What you need to know about en-bloc sales in 2021

For those who remember the en-bloc fever of 2016/17, the current Singapore property market may look a little depressing.

Back then, a certain Stirling Road plot (today Stirling Residences ) made history by selling for $1 billion; and Shunfu Ville (today JadeScape ) raked in an impressive $638 million.

Ever since however, a combination of cooling measures and rising development charges have put out the fire.

That’s why it’s surprising that – in these Covid-19 days – that en-bloc movements may be seeing a revival. And while we don’t think it will be as overheated as 2017, it might be a relief to owners of older condos who have been waiting.

Here’s what you need to know about en-bloc sales in 2021:

Notable changes to the en-bloc scene

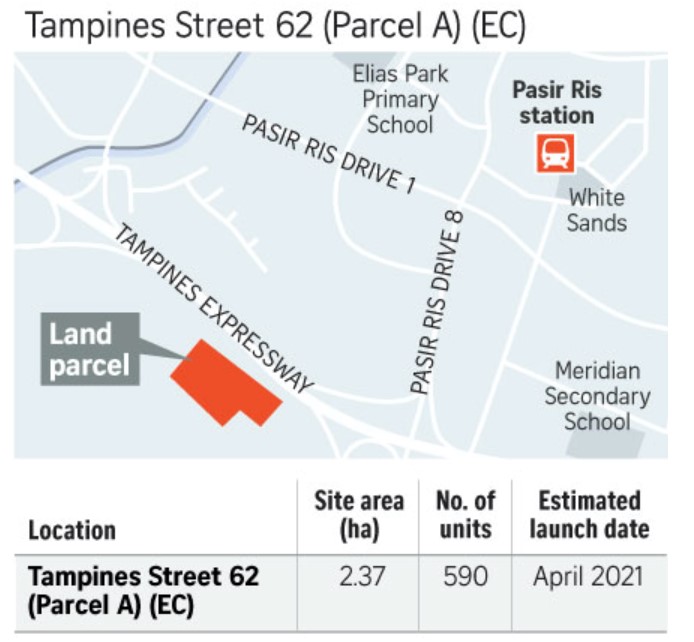

For 1H 2021, there are only three confirmed residential sites (one of which is an Executive Condominium or EC site), which can yield about 1,605 new homes, including 590 EC units.

What’s significant is that this follows a supply cut in 2H 2020. At the time, the government had reduced residential supply by close to a quarter (23 per cent) from 1H 2020. This meant 2H 2020 saw the lowest supply in close to 11 years.

As such, it was expected that – with the Covid-19 situation improving – the government would significantly ramp up supply in 1H 2021 to make up for it.

That hasn’t happened though, and developers may be worrying about their land banks. This is compounded by the limited number of locations: two of the confirmed sites (Slim Barracks Rise, Parcels A and B) are more or less across from each other in One North. The other site is at Tampines Street 62, which is an EC site.

While One-North is a current hot spot, there’s just a lack of options elsewhere. Developers who want to tap on the momentum of District 7 properties, seafront properties in District 16, etc. are stuck with considering en-bloc sales.

So coupled with the healthy uptick in transaction volumes (see below), we do expect more collective sale interest in the coming year.

These were the top few collective sales in 2017, during the last en-bloc rush:

| Old Project | New Project | Units | Take-up Rate |

| Tampines Court | Treasure at Tampines | 2,203 | 77.3 per cent |

| Amber Park | Amber Park | 592 | 41.2 per cent |

| Normanton Park | Normanton Park | 1,862 | 32.3 per cent |

| Eunosville | Parc Esta | 1,399 | 99.6 per cent |

| Florence Regency | Florence Residences | 1,410 | 68 per cent |

| Rio Casa | Riverfront Residences | 1,451 | 93.6 per cent |

Former Serangoon Ville (now Affinity at Serangoon), and Royalville (now RoyalGreen ) have also launched (although RoyalGreen isn’t doing so well on the sales front). As such, we have a situation where many of the 2016/17 en-bloc sales are done with, and developers will be looking for a new slate.

This, coupled with a distinct lack of options from GLS (see above), could push many into the first en-bloc discussions.

To date, the pandemic has given developers only theoretical reasons to slow down. Buyers should be cautious, the economy is rocky, etc. However, those theories ring hollow next to the numbers we’ve seen:

Private homes sales are at their highest point in almost eight years , with last December seeing a 57 per cent rise in transactions from November. Notably, the sales were driven by new launch condos, with Clavon and Ki Residences accounting for over half the transactions in December.

Overall, private home sales ended 2020 up 126.2 per cent from the previous year.

Despite Covid-19, there’s a slew of flats reaching their Minimum Occupation Period (MOP), and clear signals that buyers are willing to take the plunge. It’s unlikely that developers are going to sit on their thumbs and play cautious, while the market roars ahead.

In a move that’s been expected since 2016/17, the government has passed laws restricting proxy votes at condo general meetings.

The cap for proxy holders is now two per cent of the total number of lots in a strata development (or just two lots, if that would be higher). The Ministry of Law also said that:

“We will also improve the form of instrument to appoint a proxy, to allow the proxy giver to explicitly direct his proxy to vote as he intended.”

[[nid:502096]]

According to real estate agents on the ground, this fixes a longstanding issue of abuse. Here’s how it works:

Say a group of people have an interest in pushing for an en-bloc sale. A long time before such any en-bloc meetings, they go around asking owners for the right to vote on their behalf (getting a proxy vote). This may be under the guise of helping them vote on issues like parking fines, changing the cleaners’ routines, etc.

After a while, these people would have amassed a significant number of proxy votes this way. Later during an en-bloc meeting, they use all those votes to push for a collective sale; and it’s not always clear if some of the owners actually gave their consent for such a vote.

There have also been complaints that some owners, such as elderly homeowners, may not understand the significance of giving away their vote.

While the changes are fair and reasonable, there is an issue going forward: there’s a risk of insufficient attendance, which may slow the en-bloc process even if everyone really does agree. This is because more owners now need to be physically present and take the time to vote.

We mentioned this last year, and it still applies this year: developers are more likely to eye smaller developments (those with 300 units or less), when it comes to en-bloc sales.

This is because the five-year Additional Buyers Stamp Duty (ABSD) time limit applies regardless of the development’s size. Whether it’s 20 units or 2,000 units, the developer must finish and sell the project within five years (or pay 30 per cent tax on the land price).

There is some “give” with regard to the deadlines, such as last year’s four-month extension due to Covid-19. Nonetheless, we feel developers will be cautious in this regard, as there’s no telling how the pandemic will affect supply chains and manpower.

Malaysia, for instance, announced a second Movement Control Order (MCO) last week; and the closure of factories in places like Johor can affect construction timetables here.

So while rising sales may be encouraging to developers, we feel they’ll still show a preference toward smaller projects; these are likely to be completed and sold before any unfortunate whims of fate.

This article was first published in Stackedhomes.