You will no longer make huge profits: 5 crucial truths about the property market in 2021

Let’s start with a story today.

A police officer sees a drunken man intently searching the ground near a street lamp and asks him what he is looking for. The drunk man replies that he is looking for his car keys, and the officer helps for a few minutes without success then he asks whether the man is certain that he dropped the keys near the lamppost.

“No,” is the reply, “I lost the keys somewhere across the street.”

“Why look here?” asks the surprised and irritated officer. “The light is much better here,” the intoxicated man retorts.

In what is better known as the streetlight effect, this is a mistake that many people often make – we choose the familiar and convenient over finding the truth.

Likewise, if you are looking for a property in this climate, and have not bought one in a while – it’s time to reframe what you used to know about the property market.

The Singapore property market is dynamic; the truisms that held in the ‘90s, ‘00s, and even just a decade before tend not to last. Remember when your parents or grandparents believed the flat would provide for a comfy retirement? Between 2013 and 2020, flat prices dropped for around seven straight years; and they’ve only recovered recently.

Or how about 2012, when shoebox flats were the diamonds of real estate investment? Today the demand for larger homes – and a Covid-struck rental market – is making them tougher to offload. It’s time for an update, so here are some blunt truths to consider in the here-and-now:

There was a time when Singapore real estate was “free money”. You could rely on rental income to cover both the monthly loan repayment, as well as maintenance costs. There was even a time when you could enter and exit a property investment in the span of a few days, and make quick money.

If you want to know how some investors did this a long time ago – even with the Sellers Stamp Duty (SSD) – we’ll tell you since it’s not possible anymore: they would first secure the Option To Purchase (OTP) with the deposit.

Back then, the OTP was written such that it could be transferred to another person. So they would secure the OTP when they found a property that’s slightly undervalued; then they would transfer the OTP to an interested buyer at a higher price.

In effect, they sold the OTP rather than the property. The gains would be realised within the two-to-three-week validity period of the OTP.

But like many things in the past, such tricks are no longer possible. It’s clear now that the Additional Buyers Stamp Duty (ABSD) isn’t “temporary”, but here to stay. Why would the government get rid of it, when ABSD nets the country amounts like $4.9 billion (in 2017), and people continue to buy anyway?

So with no way to avoid SSD and increasing ABSD amounts, fast and big gains are out of the picture. It will take a longer-term investment to recoup your costs, and finally see returns.

