Why are there 2 DCS Ultimate Platinum Cards? Should I get 1?

I'm always wary of cards that are marketed as "XX Ultimate" or "XX Platinum". For all their outlandish names declaring "I am the best!", these cards seem to be mostly underwhelming or unattainable-the by-invite-only Citi Ultima Card is a perfect example of the latter.

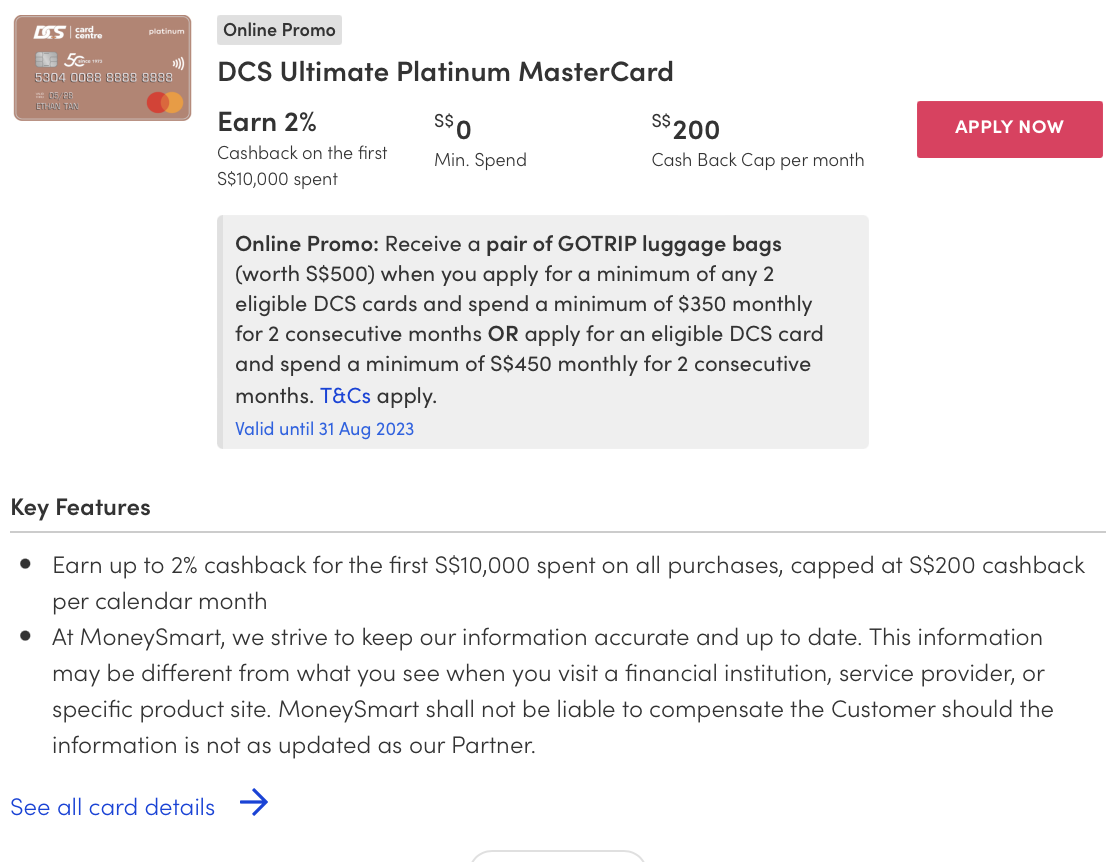

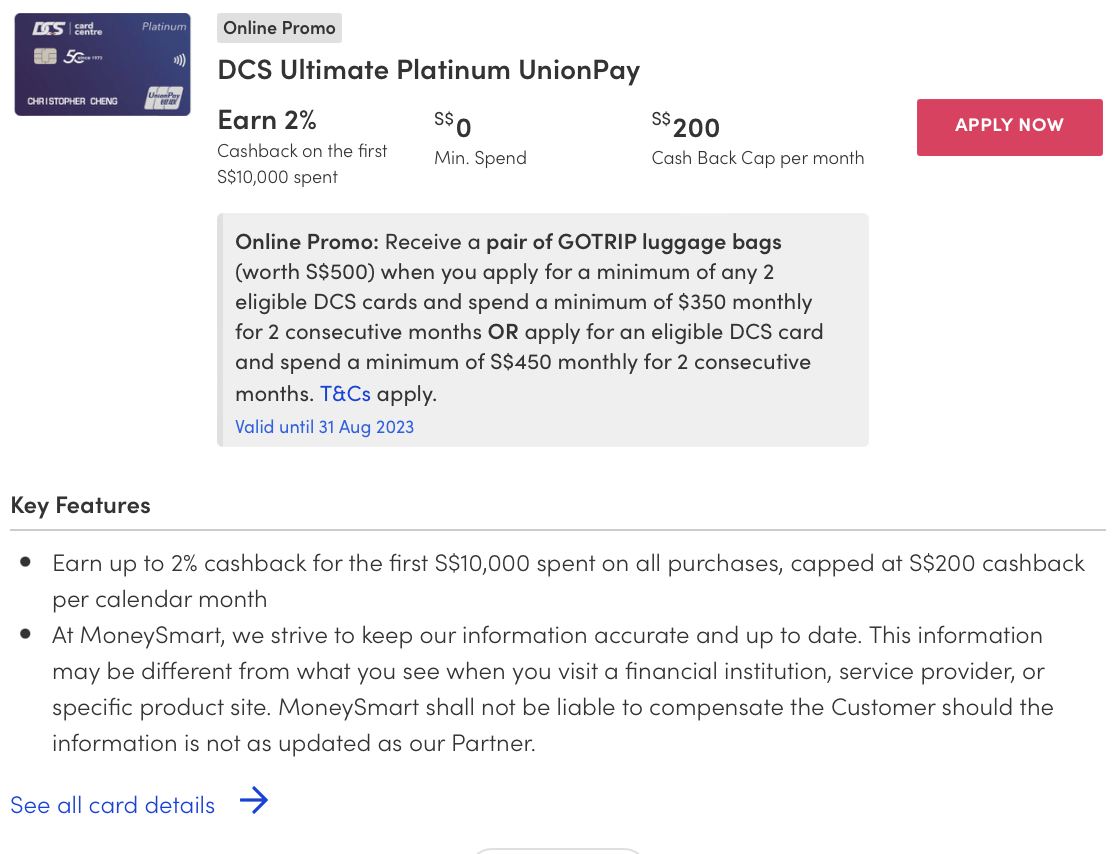

So when I saw that DCS launched a credit card with not just one, but both words in its name, I had my reservations. The DCS Ultimate Platinum comes in two versions-one is the DCS Ultimate Platinum MasterCard, which promises special Mastercard privileges, and the other is the DCS Ultimate Platinum UnionPay, which promises UnionPay perks. Both cards are dubbed "Ultimate Platinum"-but do they really offer a "platinum" level experience? Are they really the ultimate cashback cards?

Let's take a look. We review the DCS Ultimate Platinum Card, including why it could be better than an unlimited cashback card, its member perks, and more.

| DCS Ultimate Platinum Cards Review—Is it MoneySmart? | ||

|

Overall: ★★★☆☆Best for: Entry-level cardholders who want fuss-free cashback for general spending, and who spend $10,000 or less a month (because you’ll hit the cashback cap). |

||

| Category | Our rating | The deets |

| Earn rates: Cashback | 💰💰💰 | – 2per cent cashback on (almost) all your purchases—usual exclusions like insurance and bills apply– No minimum spend– Cashback cap of $200 a month ($10,000 spend)– Fuss-free cashback mechanism: Cashback earned offsets the same month’s credit card bill |

