8 little-known things about CPF that most Singaporeans are still unaware about

The CPF system in Singapore is a valuable scheme. In fact, it is often cited at the international stage for being one of the best pension systems in the world, providing financial security for both individuals and the society as a whole.

As a great scheme, the CPF fulfils its role providing a lot flexibility and diverse functions in the way individuals can manage their balances. This can be both a boon and a bane - making the system overly complicated and scary to those unable to keep track with the options they are able to make and the changes to its various schemes.

In this article, we highlight 8 things that most Singaporeans, even those who actively keep up with the CPF scheme, may not know about it.

1. YOU DON'T ALWAYS EARN THE EXTRA 1 PER CENT THAT CPF CLAIMS TO PAY ON YOUR FIRST $60,000 BALANCES

CPF claims to pay an extra 1 per cent interest per annum on the first $60,000 of our CPF balances. This is technically true, but we need to understand how it pays this extra 1 per cent.

Only up to $20,000 in our Ordinary Account can enjoy this extra interest. This means that for most of us who just started working it will take several years to accumulate the $40,000 in our Special Account and MediSave Account, as these two accounts receive a significantly smaller portion of our monthly contributions compared to our Ordinary Account.

This also means that young working adults can benefit more by topping up our CPF accounts since most of us may not have accumulated $60,000 in this specific way. For older working adults who already have the $40,000 in our Special Account and MediSave Account, choosing to top up our younger children's CPF Accounts may be a much more lucrative move than topping up our own CPF accounts.

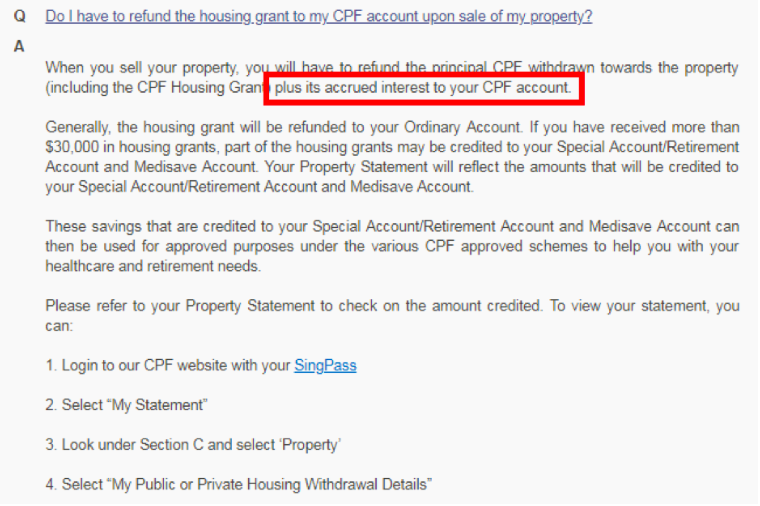

2. WE NEED TO PAY ACCRUED INTEREST ON HOUSING GRANTS GIVEN TO US

When we sell our flat, we will have to pay back what we owe our CPF accounts. This amount may include the

i. initial downpayment;

ii. monthly installment;

iii. the accrued interest on the downpayment and monthly installment; as well as the

iv. any housing grant(s) we received; and

v. accrued interest on our housing grant(s).

We need to understand that housing grants are given to us via our CPF. This means that when we use it to pay for our BTO or resale flat, we start accumulating accrued interest on these funds.

To understand why we have to do this, we need to appreciate the fact that CPF is primarily meant for our retirement needs, rather than housing, education or investment.

Even though it seems like we have to refund a large sum back into our CPF accounts, it will likely not limit us as we will get to use majority of these sums for our next home purchase.

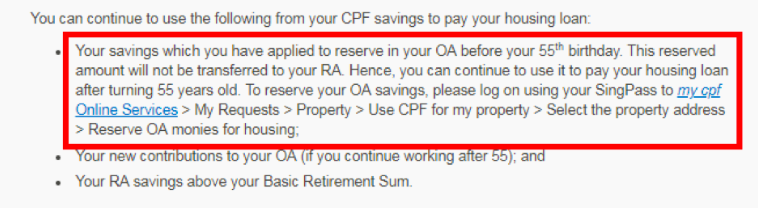

3. YOU CAN STOP YOUR ORDINARY ACCOUNT BALANCES BEING TRANSFERRED TO YOUR RETIREMENT ACCOUNT AT 55, IN ORDER TO CONTINUE SERVICING YOUR HOME LOAN

Once we turn 55, balances from our Ordinary Account and Special Account will be automatically transferred to a new Retirement Account opened for us. Our Retirement Account is meant to grow our nest egg, and ultimately provide us a lifelong monthly payout from age 65.

This is done automatically to enable us to enjoy higher interest returns on our Retirement Account, compared to our Ordinary Account and Special Account without having to take any action.

