'We calculated our interest payment alone to be $110k in 10 years': Why we chose to pay off our home loan early

Most Singaporeans resign themselves to paying off a home loan for 25 to 30 years. In most cases, the home loan is the last loan to be repaid, due to the lower interest rate (and maybe because CPF can be used to pay it). But every now and then, we meet homeowners who finish off their property loans in record time. Here’s one couple who managed it:

Our interviewee couple, T and R, were planning to get married in 2021. Getting a home was part of the plan, and the couple was committed to house-hunting by viewing two units every month.

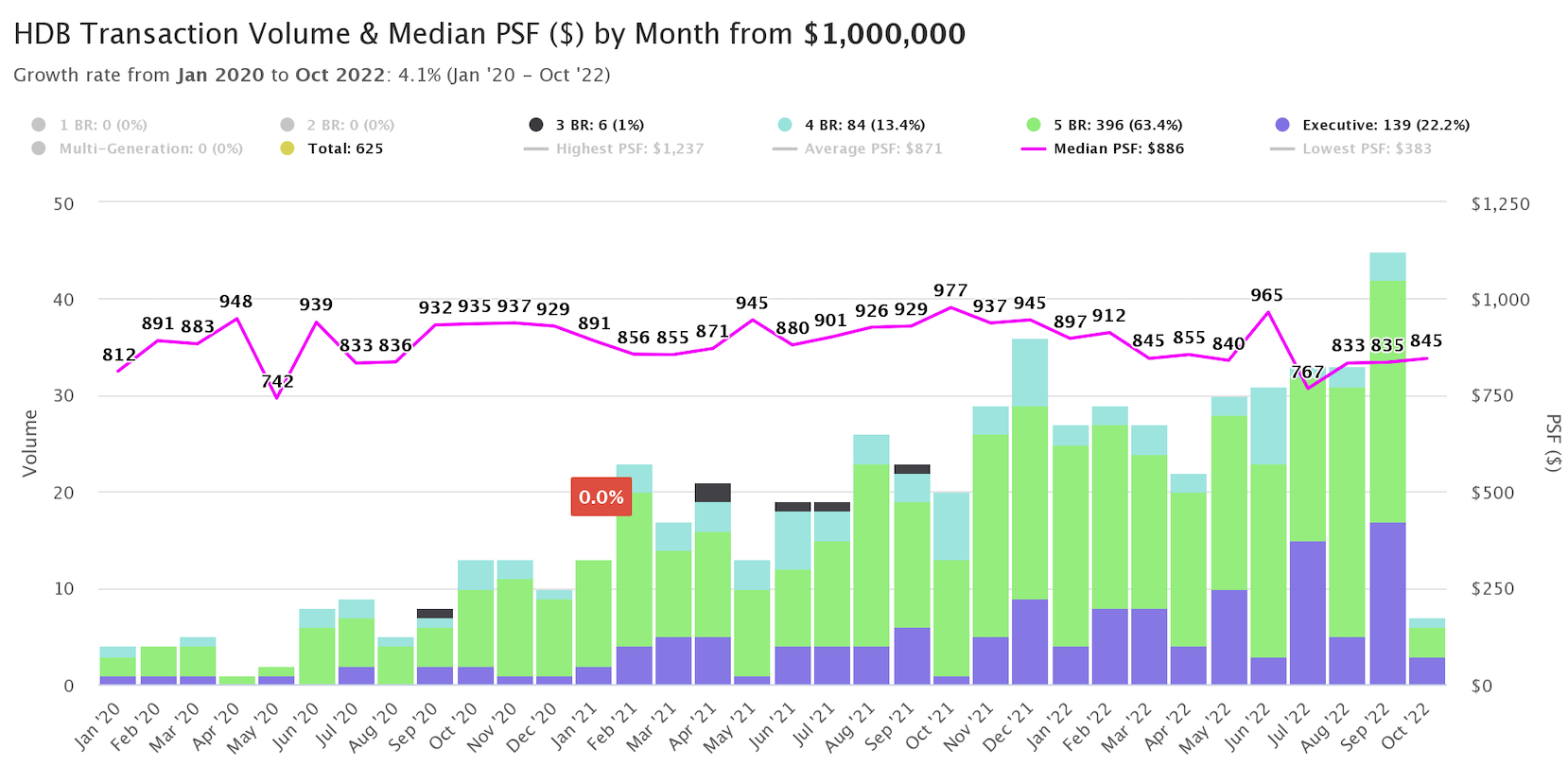

"BTO was out of the question," T says, "because of the then-long waiting times and high failure rates. We were both 29 at that time…the resale market was hot and getting hotter. It was also somewhere just before the million-dollar HDB streak started in January 2021."

(T is referring to the record numbers of million-dollar flats that were seen in 2021, and also later in 2022).

In the process of deciding against BTO flats, however, T and R also found themselves asking deeper questions:

"How long were we planning to stay for? What kind of asset growth did we want to achieve?

Long story short, we wanted to pick a place where we could stay for a relatively long time for a first home. We wanted something that could last us a bare minimum of 35 years before we moved. This gave us five years to have kids if we wanted to, and the kids could stay there till they were 30 and independent.

Considering our planned long stay in our current house, our take on property as an asset might be unique. We were okay with asset depreciation, as long as it freed up capital for us to achieve our other life goals.

As a close example:

In real terms, if on a $5,000 per month salary (around $170 a day) you spent $11 a day on housing, that’s pretty great. It’s $500,000 over 60 years, split between two people.

And we’re talking about a pretty great place."

T and R picked a location along Serangoon Avenue 2, close to the Lorong Chuan MRT station. Given the plan to stay long-term, the couple chose to go for full renovations.

The flat includes two home offices, a master bedroom, and an open-concept kitchen. They say that:

