HDB BTO & resale eligibility - The Singles Singapore Citizen & Joint Singles Scheme (2019)

You wake up, scroll through Facebook and "like" a bunch of your friends' #anniversary and #babyturnsONE photos. It's almost like any other day, except today is different. It's your 35th birthday, which means you can now apply for your own flat. Congratulations!

That's right, the government is finally giving you the ultimate consolation prize for turning 35 without a happily ever after. Here's what you need to know about getting a flat as a single person.

OVERVIEW - SINGLES SINGAPORE CITIZEN & JOINT SINGLES SCHEME

There are currently 2 schemes single Singaporeans can apply under and two types of HDB flats they're eligible for.

Under the Singles Singapore Citizen & Joint Singles Scheme, singles can purchase either new or resale flats. However, for BTO, singles can only buy 2-room Flexi units at non-mature estates. There are no restrictions on the size or location for resale flats.

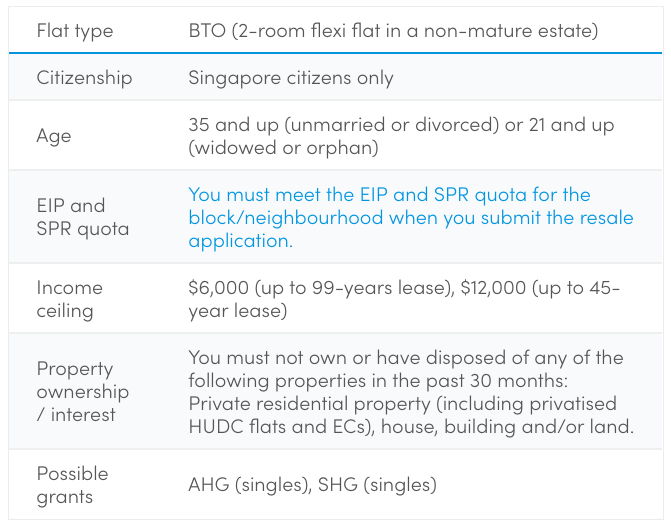

Here's a quick overview of the general eligibility criteria:

Generally, only Singapore citizens can buy a flat. And as a single, you need to wait till you're 35 before you become eligible - that is, unless you're widowed or orphaned. Then, you can actually apply to buy a flat as soon as you turn 21.

These criteria that apply to both the Singles Singapore Citizen & Joint Singles Scheme. The former is for individuals, and the latter is for joint ownership for up to 2 to 4 single Singaporeans. For the joint singles scheme, all applicants must fulfil the above, and you must all be listed as co-applicants.

Depending on whether you choose BTO or resale, there are several more eligibility conditions, but we'll touch on that later.

The income ceiling for BTOs is $6,000, and there's no income ceiling for singles who want to buy an HDB flat from the resale market. However, do note that there is still a maximum income limit if you want to qualify for a CPF Housing Grant or HDB Loan.

In terms of financing your new home, there are 4 grants available: Additional housing grant (AHG), special housing grant (SHG), enhanced CPF housing grant (Singles grant) and proximity housing grant.

All CPF housing grants will go into your CPF Ordinary Account, and can be used to offset the purchase price of the flat and reduce the mortgage loan. However, you cannot use it for your cash downpayment (if any) and monthly mortgage payments.

HDB FOR SINGLES - 2-ROOM FLEXI BTO FLATS

Eyeing a new flat? Let's see if you qualify to apply:

INCOME CEILING - $6,000

If you want a new HDB flat, the first hoop to jump through is the income ceiling - you must not make more than $6,000 (up to 99-years lease) or $12,000 (up to 45-year lease).

TYPE OF FLAT AVAILABLE - 2-ROOM FLEXI, AT NON-MATURE ESTATES

The only new flat option is only for 2-room Flexi units, and they must be at non-mature estates. Non-mature estates refer to residential areas that are considered less than 20 years old. More specifically, this includes neighbourhoods like Bukit Batok, Sembawang and Punggol.

2-room Flexi flats have an area of either 36 or 45 sqm (depending on type 1 or 2), and comes with just 1 bedroom, 1 bathroom, a kitchen and a storeroom or apartment shelter.

That means the only new flat you're getting is going to redefine the word "cosy", and you'll need a miracle-working interior designer to transform your crib into a similarly-sized hotel room at the Ritz-Carlton.

If you just need a bachelor crib, this may be perfect. But if you want more space, consider going for resale units.

Alternatively, you can get the small BTO first, and if you find love several years down the road, you can reapply for BTO as a first-timer and second-timer couple.