| Earn categories | 💰💰💰💰 | |

| Annual fees and charges | ★★★★☆ | $194.40 (main) / $97.20 (supplementary). First year fee waived. |

| Accessibility | ★★★★☆ | Age requirement: 21 to 65 years oldMinimum income requirement: – Singaporeans & PRs: S$30,000 / S$15,000 p.a. (age 55 & above) – Foreigners: S$60,000 p.a. |

| Extras/periphery rewards | ★★☆☆☆ | Mastercard Priceless Specials privileges:– One Dines Free: 1 complimentary main course (1 per bill) at partner restaurants– One Night Free: 1 complimentary night’s stay at participating hotels – E-Commerce Protection: Up to USD 200/year coverage for online purchases UnionPay exclusive benefits:– Complimentary Sands Rewards LifeStyle Elite tier membership– Up to 15per cent off Agoda hotel bookings– Up to 10per cent off at over 100 International Airport Duty Free Shops |

| Sign-up bonus | ★★☆☆☆ | Get a pair of GOTRIP luggage bags (worth S$500) if you: – Apply for any 2 eligible DCS cards and spend a minimum of $350 monthly for 2 consecutive months; OR – Apply for 1 eligible DCS card and spend a minimum of $450 monthly for 2 consecutive months. Valid till 31 Aug 2023. See the DCS Ultimate Platinum Mastercard page or the DCS Ultimate Platinum UnionPay Card page for the latest promotions. |

The DCS Ultimate Platinum Card is an entry-level, $0 minimum spend cashback card from DCS Card Centre, formerly known as Diners Club Singapore (they renamed themselves in Oct 2022). Offering up to two per cent cashback capped at $200 a month, the card comes in two versions—one Mastercard, and one UnionPay.

