Sembcorp Industries and Marine demerger: What you need to know and what to do

The Sembcorp Group of companies finally announced that Sembcorp Industries and Sembcorp Marine will be demerged with the creation of two focused companies.

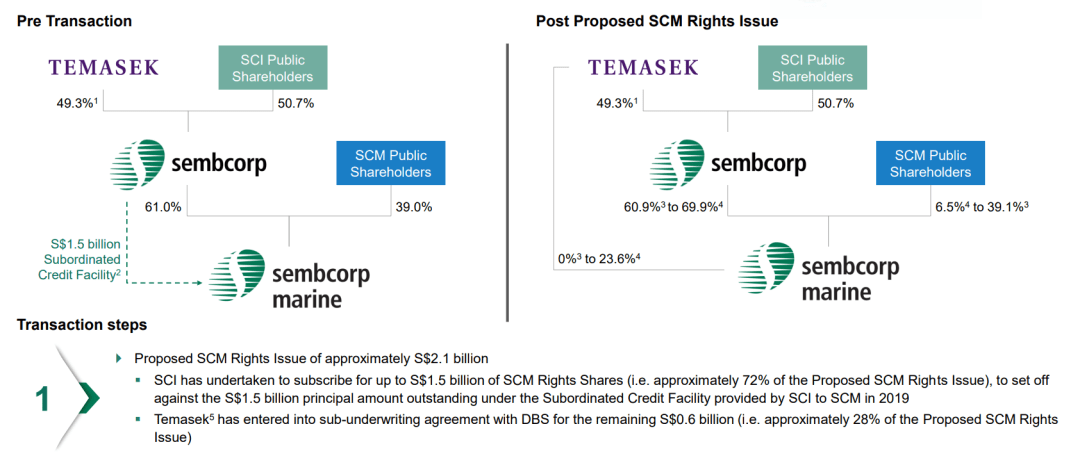

There will be a proposed Sembcorp Marine Rights issue (SCM Issue) in conjunction with the demerger.

I have written on both Sembcorp Marine and Sembcorp Industries several times, stating that it will be in the best interest for Sembcorp Industries, the parent of Sembcorp Marine, the former holding a 61 per cent stake in the latter, to divest its stake in Sembcorp Marine to become a pure utilities/energy player that will find favor among investors who do not wish to have exposure to its marine business.

With the current demerger announcement, that reality is finally happening and I believe, just on face value, it will be positive for Sembcorp Industries shareholders.

Let’s go through the step by step procedure of this demerger exercise.

The separated Sembcorp Marine will need additional funding to stand on its own, given the current cash burn rate as well as the bleak prospect in the offshore and marine sector.

There will be a recapitalisation exercise which involves raising $2.1 billion through the SCM Rights Issue.

This $2.1 billion will be mostly undertaken by Sembcorp Industries (SCI), amounting to $1.5 billion since it is currently the largest shareholder of SCM at 61 per cent.

However, Sembcorp Industries does not have to fork out real cash as this $1.5 billion rights will go towards offsetting the $1.5 billion loan it provided to Sembcorp Marine back in 2019 under the Subordinated Credit Facility.

The other $0.6 billion will come either from the existing Sembcorp Marine’s shareholders (which currently own the other 39 per cent of the company) or from Temasek through a sub-underwriting agreement with DBS if it is not being taken up by Sembcorp Marine’s shareholders.

This proves to be a dilemma for existing Sembcorp Marine shareholders which could see their stakes being diluted from the existing 39 per cent to 6.5 per cent if none decides to take up the rights offer.

For every one existing Sembcorp Marine share, shareholders are entitled to five Sembcorp Marine Rights Shares at $0.20/Rights Shares.

According to Sembcorp Group, this is approx. a 76.5 per cent discount to the Last Close Price and a 31 per cent discount to the Theoretical ex-rights Price (TERP) of $0.29 based on last 5-Day VWAP (of $0.74/share).

Base on a price of $0.74/share and outstanding shares of 2.09 billion, the market cap of Sembcorp Marine is $1.55 billion.

[[nid:491196]]

The company will raise an additional of $2.1 billion in cash (actual additional cash raised is only $0.6 billion as $1.5 billion will be used to repay the existing subordinated loan).

So total post recapitalisation market cap is $1.55 billion + $2.1 billion = $3.65 billion

There will now be 2.09 billion shares + (2.09*5) = 12.54 billion shares outstanding

So ex rights price = $3.65 billion / 12.54 billion shares = $0.29

So assuming that this deal goes through, Sembcorp Marine will see its outstanding shares increase from 2.09 billion to 12.54 billion, and its share price collapse to approx. $0.30, potentially as soon as when the shares are un-halt.

This is unless the market does not believe that the deal will go through.

For Sembcorp Industries as mentioned, there is no actual cash transaction to Sembcorp Marine, but its outstanding $1.5 billion loan to Sembcorp Marine will be converted to equity.

After the rights issue, Sembcorp Industries equity stake of Sembcorp Marine will either remain between 60.9 per cent (if all existing Sembcorp Marine public shareholders exercise their rights) and 69.9 per cent (if no existing Sembcorp Marine public shareholders exercise their rights). Do refer to the diagram above.

If no existing Sembcorp Marine public shareholders take up their rights, then Temasek will subscribe for it which will give Temasek direct equity ownership of up to 23.6 per cent in Sembcorp Marine.

