We own an executive maisonette and a condo - should we sell our maisonette to buy another condo or sell both to buy a landed property?

Hi stackedhomes!

I have been following and reading your articles religiously as I enjoy the different perspectives that you bring to the table.

We are currently in a tricky property situation and would appreciate your professional advice.

Here is a summary of our housing situation:

Property 1: 32 year old EM at Choa Chu Kang owned by my husband and I am an occupier. We cleared the MOP in 2021. The EM is currently tenanted out at 3.5k per month. Tenancy ends on February 2025

Property 2: Newly bought NeWest at 2.3 million in 2021.

We have two children with minimal CPF OA due to the above commitments. As for SA and MA, we have about 200k.

As both of us are moving into 40s soon, we would like to start planning for retirement and legacy planning which includes property restructuring at some point in time. Our main concern is the lease decay of our EM as we understand that younger buyers are unable to fund the house with CPF. This leaves us with a limited pool of buyers.

Would you advise for us to sell the EM and cash out on the profits and buy another property, hold on to the EM and continue renting until much later or sell both properties and buy a landed property?

Appreciate if you could offer your opinion and we do hope to hear from you soon!

Thank you so much and have a nice weekend ahead!

Editor's Note (Oct 7 2022): Edited information related to budget

Hi there.

We're glad you've been enjoying the content we're putting out and thank you for the support so far!

As the saying goes, a bird in the hand is worth two in the bush, and that's probably the pickle that you find yourselves in right now. You do have a lot of options at hand, and it may seem like a coin flip to see which would put you in the most advantageous position in the future.

While we can definitely look at the hard numbers for you, we do think that this decision also involves a lot more than just the numbers on paper. For example, should the landed property be a clear winner in terms of capital appreciation, etc, there are other issues to think about as well.

Is a landed home really going to be ideal for your lifestyle? As you age, buying one with a practical layout (either a lift, or having bedrooms on the first floor would be important). There's also the issue of the inheritance that you want to leave to your children in the future, how would you structure a single property?

We've heard of cases where the family is the same as yours - two parents, two kids. As the children gets older, one kid moves out, and the other continues to stay with the parents. Once the parents are gone, it would seem heartless to kick one sibling out, but what would be a fair way to split? Is it to sell the home immediately to split even if it's not the right time to cash out? Does one sibling pay the other for rent to stay as they effectively own half? As a parent, you definitely do not want such squabbles in the future.

And this is just one part of the equation, there will naturally be other questions that you'd have to answer about what you really want in the future that is not something we can help with.

For now, we'll try to give some clarity based on the numbers and detail that you've provided.

Let's start by looking at the two properties you guys currently own.

First up, let's look at your Executive Maisonette situation.

Executive Maisonette (EM) units in Choa Chu Kang were completed between the years 1989 to 1997 with the youngest being 25 and the oldest being 33 this year.

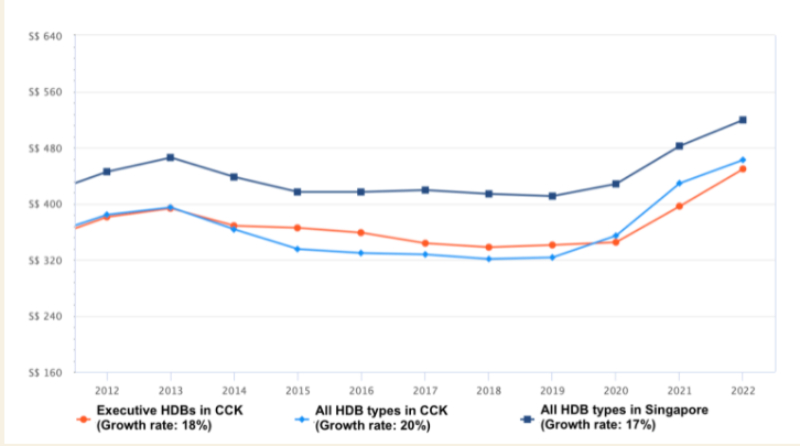

We can see from the graph above that in the last 10 years, prices of executive flats in Choa Chu Kang have been moving in tandem with the overall HDB prices in Singapore.

You'll notice that since 2019, the average price of all HDB types in Choa Chu Kang has risen above that of the executive units. This is likely due to the sudden influx of flats that have reached their MOP. From 2018 to 2022, there were a total of 8178 units in Choa Chu Kang that obtained their MOP.