Both cards come with the same cashback rates and perks like complimentary insurance. The only differences are these three:

We’re looking at very standard age and income requirements for the DCS Ultimate Platinum cards.

Age requirement: 21 to 65 years old

Minimum annual income requirement:

These are similar to pretty much any other entry-level credit card out there, such as the Citi Rewards Card and Standard Chartered Simply Cash Credit Card.

Like its eligibility requirements, the DCS Ultimate Platinum Card’s annual fees are also pretty standard:

These credit card fees are about as low as they get, aside from cards like the OCBC 90°N Card ($54 annual fee) or better yet, credit cards with no annual fee.

DCS will waive the annual fee for the first year for both your main and supplementary DCS Ultimate Platinum cards (if any). No promises for the years after that, but you can (and should!) always try to waive your card fee.

Now let's get into what the DCS Ultimate Platinum Card was made to deliver: Cashback.

The DCS Ultimate Platinum Card gives you two per cent cashback on (almost) all your purchases with no minimum spend required. If you've taken a look at the DCS Ultimate Platinum Card page, you may notice that its marketing materials say "two per cent cashback* on all purchases" with a very sus looking asterisk. That's because there are two catches to this two per cent cashback.

Firstly, the two per cent cashback is capped at a monthly spend of S$10,000, or S$200 cashback each month. If you know you're going to spend more than 10 grand a month, opt for an unlimited cashback card instead.

