What are the best financial products for your 20s?

You're in an exciting part of your life if you are in your 20's. At this stage, you are finishing up your education, beginning your career and setting up plans for your future. On average, people in their 20's are just starting to make money and will most likely be single and still living at home.

In some cases, you may be renting a flat or live in a condo. However, what is most important about this age group is that financial independence is still a relatively new concept and unlike the prior years, the burden of bills shifts from the parents to the young adult.

So what are the best financial products for people in their 20's? We explore below.

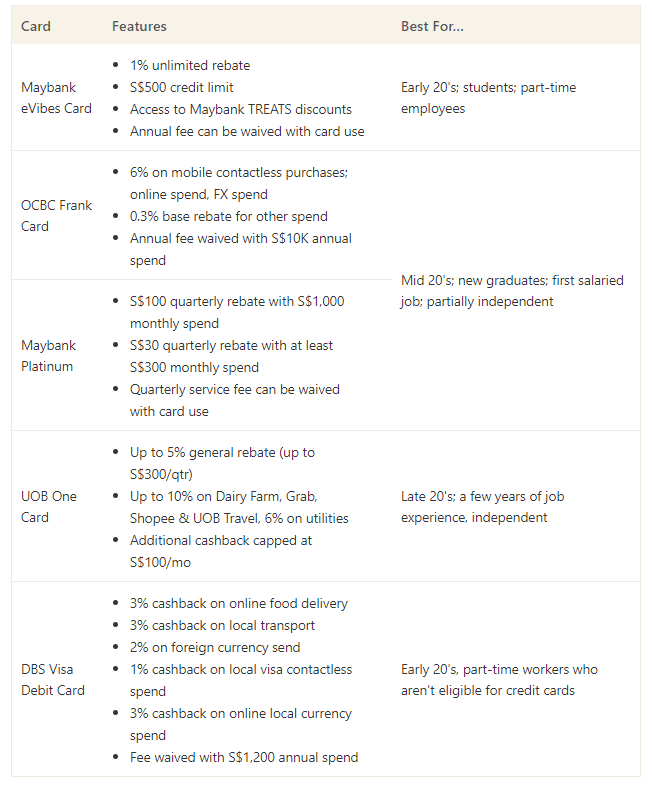

If you are currently in your first job or working part-time while going to school, then the best credit or debit card for your needs will be one that matches your spending habits, has low fees and doesn't require a high monthly spend.

As you move up in your career and begin earning more, you can upgrade to a card that may require an annual fee in exchange for higher cashback and rewards. Since credit cards typically have a minimum income requirement of $30,000, university students may fare better with a debit card.

An example of a student-friendly debit card is the DBS Visa Debit Card provides three per cent cashback on online food orders (perfect for the busy student), one per cent on all local spend and a low monthly minimum spend of $500.

If you do make above the minimum annual salary required for most credit card accounts, then you should look for cards that have low annual fees and provide rewards for things you care about (food shopping, activities, online shopping, etc.).

Two examples are the OCBC Frank Card and the Maybank Platinum Visa. Both waive their annual fee if you spend a reasonable amount per year and they offer either rebates or cashback on things most young adults need like online spending, mobile contactless spending and FX transactions.

[[nid:527110]]

For young students in university looking to build their credit scores, you can look for credit cards with low credit limits to avoid overspending. An example can be the Maybank eVibes card, which has a low monthly limit of $500, but still offers generous rewards and perks.

If you are out of university and are several years into a high paying career, then your credit card needs will change. At this stage in your life, you have a stable income and you are taking control of more bills. You may have found a partner and are sharing a home together.

In this case, a card like the UOB One Card will be a suitable upgrade. This is because in addition to the five per cent flat rebate, it also offers cashback on things you have started paying for like, Grab, Shopee, utilities and travel.

It's better suited for younger people with stable careers, rather than university students, since its rewards rates are maximised when there is at least $2,000 of spending per month.

If you are still quite young and living with your parents, then you won't need to worry about large bills like a mortgage or car loan. Because of this, your focus should be on saving as much as you can for your future goals like a flat, wedding or car.

As a rule of thumb, you should be saving around 20 per cent of your take home pay, or around $481 - $694 per month.

[[nid:524452]]

At this stage you may also not have a large chunk of change to be putting into high-yield savings accounts, CDs or investment portfolios, so it's a good time to start saving with simple savings accounts.

