SORA-pegged home loan: 5 key things to know if you're switching from SOR or SIBOR

The impending inflation and rise of interest rates are upon us, with the United States Federal Reserve looking to raise interest rates as early as March 2022.

Singapore pegs its interest rates close to that of the US, so we're likely to see our interest rates edge higher as well. UOB economists predict that the key benchmark rate of SORA might shoot from 0.25 per cent in Q1 2022 to 1.01 per cent by the end of the year.

This means that if you currently have a mortgage, your mortgage payments will be higher. Mortgage loans make up more than 75 per cent of a household's monthly recurring expense.

MAS advises households to be mindful of their ability to service mortgage obligations. It is also recommended that highly leveraged households should build up financial buffers.

Right now, the most common interest rate benchmarks are the Swap Official Rate (SOR) and Singapore Interbank Offered Rate (SIBOR). They've served as the cornerstones for interest rates for at least two decades, since the late 1990s.

We've covered the differences between SOR and SIBOR in-depth here .

SOR and SIBOR are currently phasing out to make way for SORA, the new gold standard moving forward. As of March 2021, the option for SORA has been rolled out by most major banks, with more than $1 billion of such loans extended so far.

The MAS has formed the Steering Committee for SOR & SIBOR Transition to SORA (SC-STS). It consists of a main Steering Committee comprising senior representatives from key banks in Singapore, relevant industry associations, and the MAS.

The SC-STS' role is to ease an industry-wide transition from SOR to SORA. Industry participants include commercial and retail customers (such as homeowners with current bank loans).

Here are some deadlines to note:

Since August 2020, The MAS started publishing the compounded rates for one-month, three-month, six-month and a SORA index. This assures customers that the floating rates are derived from a transparent and reliable source.

Contrary to what people may believe, SORA isn't a new kid on the block. The Monetary Authority of Singapore (MAS) has been publishing daily SORA rates since July 2005.

The Association of Banks in Singapore describes The Singapore Overnight Rate Average (SORA) as the volume-weighted average rate of borrowing transactions in the unsecured overnight interbank SGD cash market in Singapore between 8am and 6.15pm.

After the data has been validated, it is published by 9am on the next business day. MAS reviews the list of reporting banks regularly to ensure SORA stays robust and representative of the benchmark rate.

When comparing how SORA calculates interest rates compared to SIBOR, SORA takes past transactions, whereas SIBOR looks at future transactions.

This means that with SORA, you can know what to expect next month. SIBOR is more volatile as banks can decide to increase or decrease future interest rates without warning. You won't be surprised by unexpected rate hikes.

How it differs from SOR. For borrowers, the averaging effect from compounded SORA will provide significantly more stable rates than single-day SOR readings. SOR rates are regularly exposed to temperamental market factors, such as quarter or year-end volatility.

Unlike SOR, SORA transacts based on SGD, removing the need to account for the constantly fluctuating foreign exchange rates.

How it differs from SIBOR. SORA operates based on calculating the rate of all interbank lending transactions versus SIBOR, where it takes 20 banks. This makes the process a whole lot more transparent and less complicated.

Currently, SORA rates are pretty attractive due to the current low interest-rate environment. Although it has been slowly increasing, the three-month Compounded SORA is 0.2086 per cent p.a. as of Feb 4, 2022.

The all-in nett rate of the loan works out to be 1.2086 per cent p.a., assuming the bank charges a spread of one per cent.

