These are the top 5 best-selling new condo launches of Q3 2020

Q3 has been an interesting time for the Singapore private property market. It’s gotten extra attention for two reasons:

First, it’s following the Circuit Breaker in Q2, so market watchers are trying to pick up on the general direction of the market. While we surprisingly saw good sales even in Q2, it was questionable whether the momentum could continue.

(If you’re wondering, the answer appears to be yes – URA flash estimates show private home prices are up 0.8 per cent for Q3; an even better showing than the 0.3 per cent the previous quarter. However, the market appears to be led more by landed homes than condos).

Second, Q3 saw new OTP restrictions . Market watchers will be eager to see if sales numbers drop in the coming quarters, as the re-issue of OTPs was blamed for inflating sales figures. We’ll soon find out if the theory holds true.

In the meantime, here are the new launches that appear to have shaken off Coronavirus worries, and topped sales charts anyway (as always, you’d find the top performers to be the bigger scale condos as these are not ranked on a percentage basis of the total units in the development):

Total sales: 388 transactions

Available pricing data:

Lowest: $1,396 psf

Median: $1,584 psf

Highest: $1,856 psf

Last five transactions:

| Date | Unit Size (Sq. Ft.) | Price PSF | Price |

| Oct 3, 2020 | 1,399 | $1,651 | $2,310,000 |

| Oct 3, 2020 | 980 | $1,615 | $1,582,000 |

| Oct 2, 2020 | 807 | $1,708 | $1,379,000 |

| Oct 2, 2020 | 797 | $1,749 | $1,393,000 |

| Oct 2, 2020 | 797 | $1,710 | $1,362,000 |

Address: Sims Drive

Developer: Novasims Development Pte. Ltd.

Tenure: 99-year lease

Est. Top: 2024

Number of units: 566

The high sales volume can be attributed to two factors:

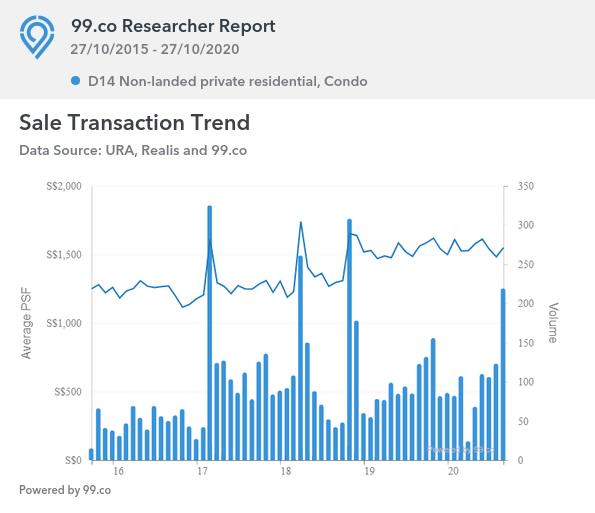

The first is price. At around $1,584 psf, Penrose is very attractively priced for a new launch in District 14. For reference, average pricing in the area is currently about $1,546 psf:

Given its new launch status, one would expect Penrose to be priced about 10 to 15 per cent higher than the district average.

A total quantum of $1.3 million to $1.5 million is more than reasonable for a Rest of Central Region (RCR) condo; in fact, the pricing here is more akin to fringe regions.

The second reason is that Penrose is practically sited – the Aljunied MRT is just 600 metres (about seven minutes’ walk) away.

Adjacent to the MRT station, there are also some popular coffee shops and even a steakhouse. Geylang Methodist Secondary School and The Nexus International School are both within a one-kilometre radius, and are a four and seven minute-walk respectively.

About 10 to 12 minutes’ walk will also take residents into the Geylang food stretch.

Unfortunately, this may also prove to be a drawback to some buyers. Although Penrose is not in the vice areas of Geylang, a handful of buyers may associate it just by basis of proximity.

Overall, this development will suit buyers who want equi-distance from both the CBD, and east-side amenities.

Right now, the price tag is unbeatable given the location. However, Penrose is in the middle of a dense urban area; some degree of noise pollution and the “urban jungle” feel are hard to ignore.