These are the clusters that hit their MOP between 2018 to 2022:

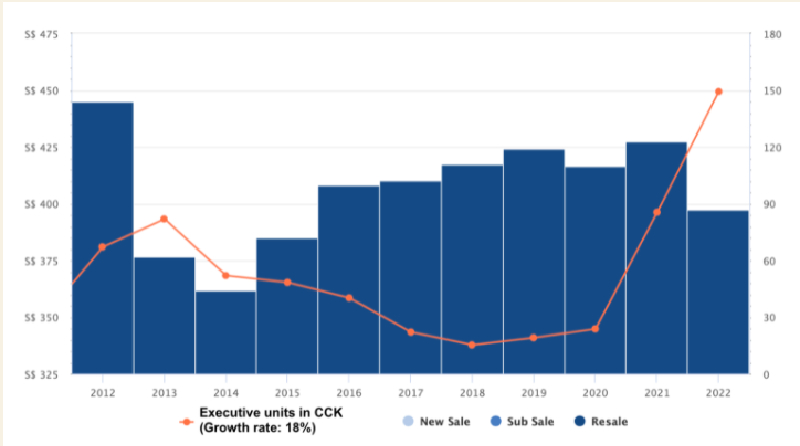

The price jump for executive units in Choa Chu Kang has been rather significant at approximately 32 per cent from an average of $341 psf in 2019 to $449 psf this year.

The WFH situation during the pandemic has driven up demand for larger unit types, so in spite of their ages, prices of these executive flats are still on the rise. Although this is the case now, lease decay is still something we have to take into consideration.

These are some of recent EM transactions in Choa Chu Kang:

| Date | Block | Street | Level | Size (sqm) | Completion | Resale price |

| Sept 2022 | 120 | Teck Whye Lane | 04 to 06 | 146 | 1989 | $758,000 |

| Sept 2022 | 203 | Choa Chu Kang Ave 1 | 01 to 03 | 146 | 1989 | $750,000 |

| Sept 2022 | 555 | Choa Chu Kang North 6 | 01 to 03 | 145 | 1996 | $765,000 |

| Aug 2022 | 109 | Teck Whye Lane | 01 to 03 | 146 | 1989 | $742,000 |

| July 2022 | 601 | Choa Chu Kang St 62 | 07 to 09 | 151 | 1996 | $850,000 |

| July 2022 | 101 | Teck Whye Lane | 04 to 06 | 146 | 1989 | $712,000 |

| July 2022 | 287 | Choa Chu Kang Ave 2 | 07 to 09 | 146 | 1990 | $735,000 |

| July 2022 | 448 | Choa Chu Kang Ave 4 | 13 to 15 | 143 | 1997 | $742,000 |

| June 2022 | 764 | Choa Chu Kang North 5 | 04 to 06 | 144 | 1996 | $798,000 |

| June 2022 | 448 | Choa Chu Kang Ave 4 | 10 to 12 | 139 | 1997 | $710,000 |

Source: HDB

If we were to look at the units completed in 1989 and 1990 which are 32 and 33 years old this year, the average price is $739,400. Based on this average price and a monthly rental of $3500, the rental yield is 5.68 per cent which is good for this particular type of HDB.

The following is the average rental yield for the various HDB estates and unit types:

| Town | Three-room | Four-room | Five-room | Executive |

| Ang Mo Kio | 6.58 per cent | 5.59 per cent | 4.05 per cent | |

| Bedok | 6.96 per cent | 6.19 per cent | 4.85 per cent | |

| Bishan | 6.10 per cent | 5.16 per cent | 3.95 per cent | |

| Bukit Batok | 6.61 per cent | 5.82 per cent | 3.72 per cent | |

| Bukit Merah | 7.13 per cent | 4.63 per cent | 4.16 per cent | |

| Bukit Panjang | 5.71 per cent | 5.81 per cent | 5.13per cent | |

| Bukit Timah | ||||

| Central | 3.80 per cent | |||

| Choa Chu Kang | 6.15 per cent | 5.44 per cent | 5.15per cent | 4.54 per cent |

| Clementi | 7.14 per cent | 4.42 per cent | 3.83per cent | |

| Geylang | 6.88 per cent | 5.05 per cent | ||

| Hougang | 6.25 per cent | 5.33 per cent | 4.93 per cent | 3.93 per cent |

| Jurong East | 6.83 per cent | 5.76 per cent | 5.10 per cent | |

| Jurong West | 6.81 per cent | 6.14 per cent | 5.45 per cent | 4.87 per cent |

| Kallang/ Whampoa | 6.86 per cent | 4.15 per cent | 4.23 per cent | |

| Marine Parade | 6.32 per cent | |||

| Pasir Ris | 5.52 per cent | 4.80 per cent | 4.45 per cent | |

| Punggol | 6.41 per cent | 5.45 per cent | 4.76 per cent | |

| Queenstown | 7.17 per cent | 4.20 per cent | 4.39 per cent | |

| Sembawang | 5.59 per cent | 5.28 per cent | ||

| Sengkang | 5.39 per cent | 4.97 per cent | 4.45 per cent | |

| Serangoon | 5.70 per cent | |||

| Tampines | 6.62 per cent | 5.53 per cent | 4.80 per cent | 4.01 per cent |

| Toa Payoh | 7.50 per cent | 4.45 per cent | 4.36 per cent | |

| Woodlands | 7.12 per cent | 6.13 per cent | 5.28 per cent | 3.97 per cent |

| Yishun | 6.50 per cent | 5.74 per cent | 4.63 per cent | 3.80 per cent |

| Average | 6.68 per cent | 5.29 per cent | 4.66 per cent | 4.25 per cent |

Source: HDB

NEWest is a small 956 years leasehold development with 136 units, located in District five and was completed in 2017.