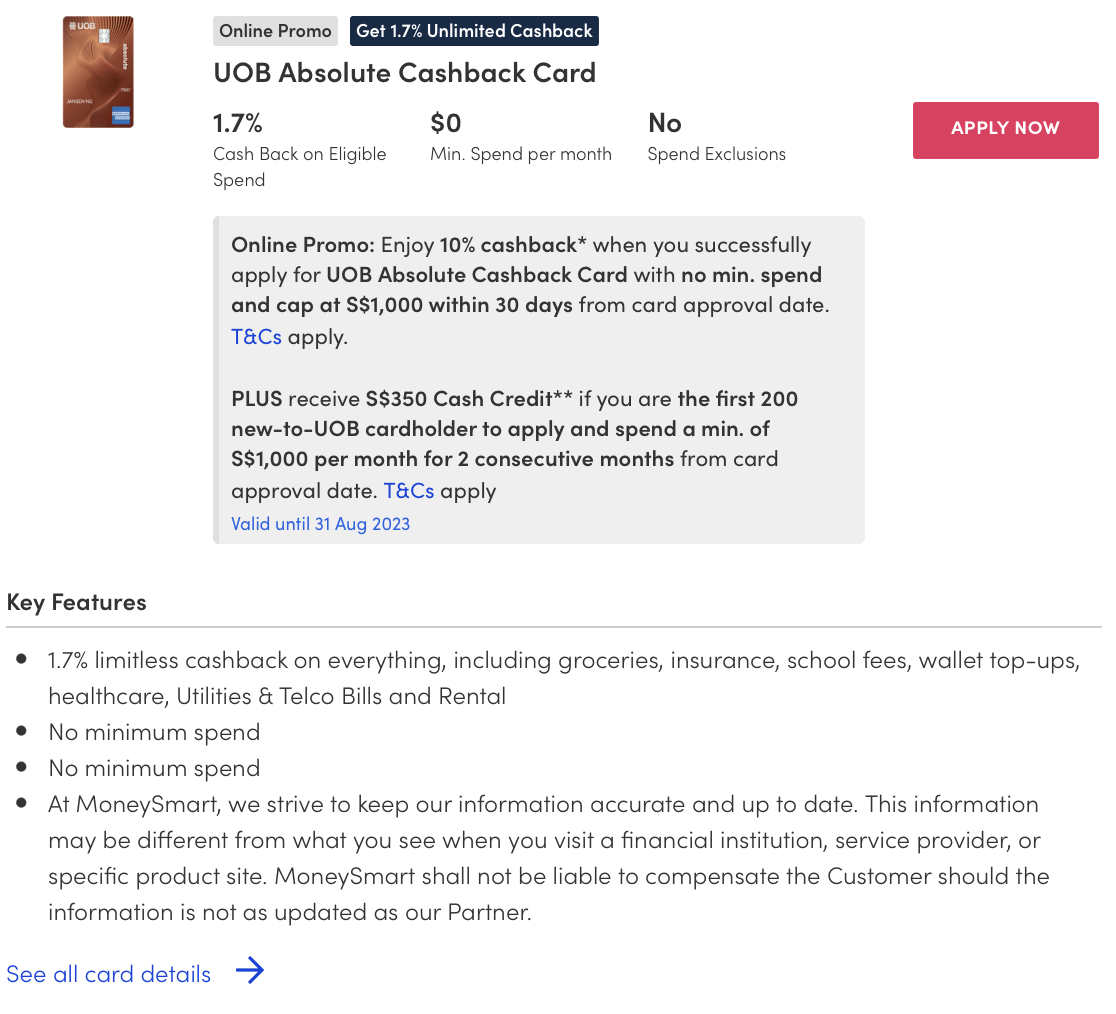

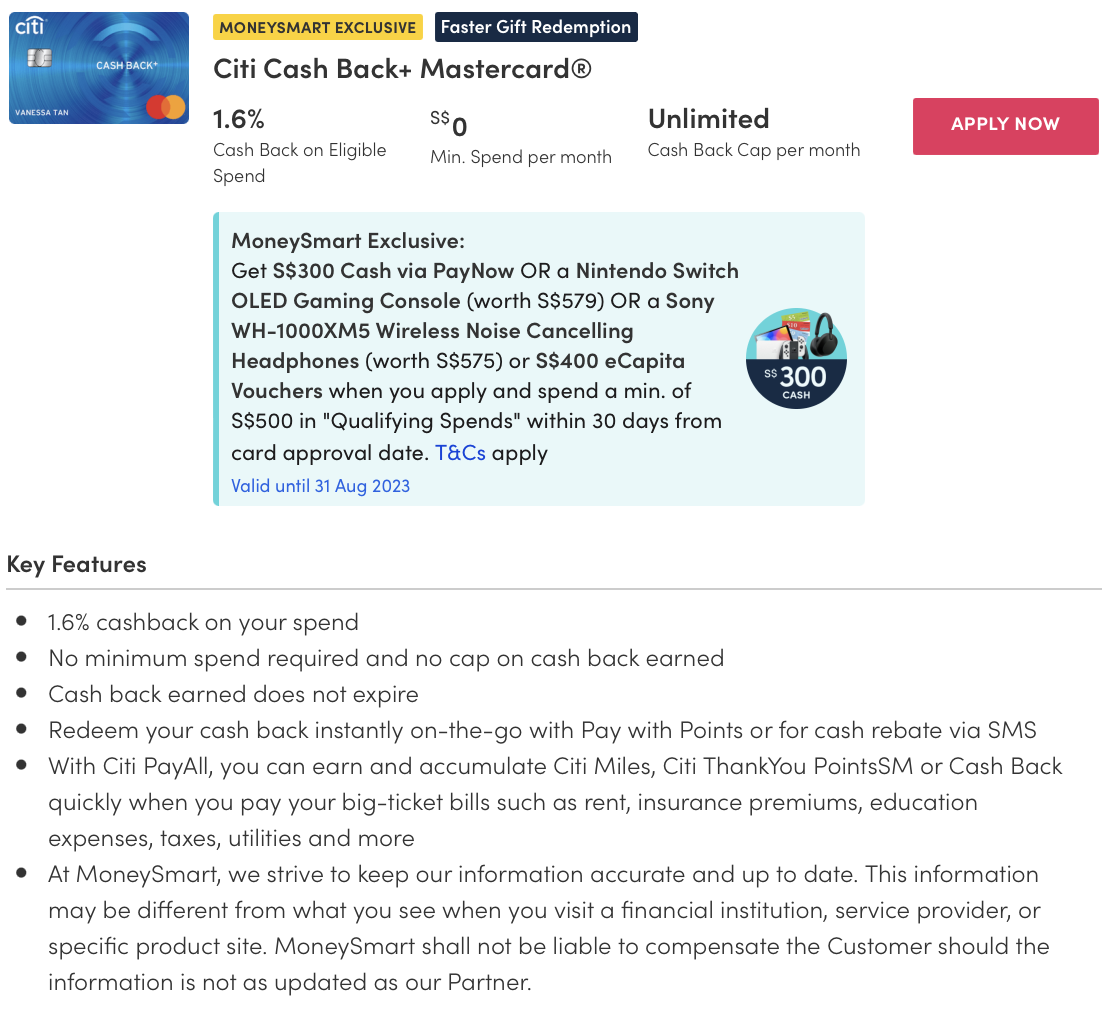

These probably won't come with as high a cashback rate, but at least you've got no cashback cap. You can consider the UOB Absolute Cashback Card (1.7 per cent cashback), the Citi Cash Back+ Card (1.6 per cent cashback), or the Standard Chartered Simply Cash Credit Card (1.5 per cent cashback).

Secondly, as for most cards, cashback cannot be earned on things like insurance payments and mobile wallet top-ups, like your EZ-link card, ShopeePay or Grab Wallet. For the full list of exclusions, you'll have to dig through the T&Cs of the DCS Ultimate Platinum Card, from pages four to six.

The DCS Ultimate Platinum Card is a general spending card. It has no bonus cashback categories, unlike cashback cards like the Citi Cash Back Card, OCBC 365 Credit Card, or HSBC Visa Platinum Credit Card. However, these cards come with certain minimum spends you have to hit each month in order to enjoy the bonus cashback rates:

| Cashback credit card | Bonus cashback | Minimum spend (monthly) |

| DCS Ultimate Platinum Card | None. Base cashback of 2per cent for general spending | $0 |

| Citi Cash Back Card | 8per cent on dining, groceries and petrol | $800 |

| OCBC 365 Credit Card | 5per cent on local dining and groceries | $600 |

| HSBC Visa Platinum Credit Card | 5per cent on local and overseas dining | $800 |

What does this mean for you? The DCS Ultimate Platinum Card is a good choice if you aren't going to spend at least $600 to $800 a month to hit higher bonus cashback other cards offer, and/or if you won't spend a lot in particular categories like dining. But remember, if you're going to spend more than $10,000 a month, you'll bust the cashback cap. As mentioned in the previous section, consider an unlimited cashback card instead.

The cashback system of the DCS Ultimate Platinum Card is my personal favourite kind of cashback mechanic. It's as simple as cashback gets: DCS will use the cashback you earn to offset your credit card bill.

Here's an excerpt from Clause 4.4 of the DCS Ultimate Platinum Card T&Cs, with my emphasis added in bold:

