Be aware of these 5 common mistakes to ensure a comfortable retirement

The goal of a comfortable retirement is challenging for many. Even those that plan ahead can fall victim to a number of pitfalls. To help consumers achieve their retirement goals, we've identified some of these mistakes and provided advice for avoiding them.

UNDERESTIMATING RETIREMENT EXPENSES

Perhaps the most important factor in assessing the adequacy of one's retirement savings is the estimated financial costs of retirement. One common mistake is to underestimate how much money one will require after retiring. There are a number of reasons that people commonly make this mistake.

First of all, individuals tend to ignore the impact of inflation on their expenses. Additionally, individuals may underestimate how much medical attention they will require later in life. Finally, many individuals have a hard time predicting how much money they will spend once they are not working.

For example, many will have more free time for vacations than during their retirement. To avoid a financial crisis later in life, it is important to recognise the tendency to underestimate retirement expenses and plan a more appropriate retirement savings goal.

TOO LITTLE TOO LATE

Another very common mistake is to put off retirement savings until later in life. The line chart below shows illustrates how contributing to your retirement savings early is crucial.

For example, in scenario A, an individual who saves $500 per month from age 25 to 65 will accumulate approximately $724,799 assuming an annual return of 5 per cent. Meanwhile, in scenario B, an individual who saves $750 per month starting at age 35 will have $597,950 in retirement savings with the same annual return.

Finally, in scenario C the individual that starts saving $1,500 each month at age 45 will have $595,187 at age 65, again assuming a 5 per cent annual return. This highlights the power of making regular contributions and of compounding interest over a longer period of time.

RETIREMENT SAVINGS COMPARISON

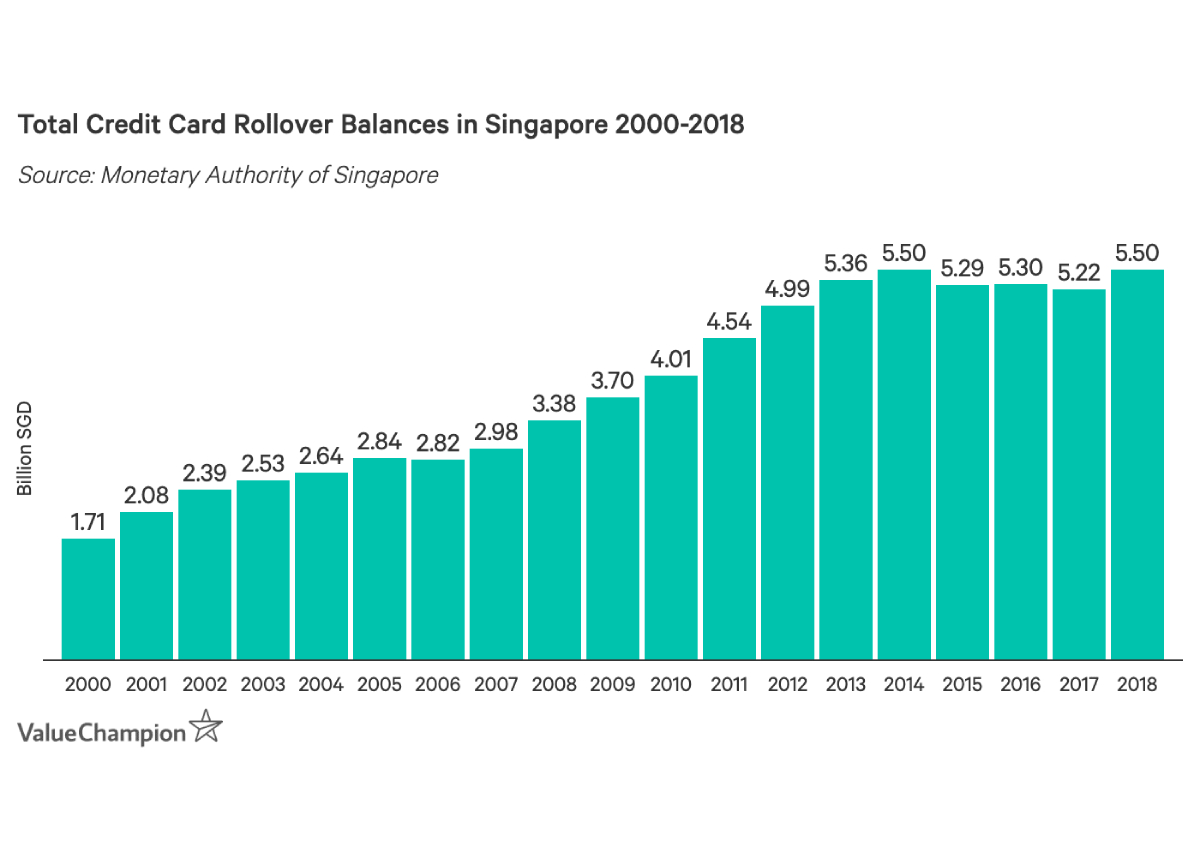

LETTING PERSONAL DEBTS GROW OUT OF CONTROL

Accruing too much debt is another obstacle to retirement. Personal debts are often useful (e.g. student loans, home loans) and sometimes unavoidable. However, left unchecked, these debts can significantly eat into your retirement savings.

For example, while credit cards offer a great opportunity to accumulate rewards, if they are used unwisely they can quickly rack up debt, given that unpaid monthly balances face interest rates of 25-30 per cent p.a. Therefore, it is important to pay down existing debts, especially those that come with high-interest rates.

TOTAL CREDIT CARD ROLLOVER BALANCES IN SINGAPORE 2000-2018

Balance transfer and debt consolidation loans are two of the best options for borrowers in Singapore. Balance transfer loans charge relatively high-interest rates (20-30 per cent p.a.), but offer interest-free periods of up to 18 months. This works well for borrowers that would be able to repay their entire debt within a short period of time.

Those that require more time to repay their personal debts should consider debt consolidation loans. These loans allow borrowers to consolidate a variety of debts to one loan, typically at a lower interest rate (7-9 per centp.a.) than many other forms of debt.

IGNORING INVESTING FEES

Finally, when it comes to investing for your retirement, it is important to be aware of the fees associated with your investments. For example, financial advisors tend to charge management fees of at least 1 per cent of total account balances, often with a minimum fee of $500 to $1,000.

While this may not seem like a lot, over the course of your working years, these fees will add up to a significant amount of money. Meanwhile, there are less expensive options, such as investing through market-leading Robo advisors, that are able to charge lower management fees (0.3-0.8 per cent) by automating several processes and using complex algorithms to monitor and balance users' accounts. Alternatively, those that are well-versed in investing strategies can consider investing on their own in stocks, bonds or low-cost ETFs through an online brokerage.

KEY TAKEAWAYS

Depending on your circumstances, there may be a variety of factors that would prevent you from a comfortable retirement. However, some of these hurdles are avoidable with proper planning. This list presents current workers a list of several key mistakes to avoid as they plan for their future retirement.

This article was first published in ValueChampion.