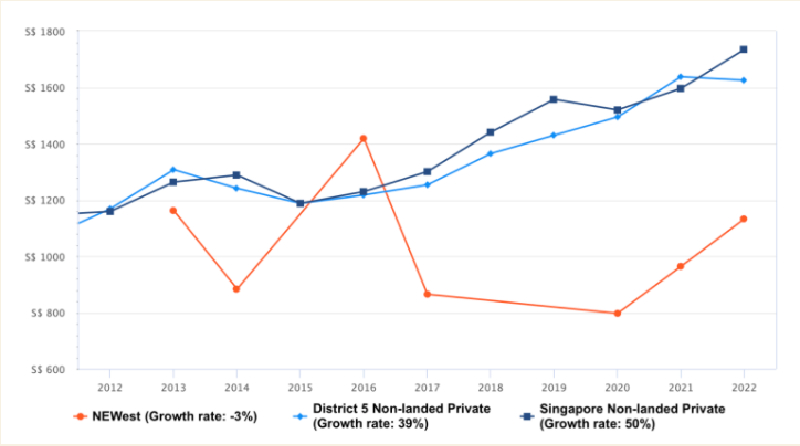

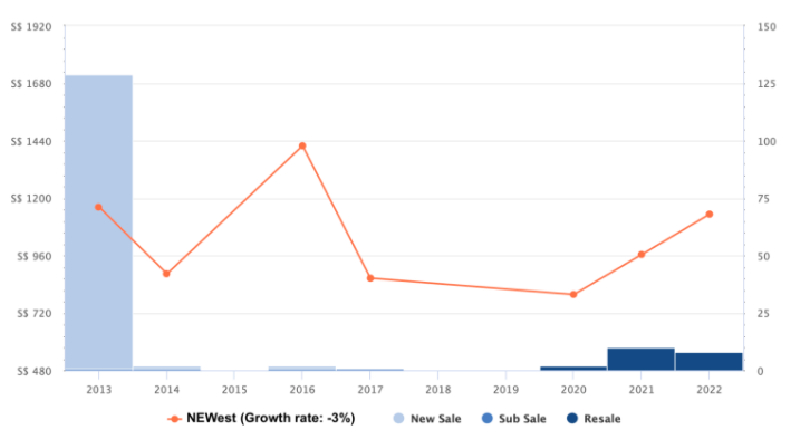

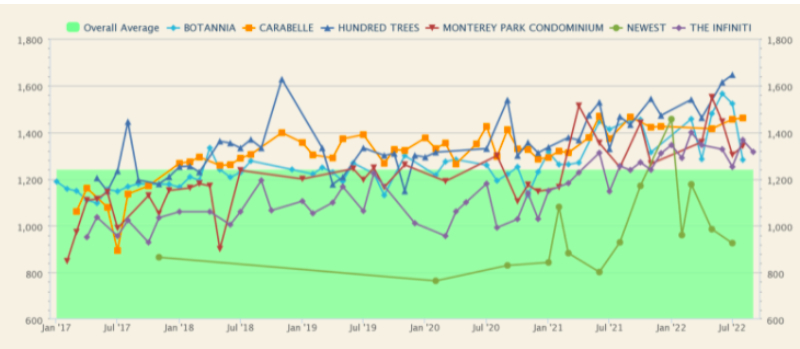

You'll notice from the graphs above that NEWest was launched in 2013 during the market upswing so the developer managed to sell it at a high price. After three rounds of cooling measures were introduced in the same year, the market slowed down all the way until 2017.

From the first graph, we can see that since the launch, NEWest prices are not moving in the same direction as the rest of District five or the overall market in Singapore.

This is probably due to the low number of transactions (only five units changed hands from 2014 - 2017) which caused the graph to spike and dip. However, since 2020 the transaction volume and price have been on the uptrend and in line with the rest of District 5 as well as the overall market.

Transaction volume is an important factor to take note of when purchasing any property and especially so for smaller developments like NEWest. In order for prices to move, there has to be a consistent flow of transactions because the banks value a property based on recent transactions in the development.

For instance in NEWest, there were no units sold from 2018 - 2019, so when sellers were trying to sell their units in 2020, the banks will have to base the valuation on the last transacted unit which was in 2017.