"The Cashback is in Singapore Dollars, and is computed on a full calendar month basis, rounded up to the nearest two (2) decimal places for every eligible Card Transaction, based on the total amount of Card Transactions charged to the Card Account. The Cashback shall be credited to your SoA statement within the same month and, where applicable, shall be applied to offset against billed amount."

Basically, DCS will give you an automatic two per cent discount on your spending that month, capped at $200. It's the least fussed cashback mechanism, especially compared to other banks that may give you reward points that you have to redeem yourself.

Rewards programmes have the advantage of giving you the flexibility to get other types of rewards from a rewards catalogue, but if you want cashback plain and simple, the DCS Ultimate Platinum Card is worth considering.

Mastercard or UnionPay? These are the two versions of the DCS Ultimate Platinum Card you can choose between, and each come with a different set of benefits.

| DCS Ultimate Platinum Mastercard: Mastercard Priceless Specials privileges | DCS Ultimate Platinum UnionPay Card: UnionPay exclusive benefits |

|

|

On top of the aforementioned card association privileges, the DCS Ultimate Platinum Card (both versions) also come with complimentary insurance coverage of up to S$1 million.

DCS has also made an effort to bump up security with the DCS Ultimate Platinum UnionPay Card (note: not the MasterCard version) by making the physical card numberless. That means your card number, expiry date and CVV code aren't featured on the card, and hence won't be made known to any wrong hands your card may fall into.

The slight downside for you is that you have to log in to your DCS Cards App to access the information instead, which some may find an inconvenience. It's a trade-off with safety. While it doesn't seem like the DCS Ultimate Platinum MasterCard will be numberless, you can still access your card information in the DCS Cards App.

Thinking about using your DCS Ultimate Platinum Card overseas? DCS allows you to make cash withdrawals overseas easily by setting up your ATM PIN via the DCS Cards App. What they don't advertise as boldly is that they do charge a conversion commission fee of 3.25 per cent on all transactions in foreign currencies.