"The flat is on a lower flower and is odd-shaped, and we love it. We have so much greenery and the odd-shaped feature of the house makes it feel large. As a bonus feature, because we hacked walls, we also get incredible lines of sight and see amazing greenery."

A lot of the appeal also comes from the neighbourhood itself, as Serangoon is a very developed area:

"Serangoon as a mature estate is great with ample coffee shops and eateries, supermarkets, neighbourhood clinics, TCM halls … the list goes on. It’s a stone’s throw from Serangoon Gardens as well."

(We'd have to agree especially with the TCM part. Serangoon is oddly packed with TCM halls, and walking from NEX to Serangoon 2 or 3, you’ll probably see at least two or three shops selling herbal tea and Chinese medicine.)

The couple also loves that they’re about a 10-minute walk to Lorong Chuan MRT:

"This is a hidden gem of a location. 10 minutes from lorong chuan means you're 13 minutes from Nex or Junction 8 – two massive malls. Looking out a bit further, that's 30 minutes from Bouna Vista or Paya Lebar, gateways to the east or west respectively. It’s also worth mentioning we're 30 minutes from town too.

It's a location where, if we wanted to stay a long time, we could."

T says that the couple was using a bank loan for the flat at the time.

(You can opt to use either an HDB loan or a bank loan for HDB properties, except for Executive Condominiums).

"We were with UOB at a 1.28 per cent interest rate. Our monthly lay out was $1,200 on a $300,000 loan over 25 years. This was a two-year lock in rate offered in 2021.

At the end of the two-year period the rate was about five* per cent, with a monthly layout of $1,800."

*3M SOR + 1.33per cent as of April 2023

The couple realised that, if they didn't pay down the loan and rates remained that high, they would end up spending some $110,000 in interest payments alone, for the first decade of occupying the flat.

T says that:

"Doing the same calculations with the pre-rate hike environment*, the interest expenditure would be just $33,500, versus $60,000 for a HDB loan – partially why we went with a Financial Institution for a loan."

Note that, before interest rates spiked after Covid, private bank rates were cheaper than the HDB loan rate of 2.6 per cent. This had been the case for more than a decade, which was why many flat buyers used to opt for bank loans rather than HDB loans.