At this age, we recommend looking for savings accounts that have low balance fees, no minimum deposit requirement and don't require a high daily balance.

A couple examples are the POSB Everyday Savings Account, which can be good for NSFs or those under 21, and the OCBC Frank Savings Account, which also has no minimum initial deposit waives its fall-below fees and has no minimum average daily balance for account holders younger than 26.

Lastly, a different type of savings account that can be useful for when you're in your 20's is one that automatically withdraws savings from your paycheck. An example of this is the POSB Save As You Earn account, which will be linked to your POSB or DBS debit account.

Every month, the sum you request will be deposited into the PAYE account. You'll also get rewarded with higher interest rates if you deposit more than $300 per month, which is useful if you are still learning about being financially responsible adult and would like to feel incentivised to save.

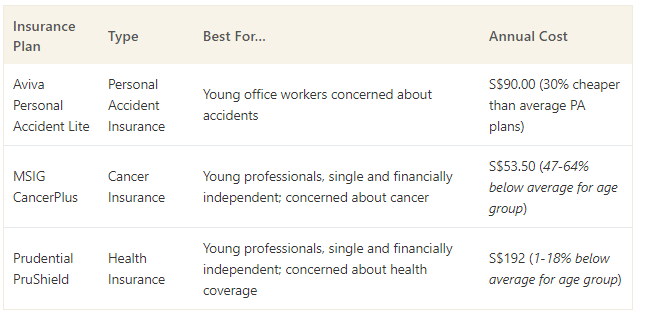

When you are starting your career and getting ready to settle down independently, it will also be necessary to have some type of insurance. In most cases, insurance plans will come in handy when you own property and have a steady income.

In your mid-20's there aren't a lot of insurance plans that are really required, besides health insurance, critical illness insurance and any mandatory insurance plans like home and car.

Firstly, health insurance is useful because it will provide full coverage (minus the copayment) if you get hospitalised.

With health insurance plans, we recommend looking at which one is the cheapest for your age group and preferred hospital ward. In most cases, we found Prudential is the cheapest for the average, healthy young professional.

If you're one of 20 - 25 per cent who own a car at this age, then it will also be worth it to shop around for car insurance instead of settling on plans you may have gotten at the dealership.

As with any insurance policy, you should take note of premiums and coverage, as there are plans on the market that may be cheaper for your age group or have a smaller young driver excess.

For instance, you can opt for Aviva's Lite car insurance plan, which provides comprehensive coverage for rates that are 30 per cent cheaper for drivers in their 20's compared to the market average.

They also offer an additional 15 per cent discount for MINDEF drivers. If you have an excellent driving record, then you can opt for price over coverage. For instance, Budget Direct, has one of the lowest premiums on the market and lets you customise coverage so you only pay for what you need.

There are a few proponents of getting term life insurance while you're in your 20's. The theory is that you can lock in cheaper rates and you are young and in good enough health so that you won't be denied coverage due to age-related pre-existing conditions.

However, do you really need to be spending money on life insurance at this age, even if it's something as simple as Direct Purchase plans?

Looking at the statistics, we see that the death rate has declined between 70 per cent - 83 per cent for 20 - 39 year olds and all four age groups currently have a death rate of 0.5 or less per one thousand persons.

[[nid:458468]]

This, coupled with the fact that DPI term life insurance only costs between $7 - $187 more per year if you buy it in your 30's than in your 20's, it might make more sense to save your money and start thinking about life insurance when you are settled down and have dependents.

Other plans that are discussed for young professionals are critical illness and personal accident insurance. Both types of insurance plans can be found as annual renewal plans, which makes them low commitment compared to life insurance policies.

Looking at the stats, cancer is the most common critical illness and cause of death in Singapore, and with 7.6 per cent of cancer diagnoses occurring in people under 40, critical illness insurance could be something to consider if you are really concerned about affording cancer treatment.

On the other hand, if you are concerned about paying for medical costs if you get into an accident, then personal accident insurance can be an alternative. With both policies though, it's best to get the cheapest plan that's available for the amount of coverage you need.

