This month's Singapore Savings Bonds: Interest rates and how to buy

The Singapore Savings Bonds (SSB) is one of the more common options for Singaporeans to invest their money in as it usually offers a higher return as compared to bank fixed deposits.

It is also one of the easier ways for risk-averse investors to combat Singapore’s average inflation rate from 1962 – 2021 which stands at 2.5 per cent (via Trading Economics).

Side note: We’ve noticed that the recent SSB rates are inching up slowly. If you’re deciding between SSBs and fixed deposits, this quick comparison should help you with your decision:

| Singapore Savings Bond (SSB) | Regular bank savings account | Fixed deposits | |

|---|---|---|---|

| Liquidity | Yes | Yes | Somewhat (can withdraw but usually with penalties) |

| Easy to get into? | Yes | Yes | Yes |

| Returns >one per cent per annum? | Depends | No (0.05 per cent base) |

Depends (at least better than regular bank savings account) |

The interest rate for SSB changes every month with each issue…

Here are the details for this month’s Singapore Savings Bonds:

| Details of this month's bond | |

|---|---|

| Bond ID | GX22010S SBJAN22 GX22010S in your CDP statement Interest payment will be reflected as CDP-SBJAN22 in your bank statement GX22010S in your SRS statement |

| Issue date | Jan 3, 2022 |

| Maturity date | Jan 1, 2032 |

| Application period | Opens: Dec 1, 2021, 6pm Closes: Dec 28, 2021, 9pm Allotment: Dec 29, 2021, after 3pm Issuance: Jan 3, 2022 (by end of day) |

| Redemption period | Opens: Dec 1, 2021, 6pm Closes: Dec 28, 2021, 9pm Redemption of Bonds: Jan 3, 2022 (by end of day) |

The interest rate for this month’s bonds is:

| Year from issue date | Interest rate (per cent) | Average return per year (per cent)* |

|---|---|---|

| One year | 0.41 | 0.41 |

| Two years | 0.95 | 0.68 |

| Three years | 1.24 | 0.86 |

| Four years | 1.48 | 1.02 |

| Five years | 1.71 | 1.15 |

| Six years | 1.94 | 1.28 |

| Seven years | 2.11 | 1.39 |

| Eight years | 2.29 | 1.50 |

| Nine years | 2.51 | 1.60 |

| 10 years | 2.78 | 1.71 |

*At the end of each year, on a compounded basis.

This means that if you invest $1,000 in this issue of Singapore Savings Bonds and hold it for the full 10 years. The effective interest rate per year will be 1.78 per cent and you’ll get $180 in interest (via the official SSB calculator).

Singapore Savings Bonds are issued by the Singapore Government, to provide Singaporeans with a safe and flexible option for long-term saving.

Before we jump into investing in the SSB, let’s take a closer look at the risks and benefits.

The longer you hold on to the bond, the higher the interest rate you enjoy. There is also no penalty for individuals who wish to exit their investment early.

Once you submit your redemption request, you will get your principal back (along with any accrued interest) by the 2nd business day of the following month.

What does this mean?

Assuming you choose to redeem $1,000 anytime during January… you’ll receive $1,000 and any accrued interest by the end of the 2nd business day of February.

So if you hate the feeling of having your money locked up for extended periods of time, the SSB is one of the many solutions available.

The amount you invest in the SSB is completely backed by the Singapore Government. Whatever your political views might be, it IS a fact that the Singapore Government received a “AAA” credit rating.

This reduces the risks of investing in the SSB to the bare minimum (there’re still risks tho). The only other countries that enjoy the same “AAA” credit rating are countries such as Switzerland and Hong Kong.

Having such a strong rating arguably makes the SSB one of the safest products in the market.

You don’t need to starve or eat grass in order to invest in SSBs. The minimum amount to invest is $500.

Which makes it suitable for almost everybody. However, the Individual Limit for SSB is currently set at $200,000 (this includes bonds bought with cash and your SRS monies). So even if you’re a millionaire, you can’t just dump all your money into SSBs either.

Here’s how you go about applying for the Singapore Savings Bonds.

Before applying, make sure you have the following:

You can apply for a Singapore Savings Bond through two methods:

Note: If you are using OCBC, the OCBC mobile app works too!

Remember to have your CDP account number on hand when applying. Take note that a minimum investment of $500 is required.

If you wish to invest more, you can do so in multiples of $500. Each application is capped at $50,000. And there will be a $2 transaction fee involved for each application.

Once you have applied for your SSB, all you have to do is sit back and relax.

The results will be announced after the “last day to apply date”. You can find out important dates like the “last day to apply date”.