2021 saw 10 units being transacted which translates to a turnover rate of 7.35 per cent and currently for 2022, there have been eight units sold which is a 5.88 per cent turnover rate and these are healthy numbers.

Now let's take a look at how NEWest is performing in comparison with other projects in the vicinity:

| Project | Tenure | Completion | No. of units | Avg PSF (Jan 2020 – Sep 2022) |

| Monterey Park Condominium | 999 years from 1885 | 2005 | 280 | $1283 |

| The Infiniti | Freehold | 2008 | 315 | $1199 |

| Botannia | 956 years from 1928 | 2009 | 493 | $1306 |

| Carabelle | 956 years from 1928 | 2009 | 338 | $1364 |

| Hundred Trees | 956 years from 1928 | 2013 | 396 | $1413 |

| NEWest | 956 years from 1928 | 2017 | 136 | $1015 |

Source: Edgeprop

The other projects in the vicinity either have the same tenure at 956 years or have a 999 years lease or are freehold. Even though NEWest is the youngest of the lot, it is not performing as well as the others. You can see from the graph that there is a clear price disparity between NEWest and the five other projects.

This could be due to it being a smaller development and has less facilities that cater to families which form the majority of home buyers in this area. It does have a commercial element to it, and there's even more commercial than residential here with 141 commercial to 136 residential units. The problem is you don't have an anchor tenant here, and with so many small commercial units and no real curation it's hard to get the right mix of tenants to drive crowd demand.

Another reason could just be down to the unit mix. With more than half being townhouses, and the rest a mix of small units, the type of clientele here will be quite a mixed bag.

| Project | No. of units | Rental volume (Jan 2021 – Dec 2021) |

Per cent of units rented out |

| Monterey Park Condominium | 280 | 44 | 15.7 |

| The Infiniti | 315 | 65 | 20.6 |

| Botannia | 493 | 108 | 21.9 |

| Carabelle | 338 | 66 | 19.5 |

| Hundred Trees | 396 | 116 | 29.3 |

| NEWest | 136 | 59 | 43.4 |

Source: Edgeprop

Looking at the rental volume in 2021, you'll see that NEWest has the highest rental transactions which means a high percentage of owners in the development are investors.

This could adversely affect owners in the project who are buying for own stay purposes because investors will go wherever they can get a better bang for their buck and are more willing to cut their losses and move on as compared to genuine home owners who may be more sentimental about their home.

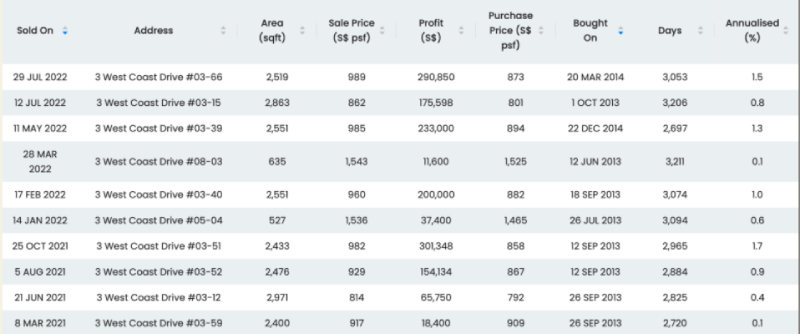

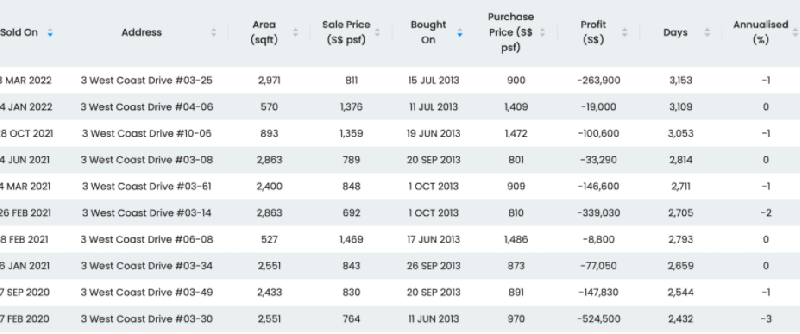

There has been 23 sub sale and resale transactions in NEWest, out of which 11 are profitable and 12 are unprofitable.

Profitable transactions:

Unprofitable transactions:

Now that we have a better understanding of the two properties you guys own, let's run through your options!

Option 1: Sell the EM to cash out on the profits and buy another property

As we do not have your exact numbers, we will not be able to do a detailed calculation and will have to base most figures on assumptions.