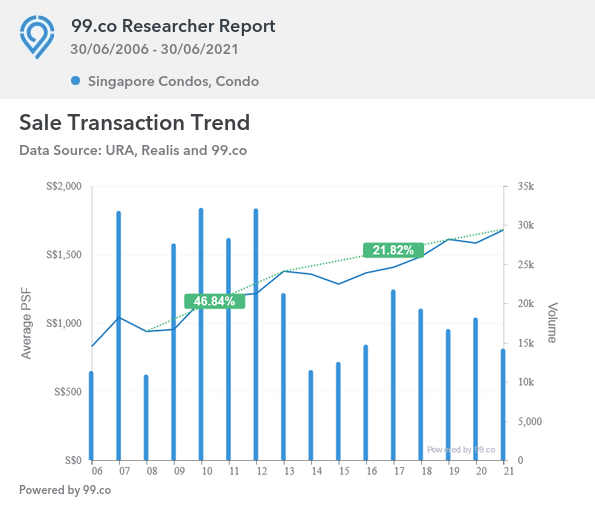

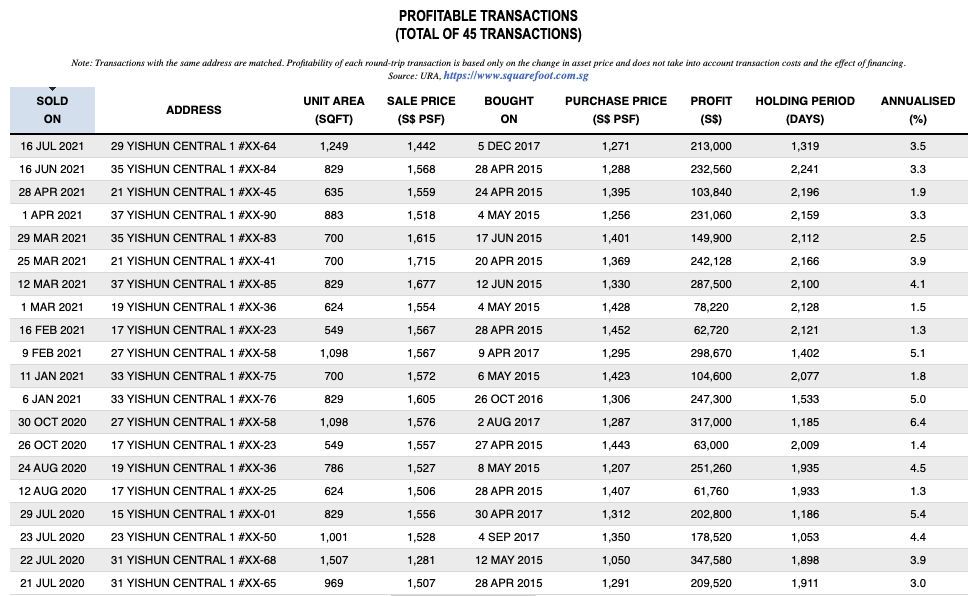

Here’s a rough glance at how much slower the rate of appreciation has become:

(This is a very simplified approach, and it does not take into account vital factors like leasehold status, region, new or resale status, etc. We just want to provide a quick snapshot to show how appreciation has slowed in the past few years).

In this rough, big picture sense, condo prices spiked from $938 to $1,378 psf, in the “glory days” between the Global Financial Crisis, and the coming of the first cooling measures. But since 2013 to end-June 2021, average prices have only risen from $1,378 to $1,678 psf.

This isn’t to say property is a bad investment, or that you can’t make money from it. You can see that prices are still rising; and as we mentioned in point 2, fast gains sometimes still happen (even if they’re sometimes from developer mis-pricing).

But investors today should be wary of the previous generation’s truisms, and temper their expectations. You can still do well with property, but your parents had more potential to make fast (and big) fortunes from real estate than you do today. Which is exactly why you have to be even more deliberate with your decisions today.

It is true that new launches will always be priced higher than resale counterparts.