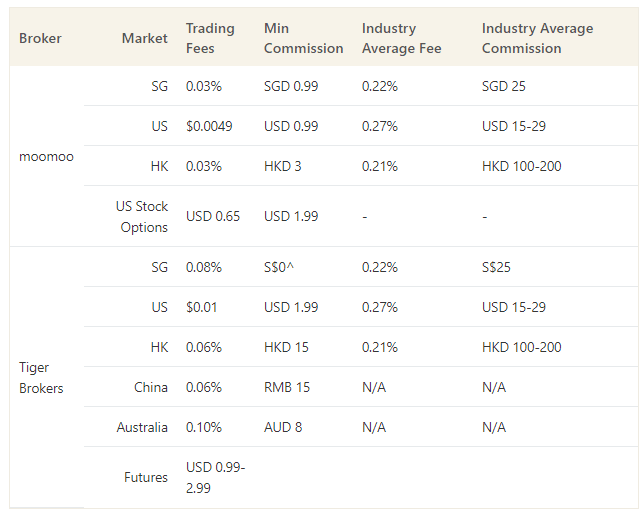

As you begin budgeting and saving, there are a few tools that can help you along the way. If you are savvy with stocks and want to invest your savings, you can opt for an online brokerage.

[[nid:523183]]

Unless you have extensive experience (through your job) in the stock market, we recommend getting a low fee, beginner's brokerage account like moomoo (offered by FUTU) or Tiger Brokers.

Since you are younger and can handle more risk, investing in stocks can be a good way to grow your savings compared to just leaving it in a low yield savings account.

You should just be sure that you do your due diligence before investing, as there is always the risk of losing money.

That said, both of these brokerages also provide clear information on trading rules and risks, as well as market insights to help you make informed investing decisions.

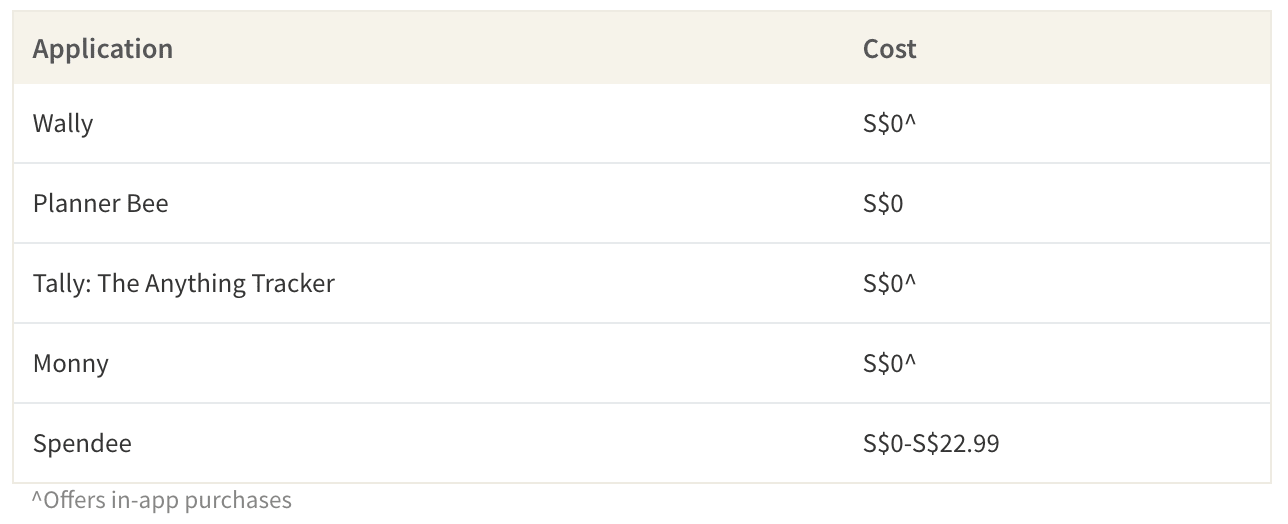

Another thing you can get are budget apps, as they're very useful in helping you keep your finances on track. Many are free and you can use them to track expenses, savings and figure out how to streamline your budget.

To sum up, students and young professionals should be equipped at least with a starter credit card, savings account, simple health or term life insurance and some useful financial budgeting apps.

Young adults with more expendable income and a good understanding of the markets can also choose a simple, low-fee brokerage account so they can grow their savings.

Below is a sample portfolio of financial products that can be useful to students and young professionals. Please note that these are examples of products that can be a good match based on the profile of an average 20 - 29-year-old individual in Singapore.

Your specific needs may differ, and thus these products are not recommendations or solicitations.

This article was first published in ValueChampion.