In any case, the couple realised that by paying down the loan sooner, the interest expenditure could fall to as low as just $17,250. T explains further:

"We paid $400,000 for the flat. In the three different scenarios, if we were to sell the flat at the 10-year mark, paying down the loan would help significantly in preventing a negative sale by reducing asset depreciation.

Our current mortgage is less than $200 a month for the next 23 years."

The couple chose to keep the mortgage-to-income ratio low, since they view the flat as a potentially depreciating asset:

"We make $9,000 a month, so in all cases, our Mortgage Servicing Ratio (MSR) is less than the required 30 per cent, which is great. But because we’re not expecting asset appreciation but lowering depreciation, this number has to be lower than 30 per cent. It’s a topic worth discussing if there’s a price correction in the future."

When homeowners worry about the mortgage, a common solution raised by brokers, bankers, and even financial planners is to go semi-fixed: this means constantly refinancing from one fixed loan to another, after the fixed period expires.

The couple explains why they didn't opt for this:

"Locking in another two years means that you were shielded from further increases, but also that you would not enjoy any decrease in rates. To make things worse, everyone had an opinion about how this would play out. Some said rates would go up, others down. For me, because not only the common man but experts were also divided, it was not a good time to commit to a view on rates.

After staying here for two years, it pretty much became cemented that we're comfortable staying here. We had everything we need and commuting to work was an ease – so we knew we can stay here for a long time. Hence we committed to paying down the loan and minimise asset depreciation."

Expert advice was also divided on another area:

"The advice we got was to pay down the loan using the CPF part (CPF interest rates fixed at 2.5 per cent and can’t outperform interest rate increase) and use the cash portion of our savings to beat the interest rate increase (requiring a net return of greater than 5.1 per cent). Most commercial portfolios had a Year-on-Year return of two to seven per cent before fees, depending on risk appetite.

My main contention with this was that this data point is for the last 10 years on average. Narrowing it to the last two years would see negative returns. Again for me, the deciding factor that was too many experts were divided on what the economy was doing, and with a small risk appetite, we were not comfortable investing."

Paying down a large chunk of your mortgage is a step that takes careful consideration – it's not for everyone. The couple says they had some key requirements to meet first.

Before paying down the loan, they ensured they had rainy day savings:

"We didn't use all our cash to pay for the house. A mortgage is usually a household's largest expense, and would be the largest drain on emergency funds and the runway (ie, how long a household can function without income coming in).

By paying down our mortgage, our emergency funds were decreased, but our runway was increased by a factor of five. (E.g. If we could survive a year without working before, we can now survive five years)".

Next, the couple ensured they had a retirement plan:

"We're both in our early 30s now and we're 35 years from retirement. As a result of our actions, we're able to save $2,000 a month each (including CPF). At 2.5 per cent a year, or 4 per cent a year, that’s $1.3 million or $1.7 million respectively.

Thankfully, time is on our side.

On a separate note – I am worried that the government would do what France did and push back the retirement age, or reduce payout, or that something might break due to falling birthrates requiring a mandatory change into the way CPF works. So we do plan to diversify investments. But from our research for someone with a low-risk appetite, a 2.5 per cent per annum portfolio with low risk is doable."

Finally, the couple ensured they had a way to buy another home if they changed their minds and sold:

"The elephant in the room is the CPF we used to pay down our house. Barring any CPF rule changes, whatever accrued interest we need to return to CPF will be used for our next house, if we ever choose to move.

Because we also minimised the risk of a negative sale by minimising asset depreciation, and the CPF returned would be used immediately again, the proceeds from our current house should be able to support any future purchases."

The couple says that finances are unique to each household, so the decision must be based on individual goals like upgrading, retirement planning, lifestyle goals, and others.

Their advice would be:

"First, explore the different goals, and find out what you would like to achieve.

Second, break down the steps and numbers to see what it would mean on a monthly basis. Quite often a little bit now would add up to a lot later.

Third, Get advice. We spoke to two bankers, one financial planner, and two agents.

Finally, plan for contingencies. Have a backup plan just in case."

This article was first published in Stackedhomes.