting that there is going to be a greater demand for healthcare services due to the increase in Covid-19 cases in Singapore during the period.

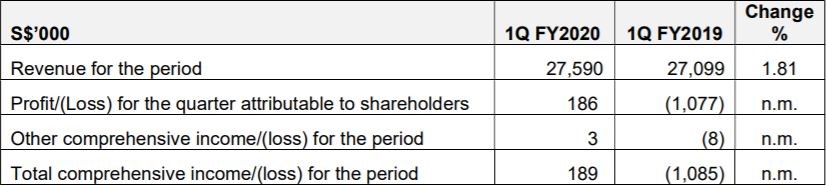

In the announcement dated May 12, 2020, Healthway Medical has provided an update on the group's financial performance for 1Q FY2020.

Healthway Medical has recorded a revenue of $27.5 million in 1Q FY2020, which is an increase of 1.8 per cent as compared to 1Q FY2019 revenue of $27 million.

The overall increase in revenue can be attributed to the Primary Healthcare Segment, which has seen an increase of $1.6 million in revenue, which is being offset by the decrease in revenue of $1.1 million from the Specialist Healthcare Segment.

The increase in revenue for Primary Healthcare segment was due to increase in patient volume during 1Q FY2020 compared to 1Q FY2019. The decrease in revenue for Specialist Healthcare segment was mainly due to Covid-19.

Despite the marginal increase in revenue, the group has achieved a net profit after tax of $0.2 million in 1Q FY2020, compared with a net loss after tax of $1.1 million in 1Q FY2019. The increase in net profit after tax was mainly due to increase in revenue and reduction in operating costs for the group.

For the latest updates on the coronavirus, visit here.

This article was first published in Investor-One.