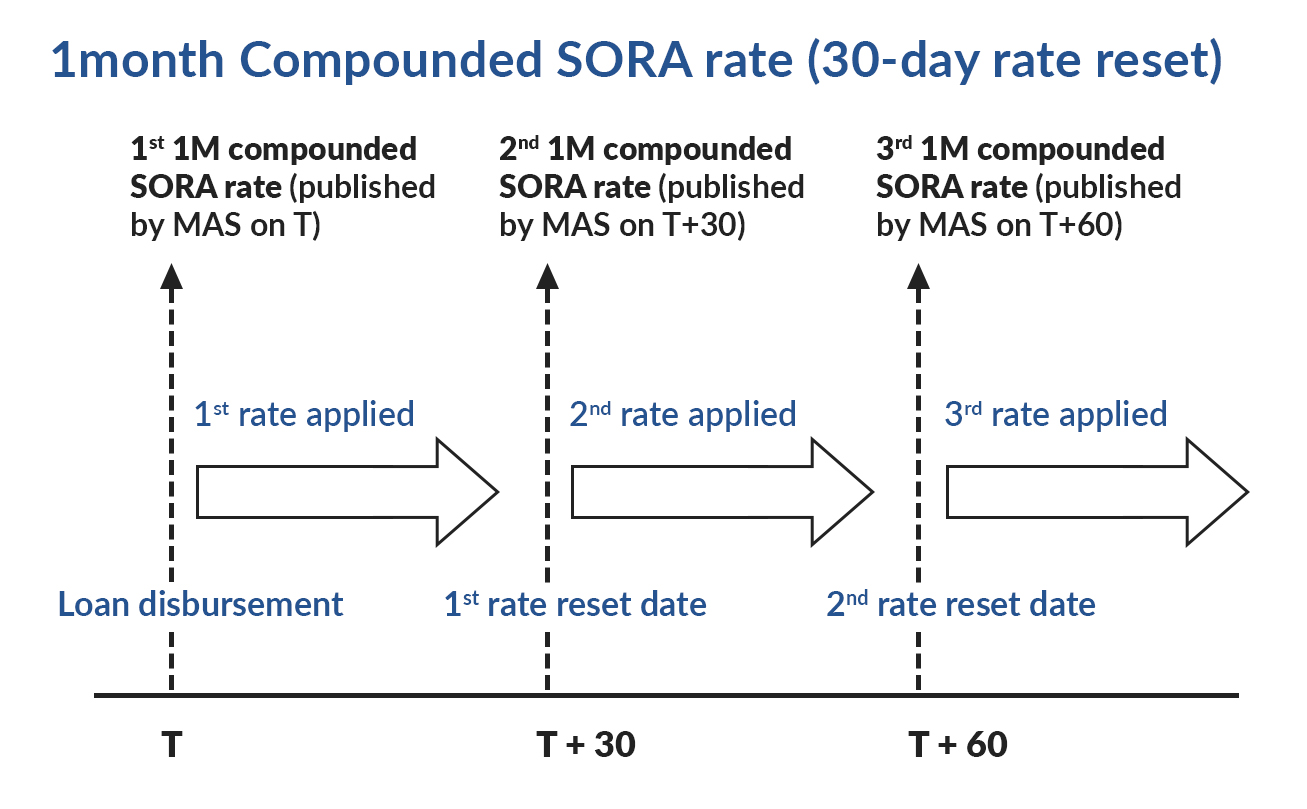

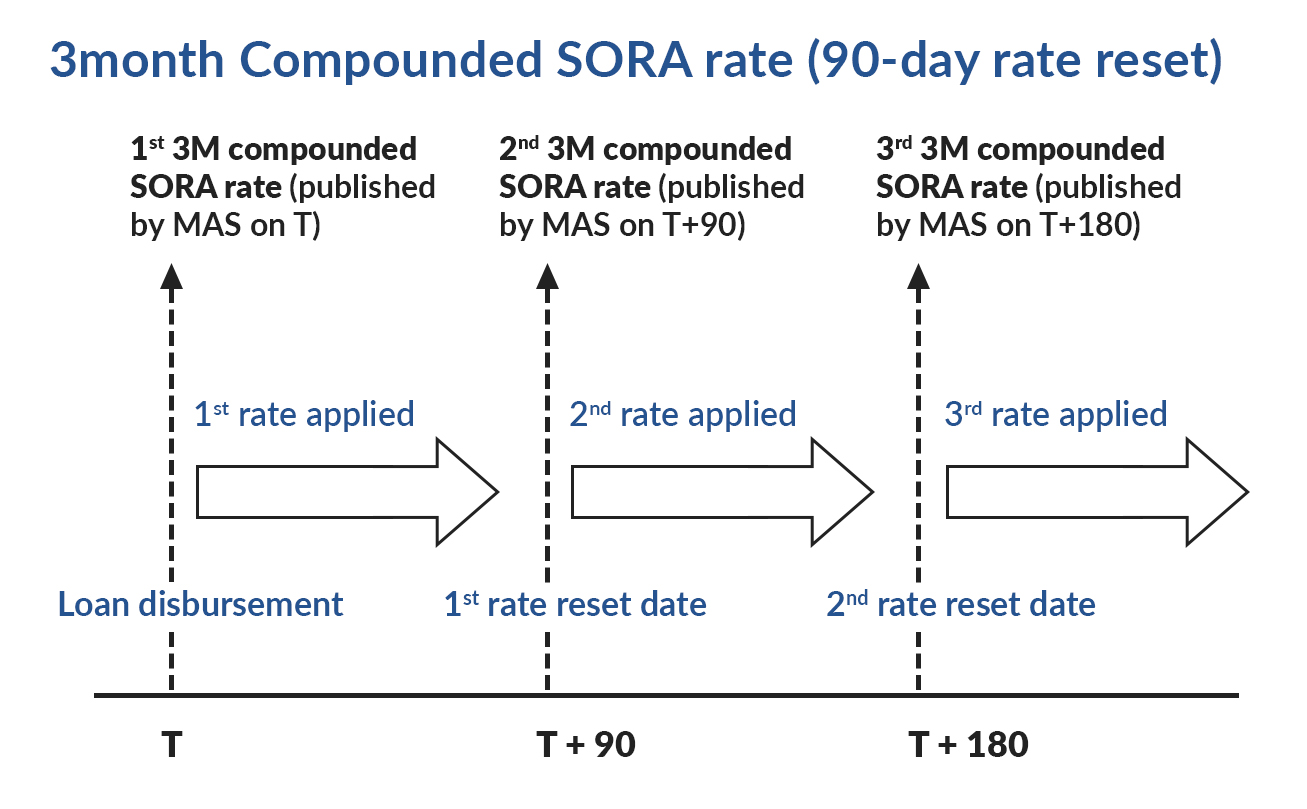

Most SORA loans in the market are based on the one-month or three-month compounded rate. Advance compounding provides notice of the applicable interest rate and the monthly instalment payable for the upcoming period until the next rate reset date.

Knowing the instalment amounts in advance lets you plan your finances better.

Here is how the one-month and three-month compounded SORA rates are calculated for a loan package with a 30-day rate reset, and a 90-day rate reset respectively.

Depending on your bank's internal processes, Day "T" refers to the date of loan disbursement or acceptance of the letter of offer, etc.

Banks may also apply a one-month Compounded SORA rate from a prior 30-day period which is not immediately preceding day "T" and each rate reset date, according to each bank's internal processes.

If you currently have a SOR loan, your bank should be contacting you over the next couple of months and provide options to convert your SOR loan no later than Oct 31, 2022. This is so you won't be disrupted by the discontinuation of SOR after June 30, 2023.

There should be no administrative or conversion fees payable, as well as a lock-in period when you decide to take up the SORA Conversion Package.

The SORA Conversion Package has three components, including:

The 3M compounded SORA is the most commonly offered default for SORA loan packages. It evens out rate volatility by taking the compounded average of daily SORA over the previous three months.

However, due to it being a floating reference rate, your monthly interest payments will fluctuate slightly. If you're more risk-averse and prefer something more predictable, you have the option of switching to a fixed-rate loan package instead.

Should there be an unexpected hike in interest rates, you can keep calm and not panic as you'll be paying the same amount regardless of any fluctuations.

Do note that switching to a fixed-rate loan means your LTV and TDSR will be recalculated based on the latest cooling measures.

Banks will carry your existing SOR margin in the SORA conversion package to ensure your new loan is comparable to your previous loan.

Published monthly on the first business day from Sept 1, 2021 until Sept 1, 2022, this spread reflects the average difference between SOR and compounded SORA-in-advance over three months before being published.

Every bank will have a different Adjustment Spread, so you are encouraged to contact your respective banks for more information about switching out your SOR loan early.

It's best to stay informed and plan ahead prior to switching out your loans or opting for a fresh loan. Consult a specialist, such as a mortgage broker or your bank, so you'll have an expert to walk you through the different options and loans available.

This article was first published in 99.co.