What causes share prices to increase?

Share price appreciation and dividends are the primary drivers of returns for shareholders.

In an earlier article, I discussed how stock prices are a function of future cash flows to the investor. In much the same light, investors sometimes value stocks based on multiples to earnings or revenue. This is because revenue and earnings is what ultimately drives cash flow to shareholders.

In this article, I discuss how business fundamentals and valuation growth may drive capital appreciation.

The equation below shows the relationship between share price appreciation, valuation, and a company's growth.

Share price appreciation = Earnings/revenue growth X Price-to-earnings/revenue multiple expansion

Put simply, a company's share price is driven by earnings/revenue growth and changes in the price-to-earnings/revenue multiple.

Increases in the price-to-revenue/earnings multiples are usually driven by a better outlook, new information, or market participants appreciating a company's future prospects.

As investors, knowing how stock prices rise can help us to pick stocks.

The sweet spot is to find a company that will grow its earnings/revenue and is also likely to experience valuation-multiple growth.

But companies that can grow revenue/earnings at a quick pace without a valuation multiple expansion can still serve investors very well. For example, a company that is growing earnings at 20 per cent per year, and does not experience a valuation compression, will give shareholders capital appreciation of 20 per cent per year.

Too often, investors focus on the second part of the equation, hoping that valuation-multiple expansion can drive stock price appreciation, without taking into account that business performance also drives stock price performance.

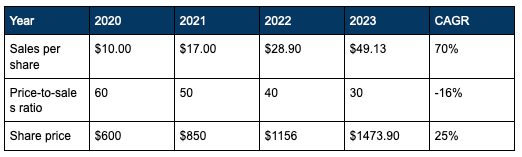

In fact, even if there is a valuation compression, a company can still be a good investment if revenue or profit grows faster than the valuation squeeze. To illustrate this, I came out with a simple example. Let's assume Company ABC grows revenue at 70 per cent per year but is expensively priced at 60-times sales.

The table illustrates what happens to ABC's share price if there is a valuation compression each year.

As you can see, ABC's share price grew a decent 25 per cent per year despite the price-to-sales multiple dropping from 60 to 30. The above example can give us perspective on what we are experiencing in today's investing environment.

There are numerous technology companies that are growing at a triple or high double-digit pace, and are expected to grow at these rates for the next few years. At the same time, their price-to-revenue multiples are so high that is it likely the multiple will fall over the years.

But if the top-line can grow faster than the contraction in the valuation multiple, we will still see the shareholders of these companies be handsomely rewarded.

Before you invest in any richly-priced stock, you must know that high valuation multiples also pose a risk. If a company cannot grow revenues or profits as fast as its valuation contracts, its stock price may fall off a cliff.

As such, investors need to be mindful that a rich valuation also comes at a cost. Valuation contraction can be extremely painful for investors if the company does not live up to the kind of growth that the market is expecting of it.

Deep value investors tend to focus on the second part of the equation, hoping that the market will realise that a company's valuation multiple is too low - when the market becomes aware of its folly, the valuation multiple could expand, which could lead to stock price growth.

But don't underestimate the importance of the first part of the equation- business growth. This is ultimately the longer-term determinant of a company's share price.

Valuation multiples can only expand up to a certain point before the expansion becomes unsustainable, while business growth can continue for years. Business growth can lead to huge stock price appreciation and is to me, the best way to find multi-baggers over the long term.

This article was first published in The Good Investors. All content is displayed for general information purposes only and does not constitute professional financial advice.