Total sales: 330 transactions

Available pricing data:

Lowest: $1,154 psf

Median: $1,379 psf

Highest: $1,620 psf

Last five transactions:

| Date | Unit Size (Sq. Ft.) | Price PSF | Price |

| Oct 4, 2020 | 915 | $1,389 | $1,271,000 |

| Oct 4, 2020 | 1,324 | $1,338 | $1,772,000 |

| Oct 4, 2020 | 678 | $1,411 | $957,000 |

| Oct 4, 2020 | 678 | $1,432 | $971,000 |

| Oct 4, 2020 | 678 | $1,445 | $980,000 |

Address: Tampines Lane (District 18)

Developer: Sim Lian (Treasure) Pte. Ltd.

Tenure: 99-year lease

Est. Top: 2023 – 2024

Number of units: 2,203

Treasure at Tampines is the largest condo development in Singapore to date. It’s also the most competitively priced development right now.

Many units have a quantum below $1 million, and the pricing feels more like an Executive Condominium than a fully private property.

The large number of units (2,203) is both a pro and con. On the upside, it helps to keep maintenance fees down, as the cost is spread out over more homes

On the downside, the sheer number of units can be off-putting to investors. It raises the risk of competition within the development, when you eventually decide to rent or sell.

For pure home buyers, one common gripe is that the high number of units could mean overcrowded facilities, as well as noise.

Nonetheless, we doubt you’ll find a more affordably priced new launch condo, which is also spacious enough to accommodate family units.

Total sales: 250 transactions

Available pricing data:

Lowest: $1,790 psf

Median: $1,928 psf

Highest: $2,073 psf

Last five transactions:

| Date | Unit Size (Sq. Ft.) | Price PSF | Price |

| Oct 4, 2020 | 947 | $1,885 | $1,786,000 |

| Oct 4, 2020 | 1,119 | $1,704 | $1,908,000 |

| Oct 4, 2020 | 980 | $1,856 | $1,818,000 |

| Oct 3, 2020 | 980 | $1,952 | $1,912,000 |

| Oct 3, 2020 | 603 | $1,974 | $1,190,000 |

Address: Toh Tuck Road (District 21)

Developer: Qingjian Perennial (Bukit Timah) Pte. Ltd.

Tenure: Freehold

Est. Top: 2024

Number of units: 633

Forett at Bukit Timah was the first property to launch following the Circuit Breaker. The developer’s confidence was based on the fact that Forett is in the upcoming Beauty World area, and that it’s a freehold property (the nearest competitor, Daintree Residence, is leasehold).

Like most properties in the Bukit Timah area, the highlights are proximity to nature, and being surrounded by lower density housing.

Bukit Timah has always been something of an exclusive, high-rent enclave, so a freehold property in this area is bound to draw attention.

While Forett at Bukit Timah is often marketed as being “close to Beauty World MRT”, this is subjective; an unsheltered 750-metre distance is not considered walkable for everybody (especially older family members or the mobility impaired).

Nonetheless, it may be manageable for some, particularly if you like cycling to the MRT. Amenities wise, this area – and in fact most of Bukit Timah – is not really for people who like giant malls and similar urban conveniences.

Forett at Bukit Timah is better suited to those who will appreciate the nearby nature reserve, or a more laid-back environment. All the major retail is in adjoining Jurong.

Total sales: 202 transactions

Available pricing data:

Lowest: $1,044 psf

Median: $1,641 psf

Highest: $1,723 psf

Last five transactions:

| Date | Unit Size (Sq. Ft.) | Price PSF | Price |

| Sept 27, 2020 | 721 | $1,586 | $1,144,000 |

| Sept 23, 2020 | 1,044 | $1,667 | $1,740,500 |

| Sept 20, 2020 | 1,688 | $1,593 | $2,658,000 |

| Sept 20, 2020 | 893 | $1,704 | $1,522,500 |

| Sept 20, 2020 | 1,238 | $1,620 | $2,005,000 |

Address: Jalan Lempeng (District 5)

Developer: Sing Haiyi Gold Pte. Ltd.

Tenure: 99-years leasehold

Est. Top: 2023

Number of units: 1,468

Parc Clematis is a mega-project divided into three zones, designated Contemporary, Elegance, and Signature.

Contemporary is the affordable, targeted at younger buyers, while Elegance is for typical family units. Signature is more upscale, and is a luxury component.

This provides a wide range of options and floor plans for different buyers; and it makes the development hard to generalise. Regardless, the median price of $1,641 may strike some buyers as being on the high end.