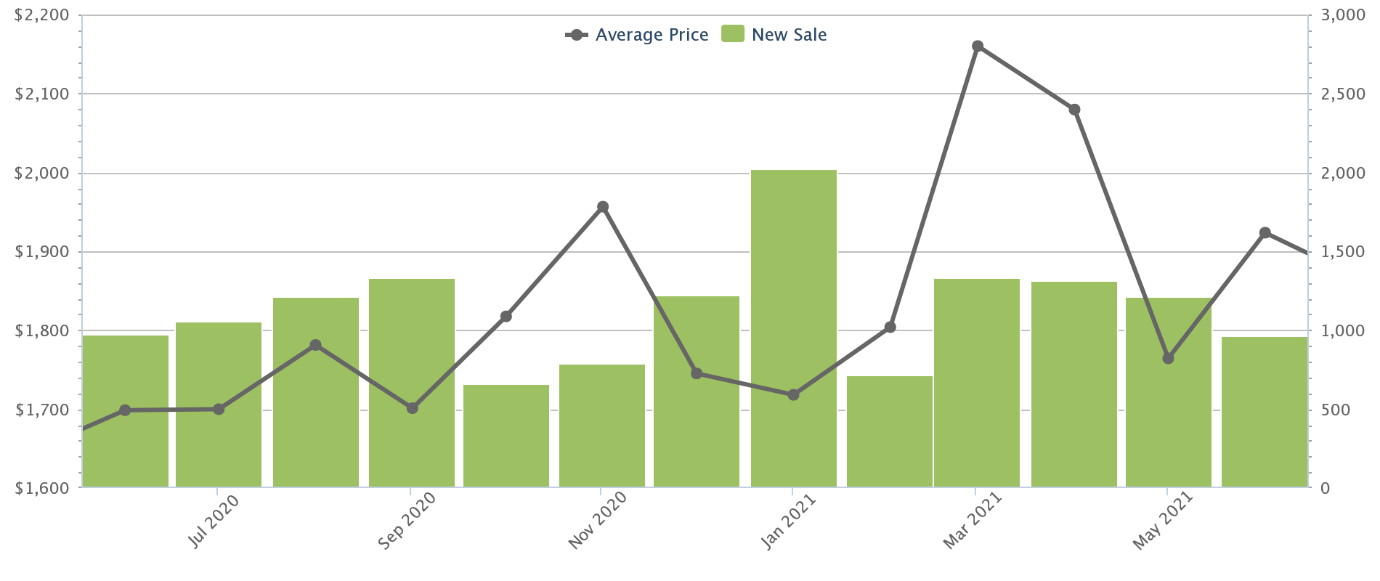

As of end-June 2021, new launch prices averaged $1,924 psf.

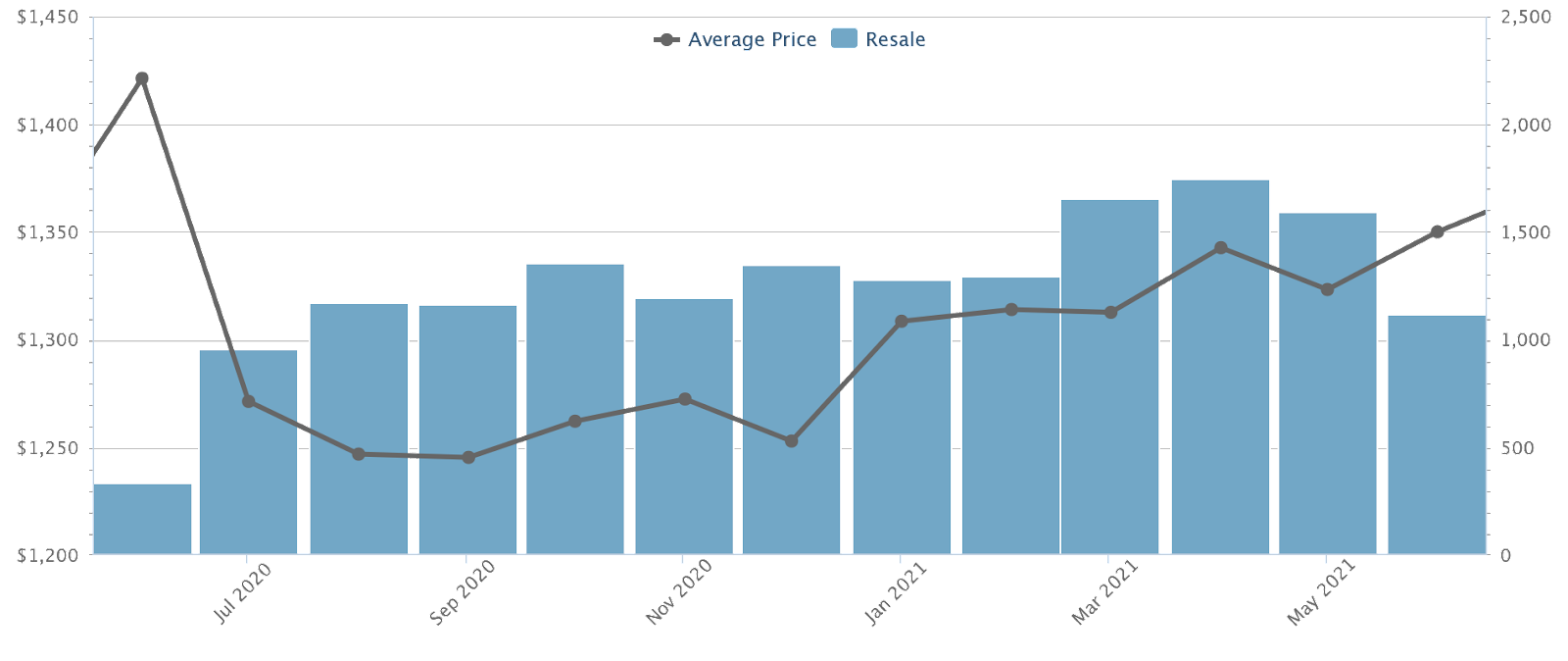

Resale condos, on the other hand, averaged just $1,350 psf.