DCS also advertises that you can use your DCS Card to pay bills at over 800 AXS stations in Singapore. I'm not terribly impressed by this "perk"-who goes to a physical AXS machine to pay bills these days anyway? And it's not like these payments will earn you two per cent cashback. AXS bill payments are specifically stated as an exclusion, according to the DCS Ultimate Platinum T&Cs.

Currently, the DCS Ultimate Platinum sign-up promotion is alright, but not amazing. Here's a breakdown of what welcome gift you can get, and what you need to do to get it:

Welcome gift: A pair of GOTRIP luggage bags (worth S$500)

What you need to do to get it:

Eligible DCS cards include the DCS Ultimate Platinum (duh), DCS Cashback Card, and co-branded cards like the DCS Don Don Donki Card and DCS Sheng Siong Card. Check out the full list in their promotion T&Cs to be sure.

This promotion is valid until Aug 31, 2023.

Here's a look at the DCS Ultimate Platinum Card pros and cons.

| DCS Ultimate Platinum Card | |

| Pros | Cons |

|

|

Our take? The best thing about the DCS Ultimate Platinum Card is its two per cent cashback with $0 minimum spend. Get it for the cashback, not its average-feeling benefits and privileges.

The two per cent cashback rate is better than an unlimited cashback card, which highest rate currently belongs to the UOB Absolute Cashback Card (1.7 per cent). Having said that…

So to choose the best cashback card that works for you, consider both how much you spend and what you're spending on each month.

There are two main considerations here. The first is the benefits of each card. The DCS Ultimate Platinum Mastercard gives you Mastercard Priceless Specials privileges, which to me feel meatier than the DCS Ultimate Platinum UnionPay Card's UnionPay exclusive benefits.

The second thing you should consider is where your card will be accepted based on its card association. We all know Mastercard, but what's UnionPay? UnionPay is a card payment method that was founded in the early 2000s in China, where Visa and Mastercard aren't widely accepted. Today, UnionPay is as recognised in China as Mastercard and Visa are ubiquitous in Singapore.

For frequent travellers to China, the DCS Ultimate Platinum UnionPay Card is a good choice. It'll be accepted all over the country, and certainly at a higher rate than Mastercard or Visa.

What if you're thinking of getting the DCS Ultimate Platinum UnionPay Card for use in Singapore? According to UnionPay Singapore, over 80 per cent of merchants here accept UnionPay cards. While that's still a sizeable number (over 10,000 merchants, according to UnionPay Singapore), if card acceptance rate in Singapore is a top priority for you, get the Mastercard version of the DCS Ultimate Platinum Card.

These cashback credit cards are strong contenders to the DCS Ultimate Platinum Card.

UOB Absolute Cashback Card: Limitless 1.7 per cent cashback on everything, including insurance, bills, and healthcare. Do note that this is an AMEX card.

Citi Cash Back+ Mastercard: The next highest cashback rate among the unlimited cashback cards, at 1.6 per cent.

OCBC 365 Credit Card: This cashback card offers up to five per cent cashback in specific categories (such as dining and online food delivery), with a cap of $80 cashback a month with $800 spend. You also get three per cent cashback on recurring telco and electricity bills, which are usually excluded.

CIMB World Mastercard: Spend $500 a month to get two per cent unlimited cashback on a bunch of categories, including Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, and Luxury Goods. No annual fees.

In case you’re wondering, here's how we decide on our credit card rankings.

| Is that credit card MoneySmart? Our MoneySmart credit card ranking rubric | |

| Category | Our rating |

| Overall | The average rating for the credit card on the whole, calculated from the ratings for the individual categories below. Plus, we’ll give you a one-liner on who we think the credit card is best suited for. |

| Earn rates: Air miles / Cashback / Rewards points | Air miles / Cashback/ Rewards points. This category looks at the depth rather than breadth of earn rates.

|

| Earn categories | This category looks at the breadth rather than depth of your earnings.

|

| Annual fees and charges |

|

| Accessibility | Minimum income requirements:

Exclusivity: We dock 1-2 stars if there is/are another category/categories that make the card exclusive and very specific to a certain clientele. |

| Extras/periphery rewards | These include:

We count the number of benefits and award between 0.5 to 2 stars for each, depending on how good the perk is. |

| Sign-up bonus |

|

ALSO READ: HSBC Revolution Card's 10x points with $0 minimum spend: Is there a catch?

This article was first published in MoneySmart.