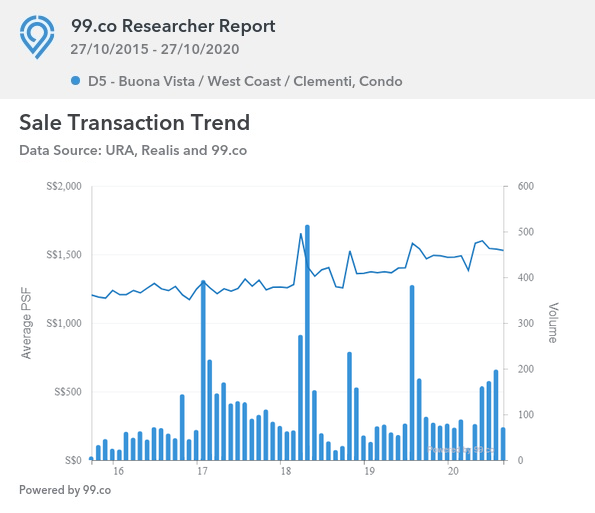

It actually isn’t, but buyers who have been out of the market for a while may not realise how high Clementi prices have climbed:

The norm for District 5 is about $1,529 psf, making Parc Clematis’ pricing unsurprising for a new launch in this area.

Parc Clematis also draws attention because Clementi is close to the One-North tech and media hub, and also Holland Village.

This makes it a potential draw to tenants or home buyers who work in One-North, or want access to Holland V (without paying Holland V prices, which are much steeper).

Like all mega-developments though, the sheer number of units may worry some away. With 1,468 units, competition for tenants and future buyers might be steep.

It remains to be seen if proximity to One-North, and to a further extent Jurong, can make up for this.

Total sales: 189 transactions

Available pricing data:

Lowest: $1,595 psf

Median: $1,774 psf

Highest: $1,901 psf

Last five transactions:

| Date | Unit Size (Sq. Ft.) | Price PSF | Price |

| Oct 4, 2020 | 764 | $1,781 | $1,361,000 |

| Oct 4, 2020 | 764 | $1,799 | $1,375,500 |

| Oct 4, 2020 | 1,259 | $1,743 | $2,195,000 |

| Oct 4, 2020 | 1,259 | $1,755 | $2,210,200 |

| Oct 3, 2020 | 764 | $1,785 | $1,364,000 |

Address: Shunfu Road (District 20)

Developer: Qingjian Realty (Marymount) Pte. Ltd.

Tenure: 99-years leasehold

Est. Top: 2022

Number of units: 1,206

JadeScape is one of the mega-projects that also happens to benefit from a nearby MRT station. It’s only about 350 metres (four minutes-walk) to Marymount MRT.

It actually wasn’t selling too well initially, with competition like Parc Esta , Stirling Residences , and Park Colonial all drawing the early demand.

Now that these developments are close to being fully sold, sales momentum has picked up at JadeScape as of recent weeks.

One of this development’s Unique Selling Points is the emphasis on smart home technology. For example, guests can use a QR code to access the main entrance and the lift lobby; and there’s an app to allow you to book condo facilities, or call in maintenance.

As an interesting aside, this development used to have 63 “Gold Standard” units. These are single-bedders designed for senior living, with features like rails and anti-slip flooring.

Sadly, as interesting as it sounds, this was scrapped for regular units given there was little to no demand for it.

There aren’t many notable drawbacks other than what we’ve mentioned about mega-developments (see above): Buyers should brace for the risk of future competition.

As for home owners who aren’t eyeing the bottom line, do consider if the larger residential crowd would bother you.

They’re currently the bellwether of where the Singapore private property market is headed, in terms of developer sales. This is because Q3 is right on the back of the Circuit Breaker, which was an unprecedented development.

To make it more interesting, the URA also passed new restrictions on re-issuing the Option to Purchase (OTP) in Q3.

Market watchers will be quick to compare sales in subsequent quarters, to see if re-issues options have truly distorted sales figures; and if so, to what extent.

Q3 also has two very affordable new launches – Penrose and Treasure at Tampines – that are clearly priced to move. These are likely to remain the highlights of the market, as price sensitivity will rise as Covid-19 drags on.

This article was first published in Stackedhomes.