If we want to continue servicing our home loan with our Ordinary Account funds, we can continue to do so from any new contributions we receive from working each month or apply to reserve our Ordinary Account balances.

We can reserve our Ordinary Account balances following the steps provided on the CPF website:

Logging on to your myCPF Online Services > My Requests > Property > Use CPF for my property > Select the property address > Reserve OA monies for housing

4. YOU CAN WITHDRAW 20 PER CENT OF YOUR RETIREMENT BALANCES AT 65

Most of us may already know we can withdraw $5,000 from our CPF balances when we turn 55. What majority of us may not know is that we can withdraw up to 20 per cent of our Retirement Account (RA) balances when we turn 65 - or right at the moment when we can choose to start our CPF Life monthly payouts - inclusive of the first $5,000 we may have withdrawn at age 55.

This ability to withdraw 20 per cent of our retirement balance at age 65 is only important if we haven't hit our Full Retirement Sum (FRS) or, if we choose to pledge our property, our Basic Retirement Sum (BRS). If we are able to hit these sums, we will be able to withdraw anything beyond it.

Finally, it's important to note that just because we have the option of withdrawing these sums does not mean we have to withdraw these sums from our CPF balances. Leaving our funds in our CPF Retirement Account enables us to compound it for our retirement, which will give us a bigger monthly payouts on CPF Life.

5. THOSE WHO CHOOSE THE CPF LIFE BASIC RETIREMENT PLAN WILL ONLY CONTRIBUTE 10 PER CENT OF THEIR BALANCES TO CPF LIFE, AND MAKE MONTHLY WITHDRAWALS FROM THEIR RETIREMENT ACCOUNT

CPF Life is an annuity scheme meant to provide all of us with a monthly income in our retirement for as long as we live. In addition, we may also leave behind a bequest amount for our loved ones, depending on how long we live (and by extension, have withdrawn from our Retirement Account or CPF Life).

There are three main decisions we have to make with regards to our CPF Life payouts: i) choosing between the Full Retirement Sum (FRS), Basic Retirement Sum (BRS) or Enhanced Retirement Sum (ERS); ii) choosing to go on the CPF Life Standard Plan, CPF Life Basic Plan or CPF Life Escalating Plan; and iii) choosing when to start our monthly payouts between age 65 and 70.

This decision concerns point ii. If we choose to go on the CPF Life Standard Plan or CPF Life Escalating Plan, our Retirement Account balances will be contributed to CPF Life. This means we would not have any Retirement Account balances, and our lifelong monthly payouts will come from CPF Life.

However, if we choose to go on the CPF Life Basic Plan, we would contribute only 10 per cent to 20 per cent of our Retirement Account balances to CPF Life, depending on our age and gender. This is to pay for the security of a lifelong monthly payout, once our Retirement Account balances have been used up as we draw down from it rather than CPF Life.

6. YOU NEED TO APPLY TO START YOUR CPF LIFE MONTHLY PAYOUTS

While CPF Life starts giving us a monthly payout from age 65, this is not automatic. CPF Life only automatically starts disbursing these monthly payouts when we turn 70. If we want to receive our monthly payouts as soon as possible, we need to apply to start receiving our CPF Life monthly payouts.

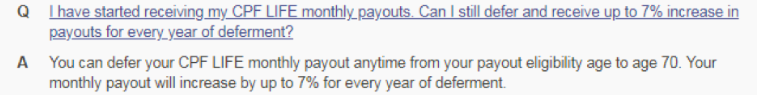

7. YOU CAN DEFER YOUR CPF LIFE PAYOUTS EVEN AFTER STARTING

After knowing that we need to apply to start receiving our CPF Life monthly payouts, we should also note that we can apply to halt our monthly payouts again - up to a maximum of when we turn 70.

This will enable us to receive up to 7 per cent more for each year we choose to defer our payouts. If we are working or do not require the funds for our daily needs, this is a good option to compound our savings.

Children can also opt to give parents an allowance in order to take advantage of this method to compound savings by a substantial amount, of up to 6.0 per cent per annum, while bearing no investment risks.

8. YOU DO NOT NEED TO JOIN CPF LIFE AT ALL

While CPF Life is our national annuity scheme, we may be fully exempted from joining CPF Life or setting aside the Full Retirement Sum if we are over 55 and i) already receiving a lifelong monthly pension; or ii) are receiving payouts from other life annuities bought using cash or via the CPF Investment Scheme.

Even if we are not fully exempted, we can be partially exempted depending on the amount we are collecting.

CPF is complicated, but it is still very relevant and valuable to Singaporeans

Even though our CPF can seem overly complicated, it is only that way because of the flexibility and security it provides Singaporeans.

We need to take the time to understand the various schemes available and leverage on them to make the most of our CPF accounts. If you have CPF-related ideas or questions, you can participate in the Personal Finance Discussion SG Facebook Group to engage a like-minded community.

This article was first published in Dollars and Sense.