Since the flat reached its MOP in 2021, this means it was purchased in 2016. Using the average PSF of $359 for executive units transacted in Choa Chu Kang in 2016 and a size of 146 sqm (~1,572 sq ft), the estimated purchase price is $564,348. We will round it down to $564,000 for easy calculation.

| Description | Amount |

| Purchase price | $564,000 |

| Assuming 90 per cent loan (25-year tenure) | $507,600 |

| Monthly repayment at 2.6 per cent interest (Assuming you take a HDB loan and pay half of the monthly mortgage in cash and half with CPF) |

$2,303 |

| 10 per cent CPF downpayment | $56,400 |

| BSD (Paid with CPF) | $11,520 |

If you were to sell it at the current average price of $739,000, you should be able to cash out approximately $157,938.

| Description | Amount |

| Sale price | $739,000 |

| Outstanding loan | $430,605 |

| CPF refund | $150,457 |

| Cash proceeds | $157,938 |

This is possible in the current market due to the surge in demand for properties. In a normal market situation, a general observation is that when most leasehold properties hit 21 years of age, prices usually start to show signs of stagnation and gradual decline as they get older. So it could be a wise choice to take advantage of this high point in time to cash out on the property.

To be eligible for a loan amount of $507,600 at that point in time, your husband will have to minimally be drawing a fixed income of $9,000/month with no other loan obligations. Now let's calculate his affordability should you decide to sell the EM and purchase another property.

| Description | Amount |

| Maximum loan (for pte ppty) based on fixed income of $9,000/month and age 38 | $979,794 |

| Monthly repayment at 4 per cent interest | $4,950 |

| CPF funds (we will just use the assumed amount of CPF refund from the sale of the EM) | $150,457 |

| Cash (using sales proceeds from the sale of the EM) | $157,938 |

Using the cash and CPF funds (total $308,395) for the 25 per cent downpayment, the maximum purchase price is $1,233,580. Do note that we have not taken BSD into consideration.

Currently, with $1.2M, there is only one new launch unit on the market that will be suitable:

| Project | District | Tenure | Size (sqft) | Type | Level | Price | PSF |

| The Venue | 13 | 99 years | 753 | One bedroom | #02 | $1,200,000 | $1,594 |

For resale, there will be more choices. These are some younger developments on the market with decent gross rental yields:

| Project | District | Tenure | Completion | Size (sqft) | Type | Asking price | Avg rent (last three months) | Rental yield |

| Parc Riviera | 05 | 99 years | 2019 | 710 | 2b2b | $1,198,888 | $3,502 | 3.5 per cent |

| Gem Residences | 12 | 99 years | 2019 | 592 | 2b1b | $1,100,000 | $3,280 | 3.6 per cent |

| Kingsford Waterbay | 19 | 99 years | 2018 | 678 | 2b2b | $890,000 | $2,980 | 4 per cent |

| Eight Riversuites | 12 | 99 years | 2016 | 700 | 2b2b | $1,140,000 | $3,304 | 3.5 per cent |

That said, these may or may not be suitable for you, it will be best to consult an agent for further analysis.

At 5.68 per cent, the HDB definitely is no doubt giving you a better rental yield. It is usually the case that an HDB has a higher rental yield than a condominium due to the lower purchase price. Let's also not forget, you will have to account for the monthly maintenance for the condo too, which results in an even lower overall yield.

Though if you take into consideration lease decay, it may be wiser to trade the HDB for a private property that still has the potential for capital appreciation or at the very least better value retention.

Let's do a 10-year projection.

If you were to hold on to the HDB and continue renting it out:

| Description | Amount |

| Assuming a 2 per cent growth annually | $900,837 |

| Original purchase price Current Valuation | $564,000 $739,000 |

| Interest costs (Assuming outstanding loan of $430,605 at 2.6 per cent interest with 19 years tenure remaining) | $86,204 |

| Rental ($3,500/month up till Feb 2025, thereafter at $2,500/month for 11 months a year – assuming 4 per cent yield for prudence here given the current extraordinary high market rental yield) | $313,000 |

| Agency fees if you engage an agent (Assuming you already paid for the current tenancy till 2025) | $10,238 |

| Cost of repairs/replacements (Assuming $1,000/year) | $10,000 |

| Property tax (Assuming $3,000/year) | $30,000 |

| Estimated gains | $513,395 $338,395 |

Editor's Note (8 Oct 22): Previous calculations used the purchase price of the HDB to estimate gains. This was incorrect since it would not be a fair comparison to other options the homeowner could take as the value of the flat should be considered at the point of the decision since the gains from the past are irrelevant.