Do note that if there is an event of over-subscription, meaning more demand than the amount available, you might find yourself only investing a portion of the amount you applied for.

The rest of the amount will be returned back to your bank account.

The successful allocated Savings Bonds will be issued on the first business day of the following month.

You can expect your first interest six months after the bonds are issued. Interests are payable every six months.

All these will be reflected in your statement, and interests are automatically credited to your bank account.

We’ve established in other articles that SSBs are a better investment as compared to fixed deposits given their:

However, with the recent drop in average return per year for SSBs, this claim is highly contestable if we compared Singapore Savings Bond vs fixed deposits.

Let’s say you wish to invest $10,000 in SSBs. If we look at the most recent Fixed Deposit Promotion Rates with a one-year tenor, your best bet would be a little more than 1.0 per cent per annum.

And if we compared it with the average return per year for this month’s SSB…

It seems like leaving your money in a fixed deposit account is a better investment regardless of whether your investment horizon is one year or 10 years.

However, you should note that most fixed deposit plans require a huge sum of money — usually more than $10,000 just to qualify for the best rates — to be parked with the banks till maturity .

I mean… you could probably withdraw your money from the fixed deposit anytime. But you’ll probably incur penalties and might lose any earned interest altogether.

Conclusion?

If you have $10,000 and a long investment horizon, then you might want to consider fixed deposits as another viable option.

But if you don’t have $10,000 to spare, would prefer more flexibility, and are happy with getting more than the paltry 0.05 per cent which the banks give you… then SSBs are still your best bet.

Alternatively, you could also look at high-interest savings accounts … although you might need to jump through a few hoops in order to get the highest interest rate possible.

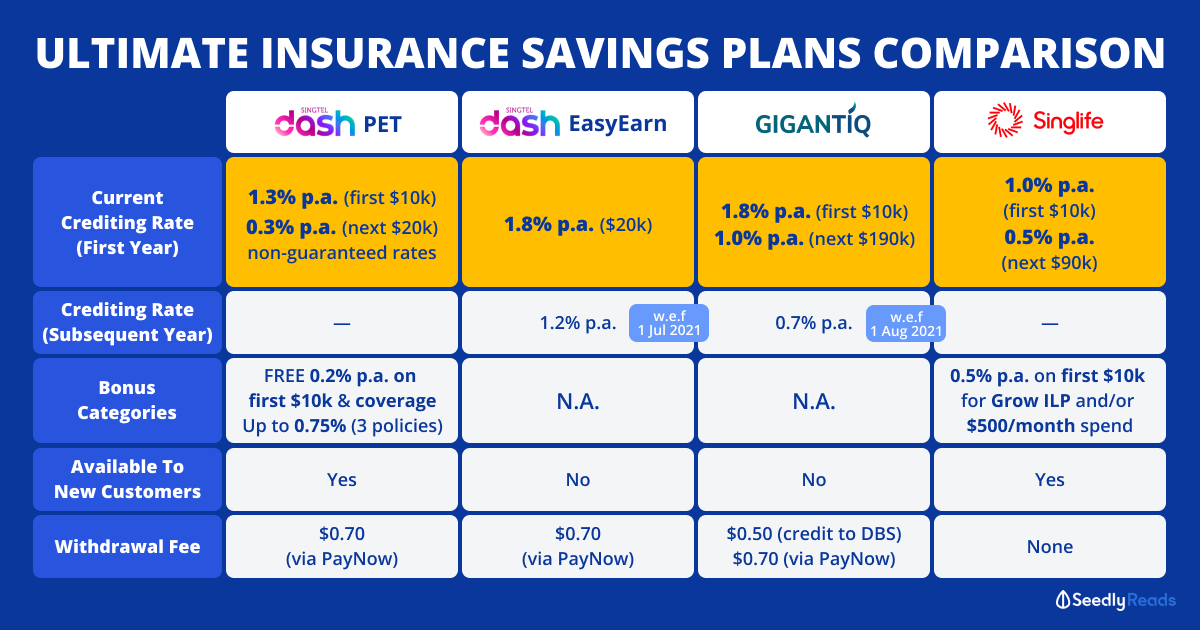

Or even consider other financial instruments like insurance savings plans.

We know that you’ve got limited funds to work with and you want to maximise your investment potential.

Are you wondering if investing in SSBs is better than Temasek bonds? Wondering what is the best SSB strategy to adopt?Thinking about investing in ETFs or SSB?

ALSO READ: Google Pay brings more ways to earn rewards and cashbacks this month

This article was first published in Seedly.