I tried tracking my personal finances for a month - automatically. Here's what I learnt

One of my (financial) resolutions for 2019 is to actively track my finances to better understand how much I have and what am I spending on. My goal was to identify how I can cut unnecessary costs that I can do without and spend smarter on the things I need.

TWO WAYS OF TRACKING PERSONAL FINANCE METRICS

One of the things I have long admired Kyith of InvestmentMoats for, is the meticulous manner in which he reviews his investment portfolio and net worth. Kyith has detailed spreadsheets with numerous carefully collated data points, which are then moulded with formulas and displayed as charts. These spreadsheets created are also available for anyone to download.

As much as I admire the rigour and discipline that people like him have to stay on top of their personal finances, I admit that I am sorely lacking in those qualities. I also doubt that I am the only one not spending a lot of time tracking and making sense of my personal finances.

Is there a way for data about my savings, spending, insurance and investments to be collected automatically, with insights presented intelligently, and recommendations tailored to my financial situation - to let me know how I can improve?

It turns out there is. I recently got to learn about a tool known as Your Financial GPS.

MEET YOUR FINANCIAL GPS

Your Financial GPS is a financial planning tool that can give you personalised insights and suggestions based on the way you use your savings accounts, credit cards, whether you are protected with coverage or have made investments to grow your wealth.

Your Financial GPS is part of NAV, is a comprehensive suite of resources developed by DBS and POSB to help you improve your financial know-how, empower you to critically assess your own financial needs and develop action plans according to your stage of life and specific financial situation.

Besides providing an intuitive digital financial tool that gives you insights on your money habits and personalised suggestions on how to build or adjust your financial plan, NAV also offers a repository of quality, relevant content, an open community for discussion of money matters, as well as in-person events and free one-on-one consultations. NAV aims to provide the various enablers you need to help you find your way.

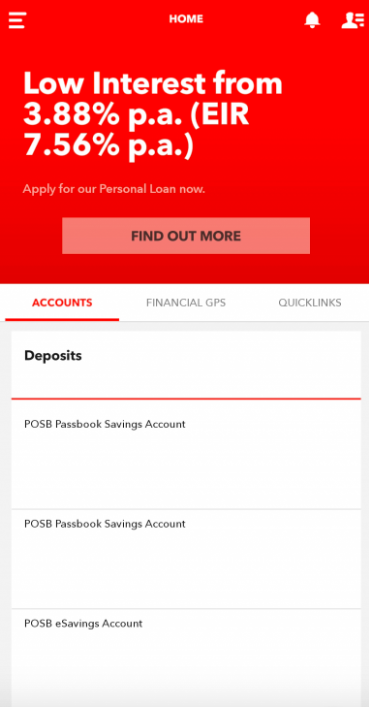

If you already have a DBS or POSB iBanking account, you already have Your Financial GPS. You don't need to download any new apps or create any new accounts. Plus, data will be automatically pulled from your DBS and POSB accounts, so you would be able to access insights and suggestions from day one!

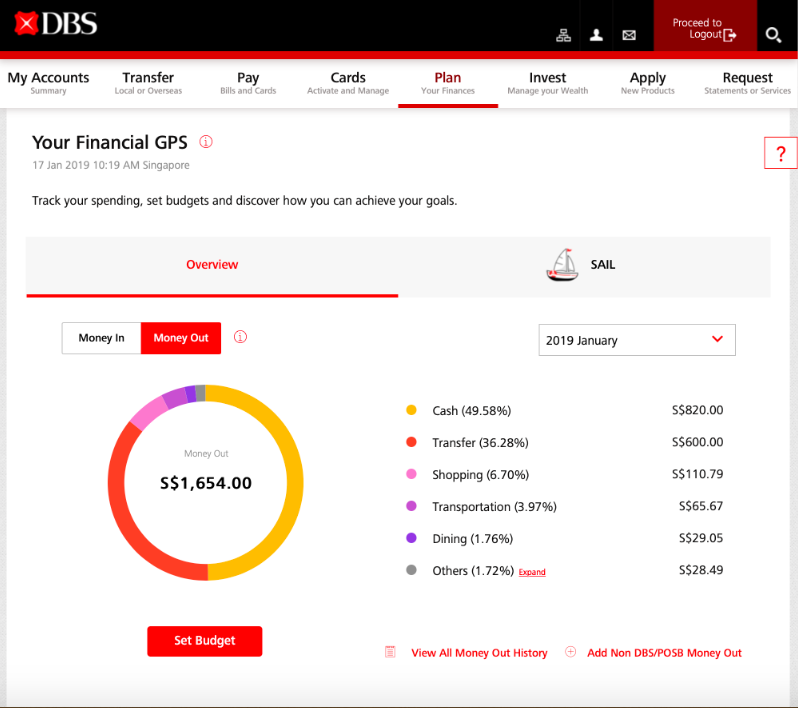

If you're on your desktop, simply log into DBS/POSB digibank online and select Your Financial GPS from the Plan menu. You don't even need to create any additional accounts or have a separate password.

For those who don't have an existing DBS/POSB account, you can sign up for free.

USING YOUR FINANCIAL GPS

Think of Your Financial GPS as a digital dashboard coupled with a smart financial advisor - accessible wherever you are, anytime of the day.

After logging in, the Your Financial GPS dashboard is just one click away. The ease of accessing Your Financial GPS has certainly contributed to my regular use over the past month.

Because it was a digital dashboard, I did not need to manually compile and furnish Your Financial GPS with transactions across all my DBS/POSB accounts. All my transaction data - even those dating back before I started using Your Financial GPS - can be accessed automatically.

Like me, you probably have accounts with other banks as well. Not to fret, because Your Financial GPS allows you to easily input additional data or change existing information, making the charts and recommendations more holistic and useful.

To help you make sense of the wealth of information available, Your Financial GPS categorises the information using the SAIL framework, which stands for Savings, Assurance, Investment, and Life Goals.

Savings: Understand your money inflows and outflows at a glance, and ensure you have enough liquid cash set aside for emergencies.

Assurance: Identify insurance protection gaps based on your life stage and dependents.

Investments: Discover suitable investment products based on your risk tolerance.

Life Goals: Specify how much you need and the timeframe to find if your current savings rate and investing portfolio is enough to hit your goals.

One of my financial goals is to actively save up for my wedding. I used the Life Goals planner to specify how much I wanted to save and the date I would need the money.

Right away, Your Financial GPS noticed that my target wedding date necessitated dipping into my emergency savings and suggested a review.

Alongside the Life Goals planner, I found that the curated selection of personal finance articles and tools was useful in helping me better understand what the data means and the actionable steps I can take, such as making investments that are suitable for my risk tolerance.

This article was first published in Dollars and Sense.