Should you rush through your home loan repayment before interest rates rise?

Mortgage interest rates are on the way up in 2022. Yes, we’ve heard this before, way back in ’18, but that doesn’t mean the prediction was inaccurate. Covid-19 was unforeseen and prolonged the period of low rates.

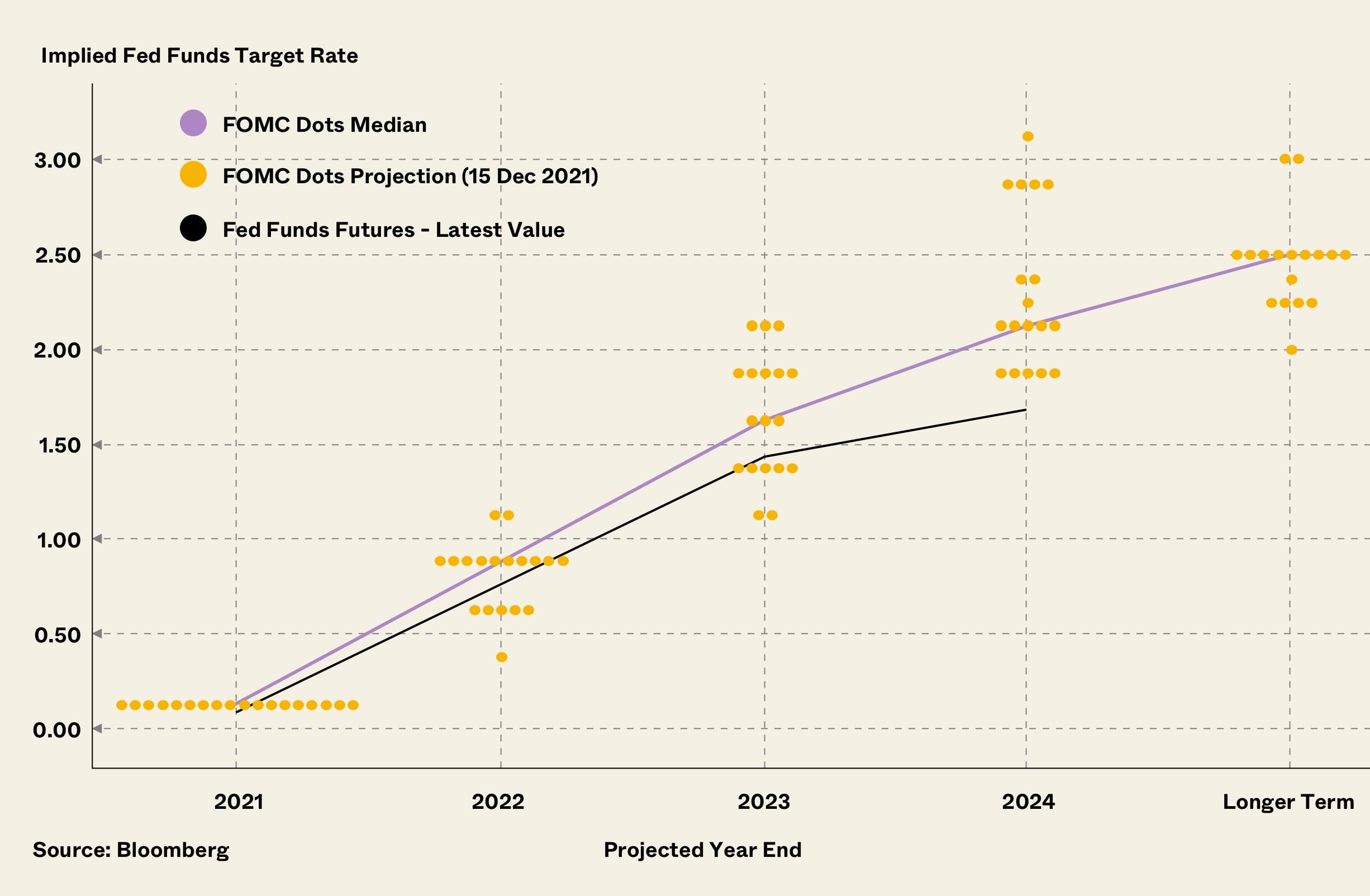

But with the US eyeing its inflation rate nervously, the Fed seems ready to start rate hikes as early as March. And so while it isn’t exactly an impending doom and gloom scenario , this leads some borrowers to ask if, just maybe, it’s time to accelerate loan repayments and get it done. Here’s what to consider:

Note: All of the following applies only to bank loans. If you use HDB loans, this isn’t relevant as the HDB loan rate is always 0.1 per cent above the prevailing CPF rate (it’s been 2.6 per cent for going on two decades).

Home loan interest rates are affected by US Federal Reserve policies. When the Fed sets interest rates lower, home loans in Singapore tend to see interest rates fall as well.

During periods of crisis, such as the ’08 Global Financial Crisis and more recently Covid-19, the Fed likes to set interest rates near zero. This encourages spending and stimulates economic recovery.

However, prolonged periods of low interest rates tend to result in rising inflation; and interest rates have been low for over a decade now. The average home loan rate hasn’t risen past two per cent since around ’09, despite the “normal” interest rate in Singapore previously being about three to four per cent.

With low rates, the US isn’t the only country seeing rising inflation. In November 2021, Singapore’s headline inflation reached 3.8 per cent, which was the highest in nine years.

To put it in simple terms, the Fed has to normalise interest rates, before they end up with runaway inflation. That means raising the interest rate, which will have a knock-on effect in Singapore.