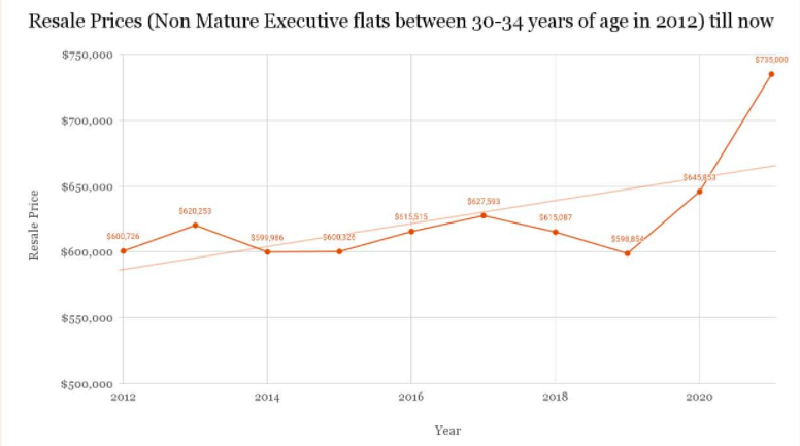

You might be thinking: 2 per cent growth per annum may sound a little far-fetched for an HDB that's already 30+ years of age. However, we plotted the prices of executive flats in non-mature estates that were between 30-34 years of age in 2012 and tracked their prices till recently:

Looking at the trajectory executive flats are taking, it is plausible for an executive unit in a non-mature estate to cost up to $900K in the future - even at this age. Needless to say, it would also mean that other HDBs would cost more by then too.

If you were to sell the HDB and purchase another property:

| Description | Amount |

| Assuming a 3.3 per cent growth annually | $1,231,383 |

| Original purchase price | $890,000 |

| Interest costs (Assuming loan of $581,605 at 4 per cent interest with 27 years tenure) | $201,494 |

| Rental ($2,250/month for 11 months a year – assuming 3 per cent yield) | $247,500 |

| Agency fees if you engage an agent | $13,163 |

| MCST (Assuming $300/month) | $36,000 |

| Cost of repairs/replacements (Assuming $1,000/year) | $10,000 |

| Property tax (Assuming $3,000/year) | $30,000 |

| Estimated gains | $298,226 |

Presuming you purchase the Kingsford Waterbay unit at $890,000

A 3.3 per cent growth rate is assumed here - this is based on the average growth of private property prices in the past 10 years.

Do note that these projections are just paper estimates to serve as a rough guide and may not be the most accurate as market situations can change like rental demand and price, etc.

Option 2: Hold on to the EM and continue renting till much later

From the projections done for Option 1, we can see that you will still be making a tidy profit of $513,395 $338,395 (based on today's valuation, not purchase price) if you continue holding on to the EM and renting it out for the next 10 years. However, by then, the flat will be 42 years old with a remaining lease of 57 years.

This means buyers below the age of 38 will not be able to fully utilise their CPF funds for the purchase, and their CPF housing grants and HDB loan will also be pro-rated. As you have rightly mentioned, this might limit your pool of potential buyers.

As before, since we do not have your exact numbers, the figures used are based on assumptions.

| Description | Amount |

| Purchase price for NEWest | $2,300,000 |

| Assuming 75 per cent loan (28-year tenure) | $1,725,000 |

| Monthly repayment at 4 per cent interest (Assuming you pay half of the monthly mortgage in cash and half with CPF) |

$8,542 |

| 5 per cent cash downpayment | $115,000 |

| 20 per cent CPF downpayment | $460,000 |

| BSD (Paid with CPF) | $76,600 |

Let's say you were to sell the NEWest unit in 2024 so that SSD will not be incurred, recent prices have already hit $2.4 - 2.5 million so this would seem to be realistic.

| Description | Amount |

| Sale price (Assuming 3.3 per cent growth annually) | $2,535,297 |

| Outstanding loan | $1,618,381 |

| CPF refund | $737,618 |

| Cash proceeds | $179,298 |

And we’ll presume you sell the HDB in 2025 after the lease is up:

| Description | Amount |

| Sale price (Assuming 2 per cent growth annually) | $784,233 |

| Outstanding loan | $361,391 |

| CPF refund | $224,230 |

| Cash proceeds | $198,612 |

\In order to be eligible for a loan of $1,725,000 (your wife purchased NEWest in 2021), your wife's income needs to be minimally $16,000/month with no other loan obligations.

From the calculations previously, we have also determined your income is minimally at $9,000/month. We'll use these numbers to do up your affordability.

| Description | Amount |

| Maximum loan based on a fixed combined income of $25,000/month and age 41 (in 2025) | $2,543,043 (24 years tenure) |

| Monthly repayment at 4 per cent interest | $13,750 |

| Combined CPF (After refund from the sale of both properties) | $961,848 |

| Cash from the sale of both properties | $377,910 |

| Total loan + CPF + Cash | $3,882,801 |

| BSD based on $3,882,801 | $139,912 |

| Estimated budget | $3,742,889 |

With a budget of $3.7M you can definitely get a decently sized freehold/999 years leasehold landed property which if you are planning to stay for a long term, will be a wise choice as there is greater potential for growth.