PROPERTY OWNERSHIP - NO OTHER PROPERTIES FOR AT LEAST 30 MONTHS PRIOR

If you already own a private property, you will still be allowed to apply for an HDB flat, whether on the BTO or resale market. However, you will be expected to dispose of your previous property at least 30 months BEFORE the date of application.

This is because if you buy an HDB flat, you are expected to live in it, regardless of how many other properties you own or can afford.

CPF HOUSING GRANTS - AHG, SHG

The additional CPF housing grant (AHG) goes up to $20,000, and is applicable across the board, resale or BTO. The income ceiling is pretty tight though - you must make no more than $2,500 per month.

The special CPF housing grant is similar to AHG, but has a higher income ceiling ($4,250 instead of $2,500) and is for BTO purchases only. If you are eligible, you can get them both to stack the subsidy.

For the exact grant amounts and conditions, refer to the HDB official website.

HDB FOR SINGLES - RESALE FLATS

If you earn more than $6,000 a month, you're not eligible for a new flat. Sorry. Your only option is the resale market.

INCOME CEILING - NONE

Good news! There's no income ceiling for singles who want to buy an HDB flat from the resale market.

However, there is a maximum income limit if you want to qualify for a CPF Housing Grant or HDB Loan. Essentially that means that if you have no problems paying for a flat by the time you're 35, then you won't need or get any help paying it off.

TYPE OF FLATS - NO RESTRICTIONS

Unlike BTOs, there are no restrictions on the location and size for resale flats, so you can even get say, a 5-room flat in Bishan if you want (and can afford it).

PROPERTY OWNERSHIP - NO OTHER PROPERTIES FOR AT LEAST 6 MONTHS PRIOR

As with the BTO property ownership rule, you will need to dispose of your previous property before the date of application. However, for resale you're only expected to do this at least 6 months prior (as opposed to 30 months).

CPF HOUSING GRANTS - SINGLES GRANT, AHG, PHG

As mentioned earlier, the AHG is open to applicants buying both BTO and resale units.

And while resale-shoppers won't be able to apply for SHG, they are eligible for more CPF housing grants.

There's the singles grant - an extra grant for resale flat purchases - which offers a generous $25,000 (4-room and under) or $20,000 (5-room) subsidy, with a reasonable income ceiling of $6,000 for singles and $12,000 for joint singles.

If you are looking at a resale flat near your folks (max 4km), you can score an additional $10,000 proximity housing grant.

For the exact grant amounts and conditions, refer to the HDB official website.

4 THINGS TO CONSIDER BEFORE BUYING A HDB FLAT AS A SINGLE APPLICANT

With all that said and done, should you be looking at applying for an HDB flat as soon as you're eligible? Here are some things to consider:

YOUR INCOME MAY INCREASE AS YOU GROW OLDER

If you don't apply for an HDB flat as soon as you turn 35, there's a chance you might not be eligible for grants to buy an HDB flat because your income has exceeded the requirement.

As mentioned earlier, any single earning more than $6,000 is no longer eligible to buy a new HDB BTO flat, and any single earning more than $6,000 will not be eligible for any grants.

But even if you think you'll never earn that much money (which is a pretty depressing thought in Singapore with our high cost of living) that doesn't mean that you can afford to wait.

MAKE SURE YOU CAN AFFORD TO BUY NEW PROPERTY

Since the grant amount you're eligible for is based on your income, it kind of makes sense to apply for your flat while your income is still low in order to maximise the grants you can get. Of course, that doesn't mean you should manipulate your income too much before applying for a flat - remember that TDSR requirements are designed to ensure you only buy property you can afford.

The cost of the flat may seem cheap, but you'll find yourself with high initial costs, not just for your downpayment, but also renovation costs.

LIVING WITH YOUR PARENTS? DON'T FORGET TO BUDGET FOR NEW LIVING COSTS

For most of us, living with our parents is going to be easier on our wallets. There are many things we often take for granted when we're living under their roof, like the convenience of living in a mature estate for example, that we may not get to enjoy in a new property.

DO YOU THINK YOU MIGHT GET MARRIED IN THE NEXT 10 YEARS?

At first glance, this may seem far-fetched, but cupid's arrow really may affect your decision to buy a BTO flat. Since it can take up to 3 or even 5 years before you get your keys, and then there's the Minimum Occupation Period of 5 years, that's at least 8 to 10 years you'll both need to stay in that 2-room shoebox of an apartment.

That might not be a problem if neither of you are planning to have kids, but if you are - it might make more sense not to tie yourself down to a 2-room BTO flat when you'll be eligible for subsidised housing once you find the right person. Or the most convenient person, really.

This article was first published in MoneySmart.