Rates don’t immediately get reset to normal; the Fed usually raises the rate in slow increments, of about 0.25 per cent every few quarters. But for Singapore homeowners on 20 or 25-year loan tenures, they might be paying full rates long before they’re done with the loan.

Most homeowners are aware that the longer they service a loan, the more interest they pay. However, this is now compounded by fears of a rising interest rate; this might mean lower returns (e.g., in terms of capital gains when they sell the property), or the possibility of an empty CPF Ordinary Account (if they use CPF to service the home loan).

The tricky part is, no single answer is right for everyone. Whether or not you should rush your home loan repayment depends on a variety of factors:

Whether you prepay your home loan or pay off your entire home loan early, you are locking down a large portion of your finances. Property is inherently illiquid, so this can cause complications later. For example:

Say you have a total of $300,000 in savings, and an outstanding home loan of $500,000. Your net position is negative $200,000, but you at least have $300,000 in cash.

If you were to prepay $300,000 to accelerate loan repayment, your immediate position becomes $0 in savings, with an outstanding loan of $200,000.

Note that your net position remains negative $200,000, but with the added disadvantage that you have no savings.

In the long run, you might save money on interest repayments, and could escape higher interest rates when they happen.

But the immediate situation becomes precarious, as it’s very difficult to get money back out of the property when you need it.

In an emergency, you could end up cash-out refinancing (which puts you right back in debt, with added administrative fees), or having to use personal loans and lines of credit (which have higher interest rates than your home loan, thereby defeating the purpose of trying to avoid higher rates).

So despite conventional wisdom about avoiding debt, it could be financially imprudent to wipe out your savings, for early home loan repayment.

This is a matter of personal finance as it is property, so you should consult with a qualified financial planner.

Most banks have a lock-in period, during which you’re penalised for redeeming the loan early (this allows banks to recoup some of the interest they would lose).

For most loans, the lock-in period lasts anywhere between the first three to five years. Attempting to pay off the loan in that time incurs a financial penalty, usually around 1.5 per cent of the undisbursed loan amount (e.g., if you still have $700,000 outstanding, you pay $10,500).

You may be tempted to rush and repay the loan right now before the interest rates rise – but you may be better off waiting out the lock-in period. For example:

If you currently have a loan amount of $700,000, at a rate of 1.3 per cent for 25 years, you’ll pay about $2,743 per month.

Even if the rate were to rise to 1.8 per cent, your monthly repayment would only rise to around $2,899; a difference of just $156 a month.

Assuming a penalty of $10,500, it would take around five and a half years of savings, just to cover the cost of the prepayment penalty. So you’re probably better off accepting a rate hike, and then paying off the loan once you’re out of the lock-in phase.

Some loan packages offer waivers for prepayment but read the terms and conditions of the loan carefully. Sometimes the waiver on prepayment penalties is only up to a certain amount (e.g., up to $100,000, and you pay the normal penalty on the rest), or the waiver may only apply under specific conditions, such as the sale of the property.

If you’re planning on buying more property, there’s an added advantage to paying off the home loan early: that’s a higher Loan To Value (LTV) ratio on your next property.

When you have one outstanding home loan, your second home loan will have a maximum LTV of 45 per cent (i.e., you can only borrow up to 45 per cent of the property price or value, whichever is lower). If you have two or more outstanding home loans, the LTV limit decreases to 35 per cent.

| Outstanding Home Loan | LTV Limit | Minimum Cash Downpayment |

| None | 75 per cent or 55 per cent | 5 per cent (for LTV of 75 per cent) 10 per cent (for LTV of 55 per cent) |

| 1 | 45 per cent or 25 per cent | 25 per cent |

| 2 or more | 35 per cent or 15 per cent | 25 per cent |

Do note that you should apply the lower LTV limit if your loan tenure exceeds 30 years (25 years for HDB), or if the loan period extends beyond the borrower’s age of 65 years.

Besides this, the minimum cash down payment also increases. For the second and subsequent property, you need to pay the first 25 per cent in cash (the rest can be in any combination of cash or CPF).

So for investors looking at multiple properties, there are two potential reasons to pay off the existing loan: first, to minimise interest repayments and get better returns on the first property, and second, to have a smaller cash outlay on the next home.

There is a bit of number crunching here: you have to determine if the loss of liquidity, from paying off your existing home loan, is worse than the higher cash outlay of your subsequent property purchases.

The higher the interest rate rises, the more of your CPF gets used for loan repayment (assuming you service your home loan with CPF and not cash).

We suggest that you keep a close eye on your CPF usage, as there’s a withdrawal limit for property. This is 120 per cent of the property price or value, whichever is lower (also referred to as the Valuation Limit, or VL).

[[nid:565185]]

For example, if the property is valued at $1.5 million, the withdrawal limit would be $1.8 million. Once you reach this amount, any other loan repayments will have to be made in cash.

A higher interest rate will draw more from your CPF, and raise the risk of reaching the withdrawal limit before you’ve finished paying the home loan. For some homeowners, this is an undesirable scenario (e.g., they intend to stop working at age 55, and don’t want to end up servicing a home loan in cash beyond that point).

So if you’re very close to your CPF withdrawal limit, and you’d still have savings after paying off the outstanding loan, it might make sense to do so before rates rise.

To be clear, paying off your home loan sooner – especially now that interest rates are set to rise – almost certainly means higher savings and a better return in the long run. However, it’s important not to oversimplify the solution.

Early prepayment is not right for everybody. Some borrowers are better off accepting the higher rates than suffering the loss of liquidity; especially during Covid-19, when jobs may be threatened.

This article was first published in Stackedhomes.