When we take such a large, bird’s-eye view, it can seem as if new launches just aren’t worth buying. A 970 sq. ft. unit (typical three-bedder) might cost about $1.3 million if it’s resale, but well over $1.86 million if it’s new.

However, this is a generalised view that doesn’t take into account sales phases, developer discounts, and a very important factor – people that are willing to pay a premium for something new and shiny. So new launches can offer greater returns, if you pick the right unit at the right time.

A good example of this would be Pasir Ris 8 . During the early launch on 24th July, prices averaged $1,400 psf.

By 8pm on the same day, prices had risen to over $2,100 psf, for some of the two-bedders. After moving 85 per cent of units over the launch weekend, the average price at Pasir Ris 8 is still at around $1,600 psf.

This is a significant paper gain for buyers who moved early, and purchased units at $1,400 psf. If you had bought the 829 sq. ft. two-bedder at this price (approx. $1.16 million), it would have been worth about $1.32 million that very night.

ALSO READ: Property market predictions in 2021: Have cooling measures been effective?

This isn’t to say that buying a new launch early always guarantees a discount, or that new launches are better than resale – there are many examples of resale condos that may have been a better investment than its new launch counterpart.

Rather, the point is that you shouldn’t be too quick to brush off every new launch as “expensive”. Such assumptions are akin to the old fallacy of not picking up a $50 note on the floor, we theorise that someone else would have already picked it up if it were really there.

As recently as the early ‘00s, you would have heard the belief going around that “serious investors will only look at CCR properties”.

This is a very outdated belief. It’s rooted in the assumption that prime locations cannot be replicated, so this scarcity causes CCR properties to appreciate best. In short, it doesn’t matter how many condos are built in Pasir Ris, Sengkang, Tampines, etc., because they can never take away demand from your Robinson Road or Orchard Road condo.

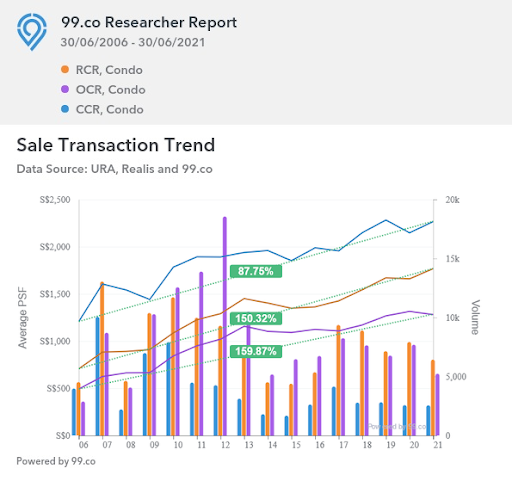

While it’s a good theory, it isn’t always true. If we look at the average prices by region, for example, the CCR tends to fall behind its RCR and OCR counterparts:

Today, the theory that RCR and OCR properties can’t match prime region amenities is questionable. The Urban Redevelopment Authority (URA) has been on an aggressive decentralisation initiative for decades.

Our government doesn’t want all the offices, malls, etc. to be concentrated in the CCR or CBD area. If you’re wondering why MRT trains break down more often in recent decades, this is the reason: huge numbers of people moving in and out of the same place, at around the same time. Our transport infrastructure can’t handle this, especially if the population grows.

That’s why you’re seeing regional centres and commercial hubs start to appear in OCR areas. The Punggol Digital District (PDD), Paya Lebar Quarter (PLQ), Woodlands North Corridor, Tampines Hub, and the Jurong Lake District are all examples of these.