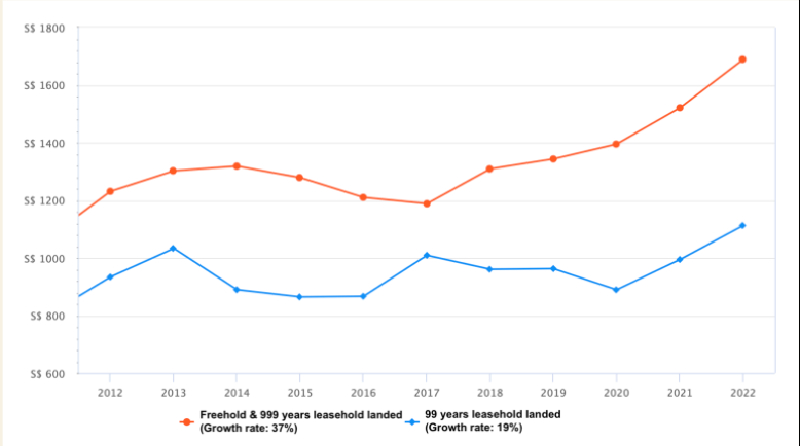

From the graph above, we can see that there is a distinct disparity between the prices for a freehold/999 years leasehold landed and a 99 years leasehold landed. The demand for a freehold/999 years leasehold landed has been growing over the years which is pushing prices north.

We have written about this previously, you can read more on that here.

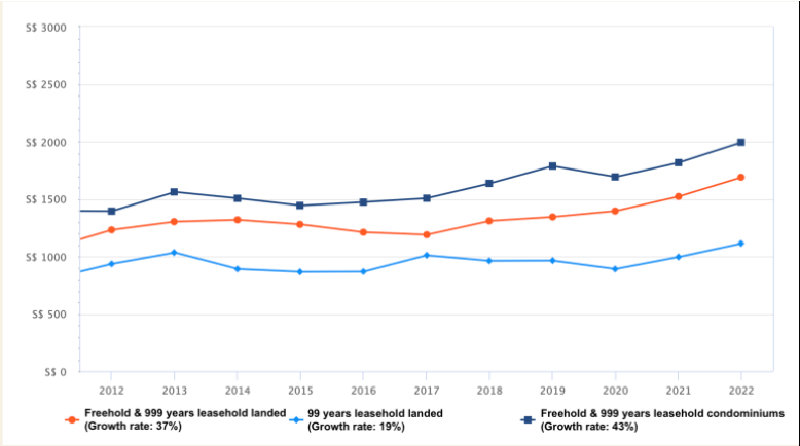

Another property type you can look into is a freehold/999 years leasehold condominium. It is also performing just as well as a freehold/999 years leasehold landed. The graph above also includes new launches which probably explains why the average prices of condominiums is higher than that of landed.

Let's take a look at the 10-year projection if you were to purchase a landed property at $3.7M:

| Description | Amount |

| Assuming a 3.3 per cent growth annually | $5,119,234 |

| Original purchase price | $3,700,000 |

| Interest costs (Assuming loan of $2,360,242 at 4 per cent interest with 24 years tenure) | $777,230 |

| Estimated gains | $642,004 |

Since you are considering a landed property, we assume you are looking for something spacious. These are some freehold & 999 years leasehold 4-bedroom units under $3.7M that are currently on the market:

| Project | District | Tenure | Completion | Size (sqft) | Type | Asking price |

| The Arte | 12 | Freehold | 2012 | 1,873 | 4b3b | $3,280,000 |

| Belmond Green | 11 | Freehold | 2004 | 1,959 | 4b3b | $3,500,000 |

| Aspen Heights | 09 | 999 years | 1998 | 1,592 | 4b3b | $3,550,000 |

| Pandan Valley | 21 | Freehold | 1979 | 2,217 | 4b4b | $3,300,000 |

As before, these units may or may not be suitable for you and it's best to consult an agent for further analysis.

That being said, do remember that this option will not be able to provide you with any passive income unlike if you were to own 2 properties and rent out one. Passive income could be helpful in your retirement years.

Also, in order to realise the capital gains, you'll have to sell the house which will affect your living situation. Owning two properties will give you more flexibility in this sense, so let's take a look at this option as well!

