What's the maximum interest rate a licensed moneylender can legally charge?

When looking for the best personal loan, licensed moneylenders are a good alternative to banks. Quick, easy and convenient, licensed moneylenders speed up the process, turning what might take weeks into days.

Depending on the type of personal loan, licensed moneylenders are more lenient with their money, allowing them to give loans to a wider variety of people. This makes licensed moneylenders quicker and more ideal for smaller sums.

However, some might feel that personal loans from licensed moneylenders are not as legitimate. This mindset, although valid sometimes , does unfortunately limit one's personal loan options available.

This isn't only detrimental if you need a personal loan fast, but is necessary if you have a lower credit score and are unable to obtain a personal loan from the bank.

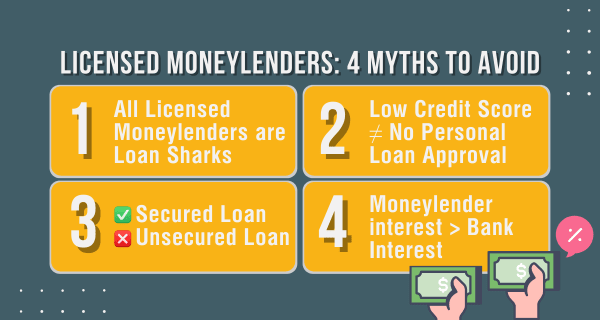

To better understand licensed moneylenders on a balanced scale, below are four common myths you should avoid when considering to borrow from licensed moneylenders.

Loan sharks (or "Ah Longs") are unlicensed moneylenders that use illegal tactics to promote, encourage and lend people personal loans. Often they come through unsolicited telemarketing SMSes and messages surrounding their personal loans.

When one fails to pay, they charge exorbitant interest rates and resort to unregulated harassment methods to chase debts. These tactics often harm neighbourhood communities and might result in unwarranted violence in order to recover their money.

These are the moneylenders that all of us should avoid. Unfortunately, many licensed moneylenders are mistaken to be the same.

Licensed Moneylenders, on the other hand, can be recognised by their licence number. These numbers are administered by the Ministry of Law and are reflected on their completed list of licensed moneylenders on their website.

To compare licensed moneylenders and their personal loan rates according to your needs, Lendela serves as a good option.

Lendela allows users to compare different personalised personal loans offers based on their needs and credit history, so that one can be sure that they are getting a legal personal loan from licensed moneylenders that suits their budget and credibility.

The truth is you can. Licensed Moneylenders are open to providing personal loans to individuals with a low credit score as long they have clear evidence of a steady income stream from a job to repay the loan. They will not charge any surplus interest rates, and occasionally might provide debt consolidation services.

In fact, taking up a personal loan from a licensed moneylender can help improve your credit score. With credit score usually being hard to improve, this is a good opportunity to move it to a better place.

Backed by collateral, secured personal loans are usually favoured upon for low interest rates. It allows borrowers to borrow a higher amount from a licensed moneylender, and allows them to spread their payments across a longer period of time. Examples include mortgage and car loans.

Unsecured personal loans (e.g. student loans), have no collateral involved. Instead, they are granted by a licensed moneylender based on a borrower's trustworthiness.

However, that means it comes without the perks of secured personal loan - higher interest rates while borrowing a lower amount. They also have to pay off their loan as fast as possible.

Though secured loans may appear favourable due to its perks, licensed moneylenders would require more time to process, evaluate and approve the collateral. This makes the borrowing process much slower, which may not be favourable for borrowers who need the money urgently.

To choose the best option, one should consider the reason for the loan. If you are a borrower tight on time, select an unsecured loan. However, if you are able to wait out the entire collateral approval process, secured personal loans might be your best bet.

Licensed moneylenders are actually tightly regulated and they are not able to charge an interest rate higher than the one stipulated by the Ministry of Law.

In fact, the regulations bank faces are slightly more lenient. Despite their interest rates being lower, there are no laws keeping them from charging higher interest rates. This results in some banks charging way higher that licensed moneylenders as a whole.

According to the Ministry of Law, licensed moneylenders can legally charge late interest up to four per cent per month. This limit is effective regardless of it being a secured or unsecured personal loan, and the income that the borrower is earning.

Interest can only be charged on the remaining money that has not been paid. That means if Person A took a personal loan of $10,000 and has paid back $8,000 on time, only the remaining $2,000 should be chargeable for late interest.

Remaining amount that has not been paid:

$10,000 – $8,000 = S$2,000

Therefore, $2,000 is payable for interest

Interest can also be charged only for amounts that have been paid late. For example, Person B took a $10,000 personal loan paid in installments of $2,000. He failed to pay his first instalment. That means only the $2,000 from that late instalment is chargeable for late interest.

Other charges licensed moneylenders can charge according to the Ministry of Law include:

This article was first published in ValueChampion.