The ownership structure of Sembcorp Industries will not change. Temasek continues to hold 49.3 per cent in Sembcorp Industries and the public holding 50.7 per cent.

At this juncture, Sembcorp Industries will distribute its 60.9 to 69.9 per cent equity stake in Sembcorp Marine to its shareholders on a pro-rata basis with every 100 Sembcorp Industries (SCI) shares will be entitled to 427 to 491 new Sembcorp Marine shares.

This will result in Sembcorp Industries’ existing shareholders holding between 30.9 to 35.4 per cent equity stake in the new enlarged Sembcorp Marine.

Notice that Temasek’s stake will increase to between 29.9 per cent to 58 per cent.

This is because Temasek is the largest shareholder of Sembcorp Industries, so at the minimum, it will have a close to 30 per cent stake in Sembcorp Marine post demerger or up to 58 per cent if no existing public Sembcorp Marine shareholders subscribe for the rights.

With a > 50 per cent majority stake in Sembcorp Marine, I reckon the next step could the merger of Sembcorp Marine with Keppel’s O&M division upon Temasek gaining majority control of Keppel which is slated to be completed before October 2020.

Sembcorp marine’s existing shareholder might not want to approve the huge dilution that comes with the rights issue.

Keeping the status quo might ultimately force Temasek to make a direct and higher offer for the existing stakes vs the current proposal.

Note that by forking out “just” $0.6 billion, Temasek will have 58 per cent of Sembcorp Marine.

This will imply that the full 100 per cent stake of Sembcorp Marine will be worth just $1 billion vs the last close market cap of c.$1.8 billion.

Is this a great deal for Temasek? Well, if you believe that Sembcorp Marine might go into receivership one day, then forking out any amount >$0 might not be a good deal.

However, given the “need” for Temasek to save one of our most iconic shipyards in Singapore, then I would think its probably a good deal on the part of Temasek to gain 58 per cent ownership status with just a direct cost of $0.6 billion.

I believe that this is a demerger that should have happened three to four years ago when Sembcorp Industries underwent a management change and a one+ year restructuring effort.

There was a huge disappointment when Sembcorp Industries subsequently announced that the key restructuring was the potential monetisation of its India utility business through an IPO. That till today has not materialised.

[[nid:490794]]

This demerger will allow Sembcorp Industries to be the largest pure utilities/energy blue-chip player in SGX which I believe will find favor among investors and institutional portfolio managers who have strict mandates to only invest in pure utility company for their earnings and dividends stability.

Hence, I sense that the market will take this news favorably for Sembcorp Industries. This is unless the market views its $1.5 billion loan to Sembcorp Marine being converted into equity as negative.

Strictly speaking, this $1.5 billion goes towards an ultimate 30.9 to 35.4 per cent stake (see the figure in Step 2) in Sembcorp Marine which does not seem like a good deal at all.

However, I guess Sembcorp Industries will have to bite the bullet as keeping the status quo will not be in the best interest of its shareholders as well.

We won’t know if the company might ultimately have to write-off a huge chunk of its shareholder’s loan given to Sembcorp marine.

For Sembcorp marine’s shareholders, the choice is harder. To take up the rights could potentially mean “throwing” money without any light at the end of the tunnel in terms of an operational turnaround for the company.

[[nid:491335]]

With no new orders and a huge load of fixed expenses, having to run both its mega yards in Singapore and Brazil, the company’s cash burn will be relatively high in my view.

Not taking up the rights will mean huge dilution and a “cheap” sell to Temasek who could ultimately end up with 58 per cent of the company by just paying $0.6 billion.

Sembcorp Marine’s share price could also be under heavy selling pressure from newly minted Sembcorp Industries public shareholders who now control more than 30 per cent of the company.

This is particularly going to be the case if Sembcorp Industries sees a valuation re-rating with its share price performing well post this exercise. Their existing Sembcorp marine shares will hence be seen as “free”.

Subsequently, I guess that Temasek will make an offer to buy up the rest of Sembcorp Marine at the cheap to combine its operations with Keppel’s O&M division (upon taking majority ownership of Keppel) to form one single entity that is cost-competitive enough to compete against our Korean and Chinese counterparts.

So, the biggest winner seems to be Temasek from this deal?

For existing Keppel’s shareholders, this news should be seen as positive on the surface and one step closer towards the ultimate divestment of its stake in Keppel O&M to Temasek.

The question lies ultimately in the “sale price” of its O&M entity which is likely to be undervalued in its books.

To me, this doesn’t look like positive news for Sembcorp Marine which the market seems to imply before the halt of its and Sembcorp Industries’ share price (Sembcorp marine’s price jump from $0.76 to $0.85).

Existing Sembcorp Marine’s public shareholders will need to take a gamble by subscribing to its rights and banking that Temasek will ultimately provide a better deal to take over the rest of the company in full (before its cash runs out again) or choose to walk away and be significantly diluted by not partaking in the exercise of this right.

For existing Sembcorp Industries’ public shareholders, though the Implied terms might not be the best, this is probably a scenario that needs to happen for the company to grow in its core utilities/energy operations without concerns of having to backstop its marine business.

The company’s valuation multiple could see a subsequent valuation re-rating if management can demonstrate greater resilience and growth in its core utilities/energy business post its marine demerger.

This is likely a prelude to the ultimate merger with Keppel O&M, which can only materialise if facilitated by Temasek.

This article was first published in New Academy of Finance.