Wife's affordability (Purchase own stay property)

| Description | Amount |

| Maximum loan based on a fixed income of $16,000/month and age 41 (in 2025) | $1,627,548 (24 years tenure) |

| Monthly repayment at 4 per cent interest | $8,800 |

| CPF funds (After refund from the sale of NEWest) | $737,618 |

| Cash from the sale of NEWest | $179,298 |

| Total loan + CPF + Cash | $2,544,464 |

| BSD based on $2,544,464 | $86,379 |

| Estimated budget | $2,458,085 |

These are some available three-bedroom freehold or 999-year leasehold units available on the market at the moment:

| Project | District | Tenure | Completion | Size (sqft) | Type | Asking price |

| The Calrose | 26 | Freehold | 2008 | 1141 | 3b3b | $2,080,000 |

| The Waterina | 14 | Freehold | 2005 | 1227 | 3b3b | $2,390,000 |

| Parc Palais | 21 | Freehold | 2000 | 1313 | 3b3b | $1,925,000 |

| Park East | 15 | Freehold | 1994 | 1346 | 3b3b | $2,200,000 |

Husband’s affordability (Purchase investment property)

| Description | Amount |

| Maximum loan based on a fixed income of $9000/month and age 41 (in 2025) | $915,496 (24 years tenure) |

| Monthly repayment at 4 per cent interest | $4,950 |

| CPF funds (After refund from sale of HDB) | $224,230 |

| Cash from sale of HDB | $198,612 |

| Total loan + CPF + Cash | $1,338,338 |

| BSD based on $1,338,338 | $38,134 |

| Estimated budget | $1,300,204 |

For the investment property, we can refer to the list of available units from Option one.

Let’s now look at the 10-year projection if you were to purchase one property each:

| Description | Amount |

| Assuming a 3.3 per cent growth annually | $3,043,869 |

| Original purchase price | $2,200,000 |

| Interest costs (Assuming loan of $1,283,084 at 4 per cent interest with 24 years tenure) | $440,734 |

| Estimated gains | $403,135 |

Presuming you purchase the Park East unit at $2,200,000

| Description | Amount |

| Assuming a 3.3 per cent growth annually | $1,231,383 |

| Original purchase price | $890,000 |

| Interest costs (Assuming loan of $467,158 at 4 per cent interest with 24 years tenure) | $153,836 |

| Rental ($2,250/month for 11 months a year – assuming 3 per cent yield) | $247,500 |

| Agency fees if you engage an agent | $13,163 |

| MCST (Assuming $300/month) | $36,000 |

| Cost of repairs/replacements (Assuming $1,000/year) | $10,000 |

| Property tax (Assuming $3,000/year) | $30,000 |

| Estimated gains | $345,884 |

Presuming you purchase the Kingsford Waterbay unit at $890,000

Based on the above projections, if you were to purchase one property each, at the end of 10 years, the estimated gains is $749,019. You’ll notice that the monthly repayment if you were to buy a landed property at $3.7M is the same as if you were to purchase two separate properties and take the maximum loan.

| Options | Profit after 10 years |

| 1: Sell the EM to cash out on the profits and buy another property | $298,226 |

| 2: Hold on to the EM and continue renting till much later | $338,395 |

| 3: Sell both properties and buy a landed property | $642,004 |

| 4: Sell both properties and buy one under each name | $749,019 |

Editor's Note (Oct 8 22): Added summary table for better comparison

Option one should be an option you guys should mull over seriously. Although the HDB is giving you good rental returns, the lack of growth relative to other property options is a potential issue if you were to hold on to it for a long period of time.

Seeing that you have two children that you are planning to leave the properties for, an older HDB might not be the best choice despite the rental yields. It's hard to say at this point how the HDB market would change in the future, especially once the current older generation passes on and leaves behind their older flats for their children who already own a flat. No one will be able to predict the measures that will come up (just like the current cooling measures).

Editor's Note (Oct 8 22): It must be added that the growth of NEWest was not considered in options one and two here. If so, then the returns would be higher.

Due to the unique market circumstances, you're still able to cash out a tidy profit if you were to sell the HDB today. It is logical to take advantage of this now and swap the HDB to another property that could possibly generate better returns in the longer run.

[[nid:530200]]

Just as we've mentioned above, holding on to the HDB for the long term may not be the best course of action so Option 2 would be last on our list.

As for Option three, buying a landed property to stay in is nice for sure given the amount of space and privacy you'll get. If you're planning to stay for the long term, getting one that is freehold or 999 years leasehold will more likely have better value retention and a higher chance of capital appreciation.

However, this option does not give you flexibility unlike owning two properties where you can sell the investment property whenever it becomes profitable without affecting your living situation.

Ultimately, as we mentioned at the beginning, the choice really boils down to your lifestyle and what you want in the future for you and your kids. If you feel that having more space for your kids to grow up in, and want the safety net of a solid asset, it's hard to look past a freehold landed property. Likewise, when it comes to enjoying the space and privacy that a landed home affords, you can't really put a price tag on that.

Owning two private properties may give you more flexibility, and to a certain extent, cash flow as you get older, but it does not give you the freedom of space or the lifestyle for your family. Given that you've purchased a townhouse at NEWest likely for more space for the kids and are considering a landed home, the lifestyle benefits for your family do seem to take precedence. While your budget isn't small by any means, splitting it into two does definitely mean that you will have to compromise on the family home

This article was first published in Stackedhomes.