The idea that the best malls, transport nodes, lifestyle areas, etc. are in the CCR is being eroded every year. This was obvious as far back as 2009, when retail chain Uniqlo opened its first outlets in Tampines rather than Orchard.

OCR areas have more room for upgrading, and more upside potential, than the CCR. If you couple this with the much lower prices in the region, an OCR condo could make better sense for investors right now.

A good example is North Park Residences, where many people were sceptical of its pricing when launched.

But as you can clearly see, an overwhelming majority of its early buyers have made great gains.

Again, this is a big picture view, and there are exceptions if you compare between specific developments. However, it’s time that buyers realise the OCR isn’t just a “viable” contender for capital gains – as of 2021, it seems to be winning.

ALSO READ: How hot is the Singapore property market in 2021?

Price PSF is an abstraction – a fact that’s easily forgotten by many home buyers. There’s a dangerous oversimplification at work, where buyers simply compare the price PSF, and use this as the be-all, end-all indicator of value for money.

However, it’s important to remember that it’s the overall price, or quantum, that has the more significant bearing. For starters, affordability is measured by the quantum, and not price per square foot.

When you get a bank loan, the maximum financing is 75 per cent of the property price or value, whichever is lower. The price PSF is irrelevant. It’s possible – even probable – that a unit with a low price PSF ends up requiring a much bigger cash outlay.

(We say probable because the bigger the property, the lower the price PSF tends to be. Bungalows tend to have a much lower price PSF than shoebox units, but they’re much less affordable).

More importantly, stamp duties are also based on the overall price, not the price PSF. The ABSD for Singapore Citizens buying a second property, for instance, is 12 per cent of the property price or value, whichever is lower.

Another area where price PSF can be misleading is when there’s strata void space. This is when a high ceiling unit (usually four metres from floor to ceiling at least) puts a price on “empty air”. Here’s an example of how it can get deceptive:

Say a unit is 1,000 sq. ft., of which 300 sq. ft. is void space. The price is $1,900 psf. This comes to $1.9 million.

However, another unit in the same development is 900 sq. ft., with no void space. The price is $2,100 psf. The quantum would be $1.89 million, which is cheaper than the unit with void space, despite a higher price psf.

This isn’t to say price PSF is a useless indicator; just that it has to be read in context with the broader price. Buyers also need to consider qualitative elements, that could make a lower price PSF less of a bargain. E.g., it may not matter that a unit is cheaper by $100 psf, if 100 sq. ft. is wasted on an air-con ledge.

We have a more extensive article showing the numbers, which you should check out if this is a big consideration for you.

For now, let’s address the counter-intuitive fact that leasehold properties can outperform their freehold counterparts. The oft-missed reason is that freehold takes a lot of time to manifest its edge. It’s very late in a leasehold property’s lifespan – such as when there’s 40 or fewer years remaining – when the leasehold status causes the price to depreciate sharply.

But in Singapore, the majority of private developments tend to go en-bloc before their 40th year. Barring a handful of names like Pandan Valley and Peace Mansions, only a tiny number of condos have remained from the 1970’s till today. And yet, these are the condos where freehold status would truly shine, compared to equally old leasehold counterparts.

[[nid:532793]]

There is an argument that developers will be willing to pay more for freehold, given that they don’t need to top up the lease. However, this is entirely speculative. Developers also need to account for market conditions, development charges, changes to the Gross Plot Ratio, the development size, and many other variables. These considerations could more than outweigh the advantage of not having to top up the lease.

In the current property market, freehold status is more of a nice bonus (if the premium isn’t too high). It shouldn’t be so important, that we refuse to consider any leasehold options.

As with many things in the property market, there will always be exceptions, and everything is completely subjective. More importantly, you will have to properly study the property in question and its surroundings before you make an uneducated, decision.

So remember, the next time you catch yourself searching for answers in the wrong place, take a step back and reframe your mind when it comes to the Singapore property market.

This article was first published in Stackedhomes.